Rare Earth Metals

Rare Earth Metals: What Are They, and Are They a Solid Investment?

The rare earth metals market worldwide reached $320 billion in 2022, substantially driven by electric vehicle manufacturers and renewable energy technologies. Between 2017 and 2022, lithium demand tripled while cobalt demand increased by 70%. These dramatic shifts have prompted many investors to question the optimal timing for investing in rare earth metals.

The market presents both opportunities and challenges for investors, as China controls 68% of global nickel refining and 85% of rare earth processing. Rare earth investments have gained attention as countries like the United States expand their production capacity, particularly when domestic companies increase their mining operations. This comprehensive guide will help you understand the rare earth metals market, assess various investment options, and develop a strategy that aligns with your portfolio objectives.

Understanding Rare Earth Metals

Rare earth elements (REEs) are a specialized group of 17 metallic elements that form the foundations of modern technology. These elements are actually quite common in Earth’s crust, with cerium ranking as the 25th most abundant element.

What Makes These Metals Special

These metals’ exceptional properties derive from their unique electron configurations, particularly their 4f electrons. The silvery-white soft heavy metals possess remarkable magnetic and luminescent features that make them unique. They conduct electricity effectively and create compounds with a valence of 3, including stable oxides, carbides, and borides.

Key Rare Earth Elements

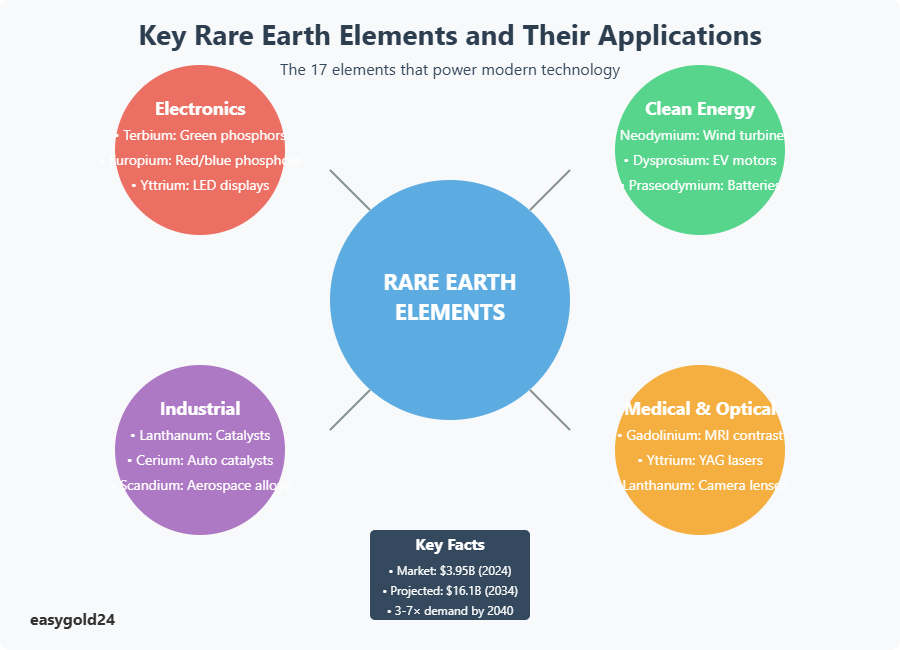

The rare earth family encompasses 15 lanthanide elements plus scandium and yttrium. These elements include:

- Lanthanum through Lutetium (atomic numbers 57-71)

- Scandium (atomic number 21)

- Yttrium (atomic number 39)

These metals’ melting points vary widely from 798°C for cerium to 1,663°C for lutetium. Their electrical resistivities fall in the middle range of metallic elements, ranging from 25 to 131 microohms-cm.

Common Uses in Technology

Rare earth elements are vital in numerous technological applications. Often referred to as the “seeds of technology,” their key uses include:

Electronics and Display Technology: Smartphones require seven different REEs to function properly. These elements are incorporated into components ranging from colored screens to speakers and miniaturized circuits. Terbium creates green phosphors at 545 nanometers for screens, while europium produces both red and blue phosphors.

Clean Energy Applications: These elements are essential to renewable energy technologies. Neodymium-iron-boron magnets, the strongest magnets known, are crucial for electric vehicle motors and wind turbines. Adding dysprosium to these magnets enhances their heat resistance, making them ideal for electric vehicle rotors.

Industrial and Medical Uses: Lanthanum-based catalysts assist in petroleum refining, while cerium-based catalysts function in automotive catalytic converters. Medical professionals use gadolinium for magnetic resonance imaging (MRI), and yttrium is essential in yttrium-aluminum-garnet (YAG) lasers.

Optical Applications: The glass industry consumes more REE raw materials than any other sector. Lanthanum comprises up to 50% of digital camera lenses, including those in smartphones. These elements also enhance the optical properties of specialized glasses used in various applications.

The unique properties and diverse applications of rare earth elements create significant investment opportunities. Making informed investment decisions in this sector requires a solid understanding of both their technical characteristics and market applications.

Current Market Overview

The rare earth elements market stands at $3.95 billion in 2024. Market projections indicate promising growth that could reach $16.1 billion by 2034.

Global Supply and Demand

Clean energy technologies and electric vehicles continue to drive increasing demand for rare earth elements. The International Energy Agency expects demand to grow three to seven times above current levels by 2040. Global rare earth output rapidly increased from 240,000 metric tons in 2020 to 350,000 metric tons in 2023.

China maintains market dominance, yet other countries are developing alternative supply chains. China’s influence extends beyond mining to refining, where it controls 98% of global operations. This concentrated supply raises concerns about market stability and security.

Key demand drivers include:

Electric vehicle production – Global EV sales reached 14.2 million units in 2023, up from 10.5 million in the previous year

Renewable energy sector – A single 3 MW wind turbine requires approximately 2 tons of rare earth permanent magnets

Consumer electronics – Mobile phone sector growth, with China’s mobile subscribers expected to reach 1.26 billion by 2025

Price Trends

Rare earth elements have experienced significant price fluctuations. Prices peaked in 2022 but began declining in 2023 as demand from green energy companies and the automotive sector softened. Dysprosium oxides saw a notable 10% increase month-on-month in May 2024, while neodymium-praseodymium oxide showed a modest 0.6% rise.

The German Mineral Resources Agency predicts substantial demand growth by 2040:

- Dysprosium demand could surge to 687% of 2018 production levels

- Neodymium and praseodymium demand might reach 227% of 2018 production

- Terbium requirements could climb to 687% of 2018 production volumes

The market outlook remains positive. Annual demand for rare earth metals is expected to double to 125 kilotons in the near future and could reach 315 kilotons by 2030. Price stability faces challenges from geopolitical tensions and supply chain disruptions. China’s strategic control over pricing mechanisms shapes global markets, as most international rare earth trades base their rates on Chinese domestic prices.

Investment Options Available

Rare earth elements offer several different investment avenues. Each investment path provides distinct advantages depending on your risk tolerance and investment goals.

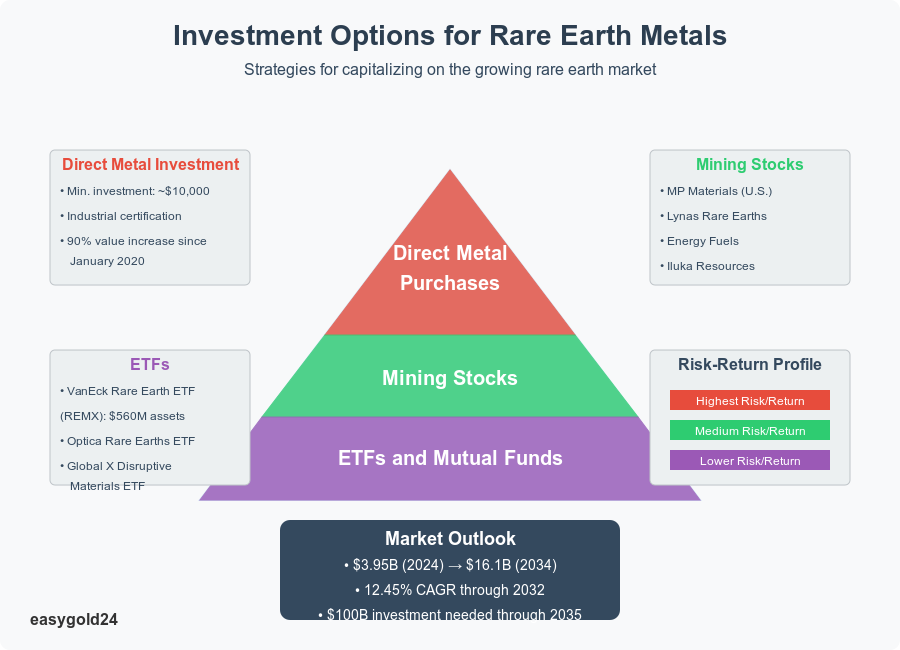

Direct Metal Purchases

Physical ownership of rare earth metals represents a tangible investment option. These strategic metals are available from certified global dealers, with a minimum investment requirement of approximately $10,000. The purchases include industrial certification and ownership documentation, similar to gold bullion investments. Currently, dealers offer five technology metals and four rare earth elements that have demonstrated impressive performance with a 90% value increase since January 2020.

Mining Stocks

Mining companies provide investors with another entry point into the rare earth market. MP Materials operates the only U.S.-based rare earth mining operation at Mountain Pass. Lynas Rare Earths is the leading non-Chinese producer of separated rare earths.

The market continues to expand with these key players:

Energy Fuels – They recently completed construction of Phase 1 REE separation infrastructure and anticipate producing 850 to 1,000 MT of NdPr annually

Iluka Resources – They are constructing Australia’s first integrated rare earth refinery with government support

Arafura Resources – The Nolans project is advancing in Northern Territory with substantial government funding

ETFs and Mutual Funds

ETFs enable diversification across the rare earth sector. The VanEck Rare Earth/Strategic Metals ETF (REMX), established in 2010, manages over $560 million in assets with a 0.54% expense ratio. This fund tracks companies involved in producing, refining, and recycling rare earth elements.

Additional fund options include:

Understanding your comfort level with market volatility is essential before investing. Physical metals offer stability but require secure storage. ETFs provide liquidity but involve counterparty dependencies. Mining stocks present growth potential but face business-specific risks. Success in precious metal investing largely depends on selecting an investment approach that aligns with your risk tolerance.

Optica Rare Earths & Critical Materials ETF (CRIT) – Launched in 2022, focusing on companies throughout the rare earth value chain

Sprott Energy Transition Metals ETF (SETM) – Tracks companies working with energy transition materials

Global X Disruptive Materials ETF (DMAT) – Targets materials companies deriving significant revenue from rare earth exploration and production

Mining company share prices often fluctuate independently from spot metal prices, making it crucial to understand market dynamics before investing. The recycling sector shows promise, with experts projecting the global rare earth metals recycling market to reach $422 million by 2026.

Global Supply Chain Dynamics

Supply chain dynamics in the rare earth metals sector reflect a complex interplay of geopolitical forces and market concentrations.

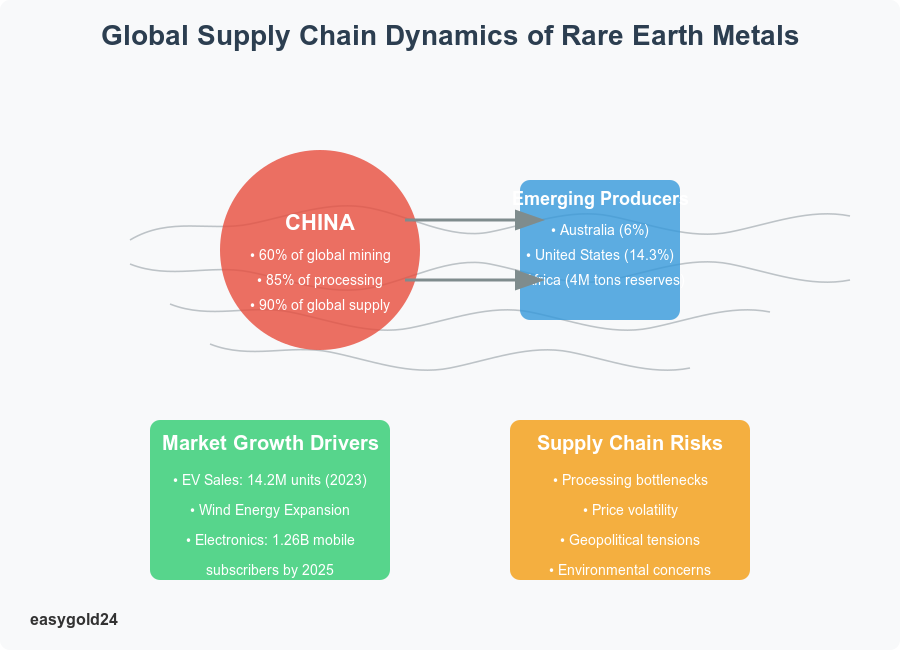

China's Market Dominance

China maintains a strong position in the rare earth elements market. The country produces approximately 60% of global output and processes nearly 90% of the world’s supply. Their strategic advantage extends beyond mining—they control approximately 85% of rare earth processing capabilities. China reinforced its market control in December 2023 by announcing restrictions on rare earth extraction and separation technologies.

Emerging Producers

Several nations are developing their rare earth capabilities outside of China. Australia contributes 6% of global rare earth mining through its expanding industry. The United States ranks as the second-largest producer with 14.3% of global mining output. Africa demonstrates significant potential with deposits containing approximately 4 million tons of rare earth reserves.

Supply Risks

The supply chain’s concentration creates numerous challenges. Materials mined in other countries still require processing in China, creating a significant bottleneck. Price volatility, particularly recent downward trends, has become a key constraint on rare earth supply.

Growth Drivers

Electric vehicle sales are accelerating market expansion. Global EV sales increased from 1 million units in 2017 to over 10 million units in 2023. This rapid growth has transformed the industry landscape—EV market share rose from 9% in 2021 to 35% in 2023.

Risk Factors

The rare earth elements market faces several significant challenges:

- Price volatility affects manufacturing costs and project budgets

- Complex supply chains increase final costs for manufacturers

- Private market transactions complicate price tracking

- Environmental concerns arise from extraction and processing operations

Market Outlook

The rare earth elements market is projected to reach USD 15.8 billion by 2032, with a CAGR of 12.45%. The Asia Pacific region leads with 72.2% market share due to its production capabilities. Recycling and reuse present significant opportunities driven by sustainability requirements and economic benefits.

Emerging technologies are enhancing recycling efficiency, which will shape the market’s future development. Stricter environmental regulations may increase production costs but will promote sustainable practices throughout the industry.

Evaluating Investment Potential

Assessing the investment potential of rare earth metals requires thorough analysis of market dynamics and risk factors. The market will require USD 100 billion in investments through 2035 to meet growing demand for magnet elements.

Rare earth projects face significant technical challenges. The separation of pure oxide forms in midstream processing is extremely complex and time-consuming. The technical barriers are so substantial that only two non-Chinese companies have successfully entered processing markets.

Price volatility represents a critical factor for investors. Neodymium oxide prices must remain above USD 150 per kilogram for midstream projects to achieve profitability. Throughout the past decade, prices have remained below this threshold most of the time.

The rare earth sector faces several risks beyond pricing:

The absence of a spot market for physical metals limits market liquidity

Industry transactions occur through long-term contracts rather than spot purchases

China’s control of 85% of global refining creates a high concentration of processing capabilities

Refining operations have one of the highest average grid carbon intensities at 607 gCO2/kWh, raising environmental concerns

Despite these challenges, the market’s future appears promising. Fortune Business Insights projects 10% annual growth between 2021 and 2028, driven by electronics and electric vehicle demand. Adamas Intelligence forecasts neodymium magnets demand will grow at 8.6% annually from 2022 to 2035.

ETFs may offer advantages over direct metal investments for risk mitigation. The VanEck Rare Earth and Strategic Metals UCITS ETF enables investors to gain exposure through production and processing companies. Investors should be aware that ETF portfolios can differ significantly from traditional mining sector funds.

Japan’s successful partnership with Lynas Rare Earths demonstrates the effectiveness of public-private collaborations. The French Observatory of Mineral Resources exemplifies growing government support for rare earth development.

Building Your Investment Strategy

Developing a successful investment strategy for rare earth metals requires careful consideration of market dynamics and risk tolerance. The following sections explore key aspects for building a robust investment approach.

Setting Investment Goals

Diversification serves as the primary objective when investing in rare earth metals. These investments help hedge against monetary inflation and provide exposure to green transition technologies. The market’s distinctive characteristics differentiate rare earth investments from traditional mining sector funds.

Choosing Entry Points

Exchange-traded funds (ETFs) offer the most accessible investment avenue for most investors. The VanEck Rare Earth/Strategic Metals ETF (REMX), with an expense ratio of 0.54% and assets exceeding $560 million, provides broad market exposure. Mining stocks represent another option. Investors should seek companies that demonstrate:

- Proven exploration methodologies

- Consistent production levels

- Stable cash flow

- High-quality resource reserves

Portfolio Allocation

Effective portfolio allocation balances potential returns with inherent risks. Consider these strategic guidelines:

Geographical diversification is paramount. Chinese companies constitute approximately one-third of the VanEck ETF’s portfolio. Understanding this jurisdictional exposure is essential for risk assessment.

Company fundamentals are critically important. Mining corporations should maintain positive cash flow even during periods of low commodity prices. Companies with existing operations that help fund development costs of secondary mines typically present lower risk profiles.

ESG risk ratings and environmentally responsible operational practices should inform investment decisions. This approach supports environmental stewardship and may reduce long-term investment risks.

Realistic expectations regarding liquidity are essential. Rare earth markets can experience high volatility and limited trading volumes. Appropriate position sizing is critical for effective portfolio management.

Futures exposure, while available, entails complex risks including contango and backwardation, making it unsuitable for most individual investors. A more effective approach involves distributing capital across different segments of the rare earth value chain, encompassing both mining operations and recycling initiatives.

Investing in Rare Earth Metals

Rare earth metals are emerging as essential components in the development of clean energy and electric vehicles. As industries increasingly turn to these metals for technological advancements, demand continues to grow. However, navigating the market requires understanding both the opportunities and risks involved.

Investing in rare earths offers significant potential for growth, but also comes with complexities such as market volatility and geopolitical factors. China’s dominance in processing these metals presents challenges for global supply chains, highlighting the importance of strategic planning for investors.

For those seeking exposure to the rare earth sector, ETFs offer an accessible option, providing broad exposure to the market with less risk. More experienced investors might opt for direct investments in physical metals or stocks in mining companies, which could provide higher returns but also come with increased volatility. Regardless of the approach, maintaining a balanced portfolio and managing risk effectively is key.

Hartmann & Benz’s recent listing on the OTCQB market provides an opportunity to engage with a forward-thinking company at the forefront of rare earth and precious metal investments. Through strategic acquisitions and a focus on gold and other valuable resources, Hartmann & Benz aims to offer innovative solutions for long-term wealth preservation.

As the demand for rare earth metals and other precious assets grows, aligning investments with global technological trends can yield substantial benefits. Consider exploring ways to diversify your portfolio with metals that play a crucial role in the future of energy and technology.