Energy Commodities (Oil&Gas)

Energy Commodities: Understanding Oil & Gas Trading

Energy commodities, including oil and natural gas, are the backbone of global energy systems, powering homes, industries, and transportation. As two of the most actively traded commodities, they play a critical role in shaping economic stability and global markets.

Oil and gas prices are influenced by a wide range of factors, from decisions made by OPEC to global weather conditions. Understanding the dynamics of energy commodity trading involves familiarizing yourself with these influences and learning how to navigate their complexities. Energy futures contracts, spot trading, and other common methods provide opportunities to manage risks and capitalize on price movements.

Key Insights:

Types of Energy Commodities: Learn about oil, natural gas, and their global significance.

Supply and Demand: Understand the factors that drive energy market prices.

Trading Knowledge: Gain essential information on how to start trading energy commodities.

Risk Management: Explore common strategies to mitigate risk in the energy sector.

The energy market continues to evolve, offering opportunities for informed investors to capitalize on both short-term fluctuations and long-term trends.

What Are Energy Commodities?

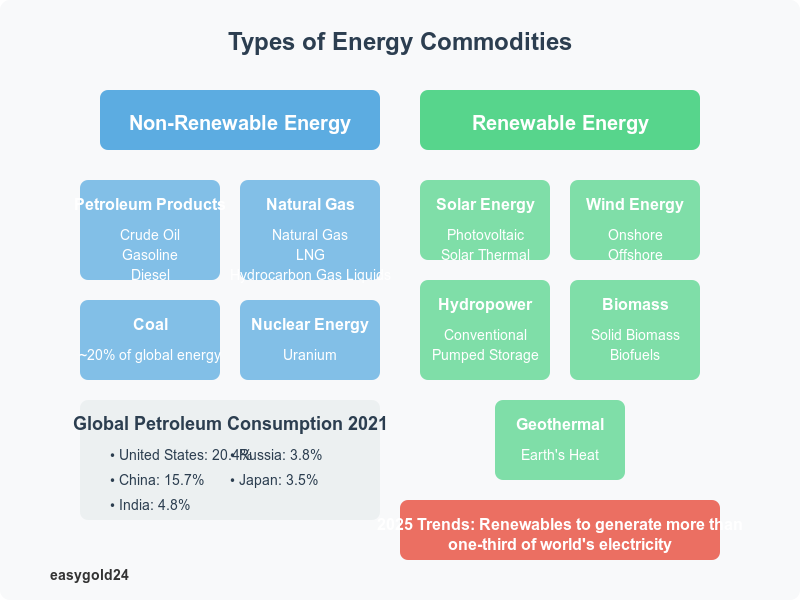

Energy commodities power our global economy through a diverse range of natural resources. These include petroleum products, natural gas, coal, and renewable energy components like wind and solar. Biofuels have also become an integral part of the energy commodity landscape.

Types of energy commodities

The energy market is divided into two categories: renewable and non-renewable resources. Non-renewable sources currently dominate the global energy supply. Five main sources constitute almost 90% of worldwide energy consumption: petroleum products, hydrocarbon gas liquids, natural gas, coal, and nuclear energy.

Crude oil is the undisputed leader among energy commodities, with daily trading reaching 87 million barrels. Natural gas plays a crucial role in electricity generation and heating, though it often receives less attention than oil. Coal comprises more than 20% of total world energy consumption.

The renewable sector consists of five main sources:

- Solar energy from the sun

- Geothermal energy from the earth’s heat

- Wind energy from natural air movement

- Biomass energy from organic matter

- Hydropower from flowing water

Why energy commodities matter

Energy commodities profoundly influence our daily lives and economic stability. Petroleum products constitute 66.6% of U.S. transportation sector consumption. The industrial sector heavily depends on these resources. Petrochemical industries use petroleum to manufacture plastics, polyurethane, and hundreds of other products.

Global consumption patterns reveal an interesting story. These countries led petroleum consumption in 2021:

- United States (20.4%)

- China (15.7%)

- India (4.8%)

- Russia (3.8%)

- Japan (3.5%)

Key energy sectors in 2025

Emerging trends are transforming energy sectors as we look toward 2025. The International Energy Agency projects that renewables will generate more than one-third of the world’s electricity. Asia will consume half of the world’s electricity, with China alone accounting for one-third of global electricity consumption.

The LNG market is poised for significant growth, with North America leading the addition of 27 million metric tons of new supply. Electric vehicles continue to experience rapid adoption in China. Transport fuel demand is expected to decline there as EVs and LNG-fueled trucks gain popularity.

Renewable energy maintains a strong market position. Utility-scale solar and wind capacity will constitute nearly 90% of all new builds in 2025. Solar capacity has experienced remarkable growth, now ranking as the fourth-largest source of installed capacity, surpassing both hydropower and nuclear.

Understanding Energy Markets

The global energy market functions as a complex system where supply and demand dynamics shape price movements and trading activities. To understand these markets effectively, one must comprehend both the physical commodities and the financial instruments that derive their value from energy products.

Supply and demand basics

The relationship between production and consumption forms the foundation of energy markets. Natural gas provides approximately 29% of the energy used in the United States, totaling 27 trillion cubic feet annually.

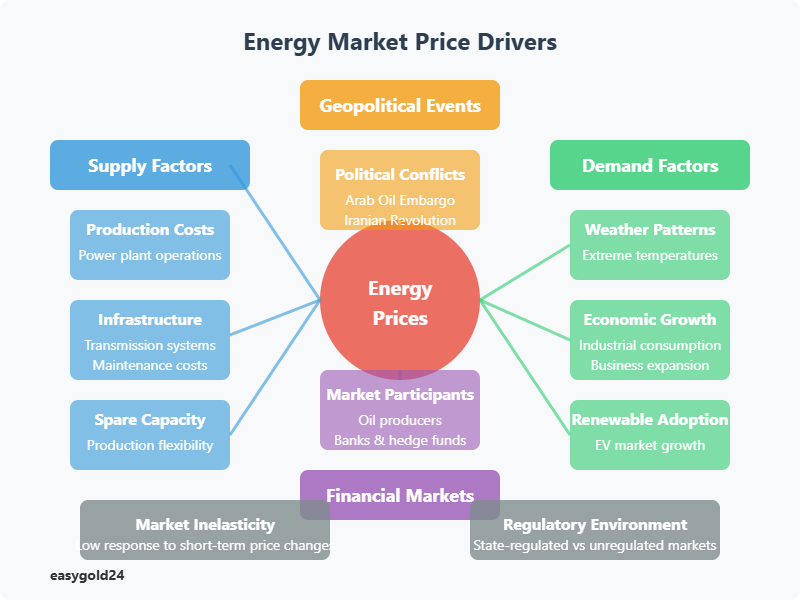

Energy markets are distinctive because they exhibit low responsiveness to price changes in the short term – economists term this characteristic as inelasticity. This trait causes significant price volatility because substantial price changes must occur to rebalance physical supply and demand following market disruptions.

Weather conditions significantly influence energy consumption patterns. Energy usage can fluctuate dramatically within a single day when temperatures reach extremes. Economic growth also directly affects natural gas consumption across industries, power plants, and businesses.

Price drivers in energy markets

Several factors influence energy commodity prices:

Production Costs: The construction, financing, operation, and maintenance of power plants substantially impact electricity prices. Fuel costs, particularly natural gas and petroleum, can experience extreme volatility during periods of high energy demand.

Market fundamentals manifest their influence through various channels:

Infrastructure Impact: Maintaining transmission and distribution systems requires substantial investment, including repairs from adverse weather and cybersecurity enhancements.

Regulatory Environment: Some states regulate all prices, while others combine unregulated generation prices with regulated transmission rates.

Significant market shifts often result from geopolitical developments. The oil market has experienced dramatic changes during events such as the Arab Oil Embargo and Iranian revolution. Political changes in Nigeria, Venezuela, Iraq, Iran, and Libya have disrupted markets.

Market participants analyze multiple indicators to assess potential supply disruptions:

- Crude oil inventory levels

- Spare production capacity

- The ability of other producers to compensate for supply losses

Financial markets play an increasingly significant role in energy trading. Diverse participants engage in these markets – from oil producers and airlines seeking risk protection to banks and hedge funds pursuing profit opportunities. Success in energy commodity trading depends on understanding both the physical and financial aspects of the market.

Getting Started With Trading

Launching an energy trading career requires careful planning and a solid understanding of market fundamentals. Energy commodities attract both experienced traders and newcomers because price volatility frequently creates profit opportunities.

Required knowledge

Traders must develop expertise in several key areas before entering energy markets:

Market Fundamentals: Understanding supply-demand dynamics and their impact on energy prices

Technical Analysis: Developing proficiency in reading price charts and identifying trading patterns

Risk Management: Mastering hedging strategies and position sizing

You can build expertise through:

- Online trading courses

- Market analysis webinars

- Industry publications

- Professional certifications

Strong analytical skills enable traders to quickly interpret news developments and market changes that influence commodity prices.

Trading platforms

Selecting the appropriate trading platform is essential for success. An effective platform should provide:

Essential Features:

- Real-time market data access

- Integrated technical analysis tools

- Cross-device accessibility

- Responsive customer support

- Compatibility with third-party tools

MetaTrader 4, MetaTrader 5, cTrader, and TradeStation are popular energy trading platforms. Peer-to-peer energy trading platforms have also gained traction, with PowerLedger and LO3 Energy pioneering direct energy transactions.

Initial capital requirements

Energy trading requires substantial capital due to its resource-intensive nature. Your required investment varies based on:

Trading Method:

- Futures contracts require higher margin deposits

- CFD trading offers leverage options

- ETF investments have lower entry barriers

Crude oil futures contracts typically represent 1,000 barrels with minimum price increments of $0.01 per barrel. Traders must maintain sufficient capital reserves to:

- Meet margin requirements

- Withstand market fluctuations

- Maintain positions during downturns

CFDs offer a practical entry point. Traders can benefit from price movements without owning the physical commodities. For example, when Brent crude trades at $80.00, you need only $8.00 to open a position with 10% margin.

Risk management is paramount. Since professional traders and hedgers dominate these markets, you must:

- Implement strict position sizing

- Establish clear stop-loss levels

- Monitor exposure limits

- Maintain emergency capital reserves

Energy trading requires thorough preparation, including knowledge acquisition, platform selection, and capital planning. These fundamentals help traders position themselves more effectively in this dynamic market.

Common Energy Trading Methods

Energy commodity trading employs various methods that provide market participants with different advantages. Traders can select approaches aligned with their risk tolerance and investment objectives, ranging from immediate delivery options to sophisticated derivative instruments.

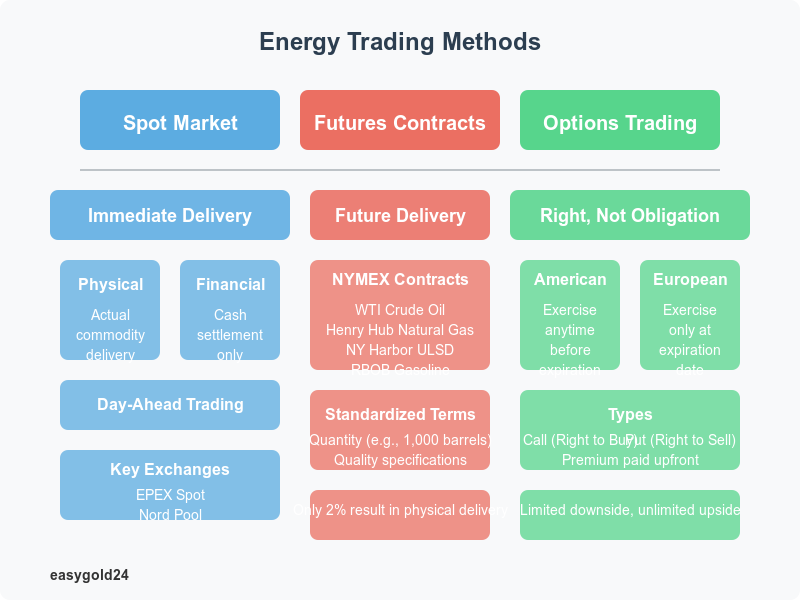

Spot market trading

The spot energy market enables traders to buy and sell commodities for immediate or near-term delivery. These markets operate globally on a 24-hour basis, with prices determined by current supply and demand conditions. Spot transactions fall into two main categories:

- Physical Transactions: These arrangements involve the delivery of actual energy commodities that businesses require for their substantial energy consumption

- Financial Transactions: These deals are settled in cash without physical delivery, appealing to speculators who monitor short-term price movements

Day-ahead trading dominates spot power markets through centralized auctions. The increasing adoption of renewable energy has shifted trading toward shorter timeframes. This transition helps traders balance their portfolios when weather conditions affect renewable power generation.

Europe’s major spot power exchanges like EPEX Spot and Nord Pool provide traders with:

- Anonymous trading capabilities

- Market transparency

- Secure payment systems

- Regulated delivery mechanisms

Futures contracts

Energy futures are standardized agreements to deliver commodities at predetermined prices on future dates. The CME Group’s New York Mercantile Exchange (NYMEX) trades four principal energy futures contracts:

- WTI crude oil

- Henry Hub natural gas

- NY Harbor ultra-low sulfur diesel

- RBOB gasoline

Traders typically close their positions prior to expiration, with only 2% of NYMEX contracts resulting in physical delivery. Most traders utilize futures for hedging or speculation.

Natural gas futures illustrate how market participants can manage price volatility by securing future prices. Buyers and sellers can settle these contracts physically or financially, agreeing to exchange gas at specific locations and dates.

Options trading

Options provide energy market participants with flexible trading strategies. NYMEX recognizes crude oil options as its most actively traded energy derivatives. These contracts are categorized into two types:

- Can be exercised at any time before expiration

- Exercise converts them into underlying futures contracts

European Options:

- Settlement occurs only at expiration

- In-the-money positions are cash-settled

European call options at expiration are valued as the difference between settlement and strike prices, multiplied by 1,000 barrels. Put options function similarly in reverse.

Options offer several advantages over futures:

- Lower capital requirements for comparable market exposure

- Long positions avoid margin calls

- Losses are limited to the premium paid

- Enhanced strategy flexibility

Selling options can generate premium income, though with increased risk exposure. Traders anticipating stable prices may earn consistent income by selling out-of-the-money options to collect premiums.

Managing Energy Trading Risks

Energy traders require robust risk management strategies to achieve long-term success. The energy market’s volatility necessitates comprehensive plans that protect trading positions and preserve financial stability.

Market risks

Energy traders face unique challenges from price fluctuations and market forces. Recent data indicates that approximately half of traders dealing with power and gas derivatives could experience margin calls during periods of extreme market volatility.

Several factors contribute to price volatility in energy markets:

- Supply-demand imbalances

- Weather patterns affecting power generation

- Grid constraints

- Geopolitical developments

Recent market conditions have featured significant price fluctuations that underscore the importance of energy derivatives markets for risk mitigation. These conditions also elevate credit and liquidity risks.

Risk management tools

Energy Trading and Risk Management (ETRM) systems help traders monitor and control their market exposure. These systems provide:

- Real-time credit exposure tracking

- Automated bidding processes

- Dynamic scenario modeling capabilities

Contemporary ETRM solutions excel at critical functions:

- Aggregating energy data from diverse sources

- Developing predictive models

- Conducting Monte-Carlo simulations for risk assessment

- Optimizing physical generation assets

These tools demonstrate their value by quantifying various risk types. ETRM systems enable traders to evaluate market, credit, and operational risks while maintaining regulatory compliance.

Setting trading limits

Trading limits constitute the foundation of effective risk management. The Commodity Futures Trading Commission (CFTC) establishes position limits in major energy markets to prevent excessive speculation. These limits typically include:

- All-months-combined position limit: 10% of the first 25,000 contracts and 2.5% beyond that threshold

- Single-month position limit: Two-thirds of the combined limit

- Spot-month limit: 25% of estimated deliverable supply

Traders should consider multiple factors when establishing their own limits:

- Regular assessment of trading and hedging strategies

- Periodic review of risk capital allocation

- Ongoing monitoring of market liquidity constraints

Energy sector companies utilize derivatives differently based on their business model and physical market exposure. Risk management plans must adapt to:

- Market price fluctuations

- Volume variations

- Liquidity requirements

Companies can mitigate potential risks by implementing comprehensive plans addressing:

- Counterparty risks

- Fraud prevention measures

- Regulatory compliance

- Balance sheet implications

- Operational requirements

Energy Commodities: Key Insights for Investors

Energy commodities like oil and natural gas are crucial to global economies, driving industries, transportation, and daily life. Trading these commodities involves navigating price fluctuations influenced by factors like OPEC decisions, geopolitical events, and supply disruptions.

With the rise of renewable energy sources like solar and wind, the energy market is evolving. While oil and gas remain dominant, understanding emerging trends and market dynamics is essential for successful trading.

For investors, strategies such as spot trading, futures, and options provide varying levels of risk and reward. Effective risk management is critical in this volatile market.

Hartmann & Benz (EasyGold) has successfully listed shares on the OTCQB market, creating opportunities for investors to engage with a growing company in the energy and commodities sector.