Why Smart Investors Choose Gold in 2025: Proven Benefits Beyond Stocks

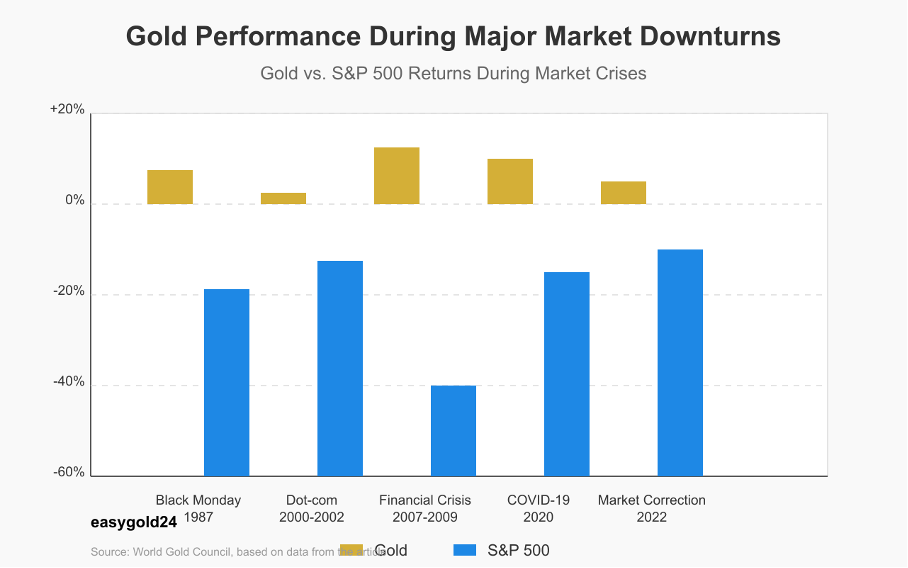

Market history clearly illustrates gold’s investment benefits. During the Global Financial Crisis, gold prices surged by more than 25% while the S&P 500 fell over 50%. Gold has demonstrated positive performance in six out of eight major stock market crashes over the last four decades.

Although stocks have outperformed gold by 16 times since 1974, gold’s unique advantages remain significant in today’s digital world. This precious metal maintains a negative correlation with stocks and provides a steady 1.2% annual after-inflation return that reliably preserves wealth. This article explores gold’s rightful place in your investment portfolio and helps you make informed decisions about gold investments in 2025.

Why Gold Remains Valuable in 2025

Gold prices reached record highs above USD 2,950 in 2024, confirming its worth as an investment asset. Central banks have maintained their historic gold buying streak for three consecutive years, purchasing more than 1,000 metric tons annually.

The Lasting Appeal of Gold

Gold’s value stems from its unique properties that have proven themselves throughout history. This metal never corrodes or tarnishes, maintaining its pristine condition indefinitely. The U.S. Geological Survey indicates a significant scarcity of gold, with only 244,000 metric tons available on Earth.

In today’s economy, this precious metal serves multiple functions. Beyond its monetary value, gold is essential in electronics, medical devices, and jewelry. Its universal recognition and high liquidity make it an ideal asset for both institutional investors and individuals.

Current Market Dynamics

Gold markets demonstrated remarkable strength throughout 2024 and early 2025. Total demand, including over-the-counter investment, increased by 6% to 1,258 tons. China’s central bank made headlines with its announcement of new gold purchases at the end of 2024.

These developments significantly impacted markets:

- Gold prices increased by 28% through November 2024

- The metal established 41 new closing highs in the first 10 months of 2024

- Global ETF holdings reached approximately 3,235 tons by December 2024

Global Economic Factors

Several economic factors contribute to gold’s value in 2025. Central banks worldwide have substantially increased their gold reserves to safeguard national wealth. The United States leads with approximately 8,133.46 metric tons.

Financial concerns and international tensions continue to drive gold prices higher. Experts note that gold exhibits a “smile profile” in relation to U.S. yields—rising when yields both fall and rise, albeit for different reasons. This characteristic makes gold excellent at providing protection across various economic scenarios.

Gold’s relationship with other financial factors is complex. The metal typically moves inversely to the U.S. dollar; as the dollar weakens, investors with other currencies can purchase more gold. High interest rates are also relevant since gold does not generate interest.

The outlook for gold markets remains positive. Goldman Sachs projects prices could reach USD 3,000 per troy ounce by late 2025, based on sustained central bank purchasing, growing Asian consumer demand, and increased ETF investment.

Gold functions most effectively as a safe haven in our interconnected global economy. The 2008 financial crisis and recent global conflicts demonstrated how rapidly investors turn to gold during uncertain periods. Gold mining faces increasing challenges from environmental regulations and rising costs, potentially limiting supply and driving prices upward.

How Gold Protects Your Wealth

According to the World Gold Council’s latest data, portfolios containing gold performed 2.4% better than unhedged ones during eight crisis periods. These statistics underscore why understanding gold’s defensive qualities is essential for investors in 2025.

Defense Against Market Crashes

Empirical evidence supports gold’s ability to protect wealth during market downturns. Gold has shown positive returns in nine out of thirteen major market declines. The performance metrics are compelling:

- Portfolios with gold overlay experienced peak-to-trough declines of only 9.2%, compared to 12.5% for currency-hedged portfolios and 13.1% for unhedged ones

- Gold prices increased by over 25% during the 2008 financial crisis while equity markets collapsed

- Gold prices have gained over 20% on average when consumer prices increase by 5% or more

Gold’s value derives from its low correlation with stocks and bonds. When market volatility increases, gold typically maintains or increases its value, thereby stabilizing investment portfolios.

Protection from Currency Risks

Gold serves as an excellent hedge against currency fluctuations and devaluation. Research demonstrates gold’s strong hedging properties in major economies, particularly in India and the United States. Several factors contribute to gold’s effectiveness as a currency hedge:

Gold exhibits a negative correlation with the US dollar and other developed-market currencies. This means gold typically strengthens as currencies weaken, helping maintain purchasing power. Consequently, gold functions as both an internal and external hedge against currency depreciation.

Using gold for currency hedging is cost-effective. Current data reveals that hedging emerging-market currency baskets costs over 4%, while a gold overlay strategy requires less than 0.5% in borrowing costs. These economical figures make gold attractive for investors seeking currency protection.

Gold’s currency protection becomes more evident through its exchange rate relationship. Studies indicate that gold can partially hedge against currency depreciation over time. This benefits investors who hold assets in multiple currencies or are concerned about their domestic currency’s stability.

- Risk mitigation

- Inflation protection

- Support for economic stability and growth

Gold’s independence from central control enhances its effectiveness as a currency hedge. Unlike conventional currencies that can lose value through policy changes, gold retains its intrinsic worth. This autonomy from government and central bank decisions makes gold excellent at preserving wealth against currency manipulation.

Recent analysis confirms gold’s effectiveness during extreme market stress. The World Gold Council reports that gold-based hedging strategies outperform traditional currency hedges, especially when currency risks are elevated. This performance validates gold’s reputation as a reliable store of value and demonstrates its vital role in protecting wealth from currency risks.

Gold vs Stocks: Making the Right Choice

New data from 2024 reveals remarkable results regarding gold and stock performance. Both the S&P 500 and gold prices have seen impressive gains, rising approximately 17-18% in the first half of the year.

Performance Comparison

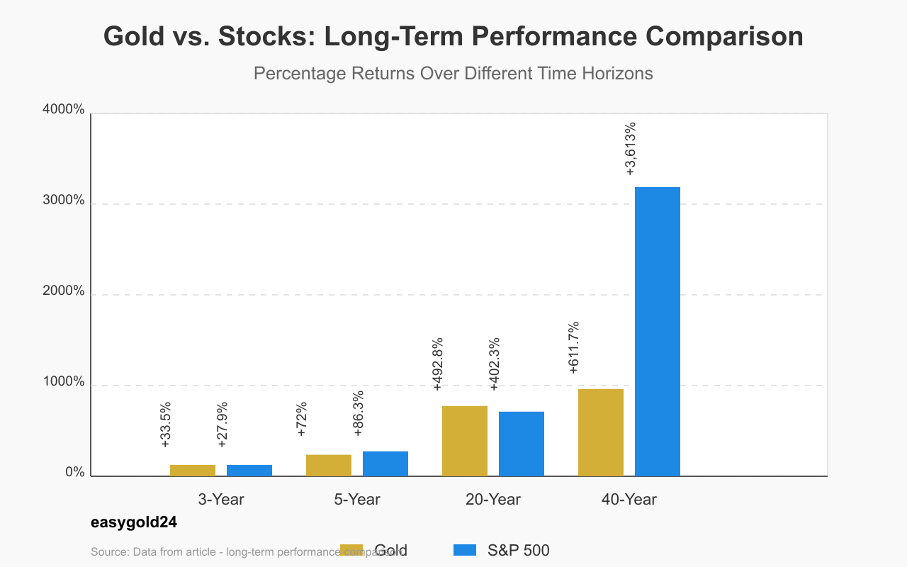

The comparative returns of gold versus stocks tell an interesting story across different time horizons:

- 3-year returns: Gold +33.5%, S&P 500 +27.9%

- 5-year returns: Gold +72%, S&P 500 +86.3%

- 20-year returns: Gold +492.8%, S&P 500 +402.3%

- 40-year returns: Gold +611.7%, S&P 500 +3,613%

While stocks demonstrate superior long-term growth potential, gold remains a vital component of any well-balanced portfolio. Gold currently trades at USD 2414.00 per troy ounce, representing a 23.3% increase over the last 12 months.

Risk Assessment

Understanding the relationship between gold and stocks is significant for risk management. Research indicates that gold has an asymmetric correlation profile with equities. It performs well during market downturns but does not decline as significantly when equities rise.

Recent studies challenge conventional wisdom about gold’s behavior. During the COVID-19 period, gold exhibited an unexpected positive correlation with stock market returns, deviating from historical trends. The relationship between these assets extends beyond a simple inverse correlation.

The World Gold Council recommends allocating 5-10% of investment portfolios to gold. This proportion helps achieve improved risk-adjusted returns without excessive exposure to either asset’s volatility.

When to Choose Gold

Several key factors help determine the optimal time to invest in gold:

Interest rates play a significant role. Gold performs better when rates decline because it becomes more attractive than interest-bearing assets. Gold prices have responded favorably to anticipated rate cuts.

Currency markets are also important. Gold strengthens as the U.S. dollar weakens, making gold valuable for protection against currency fluctuations.

Global economic stability affects gold prices. Central banks worldwide have purchased over 1,000 tons of gold annually in 2022 and 2023, demonstrating the importance institutional investors place on gold.

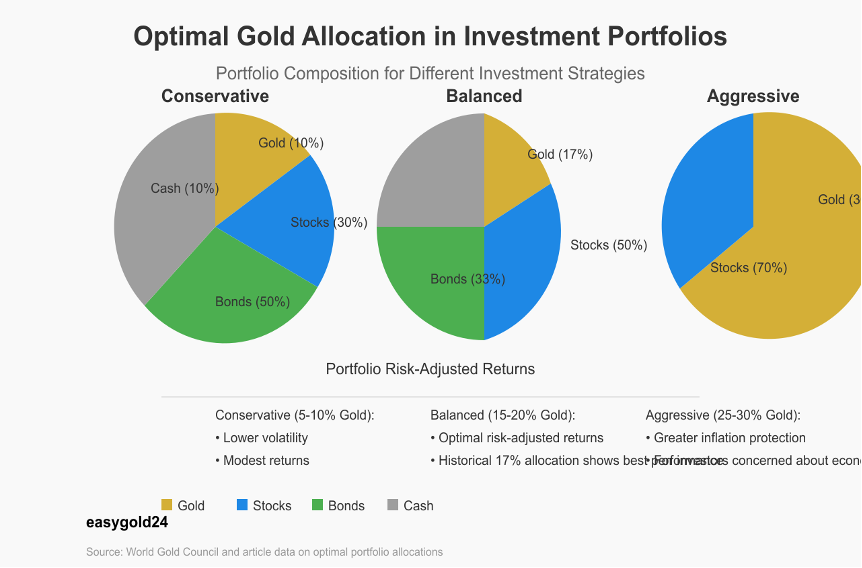

These guidelines help establish an effective portfolio:

- Conservative approach: Advisors recommend a 5-15% allocation

- Balanced strategy: Up to 17% gold allocation has demonstrated the best risk-adjusted returns

- Maximum threshold: Maintain gold below 34% to preserve balance

Duke University’s research indicates that gold functions most effectively as an inflation hedge over extended periods. Short-term price fluctuations occur frequently, so gold requires a long-term perspective.

Investors need not choose between stocks and gold. A well-constructed portfolio includes both, along with bonds and other investments. This diversification allows investors to benefit from gold’s protective qualities while maintaining stocks’ growth potential.

The ideal time to purchase gold depends on economic indicators. High inflation, negative real interest rates, or market volatility often create favorable conditions for increasing gold holdings. It is important to remember that gold does not generate interest or dividends, so opportunity costs must be considered.

Smart Ways to Invest in Gold

Gold investment options in 2025 provide investors with several methods to diversify their portfolios. Traditional physical ownership and modern digital platforms offer different approaches that enable investors to make intelligent choices with their capital.

Physical Gold Options

Physical gold remains the preferred choice for investors worldwide. Government mints produce bullion coins that offer advantages over gold bars. The American Eagle and Canadian Maple Leaf coins are globally recognized and produced in limited quantities. These coins maintain purity levels between 91.67% (22 carat) and 99.99% (24 carat).

Investment gold bars are available in various denominations:

- 1, 10, 20, 50, 100, and 1,000 gram sizes

- 1, 10, 100, and 400 troy ounce options

Institutional investors prefer London Good Delivery bars weighing approximately 400 troy ounces. Industry-accredited producers manufacture these bars with 99.5% – 99.99% purity.

Digital Gold Investments

Modern investors now have access to innovative digital gold platforms. These solutions enable gold ownership without physical possession and offer several benefits:

- Live trading capabilities

- Fractional ownership options

- Professional vault storage

- No delivery or fabrication fees

Digital platforms allow gold purchases based on value rather than weight. Investors can commit as little as $25 instead of purchasing a complete ounce. This flexibility makes gold accessible to a broader range of investors.

Prudent investors should thoroughly evaluate digital gold platforms before investing. Important considerations include:

- Platform reputation and history

- Customer service quality

- Fee structures

- Available market analysis tools

Gold ETFs Explained

Gold Exchange-Traded Funds (ETFs) have experienced remarkable growth and now hold approximately 3,244 tons of gold. These investment vehicles provide investors with exposure to gold without requiring physical ownership.

Gold ETFs are available in different forms:

Gold ETFs charge an average annual fee of 0.65%, equivalent to $65 for every $10,000 invested. Investors should consider these factors:

- Fund performance over the past five years

- Expense ratios

- Underlying assets

- Liquidity levels

Gold ETFs backed by physical gold are subject to a 28% capital gains tax rate, higher than the 20% rate applicable to most investments. Nevertheless, ETFs offer superior tax efficiency compared to mutual funds due to their passive management approach.

Financial advisors typically suggest allocating 5-10% of an investment portfolio to precious metals, including gold. This balance captures gold’s benefits while maintaining appropriate portfolio diversification.

Building a Gold Investment Strategy

Developing a robust gold investment strategy requires careful consideration of financial goals and market understanding. Studies demonstrate that portfolios with gold allocations between 4% and 15% have shown superior risk-adjusted returns over the past decade.

Setting Investment Goals

Success in gold investment begins with clear objectives. Market research indicates that investors typically align their gold allocation with three scenarios:

- Conservative approach (5-10%): Ideal for basic portfolio diversification and moderate protection against market volatility

- Balanced strategy (15-25%): Effective for investors concerned about economic risks and potential inflation

- Aggressive positioning (30-50%): Appropriate for those anticipating significant economic challenges

Historical data reveals that portfolios with a 17% gold allocation produced better risk-adjusted returns than alternative configurations. This optimal allocation consists of:

- 50% stocks

- 33% bonds

- 17% gold

Choosing the Right Gold Products

Once clear investment goals are established, selecting appropriate gold products becomes crucial. Each investment option offers distinct advantages based on specific objectives:

Physical Gold

- Provides tangible security

- Requires storage space

- Involves insurance costs

- Excels at long-term wealth preservation

Gold ETFs and Mutual Funds

- Require smaller minimum investments

- Allow transactions through brokerage accounts

- Provide affordable exposure to gold markets

- Integrate well with retirement accounts

Contemporary investors embrace innovative alternatives to traditional options. Internet Investment Gold (IIG) platforms enable investors to:

- Purchase gold online

- Store holdings in professional facilities

- Obtain physical gold when necessary

- Accumulate holdings incrementally

Gold savings plans offer opportunities for regular investment with these advantages:

- Low minimum investment

- Options for periodic purchases

- Professional storage solutions

- Flexible accumulation methods

Market data demonstrates the effectiveness of gold certificates, featuring these characteristics:

- Direct ownership of physical gold

- Professional vault storage

- Personal certification

- Straightforward withdrawal process

Recent statistics confirm that incorporating gold into traditional balanced portfolios benefits portfolios of all sizes. Research verifies that portfolios containing up to 34% gold outperform traditional balanced portfolios in risk-reward ratios.

Institutional investors increasingly recognize gold’s strategic value. The World Gold Council’s recent study, published in 2022, indicates average annual investment demand grew by 10%. This trend highlights gold’s expanding role in contemporary portfolios.

Market data demonstrates the effectiveness of gold certificates, featuring these characteristics:

- Regular portfolio rebalancing maintains target allocations

- Compare costs across various investment types

- Understand the tax implications of different gold products

- Monitor storage and insurance costs for physical holdings

Common Gold Investment Mistakes

Successful gold investment depends on avoiding common pitfalls that can diminish returns. Understanding these mistakes facilitates better decision-making and wealth protection.

Timing Errors to Avoid

Emotional decisions constitute the most significant problem in gold investment. Data indicates that buying or selling based on market sentiment frequently results in suboptimal outcomes. Investors must resist the temptation to chase short-term price movements, as physical gold functions best as a long-term investment.

Recent market analysis reveals that excessive investment during price surges creates substantial risks. Gold prices reached USD 2,700 in late October 2024, subsequently declined to USD 2,500, and then recovered. This pattern illustrates why timing decisions should correspond with broader economic indicators.

Financial experts caution against these timing mistakes:

- Purchasing hastily without adequate research

- Attempting to profit from short-term price fluctuations

- Over-investing based on recent performance

Storage and Security Issues

Secure storage is essential for protecting gold investments. Professional storage facilities offer numerous benefits:

- Comprehensive insurance coverage

- Regular auditing capabilities

- Robust security measures

- Climate-controlled environments

Many investors select inadequate storage solutions. While home storage may seem convenient, it presents significant risks. Standard insurance policies typically do not provide sufficient coverage for substantial gold holdings stored at home.

Proper documentation is critical for gold storage. Experts recommend maintaining detailed records of:

- Purchase invoices

- Certificates of authenticity

- Regular audit reports

- Insurance documentation

Cost Calculation Mistakes

Accurate assessment of multiple factors is necessary to understand the true cost of gold ownership. Currently, investors should expect to pay 5-8% above the spot price when purchasing from reputable brokers. Higher premiums may indicate excessive costs.

A comprehensive cost analysis must include:

- Monthly facility fees

- Insurance premiums

- Security costs

- Maintenance charges

Transaction Costs:

- Dealer premiums

- Shipping fees

- Insurance during transit

- Authentication costs

Tax implications are frequently overlooked. Gold ETFs backed by physical gold are subject to a higher capital gains tax rate of 28%, compared to the 20% rate applicable to most other investments. Some states also impose sales tax on precious metal purchases, significantly affecting total costs.

Monthly storage fees appear modest individually but accumulate over time. Professional vault services base their charges on gold’s value or weight, making cost calculation important for long-term planning.

Alternative investments merit consideration. Since gold does not generate interest or dividends, potential returns from other investment options should be factored into decisions. This becomes particularly significant during periods of high interest rates.

Experts recommend these steps for effective cost management:

- Compare storage options thoroughly

- Understand all fee structures

- Calculate long-term holding costs

- Consider tax implications

The World Gold Council’s data demonstrates that investors who meticulously track all costs achieve superior risk-adjusted returns.

Gold: A Core Asset for Diversification

Gold remains an essential component of a well-rounded investment strategy, offering stability during market fluctuations and economic uncertainty. While equities may deliver higher returns in the long term, gold’s unique ability to preserve wealth during downturns makes it an indispensable asset in balancing a diversified portfolio.

Investors often find that allocating between 5-17% of their portfolio to gold delivers optimal risk-adjusted returns. This allocation provides protection against inflation, hedges against currency fluctuations, and offers stability in volatile market conditions. The strong performance of gold in recent years, including its impressive surge in 2024-2025, underscores its continued relevance in modern investment strategies.

Whether you’re exploring physical gold, ETFs, or digital gold products, understanding the full spectrum of investment options is crucial. Gold investments should complement traditional assets like stocks and bonds, ensuring a diversified and resilient portfolio. A thoughtful approach to risk tolerance and investment objectives is essential before making any significant allocation.

As the gold market continues to evolve, innovative solutions such as tokenized gold and security tokens are providing investors with new ways to access and trade gold. At Hartmann & Benz, we’re embracing these innovations, with our shares now listed on the OTCQB market and a security token offering that simplifies gold ownership and trading.

Stay informed and ready to explore the opportunities as we lead the way in redefining gold investment for the future.