Inflation Protaction Through Commodities And Gold

Gold vs. Commodities: Real Data on Inflation Protection

A 1% surprise increase in US inflation can lead to a remarkable 7% real return for commodities-based inflation hedge strategies. In contrast, stocks and bonds tend to decline by around 3% and 4%, respectively. This stark difference underscores the importance of carefully considering your options for inflation protection.

Looking at five major inflationary periods over the past 50 years, commodities have consistently outperformed equities and bonds. Industrial metals, in particular, have delivered average real returns of 30% during late economic cycles, when inflation risks are highest. While gold demonstrated its resilience with a 28% increase in 2020, the data reveals that the inflation protection capabilities of these assets can vary depending on the economic environment.

Understanding the real performance of gold and commodities as inflation hedges allows you to make a more informed decision about how to protect your portfolio in an inflationary landscape.

Understanding Gold and Commodities as Inflation Hedges

An effective inflation hedge should move in tandem with inflation – as prices rise, the hedge’s value should increase proportionally. Based on this fundamental principle, let’s examine how gold and commodities measure up as inflation protection strategies.

What makes an effective inflation hedge

Real assets like stocks, real estate, and commodities traditionally serve as inflation hedges since they represent claims to real cash flows. Nevertheless, the effectiveness varies significantly across asset classes. Research shows commodities provide direct protection against negative supply shocks, which typically hurt bond and stock returns as interest rates climb. Additionally, commodities tend to rally alongside economic growth-driven inflation, offering wealth preservation if central bank credibility declines.

How gold traditionally protects against inflation

Gold’s reputation as an inflation shield stems from its status as a tangible asset that maintains value unlike paper currencies. However, empirical data reveals a more nuanced picture. Between 1980-1984, despite inflation averaging 6.5%, gold investors lost 10%. Similarly, from 1988-1991, gold yielded negative 7.6% returns against 4.6% inflation.

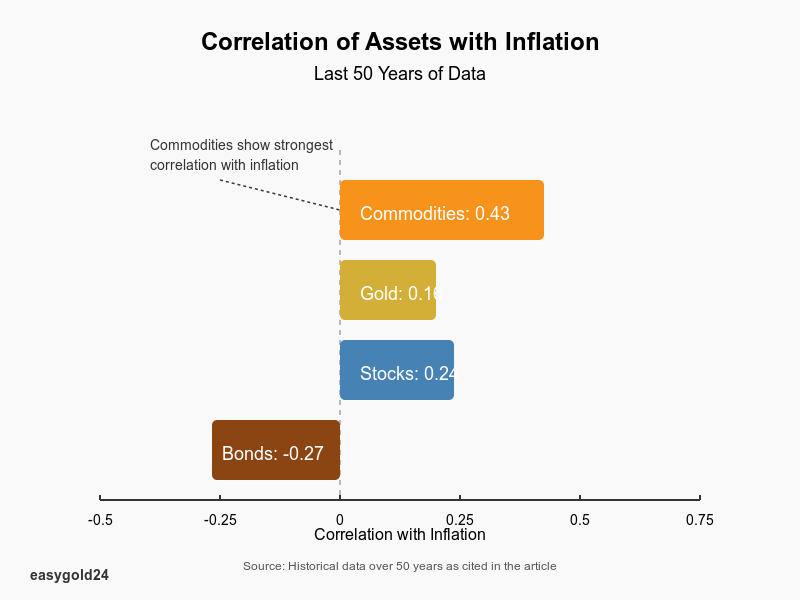

Furthermore, gold’s correlation with inflation has remained relatively low at 0.16 over the past half century. Research by Duke University demonstrates that gold functions best as an inflation hedge only over extremely long timeframes – spanning a century or more. Notably, gold typically guards against very high inflation and substantial inflation surprises caused by geopolitical supply shocks.

Why commodities respond to inflation

Commodities demonstrate remarkable resilience against inflation through multiple channels. A comprehensive analysis reveals that commodity prices account for 47% of US monetary policy’s total effect on headline inflation. Moreover, commodity prices swiftly react to economic shifts, influencing headline inflation quickly, particularly in advanced economies.

The relationship between commodities and inflation manifests through several key mechanisms:

- Direct impact on production costs and consumer prices

- Quick response to widespread economic shocks

- Strong correlation with Personal Consumption Expenditures (PCE) price index

Data indicates that since 2000, the correlation between commodities and the PCE nondurable sector reached 0.76. Additionally, when lagged by 3-5 months to account for supply chain effects, this correlation strengthens to 0.85. This robust relationship underscores why commodities consistently outperform other assets during inflationary periods.

Real Performance Data: Gold vs Commodities (2020-2024)

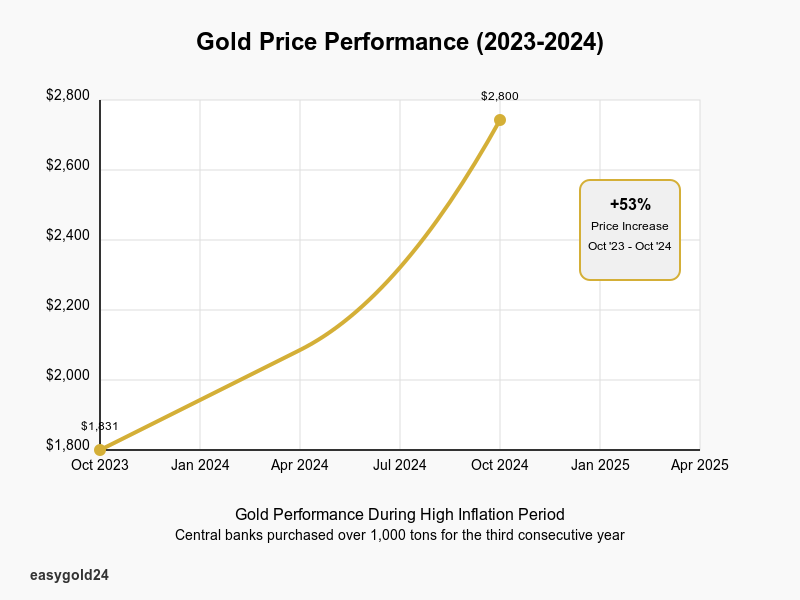

Looking at recent market data, gold prices surged remarkably from USD 1,831.00 per ounce in October 2023 to USD 2,800.00 per ounce by October 2024, marking a substantial 53% increase. Consequently, central banks continued their aggressive gold purchases, exceeding 1,000 tons for the third consecutive year.

Gold price movements during inflation spikes

The relationship between gold and inflation presents an intricate pattern. Although gold traditionally serves as an inflation shield, data reveals that changes in headline PCE inflation show minimal correlation with gold price movements. Yet, gold demonstrated exceptional performance by returning 15% annually when inflation surpassed 3%.

Central bank demand played a pivotal role in driving gold prices to new heights. Annual investment reached a four-year peak of 1,180 tons, representing a 25% increase. Accordingly, bar investment grew steadily throughout 2024, although coin purchases declined.

Commodity index returns in inflationary periods

The Bloomberg Commodity Index (BCOM) emerged as the top-performing asset class in the three years leading up to March 2023. This exceptional performance stemmed from structural dynamics, including sector underinvestment and ongoing geopolitical developments.

Historical data reveals that commodities maintain the strongest correlation with inflation (0.43) among major asset classes, alongside negative correlation with bonds (-0.27) and slight positive correlation with stocks (0.24). Undoubtedly, commodities directly influence approximately 38% of the U.S. headline CPI basket through food and energy components.

The BCOM index experienced significant volatility, declining 32% from its June 2022 peak to September 2024. Subsequently, in early 2025, the index demonstrated renewed strength, rising 4.7% in just three weeks. Presently, most agricultural commodity prices show mixed performance – wheat futures declined 8.5% and soybean prices dropped 14% since January 2024, although corn prices rallied 8% from mid-January levels.

Looking ahead, commodities appear positioned for potential gains in 2025, as experts suggest watching both inflation and growth – two key factors that traditionally drive higher commodity prices. The recent breakout in various commodities, including oil, copper, gold, silver, and steel, indicates we might be amid an extended commodity cycle.

Different Types of Inflation Impact

Recent research underscores how different types of inflation affect investment assets uniquely. Supply chain disruptions and commodity price shocks emerged as primary inflation drivers after mid-2010s.

Supply chain inflation effects

Post-COVID supply chain disruptions profoundly impacted global inflation rates. Data reveals that supply chain bottlenecks became the predominant inflation driver across Germany, Japan, the UK, and the US following the pandemic. As supplies failed to match growing demand, commodity prices soared throughout 2021 and early 2022. Yet, by 2024’s end, commodity prices moderated significantly, rising just 0.3% over the year.

Demand-driven inflation response

Economic data indicates that demand-driven inflation triggers distinct asset responses. Gold shows no clear relationship with demand-pull inflation caused by economic overheating. Rather, gold’s diverse demand drivers enable it to rise during both falling and rising U.S. yield environments.

Commodities, alternatively, demonstrate stronger correlation with demand fluctuations. Through most of 2023-2024, lagging demand, especially for oil and natural gas, contributed to price moderation. Currently, insufficient demand growth and concerns about major economies like China and Japan weigh on commodity markets.

Currency devaluation scenarios

Currency devaluation typically stems from three key factors:

- Economic mismanagement leading to loss of currency confidence

- Political instability impacting currency values negatively

- Speculative capital flows affecting prices through large trading volumes

Gold exhibits unique strengths during currency crises. As a non-yielding asset, gold becomes more attractive when interest rates lag inflation, creating negative real rates. Throughout 2024, central banks accelerated gold purchases as a hedge against potential currency debasement.

Economic sanctions, trade deficits, and expanding government debt can also trigger currency devaluation. Under such scenarios, gold maintains appeal since it doesn’t carry the same tariff risks as industrial commodities amid heightened trade tensions. Therefore, gold often serves as insurance during falling markets and times of geopolitical stress.

Choosing Between Gold and Commodities

Selecting between gold and commodities requires careful consideration of practical aspects beyond their inflation-hedging capabilities. Let’s examine the key factors that influence this decision.

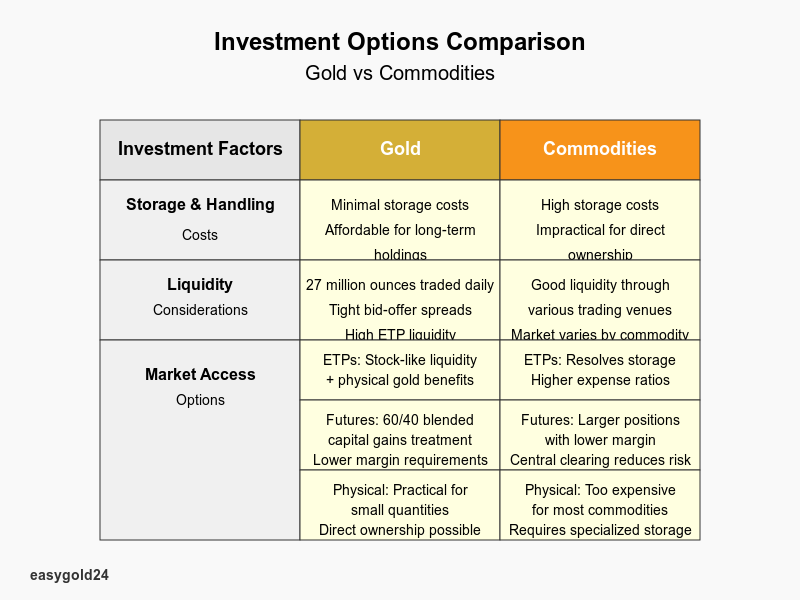

Storage and handling costs

Physical storage costs create substantial differences between gold and other commodities. Gold’s storage costs remain negligible compared to other metals, making it more cost-effective for long-term holdings. Conversely, storing commodities like natural gas incurs extremely expensive storage costs. Unless you own specialized storage facilities, direct commodity ownership becomes impractical for most investors.

Liquidity considerations

The gold futures market demonstrates exceptional liquidity, trading approximately 27 million ounces daily. Gold ETPs offer tight bid-offer spreads and high liquidity, enabling investors to quickly adjust positions as market conditions change. Nonetheless, broad commodities maintain competitive liquidity through various trading venues.

Market access options

Investment vehicles for both assets offer distinct advantages:

Exchange-Traded Products (ETPs):

- Gold ETPs combine equity-like liquidity with physical gold benefits

- Commodity ETPs eliminate storage concerns but may involve higher expense ratios

- Both options trade easily on stock exchanges with minimal paperwork

Futures Contracts:

- Gold futures provide blended 60/40 long-term/short-term capital gains treatment versus ETF collectible taxation

- Futures contracts enable control of larger positions with reduced margin requirements

- Central clearing mitigates counterparty risk in regulated markets

Physical Ownership:

- Direct gold ownership remains practical for small quantities

- Most commodities prove prohibitively expensive for physical storage

- Bank lockers or secure storage facilities add recurring costs

Essentially, gold offers more straightforward ownership options with lower carrying costs. Meanwhile, broad commodities typically require sophisticated investment vehicles or substantial storage infrastructure. For institutional investors facing negative bond yields, gold’s zero-yield nature becomes less relevant. Ultimately, the choice depends on your investment timeline, storage capabilities, and preferred market access method.

Gold vs. Commodities: Navigating Inflation Protection

Commodities have historically maintained a stronger correlation with inflation (0.43) compared to gold’s 0.16 correlation over the past fifty years. While gold surged by 53% between 2023 and 2024, broad commodities provided superior protection against different inflation types, particularly in times of supply chain disruptions and demand-driven inflation scenarios.

Commodities excel in environments where inflation is driven by economic growth and supply shocks. Gold, on the other hand, serves as a valuable asset during currency crises and geopolitical uncertainty. With recent commodity market surges, such as oil, copper, and steel, there’s potential for extended upside through 2025.

When deciding between gold and commodities for inflation protection, consider your investment strategy, goals, and risk tolerance. Gold offers easy storage and ownership solutions, while broad commodities may require more complex investment vehicles. Both asset classes serve distinct roles—commodities through direct economic linkages and gold as a trusted safe-haven asset. Combining these assets strategically can help you address specific inflation concerns and market conditions.

As inflation risks continue to evolve, managing a diversified portfolio that includes both assets may offer balanced protection.