ETF Investment

ETF Investments: Your Efficient Start into the Markets

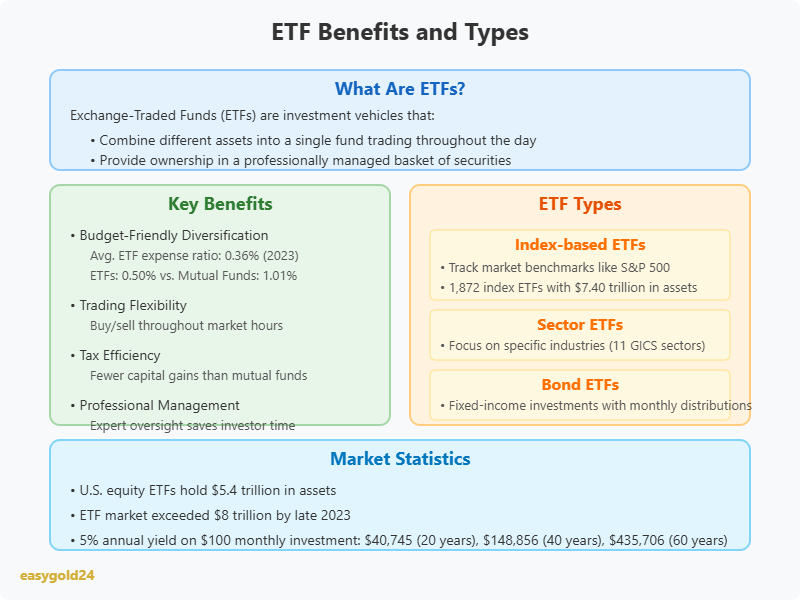

ETFs continue to reshape the way private and institutional investors approach the financial markets. With over $5.4 trillion invested in U.S. equity ETFs alone, their growing popularity speaks for itself.

For those entering the investment world, ETFs offer an accessible path. These funds provide instant diversification across stocks, bonds, or commodities—without requiring a large initial outlay. Low expense ratios, averaging just 0.36% in 2023, and widespread commission-free trading make ETFs cost-effective and transparent vehicles for wealth building.

Whether you want to track broad indices, focus on specific sectors, or take a global approach, ETFs deliver flexibility with a clear structure. Their ability to mirror market movements while remaining liquid and easy to trade positions them as a valuable addition to any portfolio.

At EasyGold, we recognize the role of efficient, diversified investing in long-term wealth creation. That’s why our approach complements traditional investment tools like ETFs with real asset-backed opportunities. With Hartmann & Benz now officially listed on the OTCQB market and the EasyGold security token available, investors can access regulated gold-backed assets with the same simplicity and structure that made ETFs so successful.

Explore how strategic diversification—through ETFs and beyond—can support your financial goals in today’s evolving market landscape.

What Are ETFs and Why Should You Care?

ETFs serve as an excellent first step toward intelligent investing. These investment vehicles combine different assets into a single fund that trades on exchanges throughout the day, similar to individual stocks.

The Simple Explanation of ETFs

ETFs function as a collection of investments—each representing an individual security that contributes to a complete portfolio. When you purchase an ETF share, you gain ownership in a professionally managed basket of stocks, bonds, or other securities. A single ETF can contain hundreds or thousands of individual investments, spreading risk across various companies and sectors.

Why ETFs Are Perfect for Beginners

New investors find ETFs particularly attractive because they eliminate the challenge of selecting individual stocks. Rather than researching numerous companies, you can invest in ready-made portfolios that follow specific themes or indexes. Most online platforms now offer commission-free ETF trading, making them easily accessible to beginners.

The transparency of ETFs makes them ideal for newcomers. Unlike some mutual funds where managers might keep their holdings private, ETFs disclose their complete portfolios daily. You’ll always know exactly what you own.

Key Benefits of ETF Investing

ETFs offer several advantages that make them a preferred choice among investors:

The remarkable growth of ETF investments—exceeding $8 trillion by late 2023—demonstrates how these versatile investment vehicles have become essential tools for building diverse portfolios.

Understanding Different Types of ETFs

ETFs come in many varieties, each serving specific investment goals and strategies. Below are the main ETF categories that form the foundation of a solid investment portfolio.

Index-based ETFs

Index ETFs represent the cornerstone of passive investing, tracking market benchmarks with precision. These funds replicate the performance of established indices by holding all or a representative sample of the underlying securities. The first U.S. ETF, launched in 1993, tracked the S&P 500 index. Today, 1,872 index-based ETFs manage $7.40 trillion in total net assets.

Index ETFs stand out for their daily disclosure of complete holdings, ensuring transparency in what you own. These ETFs maintain consistent maturity and can track markets of all sizes, from domestic indices to international benchmarks.

Sector ETFs

Sector ETFs focus on specific industries or market segments to provide targeted exposure. These funds track stock groups within selected industries such as energy, technology, or healthcare. The Global Industry Classification Standard (GICS) divides the market into 11 main sectors:

- Information Technology

- Healthcare

- Financials

- Consumer Discretionary

- Energy

- Materials

- Industrials

- Communication Services

- Consumer Staples

- Utilities

- Real Estate

Each sector ETF exhibits unique risk-reward patterns throughout market cycles. Technology sectors tend to be more volatile, while utility sectors remain stable. Transportation and financial sectors often lead during economic recoveries, with technology and capital goods following as the recovery strengthens.

Bond ETFs

Bond ETFs, also called fixed-income ETFs, allow you to invest in various bonds through a single vehicle. These funds may include:

- Treasury bonds

- Corporate bonds

- Municipal bonds

- International bonds

- Emerging market bonds

Bond ETFs distribute interest monthly, unlike individual bonds that typically pay semiannually. This structure provides investors with more frequent income.

These ETFs help stabilize portfolios through diversification. Some bond ETFs own more than 1,000 different bonds, significantly reducing investment risk. They also offer greater liquidity than individual bonds since you can buy and sell them throughout the day on major exchanges.

Bond ETFs have become important price discovery tools, especially during market volatility when individual bonds become less liquid. Note that bond ETFs don’t have maturity dates like individual bonds, which affects how they respond to interest rate changes.

By combining these ETF types, you can build well-diversified portfolios tailored to your needs. Careful selection of index-based, sector, and bond ETFs allows you to create a portfolio that balances growth potential with risk management. This approach provides flexibility to adjust your strategy as market conditions evolve.

How to Start Investing in ETFs

Starting with ETF investments requires two key steps: establishing a brokerage account and selecting the appropriate platform. This section will guide you through beginning your investment journey with confidence.

Opening Your First Brokerage Account

Your ETF investment experience begins with a brokerage account. In 2025, commission-free ETF trading has become widely accessible, making this an excellent time to invest. To open an account, prepare these basic details:

- Social Security number

- Bank account information

- Personal identification documents

Modern brokerages have eliminated common barriers by offering:

- Zero account minimums

- No transaction fees

- No inactivity fees

After opening your account, the next step is to fund your settlement account. Many brokers now support fractional investing, allowing you to purchase ETFs regardless of their share price.

Choosing the Right ETF Platform

Your platform choice significantly influences your long-term success. According to comprehensive longitudinal studies, several brokers excel in specific areas:

Fidelity Investments: Ranks as the best overall platform for ETF investing, combining reliable research tools with numerous commission-free ETFs.

Charles Schwab: Leads in ETF screening capabilities with sophisticated tools that filter thousands of funds. The platform offers detailed educational resources and zero-commission trading.

Vanguard: Ideal for buy-and-hold investors with a business structure designed for long-term ETF investing. All their available ETFs come with commission-free trades.

Interactive Brokers: Excels in research capabilities with advanced fundamental analysis tools.

Consider these important factors when selecting a platform:

1 Security and Reliability

- SIPC insurance coverage (up to $500,000)

- Platform reputation and track record

- Integration with existing banking relationships

2 Platform Features

- User-friendly interface

- Customizable charts

- Trade simulators

- Advisory tools

3 Investment Options

- ETF variety

- Market sector access

- International investment opportunities

4 Educational Resources

- Tutorials

- Webinars

- Research tools

- Market analysis

5 Cost Structure

- Commission rates

- Platform fees

- Account maintenance charges

Consider these important factors when selecting a platform:

- Asset type

- Geography

- Industry focus

- Trading performance

- Fund provider

Your new account provides access to thousands of ETFs on U.S. exchanges, with combined assets exceeding $7.60 trillion as of November 2023. This extensive selection enables you to build a diversified portfolio aligned with your investment goals.

Higher trading volume typically indicates better liquidity and tighter bid-ask spreads. ETFs with assets above $10 million demonstrate strong investor interest and market stability.

Smart Ways to Buy Your First ETF

Once you have your brokerage account, making informed decisions about your first ETF purchase will establish a foundation for long-term success. Here are proven strategies to help you begin your ETF investment journey confidently.

Setting Your Investment Budget

Carefully assess your financial situation to determine how much you can invest. Begin by analyzing your monthly income and expenses to identify available funds for investing. Establish an emergency fund equivalent to three months’ salary as your initial safety net.

Once your emergency fund is in place, consider these budgeting approaches:

- Monthly automated investments through ETF savings plans

- One-time larger investments

- A combination of both strategies

ETF savings plans offer flexibility—you can modify, pause, or cancel your investment schedule at any time. Regular automated investments also help you benefit from dollar-cost averaging, purchasing more shares at lower prices and fewer shares at higher prices.

When to Buy ETFs?

While timing isn’t critical for long-term success, certain periods provide better trading conditions:

Best Trading Hours: The middle of the trading day, from 10:30 AM to 3:30 PM, typically offers:

- More stable prices

- Better liquidity

- Tighter bid-ask spreads

When buying ETFs that track foreign markets, align your purchases with those markets’ trading hours. For example, wait for U.S. exchanges to open before buying S&P 500 ETFs.

Making Your First Purchase

Before executing your first trade, evaluate potential ETFs using these key criteria:

Asset Level Assessment: Select ETFs with at least $10 million in assets. This threshold typically indicates:

- Sufficient investor interest

- Better liquidity

- Tighter trading spreads

Trading Volume Analysis: Higher trading volumes correlate with better liquidity and easier trading. Review the average daily trading volume to ensure you can buy or sell shares efficiently.

Cost Considerations: Examine these key expenses:

- Management fees (expense ratios)

- Trading commissions (if any)

- Bid-ask spreads

Order Type Selection: Limit orders often prove more effective than market orders. They:

- Protect you from unfavorable prices

- Allow execution within the bid-ask spread

- Help you capitalize on premiums or discounts

Remember that ETF prices fluctuate throughout the day like stocks. Always check current prices to calculate how many shares fit within your budget.

Modern brokers now offer fractional share investing, allowing you to start with any amount regardless of the ETF’s share price. This feature makes ETF investing accessible to more people, especially those beginning with smaller amounts.

ETFs function best as maintenance-free investments. Avoid the common beginner’s mistake of checking your portfolio too frequently or making emotional decisions during market fluctuations. Focus on your long-term strategy and allow your ETFs to perform as intended.

Building a Basic ETF Portfolio

Creating a robust ETF portfolio requires thoughtful core holdings selection, appropriate allocation, and consistent investment planning. Here are proven strategies to develop an enduring ETF portfolio.

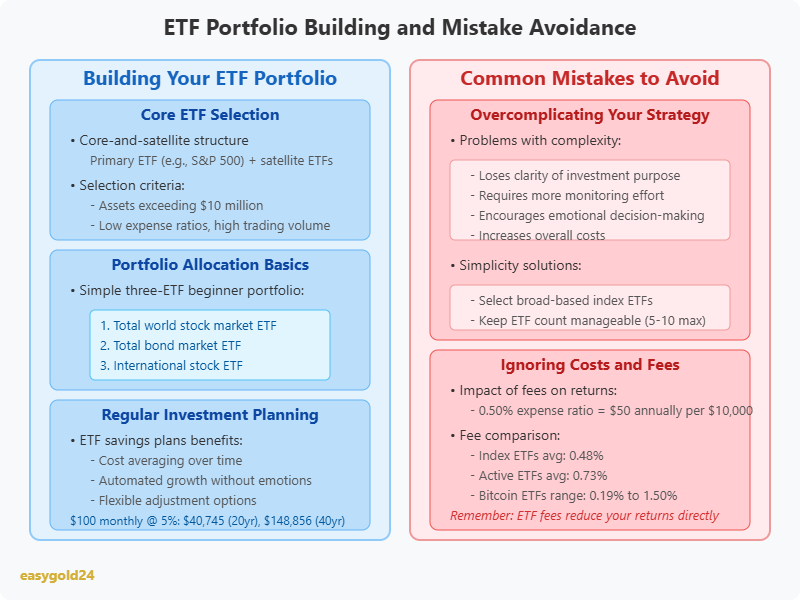

Core ETF Selection

Selecting strong core holdings forms the foundation of a successful ETF portfolio. The “core-and-satellite” structure works effectively, with one or two primary ETFs receiving the highest allocation percentages. Most investors choose an S&P 500 ETF as their core holding and add satellite ETFs from various categories such as small-cap stocks, international markets, and fixed-income funds.

Your core ETFs should possess these characteristics:

- Assets exceeding $10 million for stability

- Low expense ratios to minimize costs

- High trading volumes for better liquidity

- Strong track record of index tracking

You might consider an equal-weight portfolio structure, where each ETF receives similar allocation percentages. For example, in a five-ETF portfolio, each fund would receive 20% of the total investment.

Portfolio Allocation Basics

Asset allocations constitute the foundation of portfolio construction, reflecting your investment goals, time horizon, and risk tolerance. Your asset mix determines how you distribute your funds between stocks, bonds, and other investments.

A simple three-ETF portfolio works well for beginners:

- Total world stock market ETF

- Total bond market ETF

- International stock ETF

This straightforward structure provides broad market exposure while maintaining control over portfolio balance. As your investment knowledge expands, you might explore sector-specific or specialized ETFs.

Regular Investment Planning

ETF savings plans offer numerous advantages through systematic investing. These plans automate your regular investments, typically monthly, helping build wealth consistently over time. Their benefits include:

Cost Averaging: Regular purchases allow you to buy more ETF shares when prices decline and fewer when prices rise, potentially lowering your average purchase cost.

Automated Growth: Once configured, your broker handles investments at predetermined intervals, eliminating emotional decision-making.

Flexibility: You can adjust your ETF savings plans anytime—increase, decrease, or pause contributions based on your financial circumstances.

These strategies will enhance your results:

1. Define Clear Goals: Establish specific targets such as retirement savings, wealth building, or creating a financial safety net.

2. Set Investment Intervals: Choose monthly, quarterly, or custom investment schedules that align with your income flow.

3. Monitor Performance: Review your portfolio annually to ensure alignment with your investment goals.

4. Rebalance Periodically: Adjust your holdings quarterly or annually to maintain your target asset allocation.

Regular investing can yield powerful results. For example, a monthly $100 investment with a 5% annual yield could grow to $40,745 over 20 years, $148,856 over 40 years, and $435,706 over 60 years.

Remember that ETF investing success stems from patience and discipline. Avoid frequent trading or emotional decisions based on short-term market movements. Focus on maintaining your chosen asset allocation and regular investment schedule, allowing compound interest to work effectively over time.

Common ETF Investing Mistakes to Avoid

Despite their many benefits, even knowledgeable investors can make mistakes with ETF investments. By identifying common pitfalls and learning to avoid them, you can make more informed investment decisions. Let’s examine two key areas where many investors err: overcomplicating strategies and overlooking hidden costs.

Overcomplicating Your Strategy

The wide variety of ETF options can tempt investors to create complex investment plans. However, simpler approaches often yield better long-term results. Here’s why simplicity works better:

- Clarity of purpose: Simple plans help maintain focus on what matters—your investment goals. By avoiding unnecessary complexity, you can select ETFs that align with your objectives.

- Easier monitoring: Basic portfolios require less effort to track. You can stay informed about your investments without becoming overwhelmed.

- Reduced emotional decision-making: Complex strategies may encourage excessive trading during market volatility. Simple plans promote long-term thinking and discourage impulsive reactions.

- Lower costs: Complex plans often involve more frequent trading and more expensive ETFs, which diminish your returns over time.

Here’s how to maintain simplicity:

- Select broad-based index ETFs that cover expansive market segments

- Keep your ETF count manageable—5-10 is sufficient for most investors

- Resist chasing every new ETF introduction

- Develop thorough knowledge of your existing ETFs rather than constantly seeking new options

Even professional investors struggle to consistently outperform simple index strategies. A straightforward approach frequently delivers superior results with less stress and time investment.

Ignoring Costs and Fees

While ETFs generally cost less than other investments, overlooking fees can significantly impact your returns over time. Consider these important cost factors:

- Impact on returns: Small fee differences compound rapidly. A 0.50% expense ratio equates to $50 annually per $10,000 invested. Over time, this could amount to thousands in foregone returns.

- Expense ratios: The operating expense ratio (OER) represents your annual cost for fund management. Index ETFs average 0.48%, while active ETFs cost approximately 0.73%. Many more economical options exist.

- Trading costs: Consider commissions and bid-ask spreads. Although many brokers offer commission-free ETF trades, verify this before making purchases.

- Hidden fees: Some ETFs conceal costs within wide bid-ask spreads or tracking errors. These particularly affect frequent traders.

Smart approaches to managing ETF costs:

- Compare expense ratios among similar ETFs. Even small differences matter for long-term investing

- Select ETFs with over $10 million in assets—they typically trade more efficiently

- Higher trading volume often correlates with better pricing when buying or selling

- Be wary of ETFs charging substantially more than comparable funds, especially in alternative investments

The spot bitcoin ETFs launched in January 2024 illustrate the importance of fees. Their costs range from 0.19% to 1.50%. Since they all hold bitcoin, paying more provides no additional value. This demonstrates why comparing costs matters, even among similar ETFs.

ETF fees don’t appear as invoices—they reduce your returns. If an ETF charges 0.10% and generates 9.00% before fees, you receive 8.90%.

Consider these two dividend ETFs: First Trust Value Line® Dividend Index Fund (FVD) charges 0.65%, while Schwab U.S. Dividend Equity ETF (SCHD) costs just 0.06%. This difference becomes significant for long-term investors.

Monitoring costs carefully enables smarter choices and potentially higher earnings. Every dollar saved on fees remains invested and compounds over time.

In conclusion, avoiding these ETF mistakes—maintaining simplicity and monitoring costs—can substantially improve your investment outcomes. A straightforward approach and careful attention to expenses will serve you well in the dynamic landscape of ETF investing.

Strategic Investing with ETFs and Real Assets

Exchange Traded Funds offer an efficient path into the world of investing—cost-effective, diversified, and suitable for almost any portfolio size. Their continued growth and acceptance, especially among first-time investors, highlight their strong position in today’s financial landscape.

At EasyGold, we see ETFs as part of a broader strategy. While ETFs provide exposure to the stock market, our offering goes one step further by combining modern investing tools with tangible value. With Hartmann & Benz now officially listed on the OTCQB market, investors can participate in a transparent and regulated opportunity backed by real gold.

Alongside traditional instruments, the EasyGold security token enables access to gold ownership without the burden of physical storage. This innovative solution reflects the same core benefits that make ETFs attractive—liquidity, efficiency, and accessibility—while grounding them in one of the world’s oldest stores of value.

If you’re seeking long-term stability paired with smart diversification, consider how our approach connects traditional finance with asset-backed innovation. The next step in strategic investing is already underway—be part of it.