SAFE GOLD STORAGE

Is Your Gold Really Safe? Secure Storage Solutions

Gold remains one of the most trusted assets—valued for its lasting worth and independence from financial systems. While the benefits of owning physical gold are clear, protecting it is a different challenge altogether.

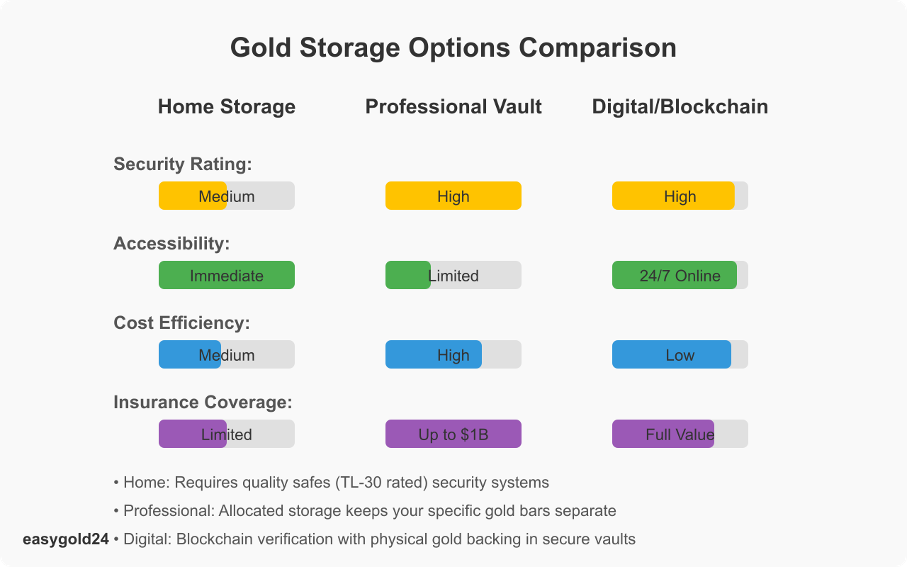

Whether stored at home, in a bank deposit box, or a high-security vault, each method comes with its own risks and responsibilities. Home safes offer quick access but require solid security planning. Bank deposit boxes may seem reliable but offer no insurance protection for your valuables. Professional storage facilities provide maximum security, including insurance coverage of up to $1 billion.

For those looking to avoid physical storage altogether, digital solutions now make it possible to invest in 99.9% pure 24K gold—fully insured, securely stored, and accessible anytime.

Understanding your storage options is key to protecting your investment—and ensuring that your gold remains safe, accessible, and truly yours.

Understanding Gold Storage Basics

Storing physical gold involves unique challenges that require thorough consideration. Unlike digital investments, physical gold requires reliable protection against theft, damage, and environmental factors that could diminish its value.

What makes gold storage challenging

Physical gold storage risks differ significantly from standard investments. Gold in physical form is vulnerable to theft, loss, or environmental damage. It also creates security concerns when storing substantial quantities at home, particularly during extended absences.

Professional storage facilities offer enhanced protection but introduce ‘contractual risk’ that necessitates comprehensive evaluation of the storage provider. Proper climate control is crucial—inappropriate temperature and humidity conditions can cause tarnishing and affect the metal’s value over time.

Another significant challenge involves market integrity. Gold stored outside professional facilities may not command its full resale value because buyers might question the quality of precious metals maintained in non-standard conditions.

Common storage mistakes to avoid

Analysis of investor experiences reveals several critical storage mistakes that could compromise your gold’s security and value:

Inadequate Security Measures

- Using low-quality safes without proper fireproofing and tamper resistance

- Insufficient insurance coverage for stored gold

- Storing gold in obvious locations such as drawers or closets

Environmental Oversights

- Failure to maintain appropriate climate conditions to preserve gold

- Storing gold alongside other valuables that could scratch or damage it

- Exposing gold to moisture or significant temperature fluctuations

Many investors also neglect proper documentation. Detailed records of your gold’s quantity, location, and value are essential for portfolio management and insurance claims.

Maintaining large quantities at home without adequate security presents substantial risk. While home storage allows quick access to your gold, it requires investment in quality safes, enhanced security systems, and comprehensive insurance coverage.

Professional storage facilities may present hidden challenges without careful examination of terms. Some companies charge excessive fees or create obstacles when selling your assets. Understanding possession procedures and all associated costs is crucial before selecting a storage facility.

Bank safe deposit boxes are not as secure as most investors assume. These boxes lack FDIC insurance for precious metals, leaving your investment vulnerable. Additionally, access is limited to banking hours, which could prove problematic during emergencies.

Professional Storage Facilities

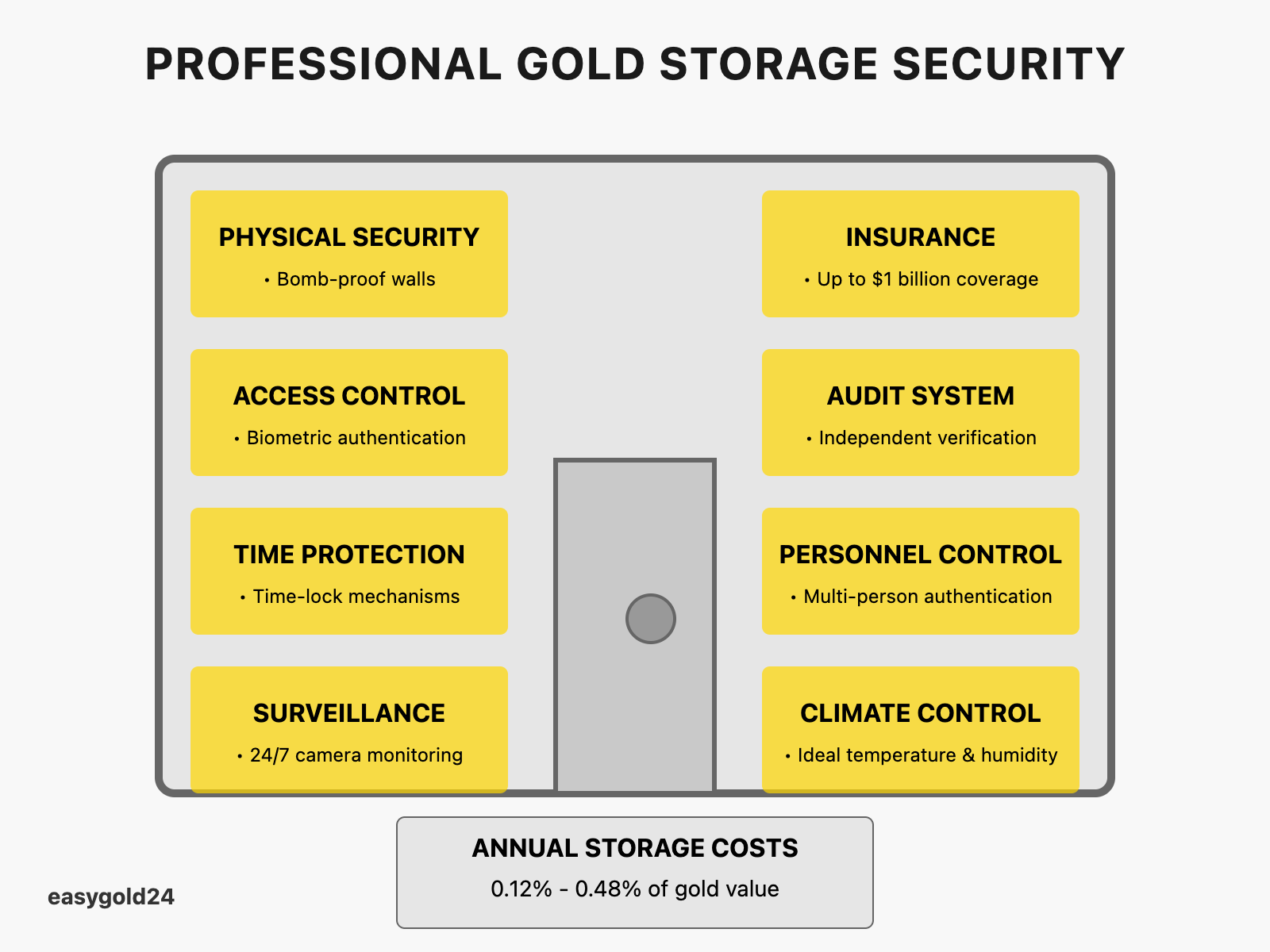

Professional vault facilities function as fortresses designed specifically for precious metals storage. These facilities deliver exceptional protection through state-of-the-art security systems and comprehensive insurance coverage.

Types of vault storage services

Professional storage facilities offer clients two primary storage options. Segregated storage maintains your gold physically separate from other investors’ assets, allowing retention of control over specific bars and coins. Non-segregated storage combines multiple investors’ gold in shared spaces and typically costs less.

Several established companies lead the professional storage industry. The New York Federal Reserve’s vault is situated on Manhattan’s bedrock 80 feet below street level and safeguards approximately 507,000 gold bars weighing 6,331 metric tons. International companies like Loomis and Brink’s operate high-security facilities across numerous locations including Switzerland, Ireland, Hong Kong, and Singapore.

Cost comparison of different facilities

Sprott Physical Gold Trust charges 0.45% annually

- BullionVault and OneGold maintain competitive rates at 0.12% per year

- GoldMoney starts from 0.12% with a minimum fee of 120 USD annually

- Austrian Mint’s fees range from 0.36% to 0.48%

Silver storage costs exceed gold storage rates because it occupies more space. OneGold charges 0.30% annually for silver compared to 0.12% for gold storage.

Security measures in professional vaults

Professional facilities implement multiple layers of advanced security protocols. The Bank of England’s vault exemplifies these measures with:

- Bomb-proof walls capable of withstanding terrorist attacks

- Multi-factor authentication systems incorporating biometric scanning

- Time-lock mechanisms that restrict vault access during specific hours

- 24/7 surveillance utilizing infrared-capable cameras

The New York Fed employs a unique control group system. Three representatives must be present for any vault access—two vault staff members and one internal auditor, even for routine maintenance. A 90-ton steel cylinder entry point creates an airtight and watertight seal when closed.

Most professional facilities maintain comprehensive insurance coverage from respected carriers like Lloyd’s of London. These policies protect against theft, damage, and other losses, providing an additional layer of security beyond physical measures.

Proper timing significantly impacts gold investment outcomes. Favorable buying opportunities can be identified through:

Your investment objectives determine whether bars or coins are more appropriate. Gold bars typically align with long-term wealth preservation goals. Collectors may prefer coins because of their:

Home Storage Solutions

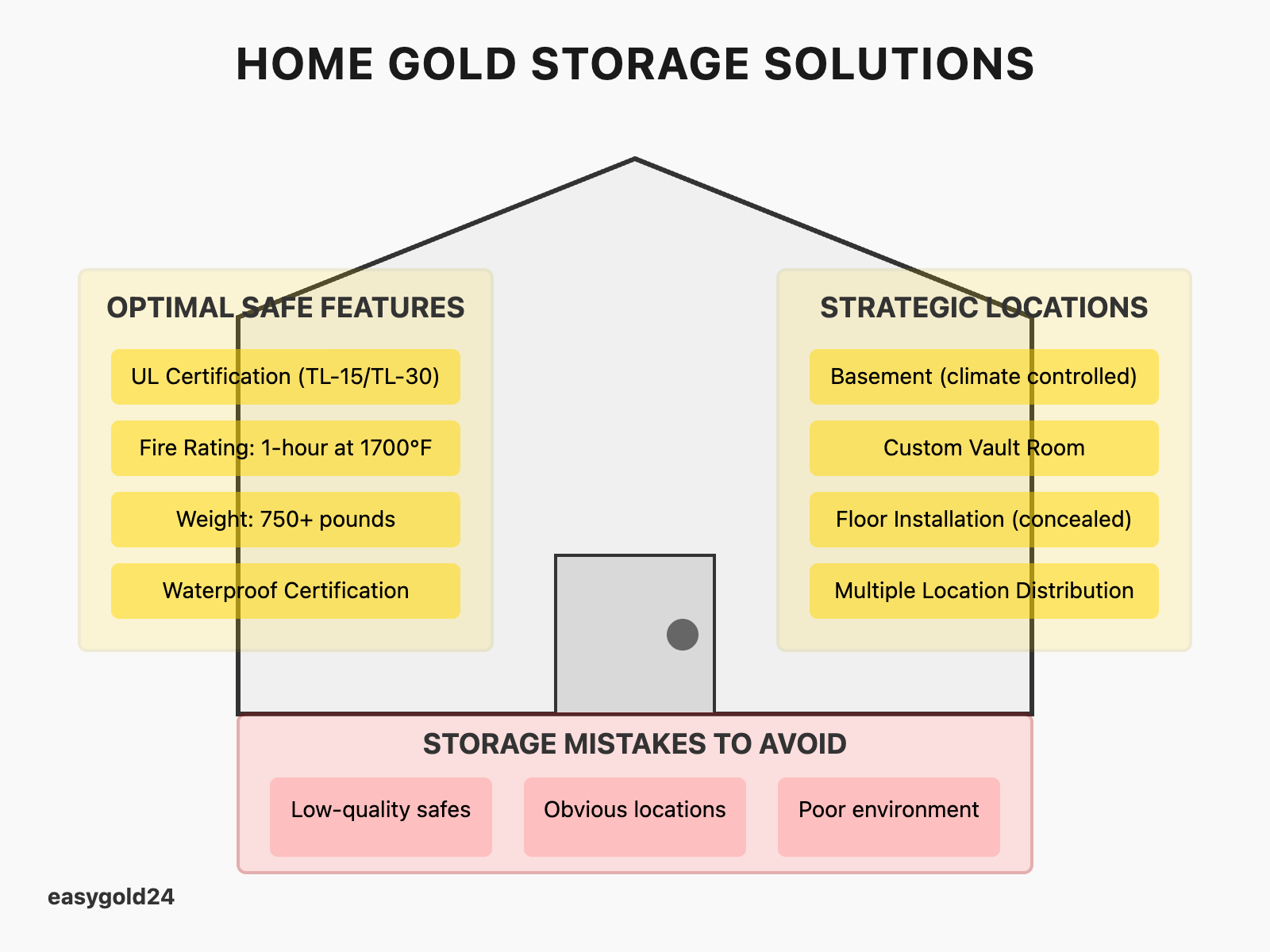

Storing precious metals at home requires careful planning and robust security measures. As the sole guardian of your gold, you must implement appropriate protections for your investment.

The appropriate safe requires several essential features. Seek safes with Underwriters Laboratories (UL) certification, particularly those rated TL-15 or TL-30. These ratings indicate the safe can withstand tool attacks for 15 or 30 minutes respectively.

A high-quality safe should include:

- Thick walls constructed with GR80 steel that provides twice the strength of standard safes

- Fire rating of minimum 1-hour at 1,700°F to ensure protection during emergencies

- Weight exceeding 750 pounds or professional bolt mounting options

- Waterproof certification to prevent moisture damage

- Biometric or electronic keypad access systems with backup key options

Quality safes require significant investment—premium models like the AMSEC CF6528 TL-30 Fire Rated Composite Safe typically cost upward of $5,000.

Best locations for home storage

The effectiveness of your storage solution depends significantly on its placement within your home. Consider these strategic locations:

Basement or Garage Areas: These spaces offer numerous concealment opportunities behind large appliances or in unused storage areas. Ensure proper climate control, as excessive moisture can damage precious metals.

Custom-Built Solutions: A vault room provides optimal security for substantial gold collections. Select a windowless space away from guest areas. Reinforce walls with steel and install an approved vault door for maximum security.

Floor Installation: Safes concealed beneath carpets or hardwood flooring offer excellent protection. Ensure your floor can support the safe’s weight, and consider professional installation.

Regardless of location, discretion is paramount. Social media posts about your gold collection could invite unwanted attention. Limit knowledge of your storage setup to trusted family members only.

Implementing multiple storage methods enhances your protection by distributing risk. A primary vault combined with strategically placed security boxes creates layered defense against various threats.

Home storage offers immediate access and personal control but requires substantial security investment. The success of your home storage strategy depends on balancing accessibility with protection while maintaining discretion regarding your precious metals.

Digital Gold Storage Options

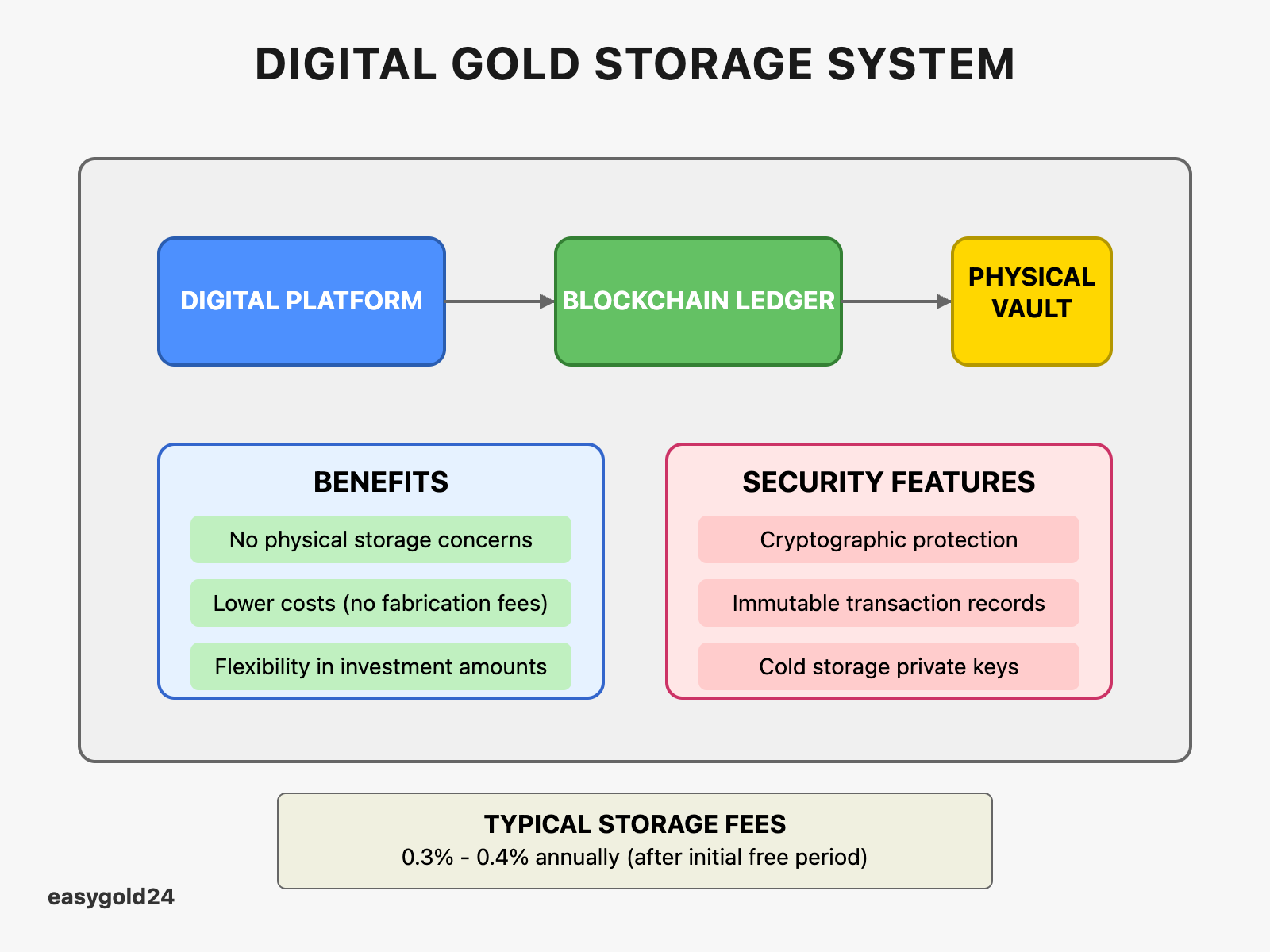

Digital gold platforms have transformed modern gold ownership. Investors can now purchase and store gold without physical possession. This innovative approach combines secure vault storage with seamless digital transactions.

Digital gold platforms store physical gold in secure vaults on behalf of their customers. Your purchase secures actual 24-karat gold that’s 999.9% pure, safely maintained in professional facilities. The process works as follows:

- Purchase initiation through a digital platform

- Allocation of equivalent physical gold in secure vaults

- Digital certificate issuance representing ownership

- Real-time monitoring through online dashboard

As a publicly traded company listed on the OTCQB market, Hartmann & Benz (EasyGold24) provides unique opportunities in the precious metals space. Our security token represents gold ownership without physical storage requirements, streamlining trading and reducing costs compared to traditional methods.

Benefits and limitations

Contemporary investors recognize several advantages in digital gold:

Advantages:

- Elimination of physical storage concerns and risks

- Reduced costs without fabrication charges or insurance fees

- Flexibility to invest in smaller amounts

- Rapid buying and selling capabilities

- Option to convert digital holdings into physical gold

Limitations:

- Storage fees after the initial free period (typically 0.3% to 0.4% annually after 5 years)

- Dependence on platform stability and systems

- Restricted opportunities for personal inspection of gold reserves

- Additional trust required in custodian companies

Security protocols in digital storage

Digital gold platforms implement comprehensive security measures for both physical and digital protection. The physical gold underlying digital investments resides in highly secure, insured vaults featuring:

- Advanced biometric authentication systems

- High-resolution surveillance cameras

- Multi-layer access control measures

- Fire and water protection systems

- 24/7 monitoring with immediate alerts

Digital security relies on blockchain technology, which provides:

- Cryptographic security through distributed ledger technology

- Immutable transaction records

- Public recording of all transactions

- Smart contracts for secure peer-to-peer transfers

Some platforms enhance security with hardware wallets or ‘cold storage’ that maintain private keys offline. These wallets utilize EAL6+ chips—the highest standard in chip security.

Established companies like Chubb Insurance Company provide coverage, and regular security audits further strengthen protection. Many platforms also select jurisdictions with strong property rights and reliable infrastructure to offer investors enhanced legal protection.

Creating Your Storage Strategy

Developing an effective gold storage strategy requires careful assessment of investment size, security requirements, and accessibility needs. A prudent approach utilizes multiple storage methods to distribute risks.

Assessing your storage needs

The volume of gold you possess will determine your storage requirements. Professional vault storage provides optimal security and insurance coverage for investments exceeding $50,000. For holdings under $50,000, home storage may be suitable with appropriate security measures.

Key factors to consider when selecting storage options include:

- Investment volume and physical space requirements

- Access frequency requirements

- Geographic location and political stability

- Insurance coverage requirements

- Budget for security infrastructure

Combining different storage methods

A multi-location strategy offers superior protection compared to centralizing all gold in a single location. Optimal protection comes from distributing your gold across:

- A small portion at home for immediate access

- The majority of holdings in secure international vaults

- Selected portions in politically stable countries

This configuration provides protection against theft, capital controls, government levies, confiscation, terrorism, war, and natural disasters that might affect a single location.

Regular security audits

Consistent audit procedures provide clear visibility regarding your gold holdings’ security. Professional storage facilities conduct comprehensive audits through:

- Daily reconciliation of client holdings against vault records

- Annual physical inventory verification by independent auditors

- Sample weight checks of precious metal holdings

Leading storage providers collaborate with independent audit specialists like Inspectorate International Limited for biannual physical audits that encompass:

- Physical inventory counts

- Quality assessment of randomly selected gold bars

- Storage facility evaluation

- Verification of gold quantities against blockchain records

For home-stored gold, establish a personal audit system. Maintain detailed records of your holdings, inspect storage conditions regularly, and update security measures as needed. Two trusted individuals should be informed about your storage details while maintaining strict confidentiality.

A reliable storage strategy that effectively protects your gold investments results from proper assessment, strategic diversification, and consistent auditing. Note that your storage requirements may evolve as your investment grows, necessitating periodic review and adjustment of your approach.

Strength Through Security and Strategy

Storing gold is not just a question of safety—it’s a matter of strategy. A well-balanced mix of secure home safes, professional storage facilities, and modern digital solutions ensures both flexibility and protection. While each method offers distinct advantages, combining them allows for tailored risk management that meets your specific requirements.

At EasyGold, protecting your assets is more than a service—it’s a foundation for building long-term value. With the successful listing of Hartmann & Benz shares on the OTCQB market, we are now opening a new chapter. This step strengthens our international positioning and gives investors a transparent opportunity to participate in the physical gold market—without compromising on security or accessibility.

The future of gold investing is evolving. Be part of that change.