Dividend Shares

Why Smart Investors Choose Dividend Investing in 2025

Dividend investing continues to gain popularity—and for good reason. Reinvested dividends have historically delivered strong long-term results. For example, a $10,000 investment in an S&P 500 index fund with dividends reinvested grew to over $182,000 in just 30 years.

Today, more than 80% of companies in the S&P 500 pay regular dividends. Many of them are established businesses with solid fundamentals, often operating for three decades or more. These companies tend to remain resilient even in uncertain markets, making them especially attractive for investors seeking consistency.

Some top dividend stocks currently offer yields as high as 12%, making them a powerful tool for generating passive income. Whether you’re looking to build monthly cash flow or reinvest earnings for compounded growth, dividend stocks can be an essential part of a balanced portfolio.

Dividend investing offers more than just payouts—it provides access to companies with a track record of stability, profitability, and investor focus.

What Makes Dividend Investing Attractive in 2025

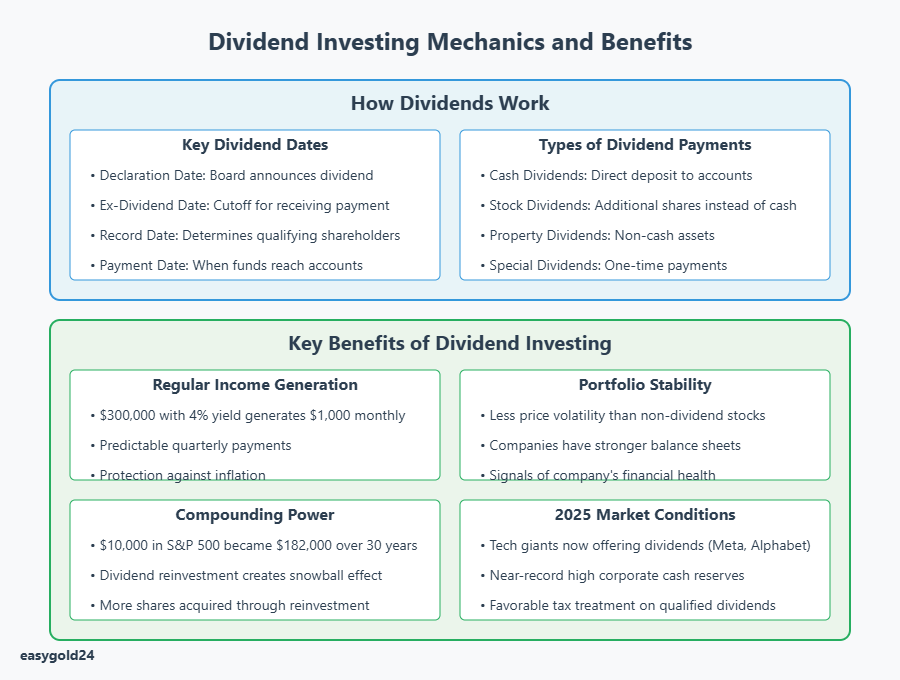

The dividend investing landscape has transformed significantly in 2025. Tech giants including Meta, Alphabet, Salesforce, and Booking.com have initiated dividend payments for the first time. This marks a substantial shift as established technology companies now embrace returning value to shareholders through regular dividend distributions.

Current market conditions favoring dividends

Companies currently maintain near-record high cash reserves, despite the Federal Reserve’s interest rate hikes in 2022 and 2023. Research indicates that companies offering steady, sustainable dividends without excessive payouts deliver the best returns over time. A recent study published by Wellington Management found that companies that grew or initiated dividends since 1930 achieved better returns with lower volatility.

Dividend-paying stocks have demonstrated their ability to weather challenging economic conditions. For instance, several dividend indexes remained positive in 2022 while the broader market declined. This occurred because investors sought refuge in defensive sectors such as healthcare and consumer staples.

The market responds favorably to dividend announcements. Nvidia’s 150% dividend increase signaled several positive indicators to investors:

- Strong financial stability

- Confidence in future cash flows

- Commitment to consistent shareholder returns

Rising interest in passive income streams

Dividend investing offers benefits beyond mere market gains. Companies that regularly increase their dividends often outpace inflation rates, making dividend payments an effective inflation hedge. These stocks also tend to exhibit greater stability than their non-dividend paying counterparts.

Dividend investing in 2025 comes with notable tax advantages. In many jurisdictions, qualified dividends are taxed at lower rates than regular income. U.S. investors pay long-term capital gains rates on qualified dividends, which are typically more favorable than ordinary income tax rates.

Reinvesting dividends creates a powerful compounding effect. Future payments increase as you acquire more shares with each dividend distribution. This snowball effect enhances total returns over time, making dividend investing particularly effective for building long-term wealth.

Technology companies have demonstrated growing interest in dividend payments. While they still prefer share buybacks as their primary method of returning cash to shareholders, their movement toward dividends represents a fundamental shift in the tech sector’s approach to shareholder returns.

Today’s market environment creates unique opportunities for dividend investors. Strong corporate cash positions and commitments to shareholder returns enable investors to build diversified portfolios across multiple sectors. Different industries such as utilities, consumer staples, and healthcare often move independently from high-growth technology sectors, adding valuable diversification benefits.

The outlook for dividend investing remains positive. Despite higher interest rates creating more competition from cash and bonds, companies with strong balance sheets and substantial cash reserves continue to offer excellent growth potential. This environment highlights companies capable of growing dividends while simultaneously investing in their future expansion.

Understanding How Dividends Actually Work

A dividend is simply a distribution of company profits to shareholders. Understanding the mechanics of these payments helps investors make more informed decisions about their dividend strategy.

Simple dividend mechanics

Every investor should familiarize themselves with four critical dates in the dividend payment process. The declaration date comes first, when the board of directors announces the upcoming dividend. Next is the ex-dividend date, which serves as the cutoff point; investors must purchase shares before this date to receive the dividend. The record date follows approximately two days later and determines which shareholders qualify for payment. Finally, the payment date is when funds actually reach shareholders’ accounts.

Most companies distribute dividends quarterly, while others opt for monthly or semi-annual payment schedules. IBM exemplifies a typical payment schedule with dividends distributed on March 10, June 10, September 10, and December 10. After board approval, the Depository Trust Company (DTC) facilitates the transfer of dividends to brokerage firms where shareholders maintain their accounts.

Different types of dividend payments

Companies distribute dividends through several methods:

- Cash Dividends: The most common form, where money is deposited directly into shareholders’ brokerage accounts

- Stock Dividends: Additional shares issued instead of cash payments

- Property Dividends: Non-cash assets with clearly defined monetary value

- Special Dividends: One-time payments typically following exceptional financial results

Dividend reinvestment plans (DRIPs) allow investors to automatically purchase additional shares with their dividend payments. These plans often eliminate commission fees and occasionally offer share discounts.

How companies decide on dividends

Boards of directors carefully consider numerous factors before determining dividend amounts. The most significant considerations include:

- Larger companies typically maintain more consistent dividend payments due to their easier access to capital markets

- Companies with stable earnings and substantial cash reserves generally sustain regular dividend distributions

- Industry norms influence dividend policies—utilities and REITs traditionally offer higher yields than companies in other sectors

- Investor sentiment regarding dividend stocks can shape corporate dividend strategies

The dividend payout ratio (DPR), calculated by dividing total dividends by net income, provides valuable insights. A high DPR indicates that a larger percentage of profits is being distributed to shareholders as dividends, which appeals to income-focused investors. A lower DPR suggests the company reinvests more capital into growth initiatives.

Debt levels significantly impact dividend decisions. Companies with higher debt burdens often reduce dividends to preserve cash for debt servicing. Bond covenants may also restrict dividend payments to protect creditors’ interests.

Mature, established companies typically maintain steady dividend payments as a demonstration of financial stability and effective cash management. Younger companies, particularly in technology and biotechnology sectors, generally retain earnings to fund research and expansion efforts.

Key Benefits of Dividend Investing

Building wealth through dividend investing offers unique advantages that differentiate it from other investment approaches. The following benefits make this strategy particularly valuable for investors seeking both income and portfolio stability.

Regular income generation

Dividend investing creates reliable income streams. Studies consistently demonstrate that dividend-paying stocks outperform non-dividend paying alternatives over extended periods.

Consider this powerful example of dividend investing’s potential: a $300,000 portfolio with a 4% dividend yield can generate $1,000 in monthly passive income. This steady cash flow particularly benefits:

- Retirees needing to cover living expenses

- Investors seeking supplementary income sources

- Individuals building long-term wealth through reinvestment

The predictable nature of dividend payments makes this approach especially attractive. Unlike growth stocks where capital appreciation is the primary return mechanism, dividend-paying stocks provide regular distributions, typically on a quarterly basis. This consistent income helps maintain lifestyle needs and cover ongoing expenses.

Dividend payments also provide protection against inflation. Companies that grow and increase profitability typically raise their dividend payments accordingly. This helps investors preserve purchasing power over time, offsetting inflation’s negative effects on fixed-income investments.

Portfolio stability advantages

Dividend investing enhances overall portfolio stability. Historical data demonstrates that dividend-paying companies exhibit less price volatility than their non-dividend counterparts. Several factors contribute to this reduced volatility:

Companies that maintain consistent dividend payments typically feature stronger balance sheets and lower debt levels. These characteristics indicate financial strength and help them navigate various economic conditions while continuing to reward shareholders.

Regular dividend distributions signal a company’s financial health. Organizations that have increased dividends for consecutive years generally possess strong fundamentals and lower risk profiles. Conversely, dividend reductions or eliminations often serve as warning signs of potential financial difficulties.

Diversification across sectors provides additional stability. Dividend-paying stocks span numerous industries including utilities, consumer staples, and healthcare. This diversity helps smooth overall portfolio performance, particularly during market turbulence.

Reinvesting dividends amplifies these benefits. Investors who reinvest can acquire additional shares, leading to substantial portfolio growth over time. This compounding effect is especially advantageous during market downturns when reinvested dividends purchase more shares at lower prices.

Quality dividend stocks, often referred to as “dividend aristocrats,” maintain payments throughout various economic cycles. These companies typically possess:

- Strong recurring free cash flow

- Solid competitive market positions

- Conservative payout ratios

- Proven business models

Dividend investing builds long-term wealth effectively. Research confirms that companies maintaining or increasing dividends throughout market cycles demonstrate exceptional resilience. This consistency provides superior risk-adjusted returns, making dividend stocks valuable components in portfolios designed for both growth and stability.

How to Start Your Dividend Investment Journey

Embarking on dividend investing requires thoughtful planning and informed decision-making. While new investors might feel overwhelmed by the array of options, a methodical approach simplifies the process considerably.

Setting clear investment goals

Success in dividend investing begins with establishing clear objectives. Recent market analysis highlights two primary approaches: high-yield dividend strategies that generate 1-1.5% more than broader market returns, or dividend growth strategies that target companies consistently increasing their distributions.

Your investment timeframe significantly influences strategy selection. Younger investors typically benefit more from dividend growth approaches, as these companies offer superior long-term appreciation potential. Individuals approaching retirement might prefer high-yield dividend strategies to generate immediate income.

Choosing between stocks and funds

Your investment style and available resources will determine whether individual stocks or dividend funds better suit your needs. Dividend ETFs and mutual funds provide instant diversification across multiple sectors. These funds typically hold at least 100 stocks, with no more than one-third of assets concentrated in their top 10 holdings.

Consider these key factors when selecting dividend investments:

Individual Stocks:

- Provide complete portfolio control

- Require thorough research into company financials

- Necessitate ongoing monitoring of dividend sustainability

- Generally incur lower costs without management fees

Dividend Funds:

- Offer professional management and built-in diversification

- Provide exposure to multiple sectors and companies

- Feature lower minimum investment requirements

- Include automatic dividend reinvestment options

Passive dividend funds typically charge lower fees, approximately 0.06% annually. Actively managed funds cost more but provide professional oversight regarding dividend sustainability.

Opening the right investment account

The investment account type you select significantly impacts dividend investing success. Tax implications deserve careful consideration—qualified dividends receive preferential tax treatment, ranging from 0% to 20% based on your tax bracket.

These account options enhance tax efficiency:

Traditional or Roth IRA:

- Provides tax advantages for dividend income

- Offers broad investment selection

- Facilitates compounding growth

Taxable Brokerage Account:

- Allows immediate access to funds

- Offers dividend reinvestment plans (DRIPs)

- Enables tax-loss harvesting strategies

After selecting an appropriate account type, implementing a dividend reinvestment plan (DRIP) can substantially improve returns. DRIPs automatically purchase additional shares with dividend payments, often without transaction fees. This tool accelerates long-term growth and potentially increases future dividend income through share accumulation.

Optimal brokers should provide:

- Commission-free dividend stock trading

- Automatic dividend reinvestment

- Comprehensive research tools

- Educational resources for dividend investors

Remember that diversifying investments across various sectors reduces risk. Focus on financially strong companies in growing industries rather than pursuing the highest yields. Exceptionally high yields frequently indicate potential underlying problems.

Smart Ways to Pick Dividend Stocks

Selecting winning dividend stocks requires a systematic approach focused on key financial indicators and warning signs. By carefully evaluating these metrics, investors can construct resilient dividend portfolios that generate reliable income streams.

Essential financial metrics to check

The dividend payout ratio serves as a fundamental metric for assessing dividend sustainability. This ratio indicates the percentage of earnings distributed as dividends. A healthy ratio typically ranges between 40% and 60%, though some industries feature higher payout ratios due to their business models.

Free cash flow represents another critical indicator for evaluating a company’s ability to maintain dividend payments. Robust free cash flow demonstrates that a company generates sufficient capital to fund operations, capital expenditures, and dividends. Analyzing free cash flow trends helps predict dividend sustainability.

The dividend coverage ratio warrants close attention as it indicates how many times a company could pay its current dividend with available net income. Most experts recommend companies with coverage ratios of at least two, providing a safety margin against earnings fluctuations.

A comprehensive dividend strategy should examine:

- Return on Equity (ROE): Measures management’s efficiency in generating profits

- Net Debt to EBITDA: Assesses debt relative to earnings

- Dividend Growth Rate: Indicates commitment to increasing shareholder returns

Red flags to watch out for

Identifying potential dividend cuts early helps avoid significant losses. A major warning sign appears when companies exhibit substantially higher dividend yields than industry peers. These elevated yields often indicate financial distress rather than exceptional value.

The relationship between debt levels and dividend payments requires careful scrutiny. Higher net-debt-to-EBITDA ratios frequently precede dividend reductions. Companies with excessive debt obligations prioritize creditor payments over shareholder distributions.

Historical patterns confirm these observations. Numerous high-dividend companies reduced their payouts during the 2008 Global Financial Crisis and the 2020 pandemic. Current yield alone provides insufficient information—comprehensive financial health assessment remains essential.

Quality dividend growth stocks generally outperform high-yield alternatives. These companies typically feature:

- Lower debt burdens

- Superior profit margins

- Consistent earnings growth

- Healthy balance sheets

Exercise caution when encountering these warning signs:

- Declining annual revenue growth

- Deteriorating profit margins

- Increasing payout ratios

- Stagnant dividend growth

Companies financing dividends through debt issuance present significant risks. This practice lacks sustainability and frequently leads to dividend reductions and share price declines. Organizations allocating most free cash flow to dividends demonstrate limited capacity to address unexpected challenges.

Industry factors also influence dividend policies. Each sector establishes characteristic dividend practices based on business models. Utilities and REITs can maintain higher payout ratios, while technology companies typically retain more earnings for growth initiatives.

Effective dividend stock selection combines comprehensive financial metric analysis with attentiveness to warning signs. A disciplined focus on these factors helps construct portfolios featuring sustainable, growing dividend streams while minimizing the risk of dividend reductions.

Building Your First Dividend Portfolio

A well-structured dividend portfolio forms the foundation of successful income investing. Constructing a balanced portfolio requires consideration of multiple factors, from asset allocation principles to monitoring strategies.

Asset allocation basics

A resilient dividend portfolio begins with appropriate position sizing. Research indicates that 20 to 60 dividend stocks provide optimal diversification benefits. A portfolio containing 25 stocks reduces diversifiable risk by approximately 80%.

Limit sector allocation to no more than 25% in any single sector. This approach maintains adequate control while ensuring sufficient exposure across different market segments. Equal position sizes prevent overconcentration in individual holdings.

Core positions should emphasize larger market capitalization companies demonstrating consistent dividend increases and sustainable competitive advantages. These established enterprises, typically operating for decades, generally offer yields between 2.5% and 6%. This provides reliable income without excessive risk exposure.

Diversification strategies

A tiered approach enhances portfolio stability. Consider organizing holdings across four distinct categories:

- Tier 1: Core anchor stocks (10 positions, each contributing 4% of dividend income)

- Tier 2: Core stocks (10 positions, each contributing 3% of dividend income)

- Tier 3: Supporting stocks (10 positions, each contributing 2% of dividend income)

- Tier 4: Special situations (10 positions, each contributing 1% of dividend income)

Sector diversification plays a crucial role in risk management. Consider exposure across telecommunications, pipelines, banking, natural resources, utilities, healthcare, retail, industrials, real estate, and technology. Limiting exposure to two stocks per industry within each tier maintains appropriate balance.

Geographic diversification merits consideration. European dividend stocks should constitute at least 30% of the portfolio. This international exposure provides access to different dividend policies and economic cycles.

Monitoring and rebalancing tips

Regular portfolio maintenance ensures alignment with long-term objectives. Annual rebalancing represents a widely accepted guideline that helps prevent excessive volatility and concentration risks. Year-end rebalancing proves most effective for many investors as it coincides with annual statement reviews.

Two primary approaches guide rebalancing decisions:

- Fixed Band Method: Establish specific percentage points above and below target allocations

- Relative Band Method: Implement percentage-based triggers relative to target allocations

Wider rebalancing bands trigger fewer adjustments. This approach capitalizes on positive momentum and minimizes tax implications. Research suggests monitoring allocations frequently but rebalancing only when portfolios deviate significantly from target allocations.

These strategies facilitate tax-efficient rebalancing:

- Direct dividends and interest toward underweighted asset classes

- Initiate withdrawals from overweighted positions

- Prioritize shares with higher cost basis in taxable accounts

Thorough documentation supports portfolio performance tracking. Essential metrics to monitor include shares owned, current prices, market values, dividends per share, dividend yields, and adjusted cost bases. This systematic approach ensures informed decisions throughout your investment journey.

Dividend Investing in 2025: Income, Stability, and a Long-Term Vision

In an environment marked by inflation concerns and shifting market conditions, dividend-paying companies continue to play a vital role in the portfolios of informed investors. These businesses often maintain strong balance sheets and a proven track record of shareholder returns—qualities that are especially valuable in uncertain times.

Dividend strategies reward consistency over speculation. Companies that raise dividends year after year typically show financial discipline, operational efficiency, and long-term vision. Many now come from sectors beyond the traditional blue-chip sphere, including leading names in technology that have adopted shareholder payout models.

Investors who focus on sustainable dividends—rather than the highest yields—position themselves to benefit from reliable income and capital appreciation. With a broad mix of 20 to 60 dividend-paying stocks across sectors, the path to income stability becomes less vulnerable to short-term fluctuations.

This investment approach aligns seamlessly with the mission of Hartmann & Benz. Following our successful listing on the OTCQB market, we now offer international investors the opportunity to participate in a forward-looking business model that combines real assets with digital innovation. Our EasyGold security token complements this vision, giving investors a gold-backed asset without the burden of physical storage.

Take part in a future where income and asset growth go hand in hand. Invest with purpose.