Commodity Trading Platforms

Commodity Trading Platforms

Futures trading challenges even seasoned investors. Selecting the right commodity trading platform is a vital step toward success. The stakes are high – 82% of retail CFD accounts lose money, which makes platform selection even more important.

Traders need platforms that provide live data, accessible interfaces, and detailed analytical tools. We have thoroughly reviewed many commodities trading platforms. Our team evaluated everything from charting capabilities to technical indicators. The research spans platforms with over 1,100 trading instruments, including commodity CFDs on metals, energies, and soft commodities.

What is a Commodity Trading Platform

A commodity trading platform is a specialized software system that enables buyers and sellers to trade raw materials and primary products. These platforms create connections between market participants – from farmers and producers to exporters and buyers – allowing them to interact in a controlled and transparent environment.

Key Features and Functions

Today’s commodity trading platforms deliver the essential tools needed for successful trading operations. The platforms provide live market data and price quotes that allow traders to track market movements in real time. Additionally, they include advanced technical analysis tools, such as chart patterns and indicators, to predict future price movements accurately.

Order execution capabilities are a vital feature. Traders can place various orders, from market orders to limit orders, directly through the platform. The systems also include robust risk management tools that enable traders to set stop-loss levels and implement position sizing strategies to protect their investments.

The platforms allow traders to create individualized trading environments. Users can tailor their layouts, create watchlists, and select specific data displays based on their priorities. Backtesting functionality is another powerful feature that enables traders to evaluate their strategies with historical data before risking actual capital.

Types of Platforms Available

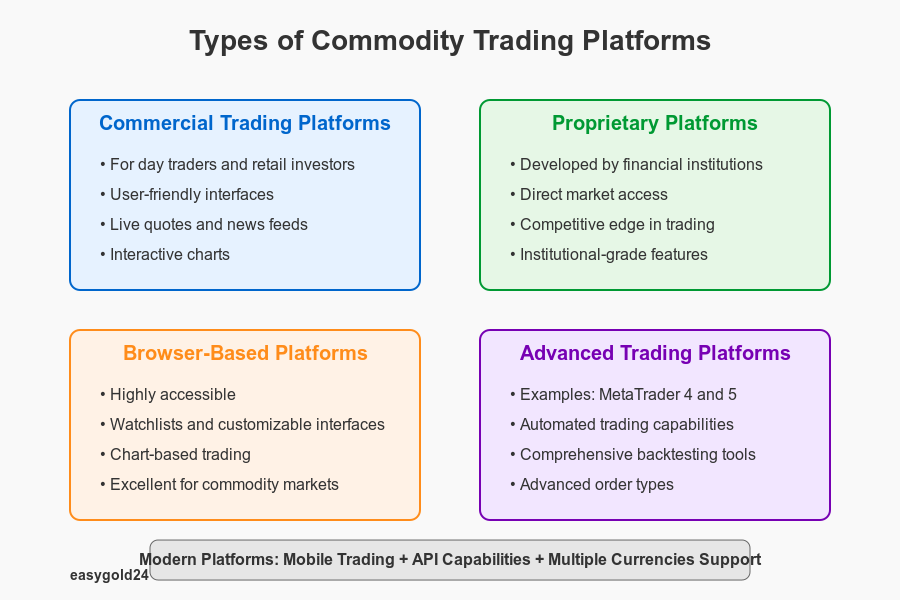

The commodity trading landscape includes several distinct platform categories:

1. Commercial Trading Platforms: These platforms serve investors of all types, especially day traders and retail investors. They combine user-friendly interfaces with essential tools like live quotes, international news feeds, and interactive charts.

2. Proprietary Platforms: Large financial institutions develop these platforms for their internal use. They provide direct market access that gives them a competitive edge in trading operations.

3. Browser-Based Platforms: These platforms excel in user-friendliness and accessibility. They include features like watchlists, chart-based trading, and customizable interfaces. Traders who focus on commodity markets benefit from these tools, as these markets respond quickly to global events.

4. Advanced Trading Platforms: Platforms like MetaTrader 4 and 5 include sophisticated features. They offer automated trading capabilities, comprehensive backtesting tools, and more order types. These platforms might take longer to master but provide serious traders with powerful tools.

The platforms demonstrate their value through practical applications. For example, J.P. Morgan’s trading platform showcases modern capabilities by offering two-way streaming prices across multiple commodity classes, including base metals, precious metals, energy, and agriculture. These platforms also support trading in multiple currencies and units, providing international traders with greater flexibility.

Security and reliability form the foundation of platform selection. Regulated commodity exchanges enforce standardized contracts and related investment products. Major exchanges like the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange handle various commodities, though some focus on specific types.

Commodity trading platforms continue to evolve in accessibility and functionality. Modern platforms support mobile trading applications that allow traders to monitor and execute trades from anywhere. Many platforms also integrate seamlessly with API capabilities, enabling automated trading systems and custom indicator development.

How to Choose the Right Platform

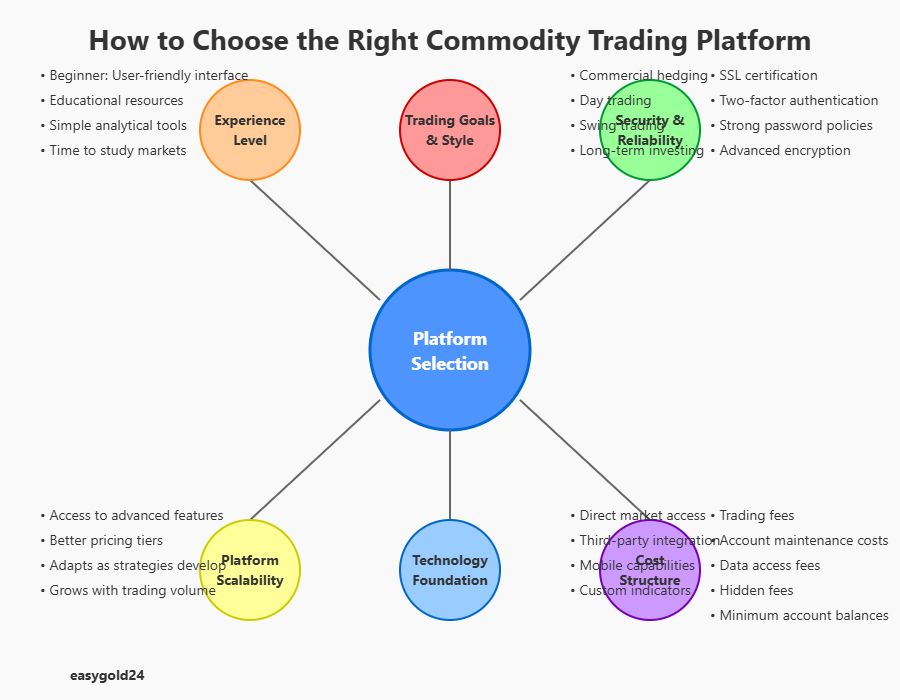

Your choice of commodity trading platform can substantially influence your success in trading. The platform serves as your primary tool to participate in the market, so you need to consider multiple factors that align with your requirements.

Your Trading Goals and Style

Understanding your trading objectives comes first when choosing a platform. Commercial hedgers focus on protecting prices and controlling risk exposure. They need platforms that offer specialized features to support these goals and provide access to research and government reports that drive their decisions.

Day traders and short-term investors need platforms with direct market access to reduce latency because speed directly affects their profits. Swing traders and long-term investors might value platforms with reliable analytical tools more than execution speed.

The right platform depends on your experience level as well. Beginners should look for platforms with:

- Accessible interfaces that allow time to study markets

- Educational resources and trading tutorials

- Simple analytical tools to understand market fundamentals

Platform Reliability and Security

Security stands out among critical factors in platform assessment. The best platforms employ multiple protection layers:

- SSL certification to transmit data securely

- Two-factor authentication (2FA)

- Strong password policies

- Advanced encryption protocols

Platform reliability encompasses several essential elements. The trading software should perform consistently, especially during busy market periods. The platform should offer:

- Continuous connection

- Quick order execution

- Regular system updates

- Reliable backup systems

Cost Considerations

The complete cost structure matters when selecting a platform. Trading fees constitute one of the biggest expenses to assess. Platforms utilize different fee structures:

- Commission-based fees

- Spread-based pricing

- Volume-based discounts

Account maintenance costs require careful attention. Some platforms charge monthly or annual fees for administrative costs. You should also consider expenses related to:

- Immediate market data access

- Research tools and premium features

- Platform usage fees

- Margin trading costs

Examine hidden fees that might not be immediately obvious. These might include:

- Withdrawal charges

- Inactivity fees

- Additional costs for historical data access

- Customer support fees beyond basic service

The platform should be transparent about its fee structure so traders can incorporate all costs into their decisions. Note that lower fees often correlate with fewer features and reduced service quality.

Some platforms require minimum account balances or have eligibility requirements. For instance, day trading platforms typically require a minimum equity of USD 25,000. Ensure the platform’s requirements match your available capital.

The platform should evolve with your needs. A good platform offers scalability options that allow you to access advanced features or better pricing tiers as your trading volume increases. This flexibility helps you avoid switching platforms as your strategy develops.

The platform’s technological foundation affects its long-term viability. Check if it supports:

- Direct market access

- Third-party software integration

- Mobile trading capabilities

- Custom indicator development

Getting Started with Platform Trading

Getting started with commodity trading begins with opening a trading account. You’ll find the process straightforward once you understand what’s required.

Setting Up Your First Account

The entire setup process typically takes less than 10 minutes. You’ll need these documents ready for verification:

- Proof of identity (passport, driver’s license)

- Proof of address (utility bills, rental agreements)

- Income verification documents

- Bank statements from the last six months

Brokers will review your financial status after you submit your documents. They evaluate factors such as liquid net worth, age, income, and trading experience. Most traders receive approval within days, though brokers might occasionally request additional information.

Your next step after approval is funding the account. Wire transfers and ACH deposits work on most platforms. Different platforms have varying minimum deposits – micro contracts might require just USD 500, while standard contracts could necessitate USD 2,000.

Understanding the Interface

Today’s commodity trading platforms feature user-friendly designs that facilitate smoother trading. New traders should familiarize themselves with these key interface elements:

- Market Data Display: Shows live price movements and market trends

- Order Entry Panel: Enables quick trade execution

- Position Monitor: Displays current holdings and performance

- Chart Analysis Tools: Provides technical analysis options

Traders can practice risk-free with demo accounts on most platforms. These practice environments help you understand market dynamics and refine your strategies before commencing real trading.

Basic Trading Tools

Traders need to become proficient with platform tools. Here are the essential features:

- Live Market Data

- Current price quotes

- Market depth information

- Trading volume indicators

- Order Management Systems

- Market orders for immediate execution

- Limit orders for price-specific trades

- Stop-loss orders to manage risk

- Analysis Tools

- Technical indicators

- Chart patterns

- Risk management calculators

Platform help centers provide valuable educational resources, including guides and video tutorials. These materials help you understand tool functions and develop effective strategies.

Platforms often include special features that optimize trading:

- Single-click trading capabilities

- Multiple account management options

- Automated trading systems

More sophisticated platforms incorporate tools like Depth of Market (DOM) displays and streaming live data feeds. These features enable traders to see the complete market picture and make better-informed decisions.

CFDs (Contracts for Difference) offer beginners an accessible way to start commodity trading. These instruments allow you to trade oil, gas, and other commodities without owning the actual assets.

Mobile trading apps come standard with most modern platforms, allowing you to trade from anywhere. Traders can monitor their positions and execute trades from any device with internet access.

Strong customer support enhances platform effectiveness. Leading platforms offer assistance through phone, email, and live chat. The support team possesses in-depth knowledge of commodity markets and can help with both technical issues and trading questions.

Essential Platform Features

A trader’s success in commodity trading depends on platforms with advanced features that enhance their decision-making abilities. Here’s an examination of the key functions that contribute to a trading platform’s effectiveness.

Real-time Market Data

Low-latency data feeds serve as the foundation of today’s commodity trading platforms. These feeds provide detailed market insights and give traders access to:

- Full depth of book data

- Trade execution details

- Best bid/ask quotations

- Auction imbalances

- Security status messages

Market data quality and speed directly influence trading outcomes. Top platforms process 9 million price updates every second. They generate 2.5 terabytes of data daily from more than 500 global exchanges and over 1000 OTC markets. This comprehensive data coverage provides traders with the accurate, timely information they need.

Chart Analysis Tools

High-quality charting capabilities distinguish premium trading platforms from simpler options. Leading platforms include:

- Technical Analysis Features

- Over 100 customizable indicators

- Automated trend line detection

- Multiple timeframe analysis

- Price comparison tools

Today’s platforms support analysis of extensive historical data. Traders can study market patterns across different time periods – from ticks and seconds to hours and days. This level of analysis helps identify trading opportunities and market trends.

Order Types and Execution

Modern order management systems allow traders to control their positions precisely. Current platforms support several order types:

Market Orders: Trades execute at the best available price immediately, prioritizing speed over specific price points

Limit Orders: Traders can set their maximum buying price or minimum selling price, ensuring trades only execute at these levels or better

Stop Orders: These trigger market orders when prices reach certain levels, helping manage risk and protect profits

Stop-Limit Orders: They combine stop triggers with limit prices to provide better control over trades

Order execution quality represents a key factor in platform selection. The best platforms deliver:

- Swift order processing

- Minimal slippage

- Reliable fills

- Multiple order duration options

Different platforms offer varying features. Some include advanced options like:

- Single-click trading

- Customizable order templates

- Position sizing calculators

- Risk management tools

Modern platforms extend beyond basic functions. Many now offer automated trading that enables traders to:

- Test strategies with historical data

- Use custom indicators

- Execute trades automatically based on predetermined conditions

The order execution interface focuses on speed and efficiency. Traders can view:

- Depth of market information

- Real-time position updates

- Trade confirmation details

- Account balance tracking

Advanced platforms handle complex order strategies through:

- IOC (Immediate-or-Cancel) orders

- AON (All-or-None) specifications

- GTC (Good-Till-Canceled) instructions

These advanced features operate on reliable technology and help traders:

- Monitor multiple markets simultaneously

- Execute complex trading strategies

- Maintain risk control

- Analyze market trends comprehensively

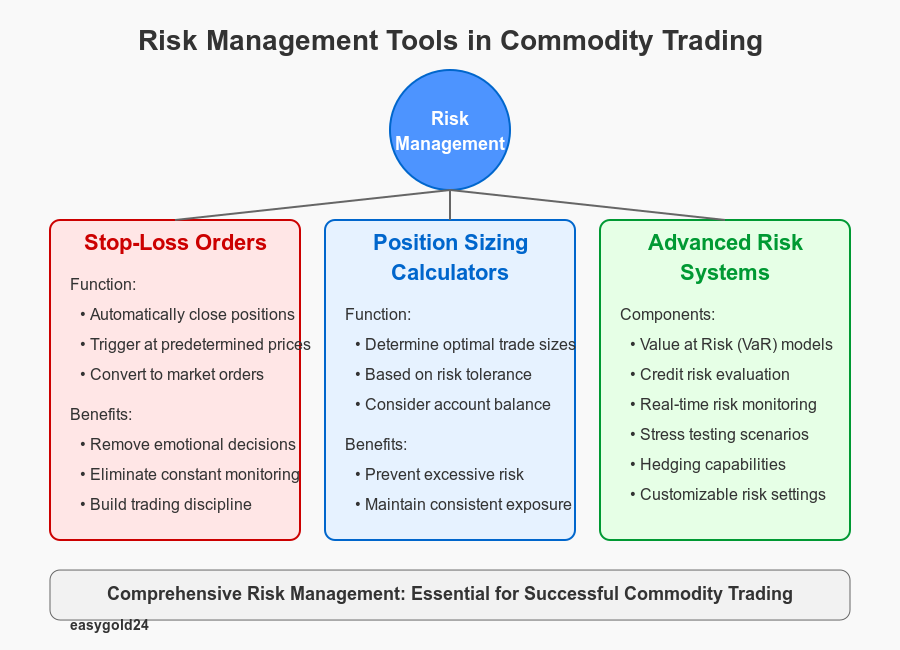

Risk Management Tools

Risk management is essential for successful commodity trading. Traders need specialized tools to protect their investments. Today’s trading platforms feature advanced risk management capabilities that help you navigate market uncertainties.

Stop-loss Orders

Stop-loss orders are vital risk management tools that automatically close positions when prices reach predetermined levels. These orders help limit potential losses by executing trades at specific price points.

A stop-loss order converts to a market order immediately after the security’s price reaches the stop price. This rapid conversion ensures your position closes at the best available market price and protects you from prolonged price declines.

Two main types of stop-loss orders exist:

- Stop-loss orders to sell: They activate when market prices fall to or below set stop prices

- Stop-loss orders to buy: They utilize stop prices above current market levels

However, traders must recognize limitations. Price gaps can present challenges – if a commodity’s price suddenly jumps past the stop price, the order triggers at less favorable levels.

Experienced traders address this by combining standard stop-loss orders with trailing stops. These stops adjust prices automatically when the market moves favorably.

Stop-loss orders provide clear benefits:

- Remove emotion from trading decisions

- Eliminate the need for constant position monitoring

- Build discipline in short-term trading

- Enable systematic profit protection

Position Sizing Calculators

Position sizing calculators are essential tools for risk management. They indicate appropriate trade sizes based on risk tolerance and account balance. These intelligent calculators consider several factors:

- Account balance

- Risk percentage per trade

- Stop-loss levels

- Current market prices

By entering these parameters, traders receive recommendations for optimal position sizes that align with their risk plans. This approach prevents excessive risk on individual trades while maintaining consistent risk levels across positions.

Position sizing calculators enhance trading success by:

- Controlling maximum risk per position

- Preventing single trades from depleting accounts

- Maintaining uniform risk exposure across different market conditions

Modern trading platforms include comprehensive risk management systems that extend beyond basic tools. These systems incorporate:

- Value at Risk (VaR) models to assess portfolio risk

- Credit risk evaluation systems

- Liquidity risk tracking tools

- Stress testing for extreme market scenarios

Effective risk management in commodity trading requires a holistic approach. Platforms now provide integrated solutions with:

- Real-time risk monitoring

- Automatic position adjustments

- Customizable risk settings

- Analysis of total portfolio exposure

Leading platforms enhance risk control with:

- Book structure definitions

- Front, middle, and back office frameworks

- Fraud risk assessment tools

- Internal control systems

These risk management tools function optimally when used properly. Traders should:

- Review and update stop-loss levels regularly

- Monitor position sizes as markets fluctuate

- Maintain consistent risk-reward ratios

- Document risk management plans

Modern platforms support sophisticated hedging through:

- Exchange-traded futures and options

- Forward market contracts

- Over-the-counter products

- Customized risk management solutions

These comprehensive risk management features enable traders to:

- Reduce market uncertainty

- Improve trading margins

- Focus on core business

- Maintain operational stability

Regular testing and scenario analysis help evaluate how risk strategies perform in various market conditions. This proactive approach allows you to:

- Identify vulnerabilities

- Develop contingency plans

- Assess strategy effectiveness

- Fine-tune risk parameters

Advanced Trading Capabilities

Modern commodity trading platforms incorporate features that extend well beyond basic trading functions. Traders can now automate strategies, integrate external systems, and develop proprietary analytical tools with these sophisticated capabilities.

Automated Trading Systems

The U.S. commodity trading landscape has transformed dramatically, with automated systems handling 73% of all trading transactions. These systems eliminate the need for manual trade execution and offer several key advantages:

1. Process Automation

- Rapid implementation of complex strategies

- Reduced human errors in execution

- Consistent application of trading rules

2. Historical Data Analysis

- Large-scale market data evaluation

- Strategy testing tools

- Enhanced performance results

Trading platforms now support various automated approaches. The CQG API enables traders to create custom algorithms and connects them to more than forty exchanges. This extensive market access allows traders to automate strategies across diverse markets.

API Integration

Application Programming Interfaces (APIs) enhance platform capabilities. Major platforms provide traders with several API options:

1. Web APIs

- REST-based interfaces

- WebSocket streaming for live data

- Account management tools

2. FIX Connections

- Rapid order routing

- Comprehensive market access

- Direct system integration

3. Trading-Oriented APIs

- Support for multiple programming languages

- Pre-built automation libraries

- Enhanced trade volume handling

Today’s APIs process 9 million price updates every second and generate 2.5 terabytes of data daily across more than 500 global exchanges. This robust infrastructure enables developers to:

- Create custom mobile applications

- Implement trading features

- Automate trading strategies

- Build personalized trading experiences

Custom Indicators

Advanced platforms allow traders to develop proprietary technical indicators and create unique analytical tools. These indicators identify:

- Market trends

- Trading opportunities

- Risk levels

- Price patterns

Platforms feature momentum indicators in two main categories:

- Oscillators for ranging markets

- Trend-following indicators for directional movements

Moving Average Convergence Divergence (MACD) stands out among custom indicators. It utilizes:

- 12-day EMA calculations

- 26-day EMA comparisons

- Nine-day signal line analysis

The Relative Strength Index (RSI) shows traders:

- Overbought conditions (above 70)

- Oversold levels (below 30)

- Potential market reversals

Bollinger Bands®, developed in the 1980s, serve as another powerful custom indicator that:

- Measures market volatility

- Indicates support and resistance levels

- Signals potential trend reversals

Platform developers continuously enhance these tools through:

- Advanced Technical Analysis concepts

- Institutional VWAP indicators

- Volume-based studies

These advanced features help traders:

- Execute complex strategies

- Monitor multiple markets

- Process trades rapidly

- Analyze markets thoroughly

Modern platforms have revolutionized how traders interact with commodity markets. The combination of automated systems, API connections, and custom indicators provides traders with unprecedented control while maintaining security and performance.

Choosing the Right Trading Platform: Key Factors for Success

The right trading platform is essential for a successful trading journey. Beyond basic trading functionality, modern platforms offer advanced tools such as automated systems, custom indicators, and robust risk management features that provide traders with unmatched control. With the ability to process 9 million price updates per second, these platforms empower traders to make informed decisions quickly.

When selecting a platform, consider factors like security, cost, technical capabilities, and ease of use. Starting with a demo account allows you to test features and get comfortable with the platform before transitioning to live trading. As you gain experience, these platforms become valuable tools in executing well-crafted strategies and managing risks effectively.

Hartmann & Benz recognizes the importance of providing innovative, secure investment opportunities. As part of our growth strategy, we are excited to announce our recent listing on the OTCQB market, making Hartmann & Benz shares available for public trading and investment. Alongside this, we are launching the EasyGold security token, which offers a streamlined and cost-effective way to own and trade gold. This represents a key opportunity for those looking to invest in a company committed to innovation and sustainability in the gold market.

We invite you to stay informed about our developments and explore how you can be part of this exciting investment opportunity.