TAX ON GOLD

Is Gold Taxed When Bought?

When purchasing investment-grade gold bars or coins, Sie typically benefit from VAT exemptions. However, that’s only part of the picture. The real complexity arises when selling. In the United States, long-term capital gains on gold can be taxed at rates of up to 28%. For high-income investors, additional federal or state taxes can push the total burden to over 50%—unless a clear strategy is in place.

Understanding your tax position is essential to protecting returns. Your personal tax rate depends on the holding period, income level, and the form of gold you invest in—whether physical bullion, ETFs, or tokenized digital assets.

Strategic planning allows Sie to minimize exposure. Holding periods, tax-deferred accounts, and compliant documentation all make a difference. When structured correctly, your gold investment can remain both secure and tax-efficient—without unnecessary losses cutting into your long-term gains.

Understanding Gold Tax Basics

Gold taxation differs significantly based on the type of gold you own and your country of residence. The tax rules vary between physical gold, ETFs, futures, mining stocks, and digital gold platforms.

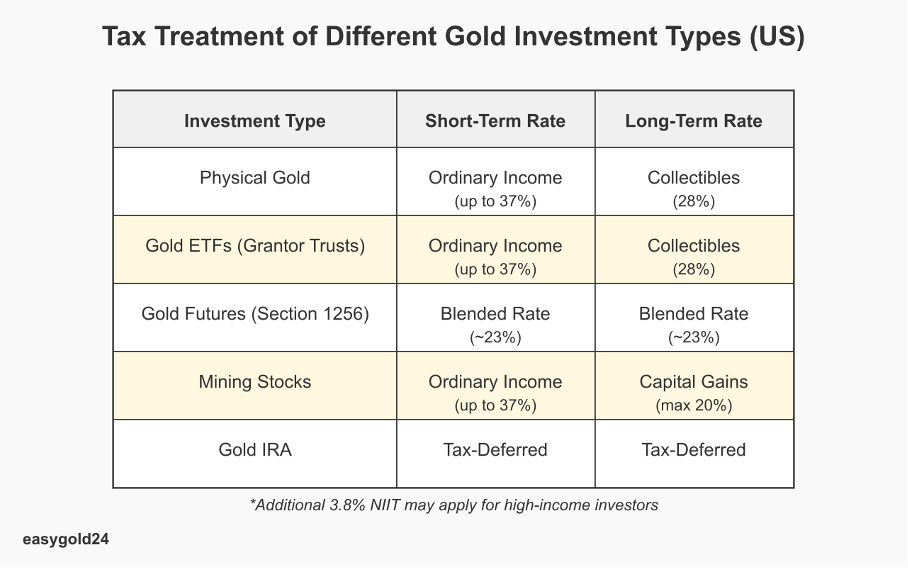

Different types of gold investments and their tax implications

Physical gold investments include bullion, coins, and jewelry. Alternatively, investors can choose gold ETFs, Sovereign Gold Bonds, mining stocks, mutual funds, or digital gold. Each option carries distinct tax advantages and disadvantages. For example, the US tax system classifies physical gold as a collectible, resulting in higher maximum tax rates (28%) compared to stocks or bonds (typically 20%).

When taxes apply to gold purchases vs. when sold

Most countries don’t impose VAT on investment gold when purchased. However, you’ll pay capital gains tax if you sell precious metals at a profit. High-income US investors earning over $200,000 (single filers) or $250,000 (joint filers) face an additional 3.8% net investment income tax (NIIT) on gold profits.

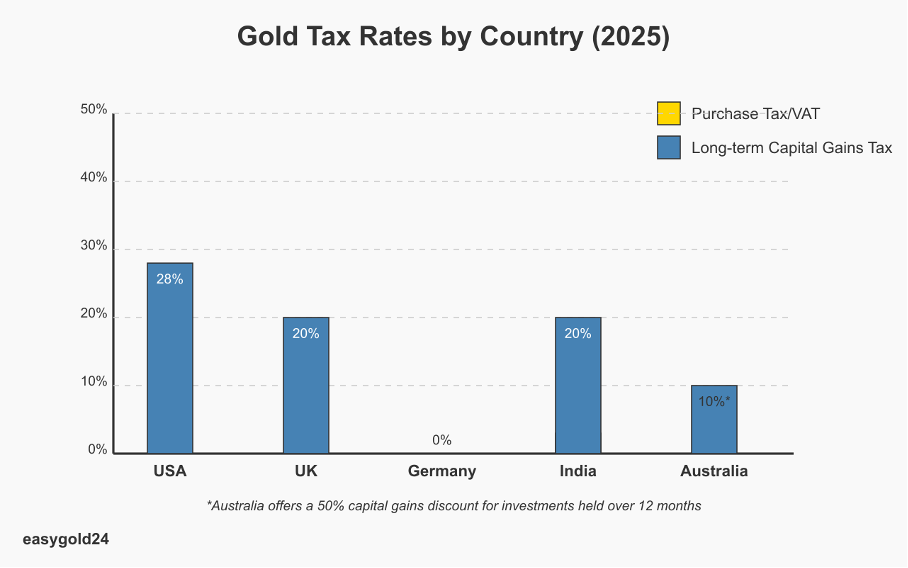

Gold tax rates by country: US, UK, Germany, India, Australia

Here's what you need to know about gold taxes worldwide:

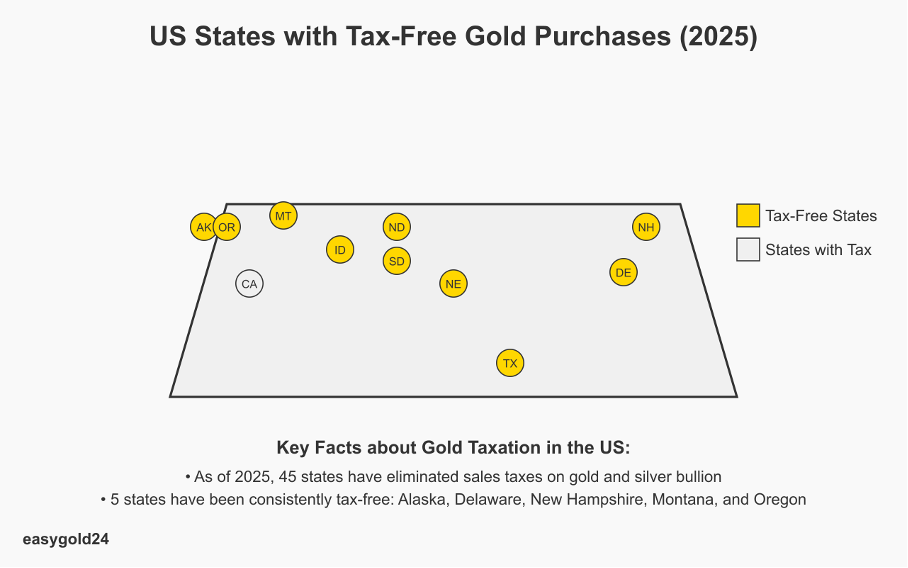

- United States: Physical gold held long-term faces a 28% collectibles tax. Short-term profits are taxed at regular income rates, which can reach 37%. Five states offer tax-free gold buying: Alaska, Delaware, New Hampshire, Montana, and Oregon.

- United Kingdom: Investment gold remains VAT-free with an exemption limit of GBP 3,000 in 2024/2025. Capital gains tax ranges from 10% to 20% based on income, with legal tender coins being tax-exempt.

- Germany: The German VAT Act (Section 25c) keeps investment gold VAT-free. Profits are completely tax-exempt if held for more than a year, with a yearly €1,000 exemption limit for sales within the first year.

- India: Gold purchases include a 3% Goods and Services Tax. After 36 months, long-term capital gains face a 20% tax rate with indexation benefits. Sovereign Gold Bonds held to maturity are 100% tax-free.

- Australia: Gold that’s at least 995 thousandths pure remains GST-free. The tax system offers a 50% capital gains discount for investments held over 12 months.

Prudent investors should consider these tax implications before venturing into gold investments. Maintaining accurate records of purchase prices and dates is essential for proper tax reporting and minimizing tax liability.

Gold Purchase Tax Rules in USA

The US government applies multiple layers of taxation to gold investments, varying by investment type, holding period, and state regulations. The IRS classifies physical gold and other precious metals as collectibles, creating unique tax considerations.

State-specific gold tax regulations: tax-free vs. taxable states

As of 2025, 45 states have eliminated sales taxes on gold and silver bullion. Each state establishes its own regulations regarding precious metal transactions. Texas doesn’t tax most precious metals, but certain non-bullion items remain taxable. California taxes only non-monetized bullion and transactions under $2,000.

How to avoid capital gains tax on gold legally

Investors can legally minimize gold taxation through several strategies:

- Holding investments longer than one year to qualify for long-term capital gains rates

- Using a 1031 exchange to defer taxes when reinvesting in similar precious metals

- Investing through a Gold IRA for tax-deferred or tax-free growth

- Strategic tax-loss harvesting to offset gains with losses from other investments

Physical gold taxation vs. ETF tax treatment

Physical gold’s long-term capital gains are subject to a 28% maximum federal tax rate. High-income investors might incur additional taxes:

- A 3.8% Net Investment Income Tax when earnings exceed $200,000 (single) or $250,000 (joint filers)

- State and local taxes that could increase the total rate up to 54%

Gold ETFs structured as grantor trusts follow similar tax rules as physical gold. Shareholders receive income and expenses directly, and long-term gains are taxed at the 28% collectibles rate.

Gold futures tax advantages under Section 1256

Futures contracts receive preferential tax treatment under Section 1256 of the Internal Revenue Code. These investments benefit from a blended tax rate:

- 60% qualifies as long-term capital gains

- 40% qualifies as short-term gains

Most investors consequently pay approximately 23% in taxes on futures, potentially resulting in significant savings compared to physical gold or ETF investments.

Worker exploitation

Unregulated mining practices take a severe human toll. Children work in hazardous conditions, carrying heavy loads and handling toxic substances without protection. Workers face numerous health risks, such as:

- Respiratory diseases from dust exposure

- Neurological damage from mercury exposure

- Physical injuries from unsafe working conditions

- Long-term disability from toxic chemical exposure

Gold Purchase Tax Rules in Germany

German investors enjoy unique tax benefits when they invest in gold for the long term. The tax advantages vary significantly depending on the type of gold investment selected.

Income tax: 12-month holding period for tax-free profits

Germany has specific rules regarding income tax on physical gold based on the holding period. If you sell within the first year, you’ll pay tax at your regular income rate. However, profits up to €1,000 remain tax-free even within that first year.

Trading gold too frequently might lead the tax office to classify you as a business. This classification could subject you to income, corporation, or trade taxes. Gold-related securities and exchange products fall under Germany’s flat tax system.

Tax-free gold buying: VAT exemptions and requirements

The German VAT Act (Section 25c) makes investment gold completely VAT-free, aligning with EU rules that treat gold as a financial instrument. Your gold must meet these standards to qualify:

- Bars must be 995 fine or better

- Legal tender coins minted after 1800 need to be over .900 pure

- The price cannot exceed 80% above the actual gold value

Physical gold becomes completely tax-free after a 12-month holding period. This tax advantage applies only to physical gold—not ETFs or mining stocks. Timing is crucial; gold purchased on July 24, 2023, becomes tax-free to sell on July 25, 2024.

Collector coins don’t receive the same VAT benefits as investment gold. Gold ETFs always face withholding tax, regardless of the holding period. Mining shares follow standard tax rules as well—both dividends and profits are subject to withholding tax.

Tax Rules for Different Gold Forms

Each form of gold investment carries distinct tax implications that savvy investors should understand before making decisions.

Digital gold taxation compared to physical gold

Digital gold has emerged as a modern investment vehicle, attracting younger investors due to its accessibility and convenience. Investors can purchase gold units online, backed by physical gold secured in insured vaults.

Digital gold follows the same fundamental tax principles as physical gold, with some variations. Buyers typically pay GST or VAT at purchase. Converting digital gold into jewelry incurs additional making charges subject to relevant taxes.

Capital gains tax depends on the holding period:

Short-term Capital Gains:

- Holding period less than 36 months (India) or 12 months (most countries)

- Gains taxed at ordinary income rates

- Tax rates correspond to the investor’s income bracket

Long-term Capital Gains:

- Applicable after 36-month holding period (India) or 12 months (most countries)

- 20% tax rate with indexation benefits in many jurisdictions

- Additional cess and surcharge may apply

Digital gold investments offer investors multiple redemption options with distinct tax implications:

- Convert holdings to physical gold (coins/bars)

- Maintain digital format

- Sell for cash

Digital gold combines tax advantages of traditional gold with modern convenience. These platforms address common concerns such as purity, theft, and storage costs while maintaining familiar tax structures.

Sovereign Gold Bonds vs. ETFs vs. Physical Gold tax benefits

Sovereign Gold Bonds (SGBs) offer significant tax advantages in many countries. In India, SGBs held until maturity (8 years) provide 100% tax-free returns, making them the most tax-efficient gold investment option. Interest earned on SGBs is typically taxable as income.

Gold ETFs offer easier liquidity and elimination of storage concerns but don’t receive the same preferential tax treatment as SGBs in most jurisdictions. Physical gold provides tangibility but requires secure storage and often incurs the highest overall tax burden due to additional costs like insurance and storage fees.

Smart Gold Buying Tax Strategies

Tax planning is essential for maximizing returns from gold investments. Informed investors can optimize their after-tax profits through strategic timing, investment selection, and proper documentation.

Timing your gold purchase to minimize tax impact

Long-term capital gains offer superior tax benefits compared to short-term profits. Gold investments held longer than 12 months qualify for long-term capital gains rates with a 28% cap for collectibles in the US. Selling within a year results in gains being taxed at regular income rates, potentially reaching 37%.

Investors in lower tax brackets might benefit more from short-term gains. Individuals in the 25% or lower bracket actually save money when their short-term gains are taxed at their regular rate instead of the 28% long-term collectible rate.

Choosing tax-efficient gold forms: futures vs. ETFs vs. physical

Gold futures contracts provide a significant tax advantage through Section 1256 treatment. The tax rate is structured as:

- 60% taxed as long-term gains

- 40% taxed as short-term gains

This structure results in an effective tax rate of approximately 23%, more favorable than the 28% maximum rate on physical gold.

Gold IRAs represent another tax-efficient approach. Since 1998, IRAs can hold bullion that’s 99.5% pure. However, qualified trustees are required for storage, typically charging annual fees between $150-300.

Documentation requirements for tax reporting

Proper record-keeping is essential for accurate tax reporting and minimizing audit risk. Maintain records of:

- Purchase dates and prices

- Sales transactions

- Storage fees

- Insurance costs

- Dealer premiums

Reporting requirements apply under specific conditions. Dealers must report transactions when:

- Customers sell large quantities of specific coins/bullion

- Cash payments exceed $10,000

Tax-loss harvesting provides an effective strategy to offset gains. You can balance profitable gold sales by realizing losses in other investments. A 1031 exchange allows you to defer taxes if you reinvest in similar precious metal assets within 45 days.

Secure Your Gold Investments – With Full Tax Efficiency

Understanding taxation is key to maximizing your gold investment. Depending on the holding period, investment vehicle, and jurisdiction, Sie may face significantly different tax outcomes. While physical investment gold remains VAT-exempt in many regions, capital gains and income taxes can impact returns if not planned for properly.

In Germany, physical gold held for over 12 months remains completely tax-free. In the U.S., long-term capital gains on gold are taxed at a higher rate of up to 28%, with additional taxes possible for high earners. Digital gold and gold-linked financial products may also fall under separate tax regimes, including GST or blended-rate structures in futures trading.

With Hartmann & Benz now officially listed on the OTCQB Market, Sie have access to a regulated investment opportunity backed by physical gold reserves and designed for long-term value. The simultaneous release of the EasyGold Security Token adds another dimension—making large-scale, storage-free gold ownership simple and cost-effective.

Plan strategically. Invest with clarity. And take full advantage of the options available to you through EasyGold.