Trends in the Stock Market

2025 Trends in the Stock Market

Young investors have embraced ETFs, with three out of four now holding these investments. This shift in stock market behavior has pushed single stock ETF assets beyond $7 billion under management.

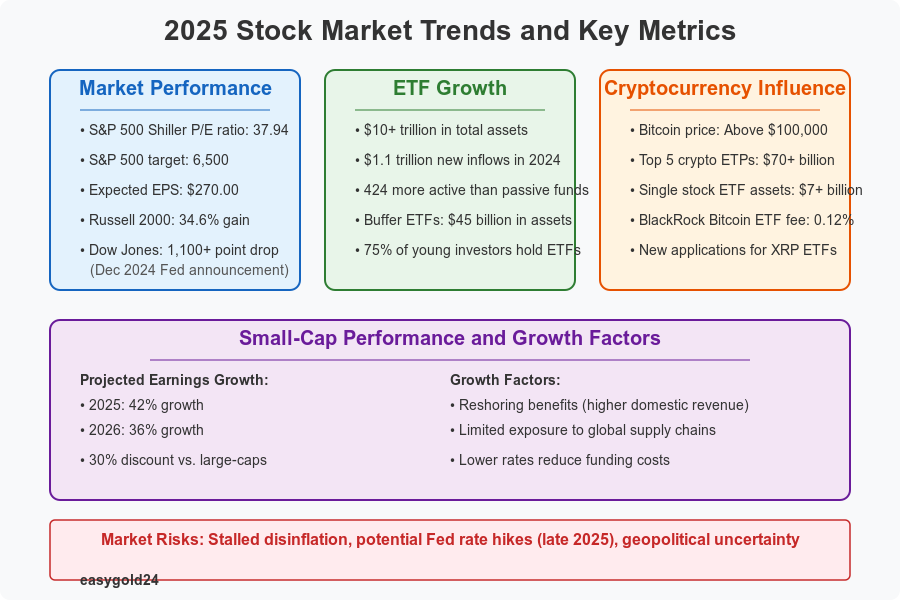

The stock market shows some remarkable patterns as we head into 2025. The S&P 500’s Shiller P/E ratio has touched 37.94, marking one of the highest levels in 154 years of bull market history. The Dow Jones Industrial Average tumbled more than 1,100 points after the Federal Reserve made its announcement in December 2024.

The year 2025 brings new market trends and investment possibilities across different sectors. These market patterns will shape investment decisions this year, whether you’ve been investing for years or just started your journey.

Latest Stock Market Trends

BlackRock’s dramatic decision to cut Bitcoin ETF fees to 0.12% for the first $5 billion in assets has revolutionized the stock market world. Major Wall Street firms now compete fiercely in the expanding crypto ETF space.

ETF Growth Patterns

The ETF market reached new heights in 2024. Investors poured $1.1 trillion in new money as total assets climbed beyond $10 trillion. Active ETFs led the charge by adding 424 more funds than their passive counterparts. Buffer ETFs attracted risk-averse investors and built up around $45 billion in assets under management.

Cryptocurrency Influence

Spot Bitcoin ETFs marked a turning point in the market. The five largest US ETPs amassed total assets exceeding $70 billion by the end of 2024. Bitcoin prices jumped above $100,000, driven by these exchange-traded funds. Financial institutions gave the cryptocurrency market additional momentum when they started submitting applications for other crypto assets, including XRP.

Small-Cap Performance

Analysts see bright prospects for small-cap stocks with projected earnings growth of 42% in 2025 and 36% in 2026. The Russell 2000 delivered stellar returns with a 34.6% gain in the 12 months ending November 2024. These returns outpaced the Dow, S&P 500, and Nasdaq 100.

Small-cap momentum draws strength from several factors:

- Small-caps benefit from the reshoring trend due to their higher domestic revenue and limited exposure to global supply chains

- Lower rates help reduce funding costs, which matters more for smaller companies with higher floating rate debt

- Small-caps trade at a 30% discount compared to their historical average relative to large-caps

Market watchers expect the S&P 500 to reach 6,500 next year with EPS of $270.00. Despite this optimistic outlook, experts warn about risks ahead. Stalled disinflation progress might force the Federal Reserve to raise rates in late 2025 or early 2026. Growing geopolitical uncertainty and changing government policies add unusual complexity to the stock market’s future.

How Different Markets Will Perform

Market analysts predict major changes in global markets as we enter 2025. The evolving market landscape brings both challenges and opportunities for investors who want to diversify their portfolios.

US Market Outlook

The US economy appears positioned for continued growth, supported by AI investments and coordinated monetary easing. Productivity improvements should sustain economic strength despite concerns about job market slowdowns.

The S&P 500 shows strong promise with price targets reaching 6,500 and expected earnings per share of $270.00. Yet experts warn about market concentration, as the five largest US companies now comprise about a quarter of the index.

The Federal Reserve’s approach remains crucial. Rate cuts are predicted, but if disinflation progress stalls, the Fed might reconsider rate hikes in late 2025. Investors should watch sectors like energy, financials, and industrials that could deliver substantial returns.

International Markets Potential

Investment opportunities beyond US borders continue to expand. Japan, Korea, and the United Kingdom show promise due to ongoing structural changes. Japan stands out with its wage-price spiral that has anchored inflation expectations near 2%.

Emerging markets reveal several exciting developments:

- India continues strong growth with attractive domestic structural drivers and predicted upward changes in earnings trends

- South Africa shows fresh potential after creating a business-friendly political coalition that has boosted business confidence

- Mexico and Vietnam gain from friend-shoring trends and global trade reshuffling

China’s outlook remains mixed as its government works to stabilize the financial system and real estate market. These efforts differ from previous infrastructure-focused stimulus packages but could still modestly benefit global markets.

The year 2025 should bring broader opportunities in equity markets according to experts. Small-cap stocks could benefit from interest rate cuts, while underappreciated sectors show growth potential. These changes across markets of all sizes point to a dynamic year ahead for global investors.

New Investment Tools and Platforms

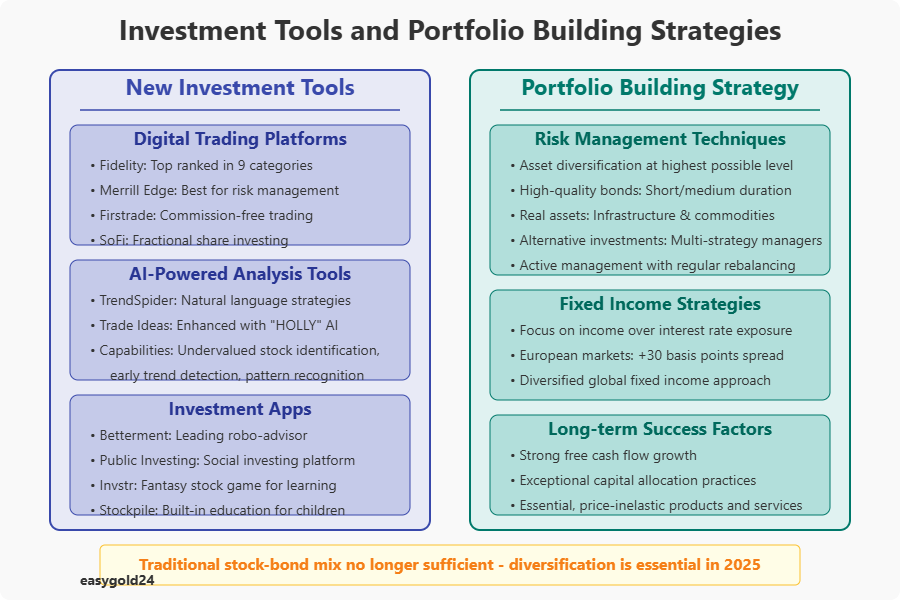

Mobile trading platforms and innovative investment tools are transforming the way investors interact with financial markets in 2025. Fidelity tops the rankings in nine significant categories, from trade execution speed to equity trading platforms.

Digital Trading Platforms

Today’s trading platforms integrate all the features investors need. Merrill Edge ranks first in risk management and research tools. Firstrade offers investors commission-free trading on stocks, ETFs, and options, among many account options. SoFi Active Investing stands out with its fractional share plan that allows investors to buy partial shares and reinvest dividends quickly.

AI-Powered Analysis Tools

AI stock analysis software has become a game-changer for market participants. These tools analyze vast amounts of historical data and market information to identify patterns and make predictions. The software helps traders find hidden opportunities through:

- Undervalued stock identification

- Early trend detection

- Unusual price pattern recognition

TrendSpider provides comprehensive market research capabilities that enable traders to create strategies using natural language and test them against historical data. Trade Ideas has enhanced its platform with the AI system “HOLLY” and OddsMaker service that provides algorithm recommendations based on market conditions.

Investment Apps

Investment applications have evolved to meet diverse investor needs. Betterment leads robo-advisor platforms with professionally managed portfolios tailored to individual risk tolerance. Public Investing adds a social element that connects investors through group chats and allows them to follow others’ investment ideas.

Invstr combines learning with real-life investing through an engaging fantasy stock game. Stockpile teaches children about investing with built-in education resources and ‘mini-lessons’ about stock market fundamentals.

These platforms prioritize security. Most investment apps employ industry-standard measures like two-factor authentication and data encryption. SIPC insurance protects brokerage accounts up to $500,000.

Building a Strong Portfolio

Your 2025 investment portfolio requires a fresh perspective, especially regarding the relationship between stocks and bonds. Traditional portfolio strategies need significant updates because bonds no longer reliably protect against market fluctuations.

Risk Management Techniques

A well-designed portfolio should combine assets that respond differently to market changes. Morgan Stanley’s Global Investment Committee now advocates for the highest possible portfolio diversification. This strategy becomes essential as market values fluctuate daily due to economic events, natural disasters, health crises, and global conflicts.

These components are vital to manage risk:

- High-Quality Bonds: Focus on short- and medium-duration assets instead of longer-duration credits (beyond 10 years)

- Real Assets: Infrastructure investments and commodities help protect against inflation

- Alternative Investments: Multi-strategy managers can provide protection against volatility from rising valuations

Fixed income strategies should focus on income rather than interest rate exposure. A diversified, income-focused portfolio that utilizes the global fixed income universe has outperformed traditional indexes with almost half the volatility.

Today’s market presents unique challenges because index-level investment-grade spreads are near their lowest points this century. Examining different regions becomes key—European markets provide an additional 30 basis points of spread among top-rated companies.

Active portfolio management remains vital through regular rebalancing to maintain target allocations. This helps control risk without attempting to enhance returns through market timing. Maintaining adequate liquidity provides flexibility during market fluctuations and unexpected opportunities.

Long-term success depends on finding companies with these characteristics:

- Strong free cash flow growth

- Exceptional capital allocation practices

- Essential, price-inelastic products and services

2025 Market Outlook: Navigating Opportunities with Strategic Investment

The 2025 market presents promising opportunities across multiple sectors, with small-cap stocks poised for substantial growth and ETFs continuing their momentum, surpassing the $10 trillion milestone. While the S&P 500 shows promising potential, investors must look beyond traditional markets to maximize returns.

The rise of modern trading platforms and AI-powered analysis tools has democratized access to the markets, empowering investors at every level. The expanding influence of cryptocurrency and digital assets further enhances the opportunities available to those who are well-prepared.

For 2025, successful investing hinges on constructing a well-diversified portfolio that goes beyond the traditional stock-bond mix. Incorporating high-quality bonds, real assets, and alternative investments will provide both growth potential and protection against market volatility.

At EasyGold, we recognize the shifting landscape and the importance of adapting to these changes. Our approach integrates the stability of gold through our tokenized gold ownership model, offering investors an innovative way to protect and grow wealth.

As Hartmann & Benz has already been listed on the OTCQB market, our shares and security token are now available for public trading. This is a significant milestone in our journey, offering the potential to participate in our growth while capitalizing on the security and growth offered by gold-backed assets.

Explore the opportunity to diversify your portfolio with EasyGold’s tokenized gold and stay ahead of the curve in 2025. Keep your investments protected and ensure long-term growth in a rapidly changing market.