Current Stock Market Prices

2025 Current Stock Market Prices

The stock market’s latest prices indicate mixed performance across various sectors and regions. Major indices have moved in different directions recently. The Dow Jones has dropped 748.63 points to 43,428.02, while Bitcoin has continued its upward trajectory, trading at $96,403.00 with a 0.29% gain.

Market conditions remain challenging worldwide. The S&P 500 declined by 104.39 points to 6,013.13, and the NASDAQ Composite fell 438.36 points to 19,524.01. In contrast, Asian markets are showing resilience, with the Nikkei index climbing 98.90 points to reach 38,776.94. These movements highlight an intriguing market phase in which gold has maintained stability at $2,949.70 despite broader market fluctuations.

Global Markets Reveal Divergent Growth Patterns

Global financial markets are displaying distinct growth patterns as 2025 progresses. The International Monetary Fund projects global growth to reach 3.3% for both 2025 and 2026, which remains below the historical average of 3.7% recorded from 2000-2019.

US Markets Hit New All-Time Highs

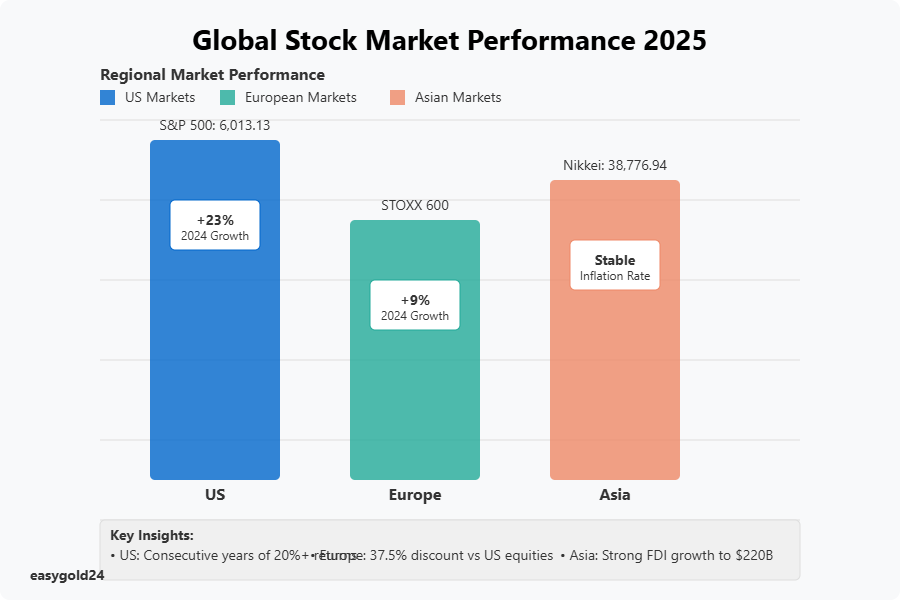

The United States economy continues to demonstrate exceptional strength, with GDP growing 2.7% year-over-year in the third quarter. The S&P 500 has delivered remarkable gains of 23% in 2024, following a 24% rise in the previous year. This achievement marks its first consecutive years of 20%-plus returns since the late 1990s. Corporate earnings remain the primary driver of market performance, though growth patterns vary significantly between mega-cap technology companies and other market segments.

European Markets Show Mixed Performance

European markets present a more nuanced picture. The STOXX 600 index of European and UK companies is projected to return approximately 9% for the year. During the first six weeks of 2025, European stocks have performed better against Wall Street than at any time in the past decade. European equities currently trade at 14 times expected earnings, representing a substantial 37.5% discount compared to their US counterparts.

Asian Markets Display Strong Recovery

Asia’s economic landscape shows considerable promise. The region has managed to maintain more stable inflation rates and interest rates compared to other global regions. Several countries, including the Philippines, Indonesia, Thailand, and Korea, initiated their rate-cutting cycles in Q3 2024. India leads as the fastest-growing major emerging market economy, supported by rising consumer sentiment and increased spending.

The ASEAN region’s economic fundamentals remain robust, with Foreign Direct Investment (FDI) inflows growing from USD 170.00 billion in 2016 to USD 220.00 billion in 2023. Taiwan and Korea continue to maintain their positions as global leaders in semiconductor manufacturing and are benefiting from heightened demand for artificial intelligence technologies.

China’s economy faces a combination of challenges and opportunities. The government has implemented stimulus measures to stabilize both the stock market and property sector. These efforts have begun to yield positive results, as evidenced by increased manufacturing activity following September’s stimulus package.

Economic Factors Drive Market Volatility

Market volatility has intensified as economic indicators reveal a complex relationship between interest rates and inflation. Trading patterns across global markets have significantly transformed due to the Federal Reserve’s recent policy decisions.

Interest Rates Shape Trading Patterns

The Federal Reserve maintains a cautious stance and forecasts two rate cuts in 2025. These reductions are expected to bring the year-end target to 3.75%-4%. Bond yields reflect uncertainty in the market, with longer-term yields having risen substantially since December. This suggests investors are preparing for potentially higher inflation.

Various regions demonstrate differing monetary policies. The European Central Bank plans to adopt a more dovish approach, with rates potentially falling below 2%. While rates in developed markets remain relatively high, there exists a clear disparity between U.S. and European rates.

Inflation Data Triggers Market Response

Recent inflation figures reveal ongoing challenges in price stability. Consumer expectations indicate 4.3% inflation for the coming year, which represents a full percentage point increase from January. The Federal Reserve’s preferred measure of inflation, the core Personal Consumption Expenditures Price Index, is projected to decrease to 2.5% by year-end.

Key inflation trends across regions:

- U.S. core inflation remains above the Federal Reserve’s 2% target

- European core inflation is expected to fall below 2% by the end of 2025

- UK inflation is projected to reach 2.5% headline and 2.7% core by year-end

- Japan’s core inflation is anticipated to reach 1.5%

Market participants closely monitor these economic indicators because persistent inflation could potentially delay expected rate cuts. Traders identify inflation and tariffs as primary market drivers, with approximately 51% of institutional trading clients citing these factors as top potential developments.

These economic factors collectively create sensitive market conditions. The combination of fiscal policy decisions and elevated interest rates necessitates increased Treasury debt to fund federal spending. Growing government deficits may exert upward pressure on rates over the long term.

Technology Sector Leads Market Rally

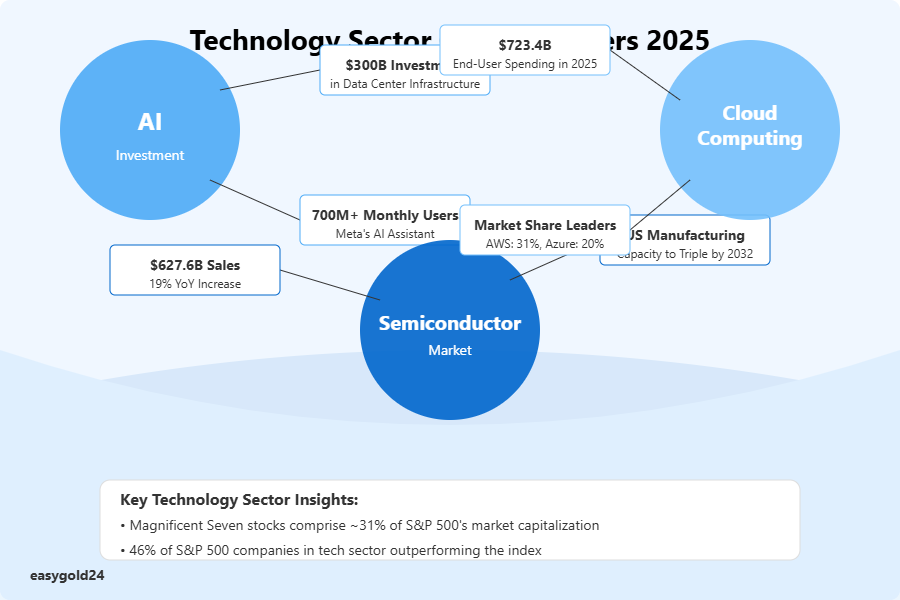

Technology stocks have attracted unprecedented attention as AI capital expenditure reaches historic levels. The technology sector demonstrates remarkable strength, with approximately 46% of S&P 500 companies outperforming the index itself.

AI Stocks Dominate Trading Volume

Four leading tech giants have committed to investing USD 300.00 billion in data center infrastructure. Microsoft has projected USD 80.00 billion in capital expenditure. Meta’s AI assistant user base has expanded beyond 700 million monthly users. Palantir Technologies stands out with a 34% surge in 2025, building upon its impressive 340% gain in 2024.

Semiconductor Stocks Break Previous Records

Global semiconductor sales reached USD 627.60 billion in 2024, representing a 19% increase from the previous year. September’s semiconductor sales in the Americas climbed to USD 17.20 billion, demonstrating a 46.3% year-over-year increase. U.S. semiconductor manufacturing capacity is projected to triple between 2022 and 2032.

Cloud Computing Companies Show Strength

Worldwide end-user spending in cloud computing is expected to reach USD 723.40 billion in 2025, up from USD 595.70 billion in 2024. Amazon Web Services maintains market leadership with a 31% share, followed by Microsoft Azure at 20%. Google Cloud is experiencing the fastest growth among major providers, with revenue increasing by 35% to USD 11.40 billion.

AI infrastructure development continues to drive the technology sector’s momentum. The Magnificent Seven stocks now comprise approximately 31% of the S&P 500’s market capitalization. Despite uncertainty created by China’s DeepSeek regarding future AI spending patterns, major tech companies maintain their ambitious investment plans for 2025.

Energy Markets Face New Challenges

The energy sector continues to transform as geopolitical tensions and shifting market fundamentals reshape trading patterns. Supply disruptions and evolving consumption habits present new challenges for the oil and gas industry.

Oil Prices React to Global Tensions

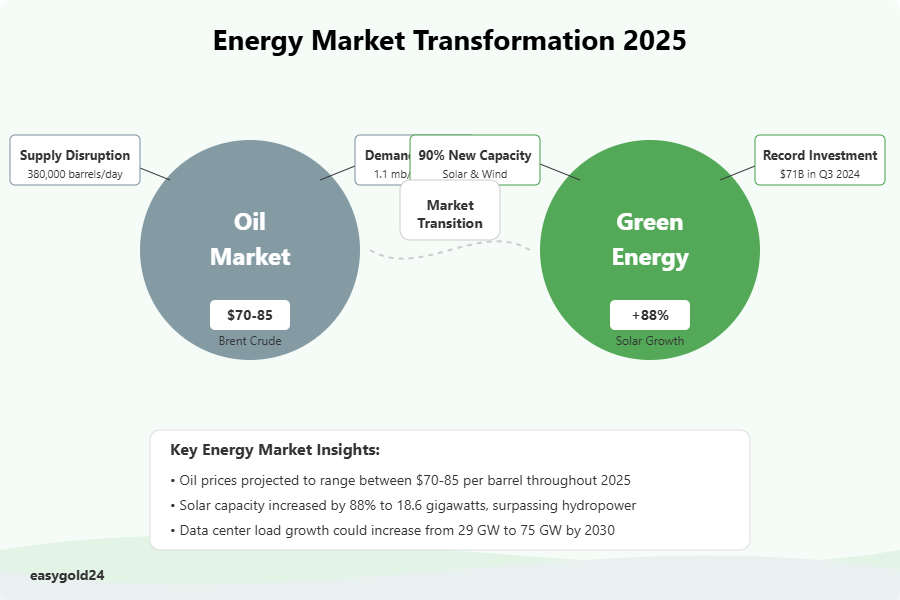

Crude oil markets demonstrate increased sensitivity to global events. A Ukrainian drone attack on Russia’s Kropotkinskaya pumping station reduced oil flows by 30-40%, potentially removing up to 380,000 barrels per day from global supply. Additionally, severe weather in North Dakota has decreased oil production by 150,000 barrels per day.

Projections indicate that global oil demand growth will reach 1.1 mb/d in 2025, rising from 870 kb/d in 2024. China leads this growth through expansion in its petrochemical sector. India and other emerging Asian economies continue to increase their market share.

Mixed signals characterize the oil market as Brent crude prices fluctuate between USD 70.00 and USD 85.00 per barrel. Stricter sanctions on Iranian oil could potentially reduce supply by one million barrels daily, which might push Brent prices to the mid-USD 80.00s by mid-2025.

Green Energy Stocks Gain Momentum

Alternative energy investments demonstrate strong growth potential. Utility-scale solar and wind capacity additions constituted approximately 90% of all new builds and expansions in early 2024. Solar capacity increased by 88% to 18.6 gigawatts, making it the fourth-largest source of installed capacity, surpassing both hydropower and nuclear.

The renewable energy sector is positioned for continued growth. The International Energy Agency anticipates that renewables will generate over one-third of global electricity by early 2025. Data center load growth could increase from 29 GW to 75 GW by 2030.

Cleantech investment reached a record USD 71.00 billion in the third quarter of 2024. Retail and manufacturing segments achieved quarterly records despite uncertainty regarding tax guidance and project delays. Approximately 60% of announced projects are expected to commence operations within four years.

Markets in Motion – And a New Way to Invest with Stability

2025 brings a dynamic investment environment shaped by tech breakthroughs, shifting monetary policies, and evolving energy markets. U.S. indices are riding strong momentum, cryptocurrencies are gaining renewed confidence, and the tech sector continues to lead—with AI and semiconductors dominating headlines and market capitalizations alike. Meanwhile, European stocks remain undervalued, offering selective opportunities for investors looking beyond the U.S.

But in a climate of innovation and unpredictability, long-term value remains key. That’s where EasyGold offers a new kind of access: a bridge between traditional market strategies and real, asset-backed security.

With Hartmann & Benz now officially listed on the OTCQB market, investors can take part in a regulated opportunity rooted in physical gold acquisition—positioning themselves in both the digital economy and the real-world commodity space. Our EasyGold security token further simplifies access to gold investment, removing the barriers of physical storage and high transaction costs.

In a world where tech and macroeconomic forces drive constant change, stability still matters. EasyGold brings that foundation—paired with transparency, innovation, and long-term vision.

Take your next step into a diversified future.