Blue Chip Stocks

Why Blue Chip Stocks Belong in Every Portfolio in 2025

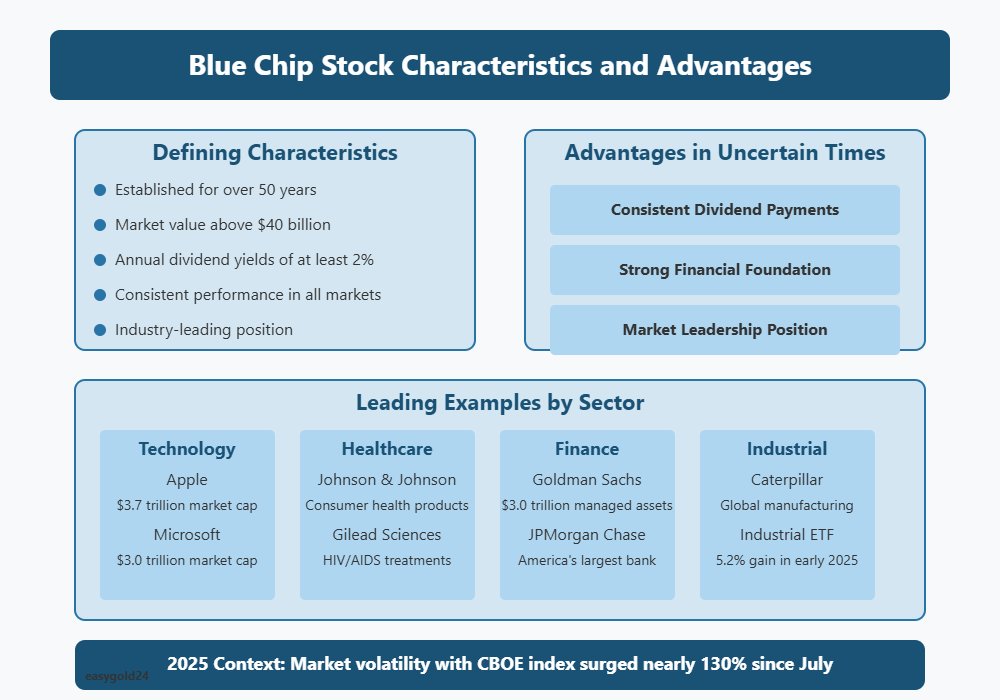

Blue chip stocks represent the foundation of global markets. Their name—borrowed from the highest-value poker chips—reflects the financial strength and dominance of the companies behind them. Firms like Apple ($3.7 trillion market cap) and Microsoft ($3.0 trillion) are not just household names—they are economic engines with proven performance, resilience, and global influence.

These companies have typically been in operation for over half a century and maintain market values above $40 billion. They weather economic cycles with consistency, often continuing to grow while distributing reliable dividends—commonly yielding at least 2% annually. Their track record includes innovation, adaptability, and shareholder commitment, making them attractive even during volatile periods.

In 2025, the S&P 500 has already delivered double-digit gains—driven in large part by these corporate titans. For investors focused on long-term stability and predictable income, blue chip stocks remain a key component of any well-structured portfolio.

At Hartmann & Benz, we follow similar principles. Our approach connects traditional asset stability—like physical gold—with modern investment channels. With our successful listing on the OTCQB market and the launch of our EasyGold security token, we invite you to explore investments rooted in value, transparency, and long-term growth.

Now is the time to act with confidence and clarity. Choose quality. Invest in strength.

What Makes Blue Chip Stocks Special in 2025

Economic forecasts indicate potential challenges ahead, making it essential to understand the special role of blue chip stocks. Market analysts expect the U.S. economy to slow down further in 2025, with scenarios ranging from shallow to moderate recession.

Current Market Challenges

The stock market faces increasing pressures. The CBOE Volatility Index—also known as the ‘fear index’—has surged nearly 130% since July. Wall Street is preparing for market volatility during upcoming earnings seasons. These uncertainties, combined with concerns about high valuations and mixed economic indicators, create a complex investment environment.

Why Stability Matters Now

Blue chip companies demonstrate remarkable resilience through their stable balance sheets and reliable cash flows during uncertain times. Their proven business models and established operations provide protection against market turbulence. These companies remain profitable even in challenging economic conditions, which contributes to their track record of stable growth.

Blue Chip Advantages in Uncertain Times

Blue chip stocks offer several key advantages that make them especially valuable in 2025:

Nevertheless, even blue chip giants cannot completely escape severe market stress—as demonstrated by notable cases like General Motors and Lehman Brothers during the 2007-2009 global recession. Blue chip stocks provide stability but should be part of a broader, diversified investment strategy rather than your sole investment choice.

How to Identify True Blue Chip Stocks

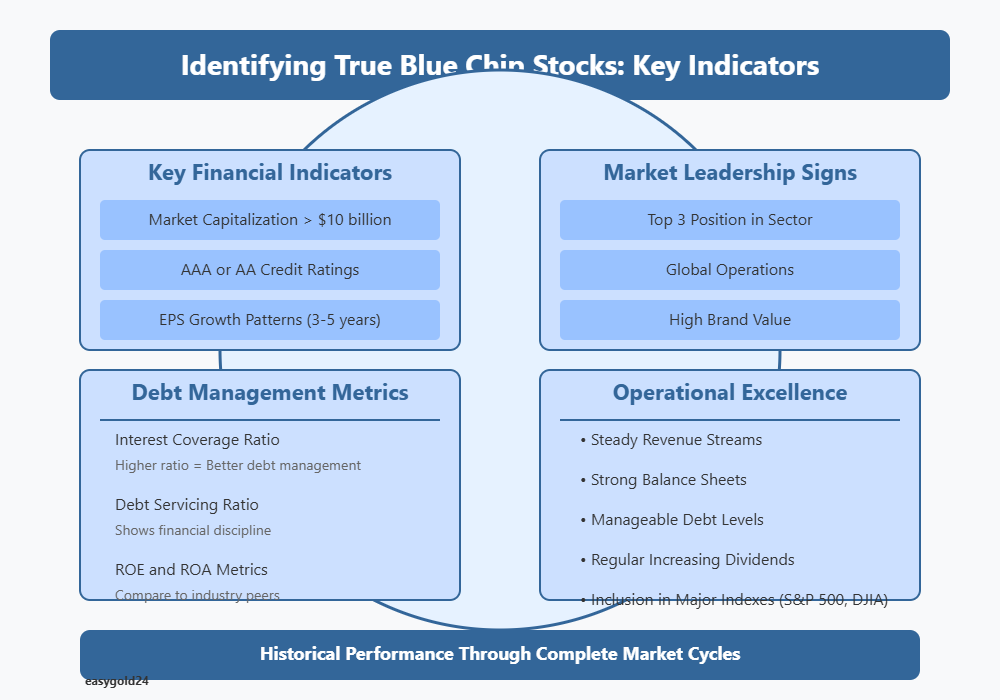

Identifying genuine blue chip stocks requires a systematic approach that focuses on specific financial metrics and market indicators. These key factors help you recognize companies that truly deserve the blue chip designation.

Key Financial Indicators

A company’s financial stability is the foundation of its blue chip status. Market capitalization stands out as the primary metric—companies valued at more than $10 billion typically qualify for blue chip status. Companies with AAA or AA credit ratings indicate excellent financial health

Consider these significant metrics:

Market Leadership Signs

True blue chip stocks exhibit clear market leadership traits beyond numerical indicators. These companies rank among the top three players in their sectors and display several distinctive characteristics:

Consider these significant metrics:

- Steady revenue streams and prudent financial management

- Strong balance sheets with manageable debt levels

- Regular dividends that increase over time

Studying historical performance through complete market cycles proves immensely helpful. This comprehensive review reveals which companies maintain their blue chip status regardless of economic conditions.

Smart Ways to Buy Blue Chip Stocks

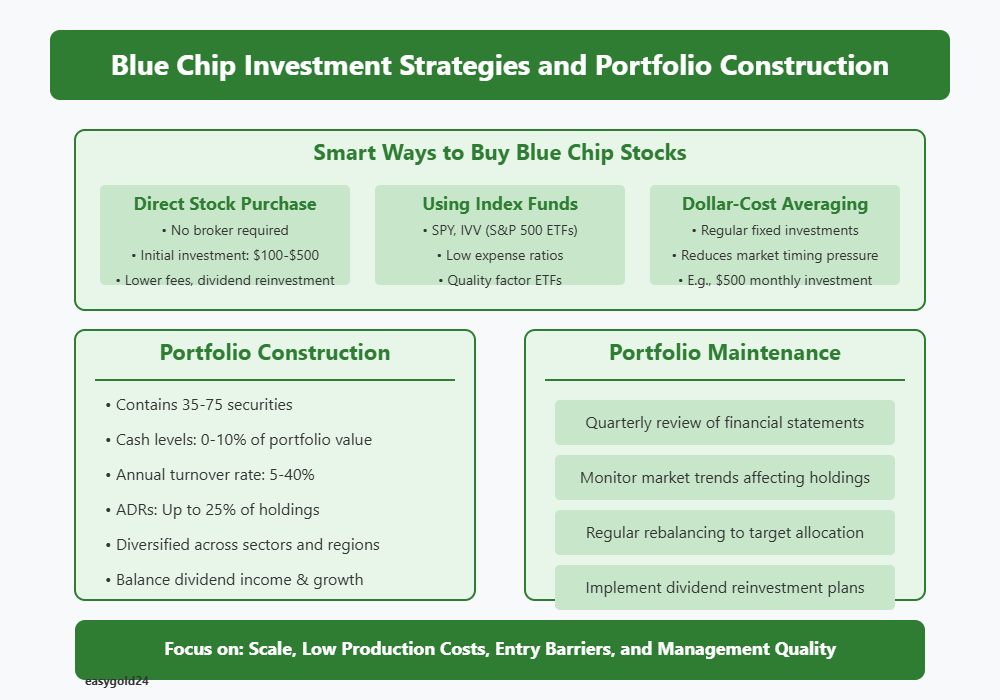

Investing in blue chip stocks becomes straightforward once you understand the different purchase methods. Each approach offers distinct advantages that allow you to choose based on your investment priorities and goals.

Direct Stock Purchase

Direct Stock Purchase Plans (DSPPs) allow you to buy shares directly from companies without requiring a broker. Many well-established blue chip companies with over 20 years of operation, such as Walmart, Coca-Cola, Starbucks, and Home Depot, offer these plans. Most DSPPs require only $100 to $500 to begin investing.

DSPPs provide these advantages:

- Lower fees compared to traditional brokerages

- Automatic reinvestment of dividends to purchase additional shares

- Potential share discounts between 1% and 10%

Using Index Funds

Index funds and Exchange-Traded Funds (ETFs) represent the most efficient way to invest in multiple blue chip stocks simultaneously. Popular options include the SPDR S&P 500 ETF (SPY) and iShares Core S&P 500 ETF (IVV), both of which track the S&P 500 index.

The most effective blue chip ETFs should feature:

- Substantial assets under management

- Established track records

- Low expense ratios

Quality factor ETFs specifically target companies that demonstrate consistent earnings growth and low debt—typical characteristics of blue chip stocks.

Dollar-Cost Averaging Benefits

Dollar-cost averaging (DCA) involves investing fixed amounts regularly, regardless of market conditions. This strategy works particularly well with blue chip stocks because:

- Market fluctuations have less impact on your overall investment

- You automatically purchase more shares when prices decline

- You develop disciplined investment habits without requiring significant initial capital

For example, investing $500 monthly in a blue chip stock means buying fewer shares at higher prices and more at lower prices, potentially reducing your average share cost. This structured approach eliminates the pressure of perfect market timing.

Top Blue Chip Sectors for 2025

Blue chip investments in 2025 present promising opportunities across key sectors. Each sector offers unique benefits and growth potential.

Technology Leaders

The technology sector dominates the market with Apple and Microsoft at the forefront. Apple’s market capitalization has reached $3.30 trillion. The company’s innovative product lineup and new AI technology called ‘Apple Intelligence’ fuel this growth. Microsoft maintains its strong position through advancements in cloud computing and semiconductors.

Healthcare Giants

Healthcare blue chips demonstrate remarkable stability during market fluctuations. Johnson & Johnson stands out with its diverse range of consumer health products and medical devices. Gilead Sciences has established leadership by focusing on profitable HIV/AIDS treatments and specialized cancer therapies.

Financial Powerhouses

Goldman Sachs illustrates the financial sector’s strength with over $3.00 trillion in managed assets. America’s largest bank, JPMorgan Chase, demonstrates its resilience by maintaining stability during financial turbulence.

Industrial Stalwarts

The Industrial Select Sector SPDR ETF tracks this sector, which outperformed the broader market with a 5.2% gain early in 2025. Caterpillar’s global manufacturing presence and diverse product lines highlight the sector’s robustness.

Balancing Different Sectors

A well-structured blue chip portfolio should encompass multiple sectors to mitigate risk. The Global Industry Classification Standard (GICS) categorizes companies into 11 distinct sectors, ranging from communication services to utilities. This system helps investors distribute their capital across market segments effectively.

Setting Investment Goals

Your investment strategy should align with your financial objectives. Consider these factors:

- Dividend income potential—many blue chips yield above 2%

- Growth prospects—certain sectors consistently demonstrate higher earnings

- Market stability—companies established for over 20 years typically exhibit less price volatility

Regular portfolio review is essential as economic conditions and company performance evolve over time. This approach ensures your investments support your long-term financial goals.

Building Your Blue Chip Portfolio

Constructing a resilient blue chip portfolio requires careful planning and strategic execution. Successful investors employ proven methods to maximize returns as markets progress through cycles.

Your initial step involves researching potential investments through financial news platforms and stock analysis websites. Seek companies that demonstrate strong financial history and industry leadership. Examine key metrics such as revenue growth, profit margins, and return on equity before making investment decisions.

Portfolio Construction Fundamentals: A well-structured blue chip portfolio typically contains 35 to 75 securities. Cash levels should remain between 0-10% of total portfolio value, with annual turnover rates from 5-40%. American Depositary Receipts (ADRs) can constitute up to 25% of holdings to provide international exposure.

These characteristics are most important when evaluating companies:

- Scale, low production costs, or significant entry barriers that create sustainable competitive advantages

- Management teams focused on generating long-term shareholder value

- Stocks trading below their intrinsic value based on discounted cash flow analysis

Risk Management Strategy: Regular portfolio monitoring helps track performance and make necessary adjustments. Your investments should be diversified across sectors and geographic regions to reduce risk. Dollar-cost averaging can help minimize the impact of market volatility on your investments.

Investment Vehicle Selection: Direct stock purchases and ETFs serve different investment objectives. Many brokers now offer fractional shares. Blue chip-focused ETFs provide efficient diversification across quality stocks for passive investors.

Portfolio Maintenance: A systematic approach to portfolio management includes:

- Quarterly review of company financial statements

- Monitoring market trends affecting your holdings

- Regular rebalancing to maintain your target asset allocation

- Implementing dividend reinvestment plans to support compound growth

Blue chip investing succeeds through patience and discipline. Quality companies have demonstrated their ability to withstand economic downturns and maintain consistent dividend payments. By employing these systematic approaches, you can build a resilient portfolio that generates long-term wealth.

Blue Chip Stocks: Stability Meets Strategy in a Changing Market

In uncertain economic times, blue chip stocks offer a powerful combination of stability, performance, and long-term potential. Their strong fundamentals, established market positions, and consistent dividend payouts make them an essential element in any resilient investment portfolio.

At EasyGold, we understand the value of assets backed by real performance and proven trust. That’s why our approach combines time-tested investment principles—like those behind blue chip companies—with the tangible security of gold. Now that Hartmann & Benz is officially listed on the OTCQB market, we offer international investors direct access to a regulated and transparent trading environment.

In addition to our public listing, the launch of the EasyGold security token enables a new level of accessibility and efficiency for gold-backed investing. Whether you’re diversifying your holdings or seeking alternatives to traditional markets, our structure is designed to offer both flexibility and long-term value.

Now is the time to align your portfolio with assets that stand for strength, credibility, and strategic growth.