Comparison: Gold, Stocks And Commodities

Investing in Gold vs. Stocks: Which Protects Your Wealth in 2025?

Historical data reveals a striking difference between investing in gold and stocks. During the 2007-2009 recession, while the S&P 500 fell by 56.8%, gold prices rose by 25.5%. This sharp contrast highlights why many investors carefully weigh their options between these two assets.

Stocks have delivered impressive returns, averaging around 10% annually, and offer the benefit of dividend income. However, gold has consistently proven itself as a reliable safe haven during times of economic uncertainty. As we approach 2025, understanding how each of these assets can protect your wealth becomes increasingly important.

Gold’s stability makes it a compelling choice for risk-averse investors looking to safeguard their capital in volatile markets. Meanwhile, stocks offer growth potential through capital gains and dividends, but they come with increased risk.

With markets facing unpredictable conditions in the coming years, making informed decisions on your investment strategy is crucial.

Understanding Gold vs Stock Market Performance

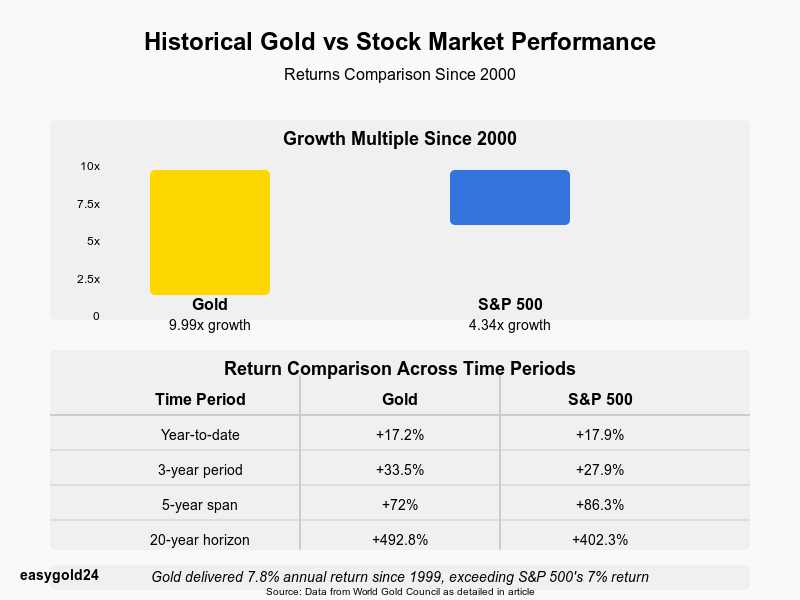

Gold’s track record since 2000 tells an impressive story about wealth preservation. Between 2000 and the mid-2020s, gold investments grew nine times over, outperforming the S&P 500’s sixfold increase. The yellow metal multiplied 9.99 times in USD terms since 2000, significantly outpacing the S&P 500’s 4.34-time growth during the same period.

Historical Returns Since 2000

The World Gold Council has demonstrated how gold outperformed several major asset classes, including emerging market stocks, U.S. bonds, global treasuries, and commodities. Gold delivered a 7.8% annual return since 1999, slightly exceeding the S&P 500’s 7% return during that timeframe.

Recent performance metrics highlight gold’s resilience:

- Year-to-date: Gold +17.2% vs S&P 500 +17.9%

- 3-year period: Gold +33.5% vs S&P 500 +27.9%

- 5-year span: Gold +72% vs S&P 500 +86.3%

- 20-year horizon: Gold +492.8% vs S&P 500 +402.3%

Gold’s impressive performance extends beyond U.S. markets. The metal’s value jumped 19.32 times in Indian rupee terms over the last 25 years, outperforming the Nifty 50’s 15.67-time growth. Gold also reached record highs of USD 2,089 per ounce during the pandemic and broke new ground in 2024 due to global tensions.

Market Volatility Comparison

Contrary to popular belief, gold’s price fluctuations closely match those of stocks. Gold’s annual volatility stands at 15.44% over the last 30 years, similar to the S&P 500’s 14.32%. However, the relationship between price and volatility functions differently for these assets.

Stock market declines typically bring increased volatility. Gold follows a different pattern; during the 2008-2009 financial crisis, both gold’s price and volatility increased as the U.S. dollar fell and inflation fears rose.

Gold and stocks share a dynamic relationship. Studies show their correlation varies significantly, even during economic downturns. This shifting relationship makes gold excellent for diversifying investment risk.

Gold particularly excels during market stress. When stock markets experience significant declines, gold delivers an average 7.18% return while the S&P 500 drops -23.48%. Gold also demonstrates better risk-adjusted returns than stocks since 2000, with a Sharpe ratio of 0.48 compared to 0.45 for stocks.

Our interconnected global economy has enhanced gold’s safe-haven status. The 2008 crisis, pandemic, and global conflicts demonstrate how investors flock to gold during turbulent times. Gold typically underperforms stocks in bull markets because it doesn’t pay dividends or represent company growth.

Key Economic Factors Affecting Both Assets

Gold and stock market performance respond differently to economic forces. Investors who understand these relationships can better protect their wealth.

Interest Rate Impact

Interest rates powerfully affect both assets through different channels. Higher rates increase corporate borrowing costs, directly impacting profits and stock values. The Federal Reserve’s decisions about rates ripple through both markets in different ways. Recent data shows gold prices increased 8.37% when the Fed cut rates, outperforming the 5.53% return during periods of rate increases.

Many believe gold and interest rates move in opposite directions. However, historical evidence tells a different story. Gold prices climbed alongside rising rates throughout the 1970s. One-year Treasury bills jumped from 3.5% to 16% while gold surged from USD 200.00 to almost USD 2000.00 per ounce. This demonstrates that interest rates alone don’t dictate gold’s performance.

Inflation Effects

Inflation is a crucial factor that affects these assets differently. Gold maintains its purchasing power even during rapid price increases, making it effective protection against inflation. Gold’s limited supply helps it retain value over time, especially when central banks expand the money supply.

Stocks react differently to inflation periods. Higher inflation typically brings higher interest rates, which can increase stock market volatility and decrease bond values. Some sectors manage inflation better than others. Energy companies, consumer staples, and materials businesses usually perform well because they can pass higher costs to their customers.

Currency Fluctuations

Currency movements add another dimension to how these assets behave. Gold trades primarily in US dollars, creating an interesting relationship with currency values. A weaker dollar means gold costs less for holders of other currencies, potentially boosting demand. Early 2024 demonstrated this clearly—UK gold prices fell just 1% despite larger drops in dollar terms because sterling was weak against the dollar.

The effects of currencies extend beyond simple exchange rates. A country’s currency typically weakens when it imports more than it exports. Countries with substantial gold exports or reserves often experience stronger currencies as gold prices rise, helping balance trade deficits. Central banks purchasing gold can alter their domestic currency supply and potentially contribute to inflation.

These economic factors interact to create a dynamic investment landscape. The Federal Reserve’s recent 0.5% rate cut made holding gold less expensive, pushing prices higher. Middle East tensions also disrupted currency markets, with the risk-sensitive pound sterling dropping from post-Covid highs of 1.34 to under 1.31 against the dollar.

Different Ways to Invest in Each Asset

Investors can choose from several methods to invest in gold and stocks. Each option offers distinct benefits depending on your goals and risk tolerance.

Physical Gold vs Gold ETFs

Owning physical gold through bars, coins, or bullion provides direct asset control without counterparty risk. Physical gold’s value is determined by its weight and purity, measured in troy ounces. However, this traditional approach incurs higher costs, including manufacturing, secure storage, and insurance expenses.

Gold ETFs offer an alternative approach that allows you to invest in gold without physically possessing the metal. Global gold-backed ETFs held 3,244 tons of gold as of early 2024. The SPDR Gold Shares ETF charges a 0.40% expense ratio, making it a cost-effective option for many investors.

The main differences between physical gold and ETFs include:

- Transaction Speed: ETFs can be traded quickly through the stock market, while selling physical gold requires more time

- Storage Requirements: ETFs eliminate the need for secure storage, unlike physical gold that must be securely kept

- Cost Structure: ETFs have lower initial costs but include brokerage fees, while physical gold requires larger upfront investment plus ongoing storage expenses

Individual Stocks vs Index Funds

Your choice between individual stocks and index funds can significantly impact your investment results. Index funds now comprise approximately half of all U.S. fund assets, growing substantially from 21% in 2012. More investors now recognize their value.

Index funds offer several key benefits:

- Built-in Diversification: These funds hold hundreds or thousands of stocks to reduce company-specific risks

- Cost Efficiency: Index funds charge about 0.05% annually, substantially less than actively managed funds

- Professional Management: Fund managers handle rebalancing and maintenance, requiring minimal effort from investors

Individual stocks function differently and present their own set of opportunities and challenges. SPIVA data reveals that 79% of actively traded funds underperformed the S&P 500 over five years, increasing to 88% over 15 years. Yet, individual stocks offer certain advantages:

- Direct Company Ownership: Investors receive voting rights and can influence company decisions

- Customization Flexibility: Investors can create portfolios tailored to specific goals

- Dividend Income: Some companies pay regular dividends that enhance returns

New investors often find index funds more accessible. These passive investments track market benchmarks and provide broad exposure without requiring in-depth market knowledge. Individual stock selection demands more effort—investors must research companies, understand fundamentals, and monitor market developments.

Your selection between these options depends on your objectives, available time, and risk comfort. Index funds work well for those seeking broad market exposure with minimal management. Individual stocks might better suit investors willing to conduct detailed research for potentially higher returns.

Risk Analysis: Gold vs Stocks in 2025

The evolving global landscape of 2025 presents unique challenges for investors choosing between gold and stocks. Recent market data provides a clear picture of how each asset protects wealth during challenging periods.

Market Crash Protection

Gold demonstrates defensive strength during market downturns. Gold prices increased by more than 25% throughout 2024 and reached new highs during periods when traditional markets faced uncertainty. The precious metal’s value stems from its limited supply and independence from corporate earnings, making it a reliable store of wealth.

Gold possesses a unique advantage—its price movements don’t correlate strongly with stocks. The metal performs better during stock market declines but doesn’t fall as significantly when stocks rise. This makes gold particularly valuable for wealth protection during economic turbulence.

Geopolitical Risk Impact

Geopolitical tensions in 2025 now drive many investment decisions. Early 2024 saw conflicts in Ukraine and the Middle East push gold prices up by 7% in just one month. Research indicates that among precious metals, only gold and silver increase in value during international tensions.

The relationship between geopolitical risk and gold prices is clear:

- Gold returns rise 2.5% for every 100-point increase in the Geopolitical Risk (GPR) index

- The GPR index increased from under 100 to over 250 during the Russia-Ukraine conflict

- Central banks have doubled their gold purchases as part of overall demand because they view it as “unsanctionable” during global tensions

Investors should understand that gold’s reaction to geopolitical events extends beyond immediate price changes. The precious metal offers protection in three ways:

- It safeguards against currency devaluation

- It hedges against political instability

- It preserves wealth during international conflicts

Gold’s future as a protective asset looks promising. Goldman Sachs and JPMorgan project gold prices will reach between USD 2,775.00 and USD 3,000.00 per ounce in 2025, driven by policy uncertainty and geopolitical risks. These forecasts reflect growing concerns about market volatility and economic instability.

Stock markets have demonstrated resilience to certain geopolitical events. Global equity markets recovered after the initial shock of the Ukraine conflict, though local markets experienced stronger effects. This resilience has limitations—European manufacturing suffered significantly from energy supply disruptions.

The current environment presents a compelling case for considering both assets for wealth protection. Gold’s performance during crises and stocks’ long-term growth potential suggest that combining both may offer the best protection against various risks in 2025.

Income Generation Potential

The fundamental difference between gold and stocks lies in their income-generating capacity. These differences are crucial for investors seeking consistent returns and capital growth.

Dividend Yields from Stocks

Stock investments provide excellent opportunities to earn through dividend payments—profits distributed by companies to shareholders. Regular payments create steady income streams that enhance total investment returns beyond price appreciation. Dividend-paying stocks are particularly attractive to investors building passive income portfolios.

The current market offers high-yield savings accounts and Treasury Bills with yields exceeding 5%. Many established companies maintain consistent dividend payments, enabling investors to construct substantial passive income streams through sizeable stock portfolios.

Dividend payments involve several considerations:

- Tax implications affect actual benefits

- Company performance influences payment consistency

- Economic conditions may force dividend reductions

Gold Storage Costs vs Returns

Unlike stocks, gold doesn’t generate passive income. Profit from gold investments only comes from price appreciation and subsequent sale. This makes gold unsuitable for investors requiring regular income.

Physical gold ownership entails additional costs:

- Secure vault facilities charge storage fees

- Insurance against theft or loss is necessary

- Transportation costs apply when buying or selling

These expenses significantly impact overall returns. Ongoing professional storage facility fees diminish investment gains over time. Although gold storage costs are considerably lower than for other materials like natural gas, they still affect net returns.

Investors should recognize that gold’s primary value lies in wealth preservation rather than income generation. The World Gold Council’s comprehensive longitudinal study demonstrates that allocating 2% to 10% of gold in typical pension portfolios improved risk-adjusted returns. These improvements primarily resulted from risk diversification rather than direct income.

Gold’s relationship with interest rates adds complexity to its income potential. Higher interest rates increase the opportunity cost of holding gold since it generates no yield while alternative investments earn more. Nevertheless, gold serves effectively as a portfolio stabilizer, explaining why many investors maintain gold positions despite its lack of income.

Your choice between gold and stocks depends on your investment objectives. Investors requiring regular income typically prefer dividend-paying stocks. Those prioritizing wealth protection during economic uncertainty might accept gold’s lack of income. Most investors find that combining both assets works best to achieve diverse investment goals.

Building a Balanced Portfolio

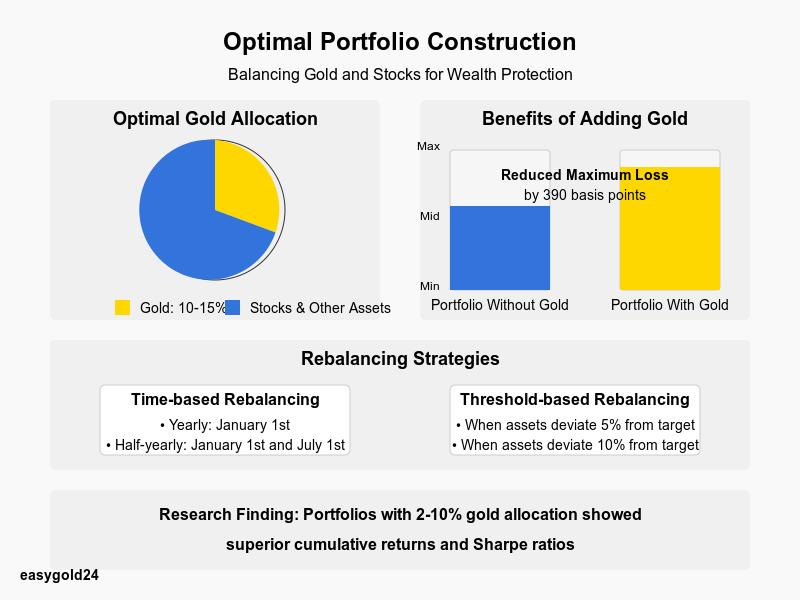

A robust investment strategy incorporates both gold and stocks in your portfolio to maintain resilience. The World Gold Council has demonstrated that portfolios with 2% to 10% gold allocation achieved superior cumulative returns and Sharpe ratios.

Optimal Asset Allocation

Your portfolio’s success heavily depends on strategic gold allocation. Research indicates that 10-15% gold exposure provides optimal diversification benefits. The allocation breaks down as follows:

- 10% physical gold helps protect against systemic risks and enhances stability

- 0-5% in gold-related equities provides growth potential

The ideal gold allocation ranges between 16-19% for maximizing risk-adjusted returns over 10 years. This strategy proves particularly effective since gold typically moves counter to most other investments.

Rebalancing Strategies

Regular portfolio rebalancing maintains your desired asset mix. Effective approaches include:

- Time-based rebalancing:

- Yearly: January 1st

- Half-yearly: January 1st and July 1st

- Quarterly: January 1st, April 1st, July 1st, October 1st

Alternatively, rebalancing can be triggered when asset weights deviate 5% or 10% from target allocations. New investors often prefer calendar-based rebalancing for its simplicity and reduced monitoring requirements.

Risk Management Techniques

Effective position sizing and appropriate exposure levels form the foundation of sound risk management. Research demonstrates that adding 10% gold to portfolios reduced maximum losses by nearly 390 basis points.

Essential risk management principles include:

- Regular monitoring of economic indicators affecting both assets

- Implementing dollar-cost averaging to minimize price impact

- Selecting secure storage options for physical gold

Your protection strategy should align with your specific requirements based on:

- Investment time horizon

- Risk tolerance

- Income requirements

- Overall financial situation

Recent data confirms gold’s role as a portfolio safeguard. Gold has maintained its value through various inflation periods and earned 7.8% annually even when inflation remained below 2%. Portfolios containing gold-backed investments consistently outperform those without gold on risk-adjusted return metrics.

Investing in Gold vs. Stocks: A Strategic Approach for 2025

Gold and stocks each offer distinct advantages when it comes to protecting and growing wealth. Gold has demonstrated its value as a stable asset, especially during periods of market stress. Over the past two decades, it has significantly outpaced the performance of stocks, proving itself as a reliable store of value in uncertain times. While stocks provide the potential for long-term growth and dividend income, they can be subject to more significant volatility, especially in market downturns.

The key to successful wealth management in 2025 lies in understanding how these assets work together. A balanced portfolio that includes both gold and stocks allows investors to benefit from the growth potential of the stock market while safeguarding wealth with gold’s stability. Allocating a small portion of your portfolio—typically between 2-10%—to gold enhances protection without sacrificing growth potential.

As global markets continue to face challenges, such as inflation, economic instability, and market volatility, maintaining a diverse portfolio will be critical. Investors looking to adjust their strategies for the changing landscape should keep a close eye on both gold and stock market trends.

At Hartmann & Benz (EasyGold), we are committed to offering innovative investment opportunities, with our shares now listed on the OTCQB market. We understand the value of strategic investments in both tangible assets like gold and modern financial technologies. Our recent listing enables investors to easily participate in the growth of our company and benefit from the value of gold through our unique security token.

Stay informed about our progress and upcoming opportunities, and explore how EasyGold can be part of your investment strategy in 2025 and beyond