ONLINE GOLD TRADING

Online Gold Trading: Key Insights for Investors

The online gold trading market provides access to one of the world’s most reliable and enduring assets, without the need for physical storage. Trading gold online has become a major global activity, with the London OTC market, US futures market, and Shanghai Gold Exchange accounting for over 90% of global trading volumes.

Gold plays several crucial roles in an investment portfolio: it serves as a hedge against inflation, a safe haven during times of economic instability, and a diversification tool. The spot gold market operates nearly 24/5, offering liquidity when major markets overlap. Most traders access gold through CFDs (Contracts for Difference), futures contracts, ETFs, or digital gold products.

Gold prices are influenced by various economic factors such as inflation data, geopolitical events, US dollar movements, and central bank policies. Understanding the market’s unique characteristics—like its low volatility compared to stocks, yet greater movement than bonds—can help you make informed decisions. Gold typically moves in an inverse direction to the US dollar, adding another layer of strategy for those seeking to optimize their portfolios.

Getting Started: How to Choose the Best Online Gold Trading Platform

Selecting the right trading platform is crucial for successful online gold trading. The best gold trading platforms offer a combination of competitive fees, robust security, and user-friendly interfaces. When evaluating brokers, regulation should be your primary concern—opt for platforms regulated by reputable authorities like the FCA, ASIC, or CySEC to ensure your investments are protected.

Trading costs significantly impact profitability, especially for active traders. Compare spreads (the difference between buy and sell prices) across multiple platforms, with top brokers offering spreads as low as 0.3 pips on XAU/USD. Additionally, assess platform liquidity, as higher trading volumes generally result in tighter spreads and faster execution.

Consider the platform’s available trading tools—comprehensive charting capabilities, technical indicators, and economic calendars can enhance your trading decisions. For beginners, prioritize platforms with demo accounts, educational resources, and responsive customer support to navigate your early trading journey effectively.

CFD Trading vs. Physical Gold: Comparing Online Trading Methods

Online gold trading presents two distinct approaches: CFD trading and physical gold ownership. CFDs (Contracts for Difference) allow traders to speculate on gold price movements without owning the underlying asset. This method eliminates storage concerns while offering advantages like leverage (amplifying potential returns), short-selling capabilities during price declines, and lower initial capital requirements. CFD trading also provides 24/5 market access with instant execution.

In contrast, physical gold ownership involves purchasing actual gold bars or coins. This traditional approach appeals to investors seeking tangible assets and complete ownership. Physical gold serves as both an investment and potential insurance against severe economic disruptions. However, it requires secure storage solutions, potentially high authentication and insurance costs, and typically involves wider buy-sell spreads.

The optimal choice depends on your investment goals. CFDs suit active traders seeking short-term profits through frequent transactions, while physical gold attracts long-term investors prioritizing tangible assets and wealth preservation. Many sophisticated investors combine both approaches to balance speculation opportunities with wealth protection in diversified portfolios.

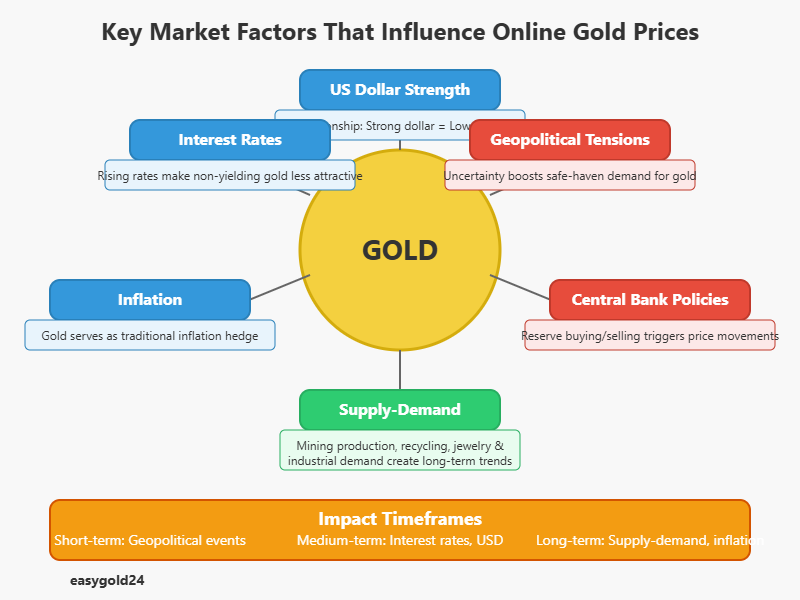

Key Market Factors That Influence Online Gold Prices

Gold traders employ various strategies to capitalize on price movements across different market timeframes. Understanding these approaches helps you select the most suitable method for aligning your trading objectives with market conditions.

Gold prices respond to a complex interplay of macroeconomic factors that online traders must monitor closely. The most significant price driver is the US dollar’s strength, with gold typically moving inversely to the dollar due to its pricing in USD globally. Interest rates also profoundly impact gold—when rates rise, non-yielding gold becomes less attractive compared to interest-bearing assets, often causing price declines.

Inflation serves as another critical determinant, as gold traditionally acts as an inflation hedge. During periods of high inflation or inflation expectations, investors frequently turn to gold to preserve purchasing power. Geopolitical tensions and economic uncertainties tend to boost gold prices as investors seek safe-haven assets during market turbulence.

Central bank policies, particularly regarding gold reserves, can significantly shift market dynamics—large-scale buying or selling by major central banks often triggers substantial price movements. Supply-demand fundamentals, though slower to impact prices than financial factors, remain relevant, with gold mining production, recycling rates, and jewelry/industrial demand creating long-term price trends. Successful gold traders develop systematic approaches to monitor these interconnected influences.

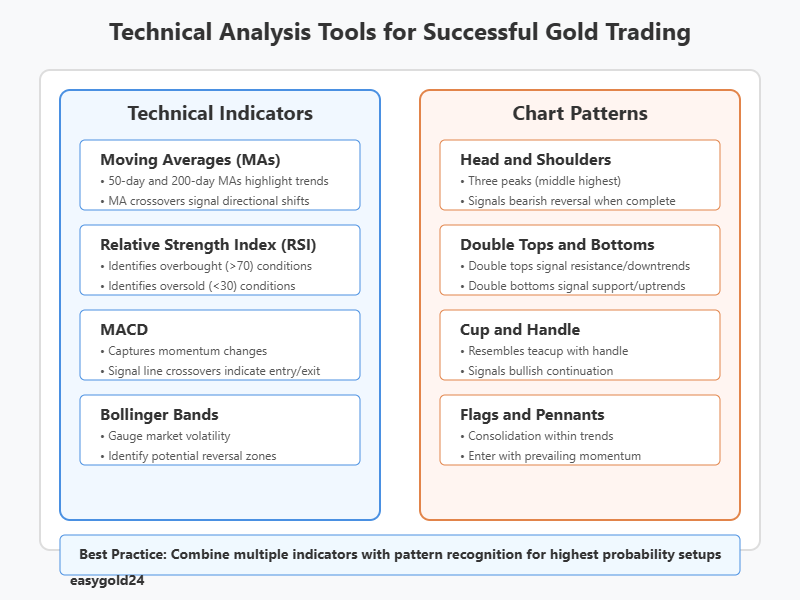

Technical Analysis Tools for Successful Gold Trading Online

Technical analysis forms the backbone of many successful gold trading strategies. Moving averages (MAs) rank among the most fundamental indicators—the 50-day and 200-day MAs frequently highlight meaningful market trends, with crossovers potentially signaling major directional shifts. Relative Strength Index (RSI) helps identify overbought or oversold conditions, with readings above 70 suggesting potential price reversals, while the MACD (Moving Average Convergence Divergence) excels at capturing momentum changes.

Bollinger Bands gauge market volatility and potential reversal zones, with price touching the upper band suggesting overbought conditions and the lower band indicating oversold territory. Fibonacci retracement levels (38.2%, 50%, and 61.8%) often mark significant support and resistance zones in gold’s price action, especially during trending markets.

Professional traders frequently complement these indicators with volume analysis to validate price movements and identify potential false breakouts. Charting platforms like TradingView and MetaTrader provide these analytical tools with customizable parameters. The most effective technical traders avoid indicator overload, instead focusing on mastering a select few tools that align with their trading style and timeframe.

Essential Chart Patterns Every Online Gold Trader Should Recognize

Chart patterns serve as visual representations of market psychology and can signal potential price reversals or continuations in gold trading. Head and shoulders patterns, characterized by three peaks with the middle peak highest, often indicate upcoming bearish reversals when complete. Conversely, the inverse head and shoulders suggests a potential bullish reversal from a downtrend.

Double tops and bottoms frequently mark trend reversals, with double tops signaling resistance and potential downtrends, while double bottoms indicate support and possible uptrends. Cup and handle formations, resembling a teacup with a small consolidation handle, typically precede bullish continuations when properly formed.

Flag and pennant patterns appear as consolidation periods within strong trends, providing traders opportunities to enter with the prevailing momentum. Triangle patterns (ascending, descending, and symmetrical) represent compression phases before potential breakouts, with volume often confirming the significance of the subsequent price movement.

Recognizing these patterns requires practice, but successful gold traders develop the ability to identify high-probability setups while avoiding ambiguous formations. Combining pattern recognition with confirmation signals from indicators maximizes effectiveness in pattern-based trading strategies.

Risk Management Strategies for Online Gold Trading

Effective risk management forms the cornerstone of sustainable gold trading success. Position sizing stands as the most fundamental risk control measure—professional traders typically risk only 1-2% of their trading capital on any single position. This disciplined approach prevents catastrophic losses during inevitable market downturns and preserves capital for future opportunities.

Stop-loss orders serve as mechanical safeguards against adverse price movements, with trailing stops helping to protect profits during favorable trends while providing downside protection. Implementing a consistent risk-reward ratio—commonly 1:3, risking one unit to potentially gain three—ensures that winning trades adequately compensate for losses over time.

Diversification across timeframes and trading methods can mitigate gold’s occasional volatility spikes. Hedging techniques, including paired positions with negatively correlated assets or options strategies, offer additional protection during unpredictable market conditions. Maintaining detailed trading journals helps identify strengths and weaknesses in your risk management approach.

Successful gold traders recognize that preserving capital during drawdowns ultimately matters more than maximizing gains during favorable periods. They exhibit patience in adverse market conditions and understand that strategic risk management transforms gold trading from speculation into a methodical, sustainable business.

The Best Times to Trade Gold in Online Markets

Gold’s 24-hour trading cycle offers multiple windows of opportunity, each with distinct characteristics that savvy traders can leverage. The most liquid trading period occurs during the London-New York overlap (8:00 AM to 12:00 PM ET), when the world’s two largest financial centers operate simultaneously. This four-hour window typically generates the highest trading volumes and most significant price movements, making it ideal for day traders seeking volatility and tight spreads.

The Asian trading session (7:00 PM to 2:00 AM ET), particularly when the Shanghai Gold Exchange and Tokyo markets are active, provides alternative opportunities with different price action characteristics. Asian hours often establish important support and resistance levels that influence subsequent sessions.

Beyond daily patterns, gold exhibits seasonal tendencies worth monitoring. Historical analysis shows stronger performance during January, August, and September, while spring months typically show less favorable trends. Macroeconomic events significantly impact gold’s intraday volatility, with FOMC announcements, inflation reports, and nonfarm payroll releases creating trading opportunities.

Successful gold traders align their strategies with their preferred trading sessions, recognizing that each time window requires adaptations in approach and risk management to match the prevailing market dynamics.

Leveraging Gold ETFs and Digital Gold Products for Online Trading

Gold ETFs (Exchange-Traded Funds) and digital gold products have revolutionized online gold trading by offering convenient alternatives to traditional methods. Gold ETFs like SPDR Gold Shares (GLD) hold physical gold as their underlying asset while trading on stock exchanges like ordinary shares. These instruments provide exposure to gold price movements without physical handling concerns, offering high liquidity, low transaction costs, and minimal storage worries.

Digital gold platforms enable fractional ownership of gold through virtual accounts, with physical backing in secure vaults. These services typically offer lower entry thresholds than ETFs and convenient mobile access while maintaining gold’s inflation-hedging properties. Some providers also allow conversion to physical delivery when desired.

Gold mining ETFs present a leveraged alternative, with their values typically fluctuating more dramatically than physical gold prices due to operational factors affecting mining companies. Sophisticated traders often complement direct gold exposure with options on gold ETFs, using strategies like covered calls to generate income or protective puts to manage downside risk.

Each vehicle offers distinct advantages—ETFs provide excellent liquidity and simplicity, digital gold platforms offer convenience and fractional ownership, while mining ETFs potentially amplify returns during bull markets. Many investors strategically combine these instruments to create balanced exposure to the gold market ecosystem.

Fundamental vs. Technical Analysis in Online Gold Trading

Successful gold trading requires balancing two complementary analytical frameworks: fundamental and technical analysis. Fundamental analysis examines macroeconomic factors driving gold’s intrinsic value—inflation trends, interest rate policies, currency valuations, and geopolitical developments. This approach excels at identifying long-term directional shifts and typically guides strategic position-taking with extended time horizons.

While pure fundamentalists or technicians exist, most successful gold traders integrate both methodologies. A balanced approach might begin with fundamental analysis to determine the primary trend direction, followed by technical analysis to pinpoint specific trade opportunities with favorable risk-reward profiles. The confirmation between technical and fundamental signals often produces the highest probability trading setups.

Technical analysis focuses exclusively on price action and statistical indicators derived from historical data. This methodology excels at identifying optimal entry and exit points, managing risk through precise stop placements, and capturing shorter-term market inefficiencies. Technical approaches particularly suit traders operating on daily, hourly, or minute-based timeframes.

A particularly valuable confirmation occurs when the gold-to-mining stocks ratio aligns with gold’s price action—when both metrics move in harmony, the trend typically demonstrates greater sustainability and reliability. Mastering both analytical frameworks provides gold traders with a comprehensive market perspective unavailable through either approach alone.

How to Develop a Profitable Online Gold Trading Strategy

Creating a sustainable gold trading strategy requires systematic development rather than haphazard approaches. Begin by defining your trading personality—your risk tolerance, available time commitment, and psychological strengths. This self-assessment should guide your choice between day trading (requiring constant market monitoring), swing trading (holding positions for days to weeks), or position trading (maintaining trades for months).

Establish clear objectives with measurable metrics beyond simple profitability—consider factors like maximum drawdown tolerance, risk-reward expectations, and targeted winning percentage. Based on these parameters, select compatible analytical methods that align with your timeframe, whether technical indicators, pattern recognition, fundamental analysis, or combined approaches.

Develop precise entry and exit rules, ensuring they’re objective and repeatable rather than subjective or emotional. Risk management parameters should be codified within the strategy, including position sizing rules, stop-loss placement methodology, and profit-taking guidelines. Testing your strategy through backtesting on historical data and forward testing with small positions helps identify potential weaknesses before significant capital deployment.

The most profitable gold trading strategies aren’t necessarily the most complex—rather, they maintain consistency between the trader’s personality, chosen timeframe, analytical approach, and risk tolerance. Successful traders continuously refine their strategies through performance review while maintaining their core methodology during inevitable market evolution.

Common Mistakes to Avoid When Trading Gold Online

Inexperienced gold traders frequently sabotage their potential through recurring mistakes that can be systematically eliminated. Overtrading ranks among the most prevalent errors—excessive position frequency driven by boredom or FOMO (fear of missing out) typically erodes capital through commission costs and suboptimal entries. Similarly, inappropriate position sizing—risking too much on individual trades—can devastate accounts during normal market fluctuations.

Neglecting stop-loss orders represents another critical mistake, as gold’s occasional volatility spikes can trigger catastrophic losses in unprotected positions. Conversely, setting stops too tightly results in premature exits before trades can develop profitably. Confirmation bias—seeking only information that supports existing positions while ignoring contradictory signals—undermines objective market analysis.

Technical errors include overreliance on single indicators without confirmation, misinterpreting correlation (particularly with the US dollar) as causation, and failing to adjust strategies for different market conditions (trending versus ranging environments). Fundamental mistakes include overreacting to isolated news events without considering broader contexts and misunderstanding gold’s complex relationship with interest rates and inflation.

The psychological mistake of emotionally chasing losses through larger positions (“revenge trading”) often transforms manageable setbacks into significant account damage. Successful gold traders recognize these pitfalls, implementing systematic safeguards through rule-based trading and emotional discipline to maintain long-term profitability.

Tax Implications and Regulatory Considerations for Online Gold Traders

Gold trading carries distinct tax and regulatory implications that vary significantly across jurisdictions. In many countries, physical gold investments are classified as collectibles for tax purposes, potentially subject to higher long-term capital gains rates (28% in the US versus 15-20% for most securities). Meanwhile, gold ETFs and mining stocks typically receive standard securities treatment with more favorable tax rates in many regions.

Gold CFD and futures trading generally falls under mark-to-market taxation in many jurisdictions, with profits and losses reported annually regardless of position closure. This treatment often allows for ordinary income/loss designation rather than capital gains classification. Some countries impose value-added taxes (VAT) on physical gold transactions, though many exempt investment-grade bullion.

Regulatory frameworks for gold trading vary tremendously across jurisdictions. Physical gold transactions above certain thresholds (e.g., $10,000 in the US) frequently trigger reporting requirements to prevent money laundering. Online gold trading platforms must typically obtain licenses from financial regulatory authorities, with requirements varying by region—the UK’s FCA, Australia’s ASIC, and Cyprus’s CySEC represent prominent regulatory bodies overseeing many international platforms.

Successful gold traders maintain thorough transaction records, consult with tax professionals familiar with precious metals regulations, and select trading platforms compliant with their jurisdiction’s requirements. Understanding these considerations prevents unexpected tax liabilities and ensures regulatory compliance throughout your gold trading activities.

Advanced Gold Trading Techniques for Online Investors

Experienced gold traders employ sophisticated strategies beyond basic approaches to extract value across market conditions. Intermarket analysis—examining correlations between gold and related markets like silver, mining stocks, bonds, and currencies—provides contextual insights unavailable through isolated gold chart analysis. Particularly, the gold-silver ratio and gold-mining stock relationships often signal significant market transitions before they appear in gold’s price action.

Options strategies offer powerful tools for advanced gold traders. Vertical spreads limit risk while providing directional exposure, calendar spreads capitalize on volatility expectations across different timeframes, and iron condors generate income during range-bound conditions. Gold futures contracts enable substantial position control with minimal capital through margin efficiency, though they require careful risk management due to their leverage.

Algorithmic trading systems, ranging from simple automated indicators to complex machine learning models, remove emotional interference from execution while potentially identifying subtle patterns invisible to manual analysis. Market profile analysis visualizes price acceptance at different levels, helping traders identify significant support/resistance zones and fair value areas where reversal probabilities increase.

Incorporating sentiment analysis through positioning reports (like the Commitment of Traders), social media monitoring, and sentiment indicators provides contrarian opportunities when market consensus becomes excessively bullish or bearish. These advanced techniques require significant experience to implement effectively but can substantially enhance returns for dedicated gold traders willing to develop specialized expertise.

The Future of Online Gold Trading: Innovations and Trends

The online gold trading landscape is undergoing significant transformation, driven by technological advances and changes in market structures. Blockchain technology is playing a key role in revolutionizing gold ownership verification and fractional trading, with tokenized gold products gaining popularity among younger investors. These digital gold representations merge gold’s long-standing stability with the flexibility and transferability seen in cryptocurrencies, expanding accessibility for a broader range of investors.

Artificial intelligence and machine learning are reshaping how traders analyze the market. Algorithms now identify complex market patterns, offering insights beyond traditional analysis methods. Sentiment analysis tools process vast streams of data, providing an unprecedented understanding of market psychology. Meanwhile, personalized analytics platforms enable traders to adjust technical indicators to match their specific strategies.

Sustainability and ethics are also influencing gold investments, particularly with the increasing importance of sustainable mining certifications and ethical sourcing. These factors are becoming crucial for investors who prioritize responsible investment practices. Additionally, the emergence of central bank digital currencies (CBDCs) could reshape the role of gold in the global financial system, potentially reinforcing its status as an alternative reserve asset during monetary transitions.

Mobile trading platforms are further enhancing accessibility, bringing intuitive interfaces and advanced charting capabilities to smartphones—tools once reserved for desktop systems. These innovations collectively signal a future where gold trading is more accessible to retail investors while providing sophisticated tools for professional traders, maintaining gold’s relevance in the evolving financial landscape.

As these trends unfold, Hartmann & Benz is embracing innovation, ensuring that gold trading remains an integral part of global financial markets. With plans already in motion to list on the OTCQB market, our journey towards offering new ways of investing in gold, including through tokenized gold and a security token, is well underway. The upcoming release of Hartmann & Benz shares will bring exciting opportunities for investors seeking exposure to gold in new and secure forms.

Stay informed about our progress as we move closer to our public listing and explore the potential of tokenized gold for a seamless and secure investment experience.