Investment Strategies For Beginners And Pros

The Truth About Investment Strategies: What Wall Street Won't Tell You

A staggering 77% of U.S. adults have regrets about their personal finances, according to Bankrate’s latest Financial Regret Survey. Many of these regrets come from following conventional investment strategies without fully understanding their true implications.

Studies show that even professional investors often fail to outperform the broader market, despite the fact that more than 60% of American households own stocks today. Instead of relying on typical Wall Street advice, it’s crucial to understand what really works.

While the stock market has historically provided higher returns than bonds over the long term, success requires more than just following popular wisdom. A long-term, low-cost investment approach could be far more effective than active trading. Avoiding the common mistakes that trap most beginners can help you achieve better results.

Understanding what truly works in investing can make all the difference.

The Hidden Costs of Popular Investment Strategies

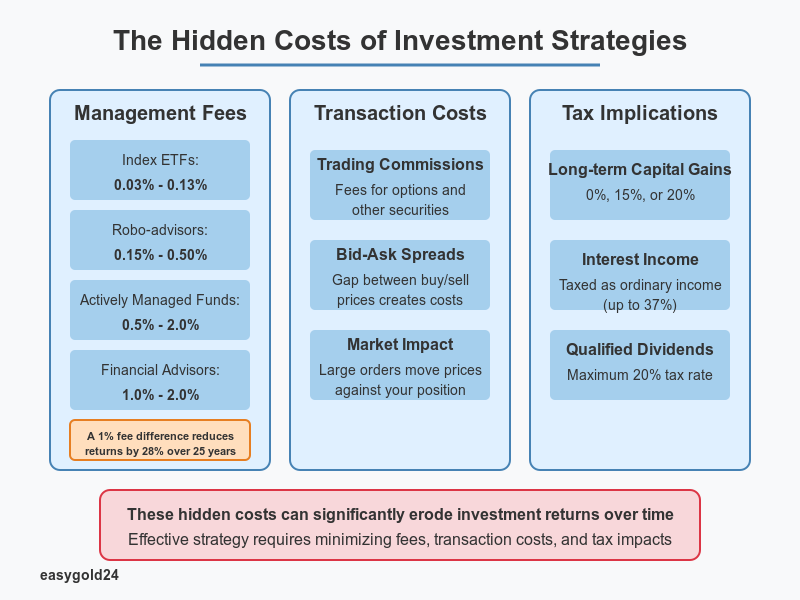

Behind every investment decision lurks a web of hidden costs that can significantly diminish your returns. Small fees might seem insignificant initially, nonetheless over time, they can substantially reduce your wealth.

Management fees vs actual returns

Your investment portfolio faces an immediate challenge from management fees. A seemingly modest 1% annual fee difference can reduce your returns by 28% over 25 years. Investment management fees vary significantly across different products:

- Index ETFs: 0.03% – 0.13%

- Actively Managed Mutual Funds: 0.5% – 2.0%

- Robo-advisors: 0.15% – 0.50%

- Traditional Financial Advisors: 1.0% – 2.0%

Furthermore, studies reveal that investments charging higher fees frequently underperform those with lower fees. The Investment Company Institute reported that equity mutual fund expense ratios declined for the 14th consecutive year to 42%, moreover bond mutual funds remained at 37%.

Transaction costs that eat your profits

Each time you buy or sell investments, transaction costs chip away at your potential returns. These costs emerge from three primary sources:

1. Trading Commissions: Despite many stock trades being commission-free now, fees still apply to options and other securities.

2. Bid-Ask Spreads: The difference between buying and selling prices creates an immediate cost. For instance, a $0.10 spread on 100 shares results in a $10 loss.

3. Market Impact: Large orders can move prices against you – upward when buying and downward when selling.

Additionally, market impact comes in two forms. Temporary impact affects only the current transaction, subsequently permanent impact changes the equilibrium price, influencing all future transactions.

Tax implications nobody mentions

The tax landscape of investing presents complex challenges that many overlook. Long-term capital gains face tax rates of 0%, 15%, or 20%, depending on your taxable income and filing status. Interest income typically gets treated as ordinary income, subject to federal tax rates as high as 37%.

Qualified dividends receive preferential treatment with a maximum tax rate of 20%, provided the company is U.S.-based or from a country with an acceptable double-taxation treaty. Nevertheless, to benefit from this rate, you must hold shares for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

Even zero-coupon bonds carry tax obligations – you must pay tax on annual interest accrual, calculated at the yield to maturity, despite not receiving cash until maturity. Municipal bonds offer some relief, since most are exempt from federal income tax.

To minimize tax impact, consider holding foreign stocks and taxable bond mutual funds in tax-deferred accounts like IRAs or 401(k)s, meanwhile keeping domestic stocks in regular brokerage accounts. You can offset capital gains against losses, with individuals allowed to deduct up to $3,000 of net capital losses against other taxable income annually.

Why Most Investment Advice Fails Retail Investors

Most retail investors struggle to make sound investment decisions primarily because of the complex relationship between financial advisors and their clients. Studies reveal that two-thirds of investors incorrectly believe stockbrokers have a fiduciary duty.

The conflict of interest problem

Financial advisors face recurring challenges that often lead to compliance breakdowns and compromised service quality. These conflicts emerge in several ways:

- Portfolio Management: Advisors might allocate investments to accounts offering performance fees or select investments that provide additional financial benefits to their firm.

- Valuation Issues: Some advisors evaluate private investments at cost instead of conducting thorough research.

- Client Relationships: Advisors sometimes provide incentives or extra services to clients with larger assets under management.

Research indicates that 90% of advisors primarily function as salespeople, whereas only 5% genuinely prioritize their clients’ interests. Even more concerning, many financial institutions avoid comprehensive training for their advisory staff, instead focusing on product sales training.

How brokers really make money

Although many brokers advertise commission-free trading, they generate revenue through various alternative channels:

- Interest Revenue: Brokers collect substantial income from margin interest and stock lending fees for short sales.

- Payment for Order Flow: Zero-commission brokers direct customer trades to specific providers in exchange for volume-based fees.

- Wrap Fees: Full-service brokerages typically charge 1% to 3% of the account value annually for advisory services and investment research.

The Securities and Exchange Commission (SEC) acknowledges these issues, especially concerning retail investors’ understanding of the market. Their studies indicate that most investors lack knowledge about the technical differences between investment professionals. Particularly troubling is that many cannot distinguish between investment advisers and brokers, unaware of their differing standards of conduct.

The situation becomes even more complex as boundaries between financial professionals continue to blur. The SEC notes that firms constantly evolve and bundle diverse products and services, making it increasingly difficult for investors to understand what they’re paying for.

These conflicts of interest have prompted regulatory responses, including the Retirement Security Rule, which aims to protect investors from conflicts when receiving retirement investment advice. However, the effectiveness of such regulations remains limited, as evidenced by the continuing prevalence of high-fee investment products and questionable advisory practices.

Common Investment Myths Debunked

Popular investment beliefs often lead investors astray from their financial goals. Research consistently shows that many widely accepted investment practices require careful examination.

The 'buy and hold forever' myth

The traditional buy-and-hold strategy, though praised by industry giants, comes with notable limitations. Studies reveal that this approach ties up substantial capital and demands exceptional self-discipline. Most importantly, even buy-and-hold portfolios can lose most gains during prolonged bear markets.

A prudent risk management strategy remains essential, as nothing prevents an investor from selecting an entire portfolio of underperforming stocks. Therefore, successful long-term investing requires periodic portfolio evaluation and rebalancing to maintain desired asset allocation.

Why diversification isn't enough

Simply owning multiple investments doesn’t guarantee optimal portfolio protection. Research demonstrates that optimal diversification occurs after adding approximately the twentieth stock to your portfolio. Surprisingly, there’s minimal difference between owning 20 stocks and 1,000 stocks in terms of risk reduction benefits.

Over-diversification presents several challenges:

- Dilutes potential returns from winning investments

- Increases transaction costs and taxes

- Makes portfolio monitoring more complex

- Can lead to “index hugging” with average returns

Many investors unknowingly over-diversify their retirement accounts by selecting multiple funds without considering overlap. For example, five of the top holdings in S&P 500 growth index funds match those in popular technology mutual funds.

Active vs passive management truth

The debate between active and passive investing strategies reveals compelling insights. Research by Wharton faculty shows that active managers frequently struggle to justify their higher fees through superior performance. Passive investments typically charge fees under 0.2%, whereas active management fees range from 1% to 3%.

Active management demonstrates better results in specific scenarios:

- During volatile market conditions

- With illiquid or lesser-known securities

- When tailoring portfolios for specific purposes

Notably, passive investing works best with easily traded, well-known holdings like large U.S. corporation stocks. Studies consistently show that active mutual fund managers, both domestically and internationally, underperform their benchmark indices. Only a small percentage of actively managed funds outperform passive index funds.

Smart Investment Strategies for Regular Investors

Building a successful investment portfolio requires straightforward yet effective strategies that stand the test of time. Research consistently demonstrates that simple approaches often outperform complex investment schemes.

Index fund advantages

Index funds offer remarkable benefits for regular investors seeking reliable returns. Studies reveal that only about 14% of actively managed mutual funds outperform the S&P 500 over five years after accounting for fees. This underperformance primarily stems from the cost difference – index funds typically charge between 0.03% and 0.10% annually, compared to actively managed funds that charge between 1% and 2%.

Beyond cost savings, index funds provide instant diversification. By purchasing a single broad-market index fund, you gain exposure to hundreds of companies across various sectors. This approach minimizes the risk of losing substantial money due to poor performance of individual stocks.

Index funds also foster investment discipline through their simplicity. Once you identify a low-cost index fund tracking your desired market segment, you can hold it long-term without constant monitoring or adjustments. This passive approach reduces emotional decision-making and helps maintain focus on long-term goals.

Dollar-cost averaging reality check

Dollar-cost averaging emerges as another powerful strategy for regular investors. This method involves investing fixed amounts at regular intervals, regardless of market conditions. For instance, if you receive a $10,000 bonus, instead of investing it all at once, you might invest $1,000 monthly for ten months.

This systematic approach offers several advantages:

- Removes the stress of timing the market perfectly

- Helps avoid emotional investing decisions

- Reduces the impact of market volatility on your portfolio

Yet, dollar-cost averaging comes with trade-offs. Studies indicate that investing a lump sum earlier typically produces better returns over time. Additionally, keeping money in cash while waiting to invest means potentially missing out on market gains.

The strategy proves most beneficial for investors who:

- Don’t have large sums to invest immediately

- Lack experience in market timing

- Feel uncomfortable with market volatility

- Prefer a disciplined, systematic approach

Ultimately, dollar-cost averaging serves as a practical risk management tool, helping you develop consistent investing habits without the pressure of perfectly timing market entries. This approach aligns particularly well with index fund investing, as both strategies emphasize long-term perspective over short-term market movements.

Proven Investment Strategies That Actually Work

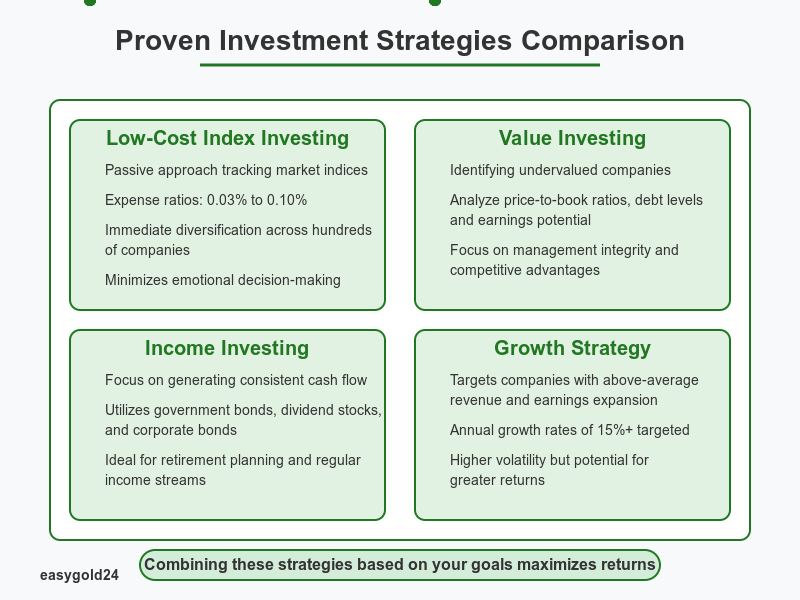

Research consistently validates four proven investment approaches that deliver reliable returns over time. Each strategy offers unique advantages based on your financial goals and risk tolerance.

Low-cost index investing

Index funds emerge as a cornerstone strategy for long-term wealth building. Studies demonstrate that passive funds typically outperform actively managed investments after accounting for fees. With expense ratios ranging from 0.03% to 0.10%, these funds provide immediate diversification across hundreds of companies.

Value investing basics

Value investing focuses on identifying undervalued companies with strong fundamentals. This approach requires examining key metrics like price-to-book ratios, debt levels, and earnings potential. Successful value investors prioritize businesses with:

- Strong management integrity and competence

- Sustainable competitive advantages

- Healthy financial statements

Income investing approach

Income investing generates steady cash flow through dividends, bond yields, and interest payments. This strategy proves particularly effective for retirement planning, utilizing:

- Government bonds for safety

- Dividend-paying stocks for growth potential

- Corporate bonds for higher yields

The approach offers potential capital appreciation alongside regular income streams, making it ideal for investors seeking consistent returns.

Growth strategy fundamentals

Growth investing targets companies demonstrating above-average revenue and earnings expansion. Successful growth investors look for:

- Market trends in emerging sectors

- Companies with competitive advantages

- Businesses gaining market share

Growth stocks typically show annual growth rates exceeding 15%, potentially doubling investments within five years. Yet, these investments often experience wider price swings than other stocks.

To maximize returns while minimizing risks, consider combining these strategies based on your investment timeline and objectives. Consequently, maintaining a balanced portfolio helps weather market volatility. Historical data shows well-diversified portfolios have returned approximately 8% annually over the past 15 years, proving that thoughtful strategy implementation yields consistent results.

Building Your Own Investment Strategy

Creating a personalized investment strategy requires careful consideration of your unique financial circumstances. Studies show that up to 90% of portfolio returns depend on proper asset allocation, making it crucial to develop a well-structured approach.

Defining clear investment goals

Prior to selecting investments, evaluate both short-term financial needs and long-term objectives. Consider these key factors:

- Time horizon for each investment goal

- Risk capacity based on current financial situation

- Regular savings potential for ongoing investments

Research indicates that investors without specific goals often make decisions by evaluating investments individually, leading to suboptimal portfolios. Hence, writing down realistic, measurable objectives becomes essential for maintaining focus.

Choosing the right investment mix

Asset allocation serves as the foundation upon which your portfolio grows over time. Studies reveal that up to 90% of investment return variability stems from asset allocation decisions. Consider these proven approaches:

- Match investments to your time horizon – longer periods allow for higher-risk assets

- Balance risk tolerance with potential returns

- Maintain broad diversification across asset classes

Your investment mix should reflect both your capacity and willingness to accept risk. Importantly, as your goals get closer, shifting toward more stable investments helps protect against losses.

Creating your monitoring system

Effective portfolio monitoring ensures your investments stay aligned with objectives. A comprehensive monitoring system should include:

- Regular performance tracking against established benchmarks

- Periodic portfolio rebalancing to maintain target allocations

- Risk assessment across various market conditions

Data shows that investors who don’t account for taxes in their monitoring system saw annual returns reduced by 2% on average between 1926 and 2022. Thus, incorporating tax-efficient monitoring strategies becomes vital for long-term success.

Remember to stay vigilant about overallocation in single securities, as this presents significant portfolio risk. Through consistent monitoring and thoughtful adjustments, your investment strategy remains responsive to changing market conditions while staying focused on your financial objectives.

Smart Investment Strategies: The Path to Long-Term Success

Successful investment often begins with rejecting conventional Wall Street wisdom. Too many financial professionals push complex strategies and high-fee products, but the truth is, achieving long-term success usually comes down to a few straightforward principles: minimizing costs, understanding true risks, and keeping a long-term focus.

Research consistently shows that low-cost, simple approaches, like investing in index funds, often outperform actively managed investments. Rather than chasing trends or paying high fees for professional management, the key is to build a diversified portfolio that aligns with your specific financial goals and time horizon.

The most effective investment strategies combine time-tested methods like dollar-cost averaging, while also considering the tax implications of your decisions. Regularly monitoring and rebalancing your portfolio helps ensure it stays on track, but excessive trading can diminish returns due to added costs and taxes.

When creating your strategy, it’s essential to tailor it to your personal circumstances, risk tolerance, and financial objectives. By focusing on disciplined investing and thoughtful asset allocation, you can build long-term wealth and avoid the pitfalls that trip up many investors.

Hartmann & Benz: A New Investment Opportunity in Gold

At Hartmann & Benz, we’ve already achieved a significant milestone by successfully listing our shares on the OTCQB market. This marks an exciting step in our journey and opens up new opportunities for investors to participate in our growth. Through this listing, we aim to acquire and manage gold, utilizing our proven model for long-term wealth creation.

Additionally, our innovative EasyGold security token provides a streamlined way to invest in gold, allowing you to hold substantial quantities of gold without the complexities of physical storage. The token reduces the costs associated with traditional trading and offers a more accessible method of gold investment.

Investing with Hartmann & Benz means joining a forward-thinking company with strong fundamentals, offering new pathways to diversify your portfolio and gain exposure to the precious metals market. We are committed to maintaining transparency and keeping you informed about our progress.

As we continue to expand, we invite you to stay updated on our journey and explore how Hartmann & Benz can enhance your investment strategy.