Gold Bar VS Gold Coin

Gold Bars vs Gold Coins: Which is the Better Investment in 2025?

Savvy investors can save approximately $1,300 by choosing gold bars instead of coins for a 10-ounce investment in 2025. Both options offer distinct advantages, with the optimal choice depending on individual investment needs. Gold bars provide exceptional purity at 99.99% and feature lower premium costs, while gold coins offer additional value as collectibles and may even be exempt from Capital Gains Tax in certain jurisdictions.

Quick Answer: Bars or Coins?

Gold bars are generally better for large investors seeking lower premiums and long-term wealth preservation, while gold coins offer greater flexibility, potential tax advantages, and collector’s value for smaller investors and those wanting easier liquidation options.

Your selection between bars and coins will significantly impact both immediate costs and long-term returns. This decision is crucial whether you’re a first-time investor or expanding your existing gold portfolio. Let’s examine the key differences between these investment options—from premium costs to storage considerations—to help you determine which approach best aligns with your investment strategy.

Understanding Gold Investment Basics in 2025

Gold has captured significant attention across the investment landscape due to its impressive recent performance. The precious metal increased by over 25% in 2024, building upon a remarkable 70% growth over the preceding five years. The market witnessed 40 new record highs through November 2024, demonstrating gold’s enduring strength as a safe-haven asset.

What Makes Gold a Smart Investment

Gold distinguishes itself from other investments through several unique characteristics. Unlike paper currencies and other assets, gold possesses inherent value due to its natural scarcity. The U.S. Geological Survey estimates that only 244,000 metric tons of gold exist worldwide. Governments cannot simply produce more at will, making it a truly finite resource.

Investors are attracted to gold for several compelling reasons:

Gold Bars: A Detailed Analysis

Gold bars constitute the foundation of precious metal investment and offer unique benefits in various forms and sizes. Cast and minted bars represent the primary categories, each possessing distinctive features that appeal to different investor preferences.

Types of Gold Bars Available

Cast gold bars result from a traditional process where molten gold is poured into molds, creating a rustic appearance with textural variations. Minted bars require more sophisticated production methods, beginning with gold blanks cut from rolled sheets. These bars undergo polishing and are stamped with intricate designs.

The market offers numerous size options:

- Small Bars: 1-gram to 10-gram options are ideal for beginning investors

- Medium Range: 20-gram, 1-ounce, and 50-gram varieties

- Large Format: 100-gram, 10-ounce, and 1-kilogram bars

Premium Costs and Pricing

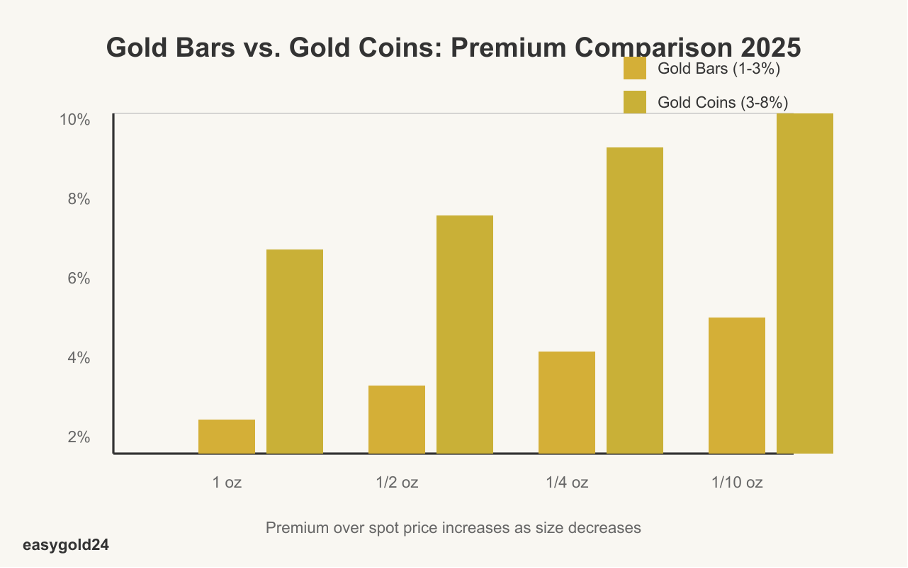

Gold bars feature lower premiums than coins, making them more cost-effective for substantial investments. The premium structure varies by size:

- Small bars (1-5 grams) command higher premiums but offer greater liquidity

- One-ounce bars provide balanced value and strong retail interest

- Larger bars (10-ounce and kilograms) offer premium savings but reduced flexibility

According to recent market analysis, investors can save up to 5-7% on premiums when purchasing gold bars versus comparable gold coins.

Storage Requirements

Secure storage is essential for preserving your gold bar’s value. Professional storage facilities provide three primary options:

Bank Safety Deposit Boxes: These offer secure vault storage but may have capacity limitations for larger holdings.

Private Vaults: These specialized facilities feature:

- Advanced surveillance systems

- Armed security personnel

- Comprehensive insurance coverage

Home Storage: This option is suitable for small quantities if you have:

- Fireproof and waterproof safes

- Proper documentation

- Regular inventory verification

Optimal protection requires maintaining detailed purchase records, including invoices and authenticity certificates. Regular verification helps ensure investment security, particularly with private storage services. Prudent investors never compromise on storage quality to reduce costs, as inadequate security could result in significant losses.

Your investment objectives should guide your preference between cast and minted bars. Cast bars have lower production costs and provide superior value for large investments. Minted bars feature refined aesthetics with detailed designs, appealing to investors who prioritize appearance and craftsmanship.

Gold Coins: Complete Overview

Gold coins have achieved global recognition and exceptional liquidity. Investors seeking tangible wealth preservation favor them as a reliable option. These precious metal pieces combine investment potential with historical significance, making them attractive for portfolio diversification.

Popular Gold Coin Types

Several gold coins have gained international investor recognition:

Understanding Premiums

Market conditions and specific factors influence premium costs. Krugerrands maintained a modest 0.6% premium over bullion from 2000 to 2007, which increased to 3% in 2008. American Gold Eagles maintained a consistent 3.3% premium following the 2008 financial crisis.

Premium pricing depends on several factors:

- Manufacturing and distribution expenses

- Market demand fluctuations

- Mint production limitations

- Dealer overhead costs

Gold coins typically command higher premiums than comparable gold bars due to their detailed designs, government backing, and collector appeal.

Collectible Value Potential

Gold coins provide unique benefits beyond their metal content. Their value appreciates through:

- Historical Significance: The British Sovereign’s 200-year heritage commands premium valuations.

- Aesthetic Appeal: Distinctive designs, such as the annually changing Chinese Panda, attract collector interest.

- Market Recognition: Government minting ensures authenticity and global acceptance.

Online dealers have transformed coin trading through blockchain verification and virtual inspection tools. Modern mobile applications display price history and rarity metrics, providing investors with immediate access to market data.

Recommended investment approaches include:

- Online dealers offering competitive premiums

- Local coin shops permitting physical inspection

- Direct purchases from government mints

Small investors find gold coins particularly advantageous for portfolio management. Strategic timing and selection enable investors to benefit from both bullion value and potential numismatic appreciation, creating a balanced precious metal investment strategy.

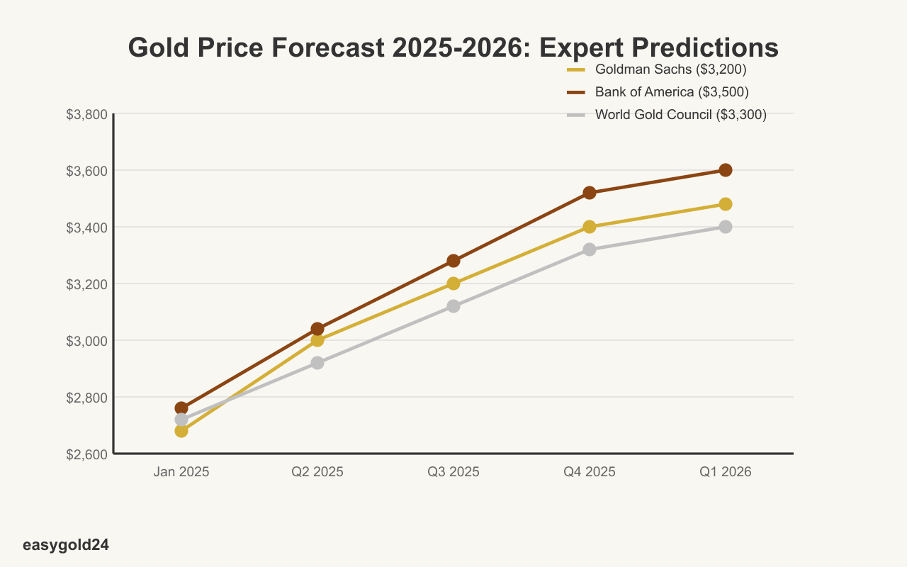

Expert Predictions for Gold in 2025-2026

Leading financial analysts have provided compelling forecasts for gold prices in the coming years:

“We project gold prices to reach $3,200 by mid-2025, driven by continued central bank purchasing and geopolitical uncertainties.” – Goldman Sachs Commodities Research

“Our analysis indicates gold could test $3,500 by Q4 2025 as inflation concerns remain elevated and institutional demand strengthens.” – Bank of America Securities

“For long-term investors, we expect gold to outperform traditional equity markets through 2026, with potential returns of 15-20% annually.” – World Gold Council

These expert projections underscore gold’s continuing role as a crucial component of well-diversified investment portfolios through 2025 and beyond.

Direct Cost Comparison

Recent cost analysis reveals significant differences between gold bars and coins in 2025. For example, a 10-ounce gold bar costs approximately $23,700, while ten 1-ounce Gold American Eagle coins cost approximately $25,000. This price difference stems from production methods and market positioning.

Purchase Price Analysis

These investment options carry different markup structures. Gold bars maintain lower premiums due to simpler production processes. Gold coins command higher prices because they require detailed designs, precision machining, and superior finishing.

Several factors influence pricing:

- Production complexity and labor costs

- Dealer inventory and distribution expenses

- Market demand dynamics

- Gold purity levels

For budget-conscious investors seeking maximum gold content for their investment dollars, gold bars consistently offer superior value.

Long-term Storage Expenses

Storage costs represent a significant component of ownership for both gold forms. Professional storage facilities typically charge between 0.3% and 0.65% of the gold’s value annually. Most storage facilities impose minimum annual fees:

- Delaware vault: $200 per year

- Texas vault: $600 per year

These fees generally include comprehensive insurance coverage from reputable providers like Lloyd’s of London. However, smaller quantities can be stored at home, though this requires additional expenditure on security systems and monitoring.

Resale Value Differences

Each investment type offers distinct advantages when liquidating. Gold bars maintain value through their metal content and can be sold with minimal price variation. Gold coins may appreciate beyond their gold content over time.

Key considerations for resale include:

Market Recognition: Government-issued coins enjoy broader market acceptance due to enhanced credibility.

Divisibility Factor: Multiple smaller coins provide greater liquidation flexibility than a single large bar.

Collector Appeal: Rare or special edition coins often appreciate in value over time.

Tax regulations classify physical gold as a collectible, with a maximum rate of 28% for long-term capital gains. Certain jurisdictions offer tax incentives—British gold coins, for instance, are exempt from Capital Gains Tax in the United Kingdom.

Professional storage services provide additional benefits:

- Enhanced security measures

- Protection against theft and damage

- Regular auditing and verification

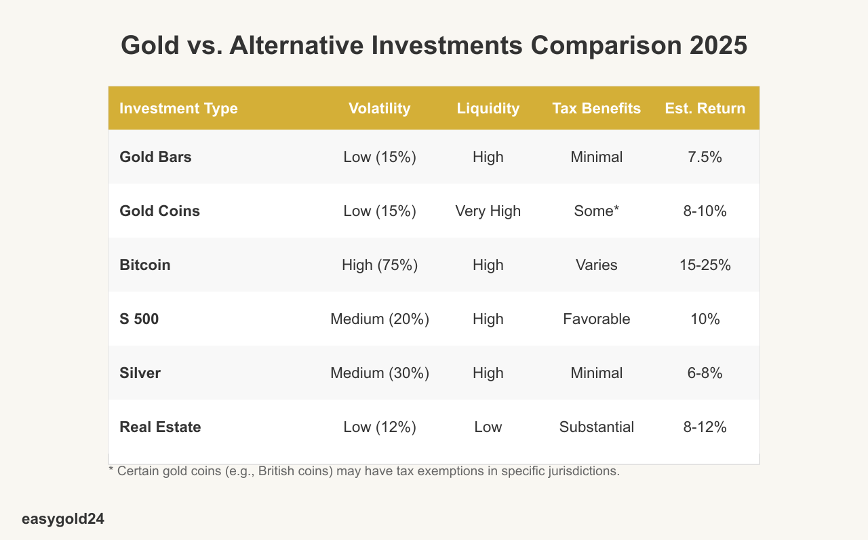

Gold vs. Alternative Investments in 2025

When considering gold investments, it’s important to understand how they compare to other investment options available in 2025:

Gold vs. Bitcoin

While Bitcoin has shown higher volatility and potential for explosive growth, gold offers superior stability and established market recognition. Recent studies show gold’s standard deviation at 15% compared to Bitcoin’s 75%, making gold the preferred choice for risk-averse investors.

Gold vs. Silver

Silver offers a lower entry point for precious metals investing but typically experiences more industrial demand fluctuations. Gold maintains a stronger correlation with economic uncertainty, making it a more reliable inflation hedge.

Gold vs. Traditional Equities

The S&P 500 has historically provided higher average returns (approximately 10% annually) compared to gold (approximately 7.5% annually). However, gold has demonstrated superior performance during market downturns, offering crucial portfolio protection during volatile periods.

Investment Decision Guide: Bars or Coins?

To determine which option best suits your needs, consider these key decision factors:

Choose Gold Bars If:

- You’re investing $10,000 or more

- Your primary goal is maximizing gold content per dollar

- You have a long-term investment horizon (5+ years)

- You have secure storage arrangements

- You prefer simplicity over collectible potential

Choose Gold Coins If:

- You’re starting with smaller investments (under $10,000)

- You may need partial liquidation flexibility

- You’re interested in numismatic appreciation potential

- You want simplified storage options

- You reside in a jurisdiction with coin-specific tax benefits

Making Your Investment Choice

Gold investors in 2025 must consider several factors when deciding between bars and coins. With gold prices exceeding $2,600 per ounce, understanding these elements is essential for maximizing investment returns.

Investment Amount Considerations

Your investment portfolio size typically determines the optimal approach. Larger investments benefit from gold bars because:

- They offer lower premiums over spot prices due to reduced production costs

- Purchasing 250g and 1kg bars in bulk provides greater economies of scale

- Storage costs must be factored into substantial acquisitions

Gold coins may better serve smaller investors by providing:

- Divisible units for strategic liquidation

- Lower initial investment requirements

- Simplified storage solutions

Market Timing Factors

Proper timing significantly impacts gold investment outcomes. Favorable buying opportunities can be identified through:

Price Fluctuation Analysis

- Daily variations based on global demand

- Impact of geopolitical developments

- Currency market movements

Seasonal Patterns

- Prices typically moderate in January and September

- Demand increases during periods of economic uncertainty

Personal Goals Assessment

Your investment objectives determine whether bars or coins are more appropriate. Gold bars typically align with long-term wealth preservation goals. Collectors may prefer coins because of their:

- Potential numismatic appreciation

- Historical significance

- Cultural relevance

Important considerations for optimal portfolio management include:

Storage Requirements:

- Small investments can be accommodated in home safes

- Larger holdings require professional vault facilities

- The Royal Mint’s Vault offers specialized services

Tax Implications:

- Gold bars may incur capital gains tax

- Certain gold coins, particularly British issues, may qualify for tax exemptions

Market Acceptance:

- Gold bars maintain consistent liquidity regardless of origin

- Prominent coins enjoy widespread commercial recognition

New investors should evaluate storage options and long-term objectives before purchasing. Professional advice can help align investment selections with financial goals. Your investment timeframe, risk tolerance, and portfolio diversification strategy should inform your final decision.

Gold Bars vs Gold Coins Comparison Table

| Characteristic | Gold Bars | Gold Coins |

|---|---|---|

| Purity | 99.99% | Varies (91.67% for American Eagle, 99.99% for Canadian Maple Leaf) |

| Premium Costs | Lower premiums overall (1-3%) | Higher premiums (3-8% average) |

| Sample Cost (2025) | $23,700 for 10 oz | $25,000 for ten 1-oz coins |

| Available Sizes | - 1g to 10g (small) - 20g to 50g (medium) - 100g to 1kg (large) | Standard 1 oz denominations for most coins, with fractional options (1/10, 1/4, 1/2 oz) |

| Storage Options | - Bank safety deposit boxes - Private vaults - Home storage (limited quantities) | Same storage options with more flexible storage due to smaller units |

| Storage Costs | 0.3% to 0.65% annually | 0.3% to 0.65% annually |

| Value Drivers | - Metal content - Market price | - Metal content - Collector's value - Historical significance - Numismatic appreciation |

| Market Recognition | Good liquidity, regardless of origin | Excellent worldwide recognition, especially government-minted coins |

| Tax Implications | Subject to 28% capital gains tax (long-term) | Some coins (e.g., British coins) might have tax exemptions |

| Best Suited For | - Large investments - Long-term wealth | - Smaller investors - Collectors - People who want selling flexibility |

| preservation - Bulk purchases | ||

| Manufacturing | - Cast bars (traditional) - Minted bars (refined) | Complex production with detailed designs and precise machining |

| Divisibility | Limited - must sell entire bar | Excellent - can sell individual coins as needed |

| Authentication | Requires professional verification | Government mint marks provide authentication |

How to Verify the Authenticity of Your Gold

Whether you choose bars or coins, ensuring authenticity is paramount. Use these verification methods:

For Gold Bars

- Check hallmarks and serial numbers

- Measure dimensions and weight precisely

- Consider ultrasonic testing for large purchases

- Purchase from reputable dealers with buyback guarantees

For Gold Coins

- Verify mint marks and edge details

- Check diameter and thickness specifications

- Perform the ping test for sound quality

- Compare design elements with official mint images

Professional authentication services cost between $30-100 per item but can prevent counterfeit losses.

Gold Investment Options: Making the Right Choice

At EasyGold24, we help investors choose between gold bars and coins based on their unique investment goals. Gold bars offer significant cost advantages (saving approximately $1,300 on a 10-ounce purchase) due to lower manufacturing costs and reduced premiums, making them ideal for larger investments.

Gold coins provide exceptional liquidity, global acceptance, and potential tax benefits—British gold coins offer UK investors Capital Gains Tax exemption and additional collector’s value. Coins also allow for strategic partial liquidation when needed.

Storage decisions impact long-term returns, with professional vault services costing between 0.3% and 0.65% annually. While home storage works for small quantities, most serious investors find professional storage worth the expense for security reasons.

Your investment size, timeframe, and objectives should guide your choice: larger investors typically benefit from gold bars’ cost efficiency, while smaller portfolios may prefer coins’ divisibility and liquidity. Both options remain strong portfolio assets as gold prices continue to appreciate in 2025.

As a publicly traded company listed on the OTCQB market, Hartmann & Benz (EasyGold24) provides unique opportunities in the precious metals space. Our security token represents gold ownership without physical storage requirements, streamlining trading and reducing costs compared to traditional methods.

Start your gold investment journey today