Precious Metal

Choosing the Right Precious Metal for Your Investment

Precious metals have stood the test of time, retaining their value when currencies have faltered. With economic uncertainty on the rise, many investors turn to these tangible assets to safeguard their wealth. Gold, silver, platinum, and palladium offer reliable diversification opportunities and serve as effective shields against inflation and financial instability.

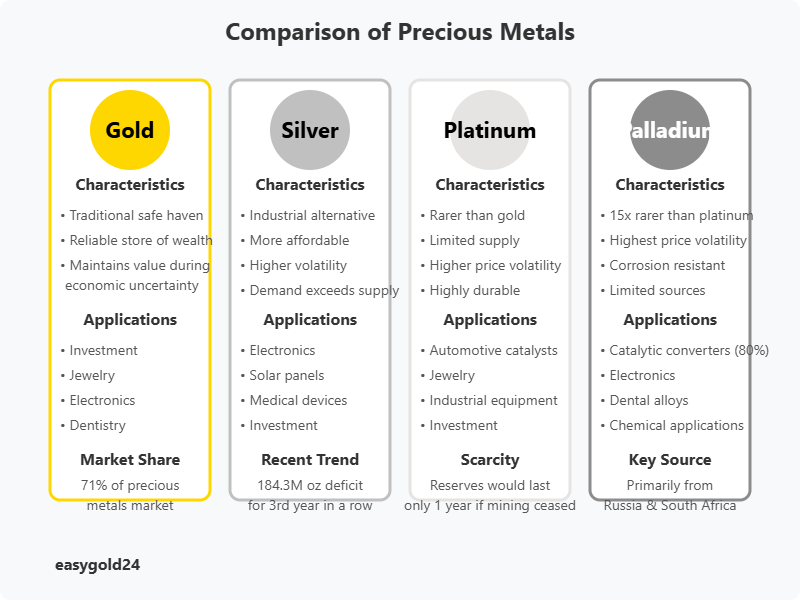

Gold remains the most popular choice due to its proven stability over centuries. It has long been seen as a safe haven in times of economic downturn. Silver, while similar, is also widely used in various industries, offering both investment potential and industrial applications. Platinum is rarer than gold and silver, making it an attractive option for those seeking unique assets. Palladium, on the other hand, is driven by industrial demand, particularly in the automotive industry.

Determining which precious metal to invest in depends on your investment goals and risk tolerance. Each metal serves a distinct purpose in a diversified portfolio, with varying levels of volatility and long-term growth potential.

Understanding Different Precious Metals

Each precious metal possesses unique characteristics that make it worthy of investment consideration. Below is an analysis of what makes these valuable assets distinct.

Gold: The Traditional Safe Haven

Gold has consistently served as a reliable store of wealth throughout history. Unlike paper currency, gold maintains its value regardless of economic conditions. Additionally, it demonstrates remarkable stability because its price doesn’t strictly follow conventional supply and demand patterns. Gold’s utility extends beyond investing—it finds applications in dentistry, electronics, and environmental technologies.

Silver: The Industrial Alternative

Silver presents a compelling investment case, particularly due to its extensive industrial applications. Recent data reveals an interesting trend—silver demand exceeded supply in 2023 for the third consecutive year, creating a deficit of 184.3 million ounces. The electrical and electronics industry significantly increased silver consumption last year, rising by 20% to 445.1 million ounces. Solar panel manufacturing has become a major demand driver, with solar applications consuming 193.5 million ounces in 2023, representing a 64% increase from the previous year.

Platinum and Palladium: The Rare Options

Platinum and palladium represent some of the rarest investment options available. Platinum’s scarcity becomes evident through a simple comparison: if all mining ceased today, current gold supplies would last approximately twenty-five years, while platinum reserves would be depleted in just one year.

These metals play crucial roles in various industries. The automotive sector utilizes nearly half of the annual platinum supply for emissions control devices. Palladium is equally essential—approximately 80% of available supply is dedicated to manufacturing catalytic converters.

Palladium is 15 times rarer than platinum, which explains its significantly higher price per ounce. Both metals excel in resisting wear, tarnish, and chemical damage. However, their limited availability, primarily from South Africa and Russia, can cause their prices to fluctuate more dramatically than gold and silver.

Comparing Investment Methods

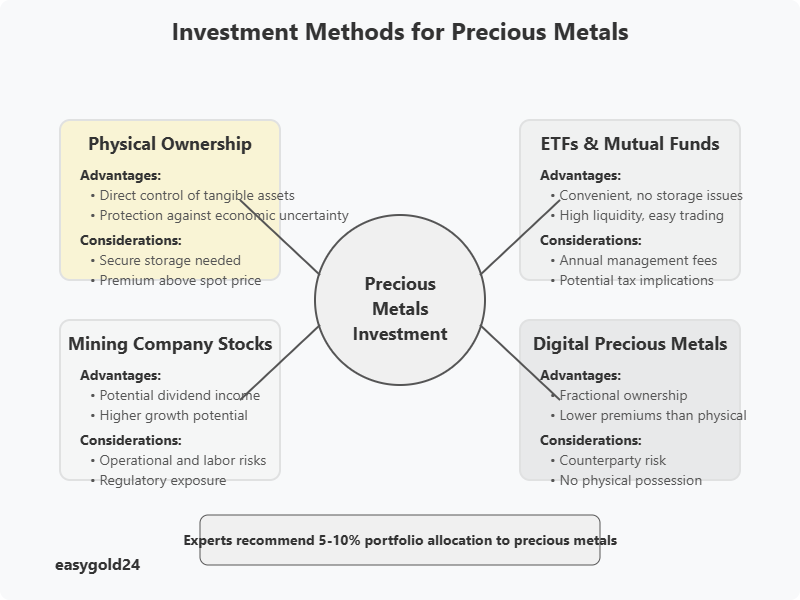

Selecting the appropriate investment method is essential when entering the precious metals market. Your financial objectives will determine which approach is most suitable for your circumstances.

Physical Metal Ownership

Possessing physical precious metals provides direct control over tangible assets. While secure storage is necessary, physical metals offer optimal protection against economic uncertainty. Investors should be aware of markups above spot prices and ongoing storage expenses.

ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) offer a convenient alternative to physical ownership. These funds track metal prices without the storage challenges. However, annual management fees can diminish long-term returns. Furthermore, tax authorities classify some precious metal ETFs as collectibles rather than conventional investments, which may affect tax treatment.

Mining Company Stocks

Mining stocks can provide dividend income while metal prices appreciate. Well-managed mining companies remain profitable even during challenging market conditions. However, mining investments carry distinct risks. Labor disputes, operational difficulties, or regulatory changes can negatively impact stock values regardless of prevailing metal prices.

Digital Precious Metals

Digital platforms enable ownership of fractional precious metals stored in secure vaults. These options typically involve lower premiums than physical metals because they eliminate manufacturing costs. Digital ownership provides continuous access to your investment, though you cannot take physical possession of the actual metals.

Short-term vs Long-term Returns

Gold generated annual returns of 10.6% from 1971 to 2019. Active traders often prefer ETFs or mining stocks for market entry and exit flexibility. Physical metal owners typically focus more on wealth preservation rather than rapid capital appreciation.

Risk Tolerance Assessment

Understanding your comfort level with market volatility is essential before investing. Physical metals offer stability but require secure storage. ETFs provide liquidity but involve counterparty dependencies. Mining stocks present growth potential but face business-specific risks. Success in precious metal investing largely depends on selecting an investment approach that aligns with your risk tolerance.

Evaluating Your Investment Goals

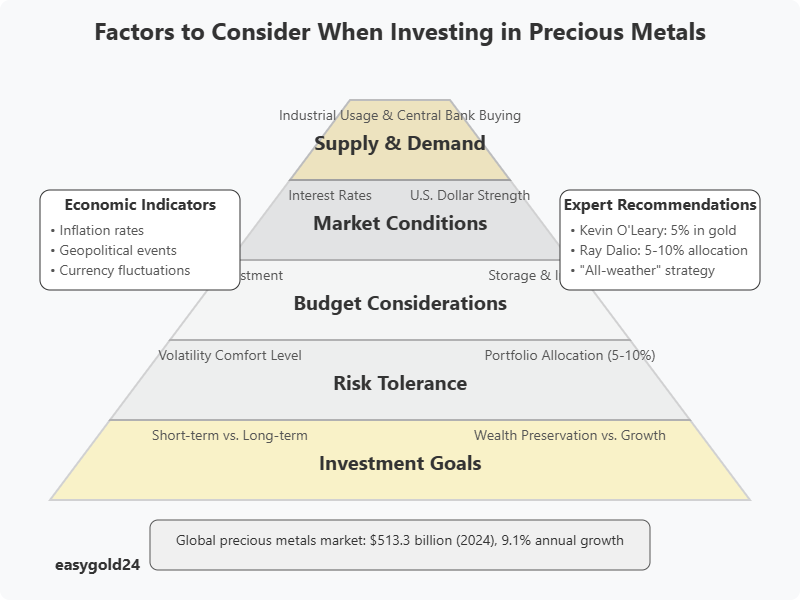

Clearly defined goals are fundamental to successful precious metal investing. Your investment purpose will influence every decision throughout your precious metals journey.

Begin by assessing your current financial situation. Evaluate your income, expenses, debt obligations, and existing investments. This comprehensive overview helps determine how much you can invest without compromising your financial stability.

Your time horizon plays a critical role in strategy development. Short-term investors might monitor market trends for quick gains, while long-term investors prioritize stability and gradual wealth accumulation. Investors seeking to preserve wealth over decades often allocate more substantial portions to physical metals.

Financial experts typically recommend allocating 5-10% of your portfolio to precious metals. For instance, Shark Tank investor Kevin O’Leary maintains 5% of his portfolio in gold bullion and ETFs, adjusting his position as prices fluctuate. Hedge fund manager Ray Dalio suggests a 5-10% allocation as part of an ‘all-weather’ investment strategy.

Consider these essential factors when establishing your investment goals:

Risk Assessment: Precious metals demonstrate lower volatility than stocks but can experience significant price movements

Liquidity Requirements: Limit investments in physical metals if you anticipate needing quick access to capital

Cost Considerations: Physical metals incur storage fees while ETFs involve management fees

Inflation Protection: Gold and silver typically perform well during inflationary periods

Your investment timeline influences strategy selection. Short-term goals (one year or less) focus on immediate needs, while long-term goals (beyond five years) require methodical planning and consistent execution.

Precious metals offer distinctive advantages: they carry no credit risk, cannot be artificially inflated, and provide protection against financial or political instability. They also move independently from other investments, which helps reduce portfolio risk and volatility.

Analyzing Market Conditions

Precious metal prices fluctuate based on the interaction between economic indicators and supply-demand dynamics. Astute investors study these forces to make more informed decisions.

Economic Indicators to Watch

Interest rates significantly influence precious metal prices. Higher rates typically drive investors away from non-yielding assets like gold. The Federal Reserve’s recent rate increases above 5% have impacted gold prices accordingly.

The U.S. dollar’s strength directly affects metal valuations. Metal prices generally decline when the dollar strengthens, as evidenced by the dollar index reaching its highest point in twenty years. Rising inflation also guides investment decisions—investors purchase metals as protection when currencies lose purchasing power.

Supply and Demand Factors

New metal supply derives primarily from mining operations (70-85%), supplemented by recycled materials. Price changes occur when supply disruptions arise from labor strikes or regulatory changes. Global central banks purchased a record 1,200 tons of gold in 2023, representing a 38% increase from 2022.

Industrial requirements substantially impact prices. Silver’s industrial consumption decreased by 5% in 2023. Jewelry manufacturers continue to purchase significant quantities—over 2,500 metric tons of gold annually, approximately two-thirds of production volume.

Price Trends and Patterns

Market statistics reveal compelling trends. The global precious metal market expanded to USD 513.3 billion in 2024 and is projected to grow at 9.1% annually through 2030. Gold dominates the market with a 71% share. The Asia Pacific region leads in consumption, accounting for 47% of total sales.

Capital flows demonstrate clear correlations with economic conditions. Precious metals appreciated approximately 20% compared to the previous year. December 2023 prices remained below March 2023 peak levels. The World Bank forecasts relatively stable precious metal prices, with a slight decline anticipated in 2025.

Making Your First Metal Investment

Initiating precious metal investments requires consideration of three primary factors: investment amount, preferred form, and dealer selection.

Setting Your Budget

Most experts recommend allocating 5-10% of your investment portfolio to precious metals. Gold provides an excellent starting point for portfolios under USD 1 million. Modern fractional ownership platforms allow entry with as little as USD 50, making precious metals accessible to virtually all investors.

Choosing Investment Form

Physical metals are available in three main formats:

- Bars: Provide options in various weights and dimensions—ideal for larger investments

- Coins: May command premiums beyond their metal content for collectors

- Rounds: Popular among new investors, typically weighing between one and five ounces

Bullion prices generally track spot prices more closely, while semi-numismatic coins offer distinct advantages. The IRS does not require reporting for pre-1933 U.S. and European coins.

Additionally, certified-graded coins between MS60 and MS70 demonstrate remarkable resilience during market volatility.

Finding Reliable Dealers

Comprehensive research is essential before selecting a dealer. Begin by verifying membership in respected organizations such as the Professional Numismatists Guild or American Numismatic Association. Established dealers should display transparent pricing and provide proper documentation authenticating their products.

Consider these factors when selecting a dealer:

- A physical office location (not merely a P.O. box)

- Clearly defined refund and return policies

- Multiple secure payment options including credit cards, wire transfers, and cryptocurrency

Gold reached a record USD 2,973.40 per Troy ounce on February 20, 2025. Consequently, dealer premiums constitute an important consideration—they cover manufacturing, shipping, and operational expenses. Compare prices from multiple dealers, but avoid selecting solely based on lowest cost since reputation and service quality are equally important factors.

Investing in Precious Metals

Precious metals offer investors an opportunity to protect their wealth against economic instability. Gold, silver, platinum, and palladium each bring unique benefits to an investment portfolio, with varying levels of volatility and risk. Gold remains the most widely recognized due to its historical stability, while silver’s industrial applications and affordability offer further diversification. Platinum’s rarity adds exclusivity, and palladium’s industrial demand makes it a strategic option for those seeking specialized assets.

Investors should approach precious metal investments with a clear strategy and objective in mind. Whether opting for physical ownership, ETFs, or stocks in mining companies, it is essential to assess which method aligns with your financial goals and risk profile.

In this evolving market, understanding the factors that drive demand—such as global economic conditions and supply chains—can help make informed decisions. Additionally, with Hartmann & Benz’s recent listing on the OTCQB market, investors have the opportunity to engage with a company dedicated to acquiring and managing gold resources.

Explore the potential of gold investments today and consider how easygold24, through innovative methods like security tokens, is reshaping the way precious metals are traded and owned. By investing in such advanced solutions, you can secure your wealth while benefiting from the growth and stability of the precious metals market.