What Are Stocks

What Are Stocks? Your First Step to Building Wealth

Stocks represent a share of ownership in a company, giving you the right to participate in its profits and assets. The concept of stock ownership dates back to 1602 when the Dutch East India Company issued the world’s first common stock. Since then, stocks have become a key tool for building wealth.

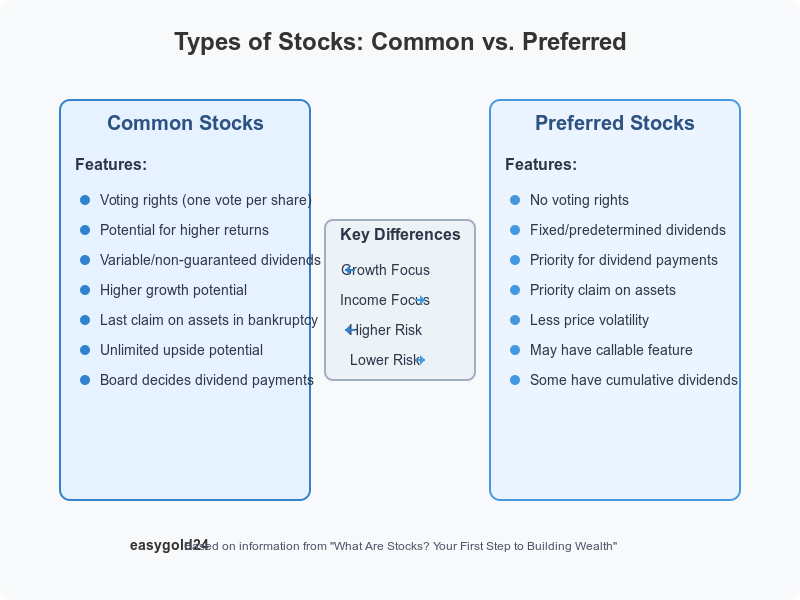

There are two main types of stocks: common stocks and preferred stocks. Common stocks come with voting rights, allowing you to influence company decisions, while preferred stocks prioritize dividend payments, providing a steady income stream.

Over time, the stock market has proven to be a powerful wealth-building vehicle, consistently outperforming most other forms of investment. By investing in stocks, you gain access to a share of a company’s growth, making it a foundational part of any long-term wealth strategy.

Whether you are just starting out or looking to expand your portfolio, understanding how stocks work and how to earn from them will help you make informed decisions. Diversifying your investments and carefully managing your portfolio will also help safeguard your financial future.

What Are Stocks and How Do They Work

Stock ownership means you own a piece of a company. Each share you purchase makes you a partial owner, and you share both the successes and challenges with the company.

Simple definition of stocks

You can buy two main types of stocks: common and preferred. Common stock owners can vote at shareholder meetings and may receive dividend payments. Preferred stockholders cannot vote but have priority in receiving dividends and company assets.

Shareholder rights are a vital part of stock ownership. Your ownership gives you:

- A share of company profits through dividends

- The right to vote on important company decisions

- A claim to company assets after creditors and preferred stockholders are paid

How companies issue stocks

Companies enter the stock market by launching an Initial Public Offering (IPO). This process transforms private companies into public ones. They sell their shares to investment banks, which then sell these shares to other investors.

Before selling stocks, companies must meet several requirements. The board of directors must approve each stock issue. Additionally, they need to determine how much money they want to raise and the appropriate price for each share.

A company’s articles of incorporation specify how many shares it can issue. If they need to issue more shares, they can amend their articles and pay the required fee.

Why companies offer stocks

Companies sell stocks to raise money without incurring debt. Unlike loans that require interest payments, stock sales generate cash without repayment obligations. This money helps companies in several ways:

- Growth and Development: Funding research, development, and purchasing new equipment

- Debt Management: Paying off existing loans to improve financial health

- Business Operations: Supporting daily business needs

Public companies often experience increased brand recognition, which can lead to greater market share. Stock-based compensation packages help them attract talented employees.

However, public companies must adhere to strict regulations. They need to regularly disclose their financial information to shareholders. These rules protect investors but also impose additional costs and oversight on the company.

Stock ownership creates value for all parties involved. Companies receive the funds they need to grow, while investors have the opportunity to build wealth through rising stock prices and dividend payments.

Understanding Different Types of Stocks

Investors need to understand the important differences between common and preferred stocks. These investments serve different purposes and have unique features that affect their risk and return profiles.

Common stocks explained

Common stocks provide investors with partial ownership in a company along with specific rights and privileges. Stockholders receive voting rights that allow them to participate in important company decisions, with one vote per share. These voting rights help them elect board members who oversee major management decisions.

Common stocks can deliver higher returns over time but also carry greater risk. In the event of bankruptcy, common stockholders are the last to receive company assets, after creditors, bondholders, and preferred shareholders have been paid.

The company’s board of directors determines whether common stockholders receive dividends. Unlike preferred stocks, these dividends are not guaranteed. This uncertainty is balanced by the potential to earn more through share price appreciation.

Preferred stocks basics

Preferred stocks combine features from both bonds and stocks, making them unique investment options. Preferred stockholders receive fixed dividend payments established when the stock is issued. These dividends are paid before any distributions to common stockholders.

Some key characteristics of preferred stocks include:

- Fixed or floating rate dividend payments that provide predictable income

- Priority claim on company assets and earnings

- Less price volatility compared to common stocks

- Generally no voting rights in company decisions

Preferred stock values fluctuate with interest rates, similar to bonds. Their values decrease as interest rates rise and increase when rates fall. These stocks often include a “callable” feature that allows companies to repurchase shares at their discretion.

Some preferred stocks have a cumulative dividend structure, meaning missed dividend payments accumulate and must be paid before common stockholders receive any dividends. This provision offers preferred stockholders additional protection.

Conservative investors seeking steady income might find preferred stocks attractive as a middle ground between bonds and common stocks. They typically yield more than corporate bonds and remain more stable than common stocks. This stability comes at the expense of limited growth potential compared to common stocks.

These differences help investors align their choices with their financial goals. Each type suits specific investment needs, whether someone seeks growth through common stocks or reliable income from preferred shares.

How Stock Prices Change

Stock prices move in response to numerous market forces, creating a complex yet fascinating financial ecosystem. Understanding these price movements helps investors make more informed investment decisions.

Supply and demand basics

Stock prices primarily respond to the fundamental economic principle of supply and demand. When more investors want to buy shares than sell them, prices rise. Conversely, when selling pressure exceeds buying interest, stock prices tend to fall.

Market makers play an essential role in this ecosystem by providing liquidity and ensuring smooth trading operations. These financial institutions help maintain price stability by ensuring that buyers and sellers are always present in the market.

Market factors affecting prices

Stock valuations respond to several external factors beyond supply and demand:

Economic Indicators: GDP growth rates and interest rates significantly affect investor confidence. Higher interest rates often make stocks less attractive compared to fixed-income investments.

Market Sentiment: Investors’ collective attitude toward specific securities or the entire market can trigger price changes. This psychological element frequently results in rapid changes in stock valuations.

Global Events: Wars, pandemics, or natural disasters create uncertainty about investment risks. These events typically cause market-wide price fluctuations as investors adjust their portfolios.

Company performance effect

A company’s financial health directly influences its stock price. Research shows that corporate performance has a positive correlation with stock price returns. This relationship manifests through several channels:

Earnings Reports: Quarterly and annual financial statements provide crucial information about a company’s profitability. Strong earnings typically boost stock prices, while disappointing results often cause declines.

Growth Prospects: Management’s forward-looking statements about future performance can significantly impact stock prices. Stock prices may fall even when current earnings meet expectations if future guidance is cautious.

Corporate Actions: Strategic decisions such as mergers, acquisitions, or management changes can cause substantial price movements. These actions indicate potential changes in the company’s future direction and profitability.

Research suggests that approximately 90% of a stock’s price changes are caused by broader market and sector movements. This “guilt by association” explains why stocks in the same industry often move together, regardless of their individual company performance.

For example, retail stocks often decline when one retail company faces challenges. Other companies in the sector experience price decreases due to sector-wide concerns. This connection demonstrates why investors should understand both company-specific factors and broader market dynamics.

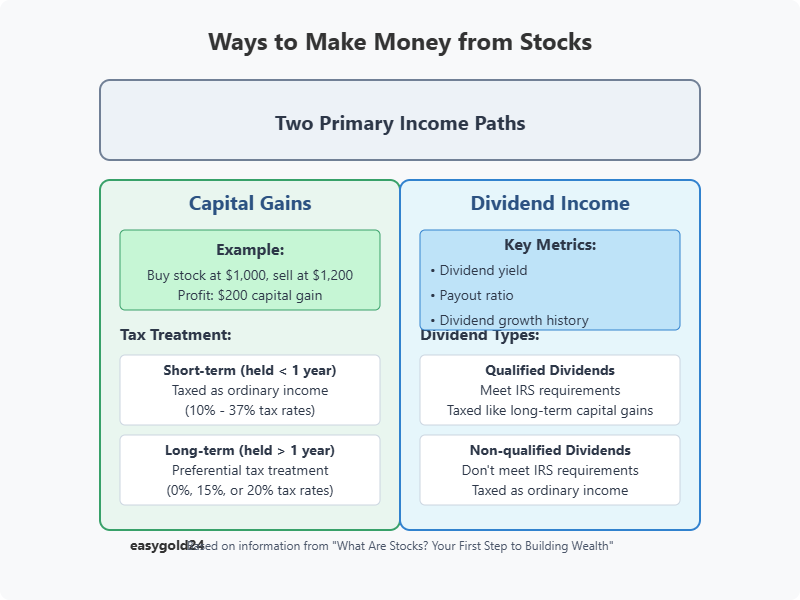

Ways to Make Money from Stocks

Stock investments can help you grow your wealth in two primary ways: through capital appreciation and dividend income. Understanding these wealth-building methods will help you make better investment decisions that align with your financial goals.

Capital gains explained

You earn capital gains when you sell stocks at a price higher than what you paid. For example, selling a stock for $1,200 that you purchased for $1,000 yields a $200 profit. The holding period determines how these gains are categorized:

Short-term capital gains: Profits from stocks sold within a year are taxed at the ordinary income tax rate. These rates currently range from 10% to 37%, based on your income bracket.

Long-term capital gains: Stocks held longer than a year qualify for preferential tax treatment. These gains are taxed at 0%, 15%, or 20% through 2025, depending on your taxable income. Single filers earning $48,350 or less, and married couples filing jointly with income of $96,700 or less, pay no tax on long-term capital gains.

The timing of your stock sales plays a crucial role in maximizing capital gains. Holding investments beyond a year often results in better tax treatment. You can also offset gains by harvesting tax losses and claim up to $3,000 in losses each year against your income.

Dividend income basics

Dividends provide regular income without requiring you to sell your shares. Companies pay these profits quarterly, monthly, or annually.

Dividends come in two types:

- Qualified dividends: These meet IRS requirements and receive the same tax treatment as long-term capital gains. Most dividends from U.S. stocks fall into this category.

- Non-qualified dividends: These are taxed at higher ordinary income tax rates.

Companies that pay dividends often demonstrate financial stability and maturity. Fidelity’s research shows that “stocks that increased their dividends the most outperformed the broad market, on average” during inflationary periods.

Growth-focused companies might reinvest profits instead of paying dividends. This approach aims to drive expansion and potentially create higher capital gains for shareholders. Companies with steady cash flows and established histories often maintain regular dividend payments to demonstrate their financial strength.

Here’s what matters most in dividend investing:

- Dividend yield: The annual dividend payment divided by the stock price

- Payout ratio: The percentage of earnings distributed as dividends

- Dividend growth history: Companies that regularly increase dividends tend to provide more reliable income

Building wealth in the stock market works best when you combine both capital gains and dividend income. This balanced approach blends growth potential with steady income, which is ideal for long-term investment planning.

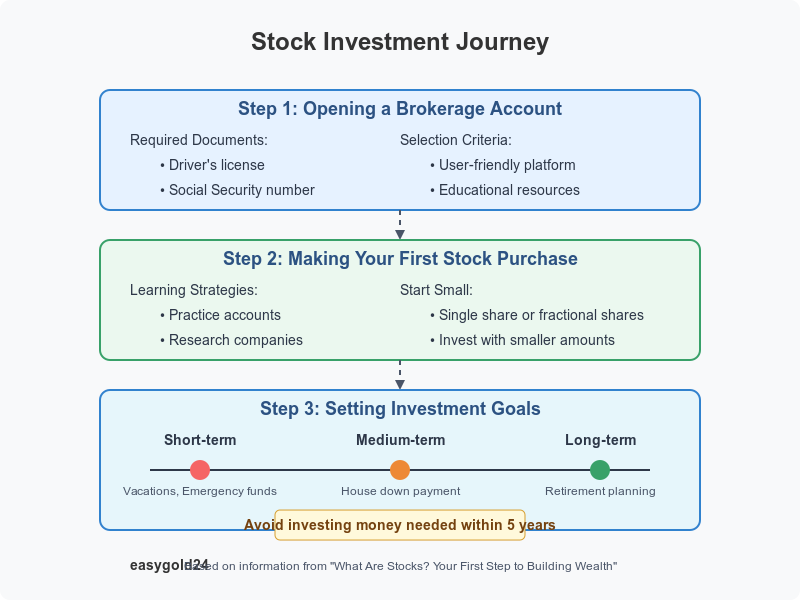

Starting Your Stock Investment Journey

Beginning your stock investing journey requires careful planning and a solid understanding of the basics. With a structured approach, you can enter the world of stock investments confidently.

Opening a brokerage account

A brokerage account is your first step toward investing in stocks. Most major online brokerages no longer charge commissions on stock trades. Consider these factors when selecting your broker:

- Platform user-friendliness and mobile app functionality

- Educational resources and analytical tools

- Access to research materials

- Additional features such as international trading or fractional shares

The account opening process typically takes about 15 minutes. You’ll need:

- Driver’s license

- Social Security number

- Bank account information for funding

Making your first stock purchase

After funding your account, your next step is to familiarize yourself with the trading platform. Many brokers provide practice accounts with simulated money to help you learn without risk. This simulation helps you develop skills in:

- Researching companies

- Understanding order types

- Executing trades

- Monitoring investments

Consider starting with a single share to understand ownership dynamics. Many brokers now offer fractional shares, allowing you to invest with smaller amounts. This feature is particularly helpful when purchasing expensive stocks because you can invest any dollar amount regardless of the share price.

Setting investment goals

Clear investment objectives provide structure and purpose to your stock investments. Your investment strategy should include:

Time Horizons:

- Short-term goals (vacations, emergency funds)

- Medium-term objectives (house down payment)

- Long-term aspirations (retirement planning)

Each goal may require different investment approaches. For instance, retirement planning typically involves more aggressive growth strategies, especially for younger investors. Maintaining separate accounts for major financial objectives helps you better track progress toward each goal.

It’s important to review and adjust your investment goals as your life circumstances change. This flexibility ensures your investment strategy remains aligned with your evolving financial needs. As you gain experience, you might want to diversify your portfolio across various sectors such as information technology, energy, or healthcare to create a balanced investment approach.

Due to market volatility, you should avoid investing money you’ll need within five years. Focus on building a responsible investment strategy that matches your risk tolerance and financial objectives. Through careful planning and consistent execution, you can develop a resilient foundation for your stock investing journey.

Stock Investing: A Key to Building Wealth

Investing in stocks provides an opportunity to participate in a company’s growth and profitability. It’s an accessible way to build wealth over time, offering returns through capital appreciation and dividends. Starting with even a small investment can help you understand how markets work without taking on excessive risk.

As you diversify your portfolio across various sectors, your understanding of the market dynamics will increase, improving your overall investment strategy. With a balanced approach, you can manage risks while positioning your portfolio for long-term growth.

At Hartmann & Benz, we’re committed to providing opportunities for growth in the evolving financial markets. As we continue our journey towards listing on the OTCQB market, our shares will soon be available for public trading, offering a unique opportunity for investors interested in securing a stake in our growth.

By investing with us, you’re not only participating in the world of stocks, but also in the future of gold-backed investments with our EasyGold security token, simplifying gold ownership and trading. Keep informed about our upcoming progress and stay connected for opportunities to engage.