Gold Price Forecast 2025: Expert Analysis & Investment Strategy

Gold prices have skyrocketed past $2,700 per ounce in October 2024, setting new records and capturing the attention of investors worldwide. The precious metal has demonstrated remarkable strength by appreciating over 30% in the last year.

Key Takeaways

- Goldman Sachs predicts gold price target of $3,000 per ounce by end of 2025

- Central bank gold buying exceeded 1,000 tons for three consecutive years

- Portfolio allocation of 5-17% in gold optimizes risk-adjusted returns

- Gold ETFs like SPDR Gold MiniShares (GLDM) offer low-cost investment options

- Gold outperformed S&P 500 over 3-year and 20-year timeframes as an inflation hedge

The gold market continues to exhibit strong momentum. Financial experts now predict prices will exceed $3,000 per ounce by the end of 2025. These projections become even more significant when examining gold’s performance since 2000. Gold investments have increased ninefold, outperforming the S&P 500’s sixfold growth during this period.

This analysis examines why gold merits consideration in your investment portfolio. It provides insight into various gold investment options and offers expert guidance for developing an effective gold investment strategy for 2025.

Understanding Gold's Historical Performance

Gold’s price trajectory over the past two decades reveals a compelling story of resilience and growth. Since its modest valuation of USD 274.5 per ounce in 2000, gold has shown remarkable appreciation, particularly during periods of economic uncertainty.

Gold price trends since 2000

Gold began its upward trajectory in the early 2000s. The precious metal surged between 2006 and 2012, climbing from USD 555 to more than USD 1,600 per ounce. From 2000 to the mid-2020s, gold’s value increased ninefold, outperforming the S&P 500’s sixfold growth during the same period.

Gold reached a notable milestone of USD 1,825 per ounce during the European sovereign debt crisis in 2011. This momentum continued into the 2020s with unprecedented gains. The metal delivered an impressive annual return exceeding 28% in 2024 and reached an all-time high of USD 2,942.52 in February 2025.

Key market events that shaped gold prices

Several pivotal events have influenced the metal’s price trajectory. The 2008 financial crisis triggered a major rally that pushed prices from USD 730 in October 2008 to USD 1,300 by October 2010. The COVID-19 pandemic created another surge, during which prices increased by 27% from USD 1,575 in January 2020 to over USD 2,000 by summer 2020.

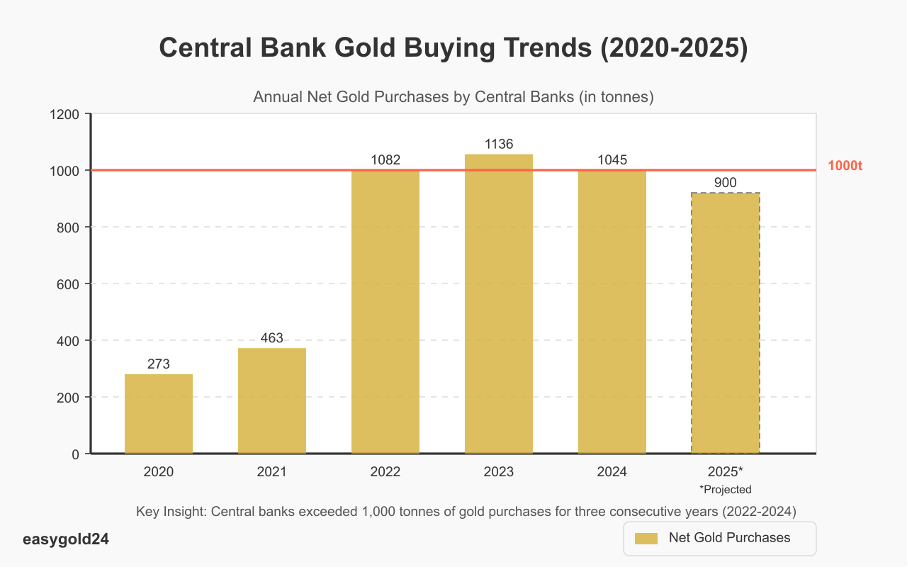

Central banks have emerged as significant drivers of gold prices. China led central bank gold buying to reach 1,037 tons in 2023, demonstrating unprecedented institutional interest in the precious metal. This purchasing trend, combined with geopolitical tensions and anticipated interest rate cuts, has established a higher price floor for gold.

Gold’s performance compared to traditional investments is noteworthy. The metal delivered average annual returns of 7.98% between January 1971 and March 2024. Gold has typically outperformed bonds over the last 20 years, confirming its value as a portfolio diversifier and inflation hedge.

Why Gold Remains Valuable in 2025

Gold has established itself as a vital investment asset in early 2025. The precious metal demonstrated its strength in 2024 with a 31.35% gain in the US market and 37.13% in the Eurozone.

Current market conditions for gold price forecast

Gold prices have reached USD 2,903.01 per ounce by February 10, 2025. This increase stems from multiple market forces, with geopolitical risks and central bank purchases being the primary drivers. The Trump administration’s new tariffs have contributed to market uncertainty.

Economic factors driving gold demand

Gold’s value in 2025 is supported by several solid foundations:

- Purchases exceeded records at over 1,000 tons for three consecutive years

- China continues building its reserves despite occasional pauses

- Banks now favor gold over traditional reserve currencies

The Federal Reserve’s policy changes have created an ideal environment for gold investment. Analysts predict approximately 100 basis points in rate cuts throughout 2025, which could enhance gold’s attractiveness as an investment option.

Expert predictions for gold price target 2025

Leading financial institutions project positive prospects for gold in 2025:

| Institution | Price Target (USD/oz) | Key Drivers |

|---|---|---|

| Goldman Sachs | 3,000 | Central bank buying, federal debt |

| Deutsche Bank | 2,725 (base) - 3,050 (high) | Monetary policy, bank activity |

| JPMorgan | 2,950 - 3,000 | Policy uncertainty, geopolitical risks |

Jim Rickards, renowned financial commentator, identifies federal debt as a key factor, which now exceeds USD 36.38 trillion. Interest payments constitute an increasing portion of debt-related expenses, enhancing gold’s value proposition.

The World Gold Council anticipates robust demand throughout 2025, supported by ongoing geopolitical and macroeconomic uncertainties. Chinese investors are expected to maintain active participation in the market as interest rate cuts and broader economic factors influence their decisions.

While gold may not replicate its dramatic 2024 surge in 2025, it remains a trusted strategic asset for portfolio diversification. Central bank demand, geopolitical tensions, and economic uncertainty continue to support gold’s enduring value as an investment choice.

Best Gold Investment Options for 2025

Gold investment opportunities in 2025 present in various forms, each with distinct advantages and considerations. Below are the most effective methods for incorporating gold into your investment portfolio.

Physical gold options

Physical gold provides investors with tangible assets. Gold bars offer stability against market fluctuations and maintain intrinsic value. These bars are available in sizes ranging from 1/10 troy ounce to one kilogram. Each bar features the manufacturer’s name, weight, and purity level stamped on its surface.

Gold coins represent another solid option that combines collector appeal with intrinsic value. The American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand coins are widely recognized and highly liquid. However, investors should note that coins typically command a premium above the spot price, and require consideration of storage and insurance costs.

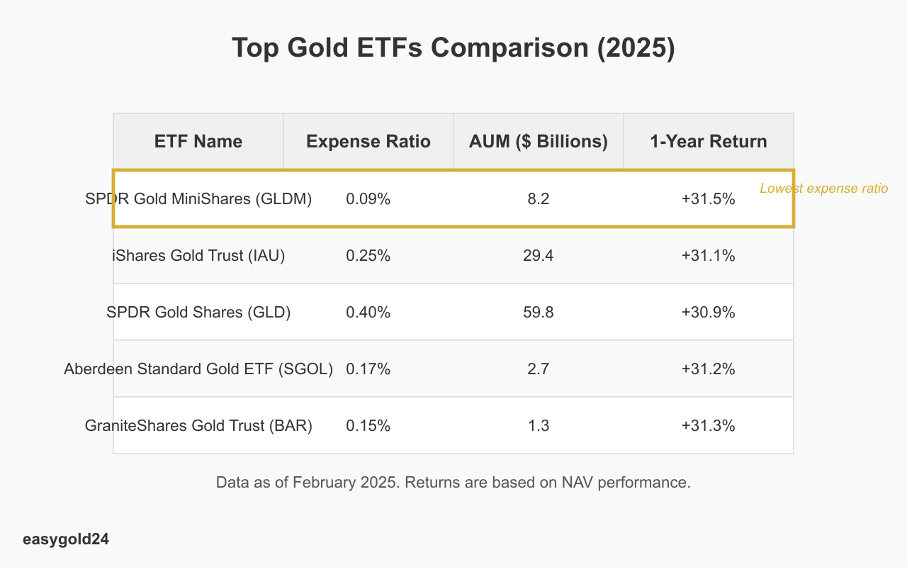

Gold ETFs and mutual funds comparison

ETFs enable gold investment without storage concerns. The iShares Gold Trust (IAU) operates with a 0.25% expense ratio, while the Aberdeen Standard Gold ETF Trust (SGOL) maintains even lower costs at 0.17%. SPDR Gold MiniShares (GLDM) offers the lowest expense ratio at just 0.09%, making it ideal for cost-conscious investors.

Gold mutual funds function differently from ETFs. These funds purchase ETF units rather than investing directly in mining operations. Their Net Asset Value (NAV) fluctuates daily based on gold prices and the fund’s holdings.

Gold mining stocks to buy

Mining stocks offer an alternative approach to gold investing. Approximately 300 mining companies are traded on major exchanges. These stocks typically demonstrate greater volatility than physical gold prices, potentially yielding higher returns when gold prices rise.

Key considerations when evaluating mining stocks include:

- The company’s diversification beyond gold

- Regulatory environments in operating countries

- Management quality and expertise

- Production costs

Top performers like Newmont (NEM) and Barrick Gold (GOLD) provide exposure to large-scale operations, while mid-tier producers like Agnico Eagle (AEM) offer balanced growth profiles.

Digital gold investments

Digital platforms have significantly simplified gold investing. These platforms enable investors to:

- Purchase gold in small increments with minimal initial investment

- Trade continuously through secure platforms

- Convert digital holdings to physical gold when desired

Younger investors are particularly attracted to digital gold due to its accessibility and features such as Systematic Investment Plans (SIPs) and pure gold without storage costs. This modern approach combines traditional gold benefits with contemporary convenience.

Each investment method presents a unique balance of risks and rewards. Physical gold offers direct ownership but requires secure storage. ETFs provide trading convenience without storage concerns. Mining stocks offer potential for accelerated growth through operational improvements, while digital platforms enhance accessibility with innovative trading features.

Gold vs Traditional Investments as Inflation Hedge

Gold exhibits fascinating patterns when compared to traditional investments across market cycles. Recent data reveals strong performance from both gold and the S&P 500, with gold rising 17.2% and the S&P 500 gaining 17.9% in early 2024.

Physical gold options

Gold has proven competitive with stocks across several timeframes, contrary to conventional wisdom. Over the past three years, gold delivered a 33.5% return while the S&P 500 achieved 27.9%. The comparison becomes even more compelling when examining a broader timeline:

| Time Period | Gold Return | S&P 500 Return |

|---|---|---|

| 5 Years | +72% | +86.3% |

| 20 Years | +492.8% | +402.3% |

| 40 Years | +611.7% | +3,613% |

Market data indicates that gold tends to appreciate during economic and political transitions. Gold’s value responds primarily to macroeconomic factors rather than corporate earnings, unlike equities.

Performance against bonds

Gold and bonds present distinct investment opportunities. Gold prices typically move inversely to bond yields as interest rates fluctuate. Treasury Inflation-Protected Securities (TIPS) offer inherent inflation protection, yet gold remains attractive as a hedge against currency devaluation.

Bank of America’s analysis suggests gold could rival US Treasury bonds as an essential safe-haven investment. Several factors support this assessment:

- Gold’s superior liquidity during market turmoil

- Strong performance when inflation-adjusted bond yields decline

- Enhanced portfolio diversification benefits due to low correlation with other assets

A portfolio allocation of 60% stocks and 40% gold has outperformed a traditional 60/40 stocks/bonds portfolio since December 2001. Bonds still provide more consistent portfolio performance as gold exhibits higher volatility.

The fundamental difference lies in income generation. Gold does not produce ongoing returns, unlike bonds that pay interest. Profit potential depends on price appreciation. Financial advisors now consider allocating 5% to 10% of portfolio assets to gold, despite this limitation.

Central Banks and Gold Reserves in 2025

Gold purchases by central banks have reached record levels, indicating a fundamental shift in global monetary policy. These institutions have become dominant players in the gold market after acquiring more than 1,000 tons annually for three consecutive years.

Recent central bank gold buying trends

Central banks’ appetite for gold remains robust in 2025. The year 2024 concluded with total purchases reaching 1,045 tons, extending the buying streak to 15 consecutive years. Emerging market banks accounted for the majority of these strategic acquisitions:

| Leading Central Bank Buyers (2024) | Gold Added |

|---|---|

| National Bank of Poland | 90 tons |

| Central Bank of Turkey | 75 tons |

| Reserve Bank of India | 73 tons |

| People's Bank of China | 44 tons |

| Czech National Bank | 20 tons |

The National Bank of Poland leads as the largest buyer, with gold reserves now constituting 17% of its total international reserves. Other European institutions have adopted this trend—Hungary added 16 tons while Serbia increased its reserves by 8 tons.

Impact on global gold prices

These collective actions by central banks have significantly influenced gold prices. Each 100 tons of physical gold demand increases prices by at least 2.4%. This relationship has strengthened as central banks have evolved from price-takers to price-setters in the gold market.

The effects manifest through several channels:

- Direct Price Support: Consistent buying has established a higher price floor for gold

- Market Sentiment: Central bank purchases demonstrate confidence in gold as a reserve asset

- Long-term Price Trends: These institutions now shape long-term price movements, while investment funds influence short-term fluctuations

UBS projects central bank demand to reach 900 tons in 2025. This forecast, combined with current geopolitical tensions and economic uncertainties, indicates sustained support for gold prices. A World Gold Council survey reveals that over 80% of global monetary authorities intend to increase their gold holdings.

This acceleration in gold accumulation reflects broader strategic considerations. Central banks now view gold as an instrument to:

- Diversify reserves beyond traditional currencies

- Maintain economic stability

- Enhance monetary autonomy

Gold Portfolio Allocation Strategy

A well-structured strategy aligned with your financial objectives is essential for successful gold investment. A recent study published by Oxford Economics demonstrates that appropriate gold allocation can enhance portfolio returns by up to 18% over a 5-year period.

Determining your investment goals

Your primary objective for gold investment should be clearly established from the outset. The World Gold Council identifies three fundamental reasons to include gold in a portfolio:

- Long-term wealth preservation

- Portfolio diversification

- Protection against market volatility

Gold’s unique characteristics make it particularly effective during economic uncertainty. The precious metal has demonstrated its ability to maintain value and deliver an annual growth rate of 7.7% since 1971.

Choosing the right gold investment type

Your resources and objectives largely determine which gold investment vehicles are most appropriate. Physical gold provides direct ownership and functions as a tangible store of value. Conversely, ETFs like SPDR Gold MiniShares (GLDM) offer more accessible entry points for beginners, with lower costs and minimal investment requirements.

Physical gold is most suitable for investors focused on long-term wealth preservation. Gold ETFs or mining stocks may be more appropriate for those pursuing short-term trading opportunities. New investors typically benefit from starting with gold mutual funds or ETFs, as these can be easily traded through standard brokerage accounts.

Portfolio allocation percentage recommendations

Financial experts and institutions provide various guidelines for optimal gold allocation:

| Source | Recommended Allocation | Key Considerations |

|---|---|---|

| Sprott Asset Management | 10-15% | 10% physical gold, 0-5% gold equities |

| World Gold Council | 17% | Optimal for risk-adjusted returns |

| Traditional Advisors | 5-10% | Basic portfolio diversification |

Sprott’s detailed analysis recommends allocating 10% to physical gold as a conservative approach, plus 0-5% in gold-related equities for more aggressive investors. This strategy balances the stability of physical gold with the growth potential of mining stocks.

- Normal market conditions: Gold ranks second to equities in returns

- Stagflation periods: Gold outperforms other asset classes

- Ideal market conditions: Gold maintains positive returns

Your allocation strategy should consider several key factors:

- Investment horizon (recommended minimum 10 years)

- Risk tolerance levels

- Storage and insurance costs for physical gold

- Current market conditions

Recent data from Oxford Economics reinforces the case for substantial gold allocation. Portfolios with up to 34% in gold have outperformed traditional balanced portfolios, particularly in risk-adjusted returns. Conventional wisdom regarding limited gold exposure may warrant reconsideration given current market dynamics.

Managing Risks in Gold Investment

Effective risk management knowledge significantly influences gold investment outcomes. Market data reveals distinct patterns in gold prices that investors should consider before making decisions.

Price volatility considerations

Gold’s price behavior differs from traditional assets. Gold volatility demonstrates a complex relationship with price levels, unlike stocks where higher prices typically correlate with lower volatility. Several factors drive the precious metal’s price fluctuations:

- Inflation reports and economic disruptions

- Mining industry developments

- Currency market movements

- Geopolitical events

Gold’s volatility serves as a vital indicator of systemic risk in financial markets. The metal’s price movements in 2024 clearly illustrated this relationship, with values ranging from USD 2,000 to USD 2,700 per ounce.

Storage and security issues for physical gold

Selecting appropriate storage solutions is critical for protecting gold investments. Professional storage facilities offer several advantages:

| Storage Type | Security Features | Access Options |

|---|---|---|

| Class III Vault | 24/7 surveillance, biometric controls | Round-the-clock viewing |

| Bank Safe Deposit | Limited access hours | Business hours only |

| Home Storage | Variable security levels | Immediate access |

Investors currently face increasing challenges with traditional banking storage options. Private vault facilities have become popular alternatives that provide enhanced security measures and improved accessibility.

Insurance needs for gold holdings

Insurance coverage plays a crucial role in gold investments. Insurance costs typically range from 1% to 2% of the asset’s value. These premiums vary based on:

- Storage location and security measures

- Total value of gold holdings

- Geographic risk factors

- Type of gold investment

Standard homeowner’s insurance policies provide insufficient coverage, limiting protection to just USD 250 worth of precious metals. This necessitates specialized insurance for substantial gold investments.

Prudent investors should:

- Maintain detailed inventory records

- Update valuations regularly

- Select comprehensive coverage options

- Consider storage facility insurance benefits

The insurance market for gold investments continues to evolve. Providers now offer more specialized policies covering risks such as theft, natural disasters, and damage during transit. The optimal insurance strategy depends on your storage method, investment size, and risk tolerance.

Professional storage facilities often include insurance in their service packages, which can be more cost-effective than individual policies. Such bundled services simplify risk management and ensure adequate coverage for gold investments.

When to Buy and Sell Gold: Market Timing Strategies

Appropriate timing can significantly impact gold investment outcomes. Studies demonstrate that selecting optimal entry and exit points substantially affects returns. A 2024 analysis of over 4,000 seasonal, technical, and fundamental timing strategies provides valuable insights for investors.

Gold market timing strategies

Successful gold investment timing relies on three primary approaches:

The most comprehensive longitudinal study by investment firms indicates that dollar-cost averaging—investing fixed amounts regularly regardless of price—often outperforms attempts to time market peaks and troughs. This method reduces timing risk while capitalizing on gold’s long-term value.

Economic indicators to watch for gold investment

Key economic signals are essential for effective gold investment timing. These indicators warrant monitoring:

| Economic Indicator | Impact on Gold Prices | Current Relevance (2025) |

|---|---|---|

| Inflation Rate | Strong positive correlation | Above 2% target |

| Interest Rates | Inverse relationship | Fed cuts expected |

| Employment Data | Indirect influence | Affects Fed policy |

| U.S. Dollar Strength | Inverse correlation | At 2-year high |

The Federal Reserve’s dual mandate of maximum employment and price stability shapes gold market patterns. Weaker employment figures may lead to lower interest rates, potentially benefiting gold prices.

- Market Sentiment: Monitor ETF flows and central bank purchasing patterns as demand indicators

- Geopolitical Events: Track international tensions that drive safe-haven buying

- Supply Trends: Evaluate mining production levels and costs that influence long-term value

Research indicates that gold prices respond more significantly to changes in real interest rates than nominal rates. The U.S. 10-year Treasury yield, currently at 4.63%, serves as a critical benchmark for timing gold investments.

- High inflation (above 3%)

- Negative real interest rates

- High market volatility

Perfect market timing remains elusive. Empirical tests suggest that most timing strategies may appear effective due to chance. New investors generally benefit from a systematic approach. Regular investments typically yield better results than attempting to predict short-term price movements.

Market data from 2024-2025 confirms this principle. Despite trending upward, gold prices experienced significant fluctuations. The metal rose from USD 2,076 in early 2024 to USD 2,648 by early 2025 through several price cycles.

Optimal gold investment timing combines technical analysis, fundamental factors, and systematic strategies. Success derives from disciplined execution rather than attempting to predict every market movement.

Why Gold Still Matters — And Why easygold24 Is Positioned for the Future

Gold has long been a cornerstone of financial resilience. Its ability to maintain value through inflation, market volatility, and economic downturns makes it a reliable hedge and a powerful portfolio enhancer. After surpassing $2,700 per ounce in 2024, gold continues to demonstrate its strength as a long-term asset with real-world utility and growing global demand—particularly from central banks and institutional investors.

At easygold24, we don’t just believe in gold—we build around it. Whether through physical gold, strategic ETFs like GLDM, or mining-related equities, modern investors have more ways than ever to access this essential asset class. Optimal portfolio allocations of 5% to 17% in gold have shown significant improvements in risk-adjusted returns, underlining its role in any well-diversified investment strategy.

Easygold24, powered by Hartmann & Benz, recently took a major step forward with our public listing on the OTCQB market—a U.S. exchange tailored for emerging international companies with strong growth potential. This listing reflects our commitment to transparency, regulatory compliance, and long-term expansion. The capital raised through our OTCQB debut enables us to acquire raw and recycled gold globally, reinforcing our mission to create accessible, asset-backed investment opportunities.

As part of this evolution, we’ve also launched the EasyGold Security Token—a digital asset representing real gold ownership. Designed for modern investors, it provides exposure to gold’s value without the burdens of storage or high transaction costs.

We’re building more than a platform—we’re building a future around gold.

Join us on this journey and be part of something enduring.