Buy Physical Gold

How to Buy Physical Gold in 2025

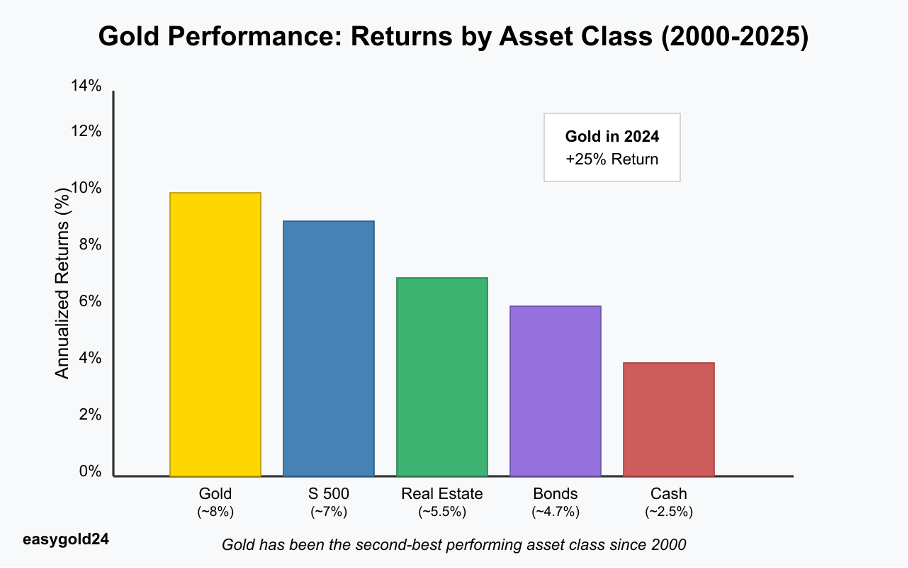

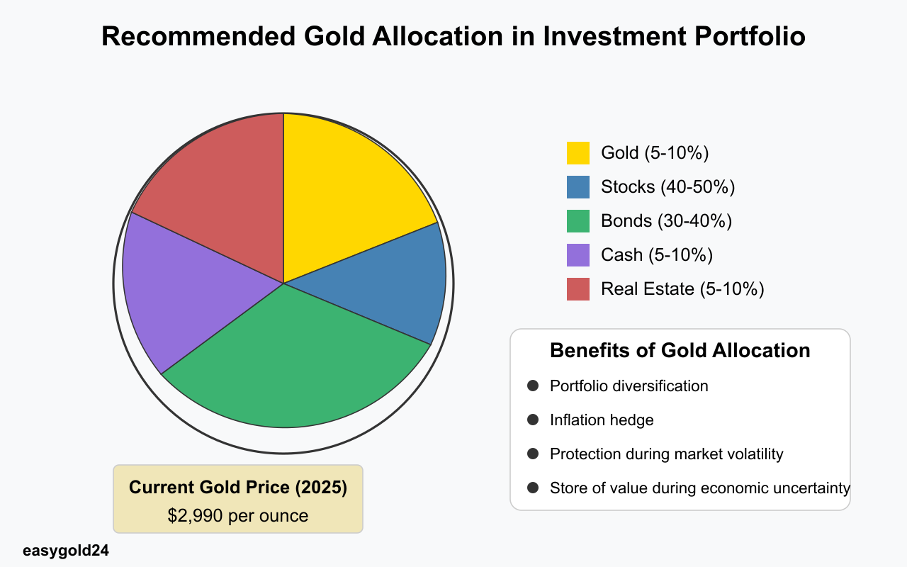

Gold remains one of the most reliable asset classes, delivering nearly 8% annualized returns since 2000. With a current price of $2,990 per ounce and a 25% gain in 2024 alone, it continues to outperform as both an inflation hedge and a store of value. Most financial professionals recommend allocating 5–10% of liquid assets to physical gold as part of a diversified portfolio.

For first-time buyers, the idea of purchasing gold bars or coins may seem complex. In reality, it’s more straightforward than ever. Reputable online dealers offer transparent pricing, insured shipping, and secure payment methods. Orders over $199 often qualify for free delivery, increasing accessibility for new investors.

When buying, focus on LBMA-certified bullion with a minimum fineness of 99.5%. Whether Sie choose 1-ounce bars, larger investment blocks, or classic coins like the Krugerrand or Maple Leaf, purity and authenticity are essential. Always verify the origin and certification of each piece.

Choose dealers who provide full documentation, fair buyback policies, and robust customer support. Storing your gold securely—whether at home, in a private vault, or via insured storage services—is equally important for protecting your investment.

Start building long-term financial stability with physical gold, backed by real value you can hold in your hand.

What is Physical Gold Investment?

Physical gold investment allows you to buy and store actual gold assets as a tangible store of value. You gain direct ownership and control of your investment, unlike paper gold or gold ETFs which represent rather than provide actual gold possession.

Types of Physical Gold You Can Buy

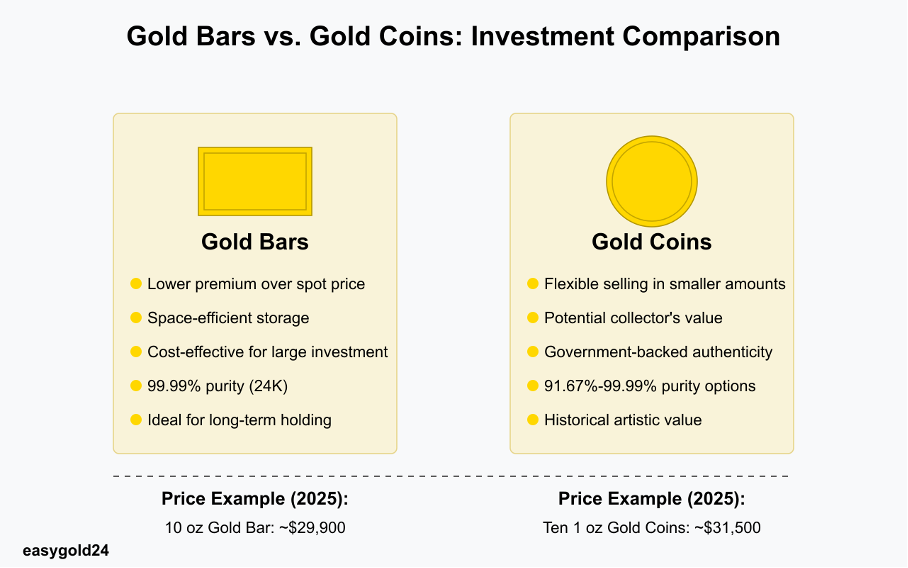

Gold bars and gold coins are the main options for investing in physical gold. Gold bars, also called gold bullion, range from 1 gram to 400 troy ounces. These investment-grade bars are almost pure gold with 99.99% purity.

Gold coins provide another solid investment path for beginners. Government institutions mint these coins in weights ranging from 1/10 ounce to 1 ounce. The Canada Gold Maple Leaf, South African Krugerrand, and American Buffalo Gold coin all boast 99.9% purity. The American Gold Eagle, at 91.67% purity, remains popular with gold investors seeking both investment value and collector appeal.

Gold certificates are an excellent alternative that proves your ownership of physical gold stored in professional vaults. These certificates demonstrate your ownership without the need for immediate possession or home storage concerns.

Benefits of Owning Physical Gold

Physical gold helps diversify your investment portfolio and demonstrates a negative correlation with stocks and other financial instruments. Gold has maintained its value throughout history as an inflation hedge, while paper currency and many other assets have not.

This precious metal particularly excels during economic uncertainty and market volatility. As one example, gold provided investors with a 25% return in 2024 as inflation concerns grew. Central banks in emerging markets are increasing their gold reserves, which highlights its strategic value in a comprehensive investment strategy.

Gold is universally recognized, making it a reliable way to store wealth regardless of your location. Its compact size and high value-to-weight ratio make it easy to transport and trade, even in challenging economic situations.

Gold’s natural characteristics make it even more appealing—it doesn’t rust and melts over a regular flame, making recycling simple. Recycled sources provide approximately one-third of all gold sold. Gold’s unique atomic structure, with heavier atoms and faster-moving electrons, creates its special color that people value.

While physical gold investment provides tangible asset security and true ownership, you need to consider storage, security, and insurance costs. Nevertheless, gold’s proven ability to maintain purchasing power and protect against economic uncertainty makes it an excellent way to diversify your investment portfolio.

How to Choose Your First Gold Purchase

Buying gold for the first time requires consideration of several important factors. The following information will guide you through everything you need to know to make a smart choice.

Setting Your Investment Budget

You should establish a realistic budget based on your financial situation before investing in gold bullion. Financial experts recommend limiting physical gold investments to no more than 10% of your investment portfolio. Begin by analyzing your monthly income and expenses. Financial planning tools can help you determine how much you can comfortably invest. Consider starting small, as even modest investments in gold can grow in value over time.

Deciding Between Gold Bars and Gold Coins

Your investment goals and budget will determine whether you should purchase gold bars or coins for your portfolio. Gold bars typically cost less over spot price because they’re simpler to produce. Gold coins, however, allow you to sell smaller amounts when necessary.

- Budget-friendly large investments with lower premiums

- Space-efficient storage with stackable design

- Straightforward value calculation based on gold content

- Flexible selling options for smaller amounts

- Potential additional value from collector’s interest

- Historical significance and artistic value beyond melt value

Understanding Gold Purity Standards for Investment

Gold’s purity significantly affects its investment value. Pure gold is 24 karats (24K), which means it’s 99.99% pure. Most investment-grade gold adheres to this standard. Here’s what different purity levels represent:

- 24K: 99.99% pure gold (ideal for investment)

- 18K: 75% gold content

- 14K: 58.3% gold content

- 10K: 41.67% gold content (minimum legal standard in US)

Investment-grade gold bars and coins include markings that indicate:

- Purity level

- Weight

- Manufacturer’s mark

- Registration number

New gold investors should focus on well-known products from prominent mints such as the U.S. Mint, Royal Canadian Mint, or Perth Mint. These institutions ensure consistent quality and adhere to strict purity standards to protect your investment’s value.

Where to Buy Physical Gold Safely in 2025

Gold buyers can choose between two main options: local gold dealers and online gold investment platforms. Each option offers distinct benefits to consider.

Local Gold Dealers vs Online Gold Platforms

Online dealers operate around the clock and maintain lower premiums due to reduced overhead costs. These digital platforms display a wide range of gold products and serve thousands of customers daily. Most trusted online gold dealers have direct connections with mints and distributors, ensuring authentic products at competitive prices.

Local coin shops allow you to examine gold items in person before purchasing. These shops stock high-quality gold coins and bullion bars. Their community presence builds trust through years of service.

- Price Comparison: Online dealers typically offer better prices and lower premiums than local shops

- Product Selection: Digital platforms maintain larger inventories of diverse gold products

- Security: Online purchases preserve your privacy and reduce theft risks

- Convenience: Online platforms operate 24/7, eliminating location and time constraints

How to Verify Gold Dealer Reputation

Finding trusted gold dealers requires thorough research. Begin by checking if they belong to respected organizations such as the Professional Numismatists Guild or American Numismatic Association. These organizations have strict membership requirements that demonstrate dealer credibility.

- Active membership in industry organizations

- Transparent pricing with no hidden fees

- Comprehensive buyer protection policies

- Clear authentication guarantees

- Excellent customer service history

Take time to read online reviews on platforms like Trustpilot and Google Reviews. Legitimate dealers should clearly display their registration numbers and compliance documentation. Select dealers with physical street addresses rather than just P.O. boxes.

Avoid dealers who employ aggressive sales tactics or make unrealistic promises about gold investment returns. A good dealer listens to your needs and gives you time to make informed decisions without pressure. Considering all these factors will help you identify a trusted source for your gold purchases.

Gold Investment Tax Considerations

Physical gold investments have specific tax implications that vary by jurisdiction. In many countries, gold bullion investments are subject to capital gains tax when sold at a profit. Some gold coins, particularly those issued by government mints, may have different tax treatment than bars. Consult with a tax professional before making significant gold purchases to understand the tax implications for your specific situation.

Physical Gold Investment: What Comes Next

Investing in physical gold is more than a safe haven—it’s a strategic step toward asset preservation and wealth diversification. As you begin building your position in gold, factors such as product purity, secure storage, and proper documentation are key to long-term value protection. Whether you start with a 1 oz bar or a government-issued coin, the goal is to secure real assets with lasting relevance.

Hartmann & Benz (EasyGold) has now entered a new phase of growth. Following our successful listing on the OTCQB market in the United States, our shares are officially available for international trading. This milestone opens the door for broader participation and allows capital raised through share offerings to be used in the acquisition of raw and recycled gold.

In parallel, our EasyGold security token strengthens access to digital gold ownership, streamlining investment without the burden of physical storage. Both developments mark a turning point—bringing institutional-grade opportunities to private investors seeking to participate in the future of physical gold.

Physical gold remains a solid foundation. Now, with tokenized options and international market access, investors can benefit from both traditional security and modern efficiency.

Take your next step toward real value.