Agricultural Commodity Trade

Agricultural Commodities Trading: A Simple Overview

Agricultural commodities offer exciting opportunities for growth, especially with global meat consumption set to rise by 14% by 2030. These markets are divided into key categories: oil seeds, cereal grains, meat, dairy, soft commodities, and other agricultural products.

Modern agricultural trading combines traditional knowledge with advanced tools like DTN ProphetX, which provides real-time updates on crop values and market movements. By using options, traders can secure prices ahead of time, helping to manage risk effectively.

Understanding the different commodity types and trading methods will help you navigate the agricultural market with confidence. Whether you’re new to this sector or looking to refine your strategy, knowing the right tools and risks involved will set you on the path to successful trading.

What Are Agricultural Commodities

Agricultural commodities are raw materials grown on farms, plantations, and ranches. These products serve two primary purposes: direct consumption by people and use as inputs for manufacturing other goods such as textiles and biofuels. The agricultural markets have evolved into a dynamic global marketplace since 1848, when farmers first met in Chicago to establish grain prices.

Common types of agricultural commodities

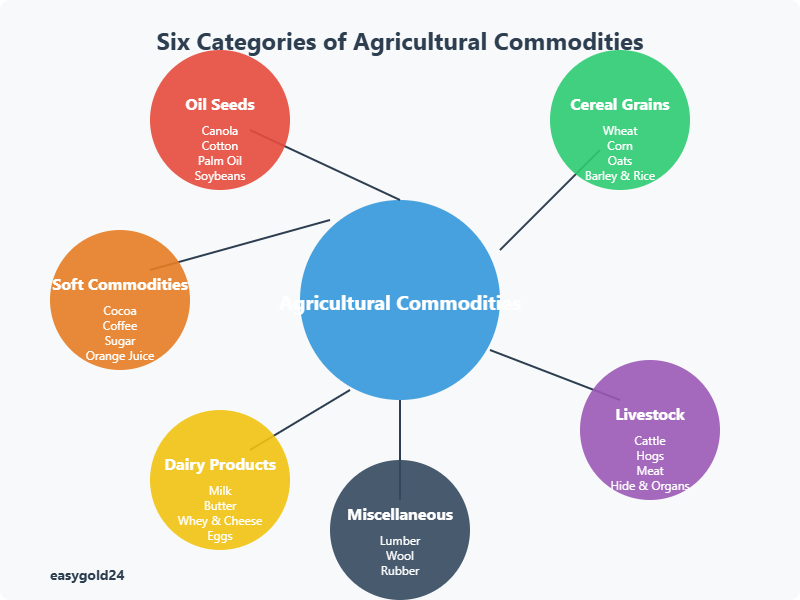

Agricultural commodities fall into six different categories that serve unique market needs:

1. Oil Seeds: These crops produce valuable oils and animal feed. The main examples include canola, cotton, palm oil, and soybeans.

2. Cereal Grains: These grains are essential to human and animal nutrition. This category includes wheat, corn, oats, barley, and rough rice. These grains also contribute significantly to biofuel production.

3. Livestock: This category includes cattle and hogs. They are valued not only for their meat but also for their hide, organs, bones, and hooves.

4. Dairy Products: The Chicago Butter and Egg Board first standardized this category in 1898. It now includes milk, butter, whey, cheese, and eggs.

5. Soft Commodities: These crops are harvested annually and include cocoa, coffee, sugar, and frozen concentrated orange juice.

6. Miscellaneous: This group includes products like lumber, wool, and rubber that don’t fit traditional classifications.

How they are traded

Agricultural commodities operate through sophisticated trading systems. The market has become one of the most active and liquid globally, especially for corn, wheat, soybeans, lean hogs, and live cattle.

These commodities are traded in three main ways:

Spot Markets: These are physical markets that facilitate immediate delivery of commodities at current market prices. Buyers and sellers engage in direct transactions for instant delivery, with prices reflecting immediate supply and demand patterns.

Futures Contracts: These agreements allow traders to exchange specific quantities of commodities at predetermined prices for future delivery. Standard contract sizes vary by commodity:

- Corn and soybean contracts typically cover 5,000 bushels

- Cattle contracts handle 50,000 pounds or approximately 23 metric tons

Options Trading: This method offers two main types:

- Call options give the right to buy commodities

- Put options give the right to sell commodities

Several key factors influence agricultural market values. Weather conditions, political developments, diseases, and shipping issues affect supply and demand patterns. Supply and demand relationships will become increasingly important for agricultural markets as the global population grows beyond 9 billion by 2050.

The United States holds a strong position in agricultural trade. It leads exports in grains, feeds, soybeans, livestock products, tree nuts, fruits, vegetables, and horticultural products. U.S. agricultural imports have grown faster than exports in the last decade, expanding at a compound annual rate of 5.8% from fiscal years 2013 to 2023.

Getting Started With Trading

Agricultural commodities trading begins when you open a trading account. Modern electronic platforms now make these markets accessible to traders worldwide.

Setting up a trading account

You’ll need to complete several steps to start trading agricultural commodities:

1. Fill Out Application Forms: Your chosen broker will provide account opening documents that require completion.

2. Submit Required Documents: You should provide:

- Identity proof

- Address verification

- Income documentation (bank statements or tax returns)

- Demat account details

3. Execute Member-Client Agreement: This legal document outlines broker services, fees, and responsibilities. Ensure you pay the appropriate stamping and registration fees.

Choosing your first commodity

Several key aspects deserve attention when you select your first agricultural commodity trade:

Market Liquidity: The most liquid markets currently include corn, wheat, soybeans, lean hogs, and live cattle. These commodities experience active trading regularly.

Supply-Demand Dynamics: Several factors influence price movements:

- Weather conditions

- Political developments

- Disease outbreaks

- Shipping disruptions

Trading Options: Your strategy will determine whether you choose:

- Futures contracts with standardized amounts

- Options that offer flexible trading approaches

- Exchange Traded Funds (ETFs) that provide diversified exposure

Understanding basic market terms

Understanding these fundamental market terms will help guide your agricultural trading decisions:

Price Movement Indicators:

- Higher: Sales exceed previous session prices

- Firm: Prices move upward without measurable change

- Steady: No change from previous session

- Weak: Prices drift lower without measurable change

- Lower: Sales fall below previous session

Market Activity Levels:

- Active: Supplies clear quickly

- Moderate: Normal clearing rate

- Slow: Gradual supply clearing

- Inactive: Limited participation with occasional sales

Supply Classifications:

- Heavy: Volume exceeds average

- Moderate: Average market volume

- Light: Volume below average

Demand Categories:

- Very Good: Supplies get absorbed rapidly

- Good: Buyers show strong confidence

- Moderate: Average trading interest

- Light: Buyer interest falls below average

Start with a sensible investment size instead of committing too much capital right away. Your trading position sizes can grow as you learn more about market dynamics and gain experience.

How to Research Market Trends

Success in agricultural commodities trading depends on analyzing market data and understanding price patterns. Market analysis employs two main approaches: technical analysis, which examines past trading patterns, and fundamental analysis, which focuses on supply-demand relationships.

Using price charts

Traders track market movements and identify trading opportunities through price charts. Bar charts are accessible to more people and show daily prices as vertical bars. These charts help traders identify:

Channel Patterns:

- Base lines connecting two lowest points create upward trends

- Top lines linking two highest points create downward trends

Key Price Signals:

- Daily highs and lows that exceed the previous two trading days create a bearish outside day

- Futures prices that suddenly drop or rise beyond the previous day’s range create gaps

- Two daily price highs reaching similar levels form double tops

Technical analysis builds on two main principles:

- Market prices reflect all influencing factors

- Price movements create patterns that repeat over time

Reading market reports

Market reports provide valuable insights about supply-demand dynamics and price trends. The USDA Market News has delivered free, unbiased price and sales information for over 100 years. These reports examine several key indicators:

Supply Indicators:

- Total receipts reveal all products available to sell

- Market offerings group supply as light, moderate, or heavy

Price Movements: Crop prices showed significant changes recently:

- Increased 18% in 2020

- Rose another 14% in 2021

- Increased 8% in 2022 to record levels

Demand Analysis: Reports categorize demand into:

- Very good: Rapid supply absorption

- Good: Strong buyer confidence

- Moderate: Average trading interest

- Light: Below-average buyer activity

The World Agricultural Supply and Demand Estimates (WASDE) report is a vital resource. Traders watch this report closely to learn about production volumes, consumption patterns, and trade projections.

Modern tools enhance market research capabilities. The USDA’s International Baseline Visualization tool utilizes information from 44 countries and regions. This platform tracks:

- Production trends

- Consumption patterns

- Trade flows

- Population growth effects

- GDP influences on dietary habits

Agricultural markets face diverse influences today. Weather conditions, political developments, and shipping disruptions affect supply-demand relationships. Successful traders use both technical and fundamental analysis to make informed decisions.

Making Your First Trade

Your first agricultural commodities trade requires careful planning and smart decisions. Traders can utilize market-based instruments to transfer risks to more suitable entities.

Selecting entry points

Price analysis forms the foundation for finding the best entry points. Traders consider:

Historical Price Ranges: Crude oil prices typically fluctuate between USD 50.00 to USD 75.00 per barrel in the last decade. These patterns help traders identify favorable entry positions.

Market Conditions: Entry decisions rely on:

- Supply-demand equilibrium

- Weather patterns that affect crop yields

- Global economic indicators

- Political developments that affect trade

Trading Volume: Markets with high activity demonstrate strong participation and facilitate smoother entry and exit. Corn, wheat, soybeans, lean hogs, and live cattle currently exhibit high trading volumes.

Setting stop-loss levels

Stop-loss orders protect traders by closing positions automatically at preset price levels. Here’s how to set them up:

Step-by-Step Process:

- Select your commodity contract

- Choose the quantity to protect

- Set your trigger price

- Pick order duration (day order or good till canceled)

- Double-check all details

Risk Management Guidelines:

- Keep potential losses between 1-3% of your trading balance

- Calculate position size with stop-loss in mind

- Monitor market conditions

- Update stops based on price movements

Executing the trade

After establishing entry points and risk limits, here’s how to execute your trade:

Order Placement:

- Select the commodity and contract month

- Decide between market or limit orders

- Enter quantity and price details

- Verify all transaction information

Trading Methods:

- Futures Contracts: Standard agreements on exchanges that require margin deposits

- Soybean contracts: 5,000 bushels

- Gold contracts: 100 troy ounces

- Options Trading: Offers flexibility through:

- Call options to buy

- Put options to sell

Risk Considerations:

- Each commodity has different margin requirements

- Price changes affect margin accounts daily

- Your account gets credited or debited each day

- Market fluctuations can alter execution prices

Platform Selection: Your trading platform should provide:

- Up-to-the-minute market data

- Customizable charts

- Quick order execution

- Tools to manage risk

Note that agricultural commodities trading involves significant risks. Start with one commodity to thoroughly understand market dynamics. You can expand your trading portfolio as you gain experience.

Common Beginner Mistakes to Avoid

Success in agricultural commodities trading depends on avoiding key mistakes that new traders often make. Risk management is the lifeblood of profitable trading, but many traders underestimate its importance.

Over-investing

Using excessive leverage is one of the riskiest approaches in commodity trading. Traders who borrow more than they can afford often lose their entire investment. Financial risks intensify when:

- Interest rates increase unexpectedly

- Lenders demand repayment sooner than anticipated

- Credit availability becomes restricted

Several factors determine appropriate borrowing levels:

- Farm profitability

- Current credit costs

- Risk tolerance

- Income stability

Ignoring market signals

Market signals help traders make informed decisions, but newcomers often fall victim to “backyarditis” – focusing on local conditions instead of the broader market perspective. Here are key market indicators many people overlook:

Global Supply-Demand Dynamics: Weather changes, political shifts, and shipping problems in growing regions worldwide affect commodity prices. The 2007-2008 food crisis demonstrated this clearly when many countries halted grain exports, causing prices to increase dramatically.

Price Movement Patterns: Astute traders monitor both spot and futures prices. Market stress can cause significant divergence between spot and futures prices, occasionally forcing commodity exchanges to suspend grain futures trading.

Market News Impact: World events can substantially alter commodity prices. Missing significant news about your commodities can result in missed opportunities and financial losses.

Poor risk management

Risk management is crucial to agricultural commodities trading, but beginners often neglect this vital aspect. Traders need to address five main types of risk:

- Production Risk: Weather changes, crop yields, and market prices can significantly impact commodity values.

- Price/Market Risk: Changes in commodity prices and costs can disrupt your trading plans.

- Financial Risk: This encompasses everything from interest rate fluctuations to credit problems.

- Institutional Risk: Government decisions regarding taxes and regulations can adversely affect trading positions.

- Personal Risk: Health problems or family issues can impair your trading judgment.

You can mitigate these risks by:

- Establishing firm stop-loss orders to limit potential losses

- Maintaining adequate liquid assets

- Diversifying across different commodities

- Staying informed about market trends and news

- Creating and adhering to a solid trading plan

Remember that effective risk management typically requires multiple strategies working in conjunction, as each trade presents unique risks. Clear communication during contract execution helps prevent confusion and financial losses.

Agricultural Commodities Trading: Navigating Market Opportunities

Agricultural commodity trading requires careful planning and informed decisions. The market’s complexity is manageable with a clear understanding of its fundamentals and strategic risk management. Many successful traders begin by focusing on a single commodity to master its market patterns before expanding their portfolios. Combining technical analysis with in-depth market knowledge is key to making confident decisions.

In agricultural trading, factors such as weather events, market shifts, and global trends play a crucial role in price fluctuations. By staying updated on these changes and employing strong risk management practices, traders can position themselves for long-term success.

Hartmann & Benz (EasyGold) is navigating its own exciting journey in the financial markets. We have already been listed on the OTCQB, making our shares available for trading and investment. As a growing company, we are committed to bringing new opportunities for investors, including the release of our security token. This token will represent ownership of gold, simplifying the process for investors and reducing traditional storage and trading costs.

Stay informed about our progress and explore investment opportunities with Hartmann & Benz as we continue to develop and expand in the global market.