Market Analysis And Forecast

2025 Market Outlook: Stocks and Commodities

Gold has reached new highs in 2024, experiencing a notable 13.4% year-on-year increase, signaling a strong start for 2025. Alongside precious metals, other sectors are also showing promising performance. The U.S. economy, for example, is expected to grow at a solid 3.2% annualized rate in Q4 2024.

The broader market is reflecting positive trends as well, with U.S. household net worth rising by $13 trillion in just the first nine months of 2024. This creates an optimistic outlook for 2025, driven in part by coordinated monetary policy easing from central banks worldwide.

The year ahead presents significant opportunities across stocks and commodities. As global monetary policies remain supportive, emerging markets are likely to attract increased attention, while potential risks such as inflation and geopolitical uncertainties could influence investment strategies. The coming year could reshape key investment landscapes, providing a variety of opportunities for strategic decision-making.

Global Market Trends for 2025

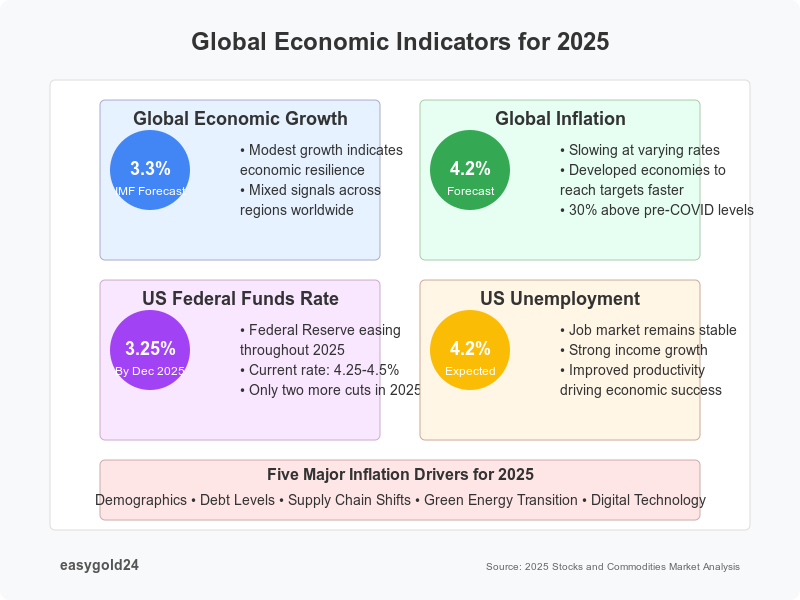

The global economic landscape for 2025 presents a complex picture, with the International Monetary Fund projecting worldwide growth at 3.3%. This moderate expansion reflects a delicate balance between economic resilience and persistent challenges across different regions.

Key economic indicators

Core inflation continues its gradual descent, though at varying speeds across economies. Advanced nations are expected to see faster progress toward their targets compared to emerging markets. The Federal Reserve anticipates easing monetary policy throughout 2025, with the federal funds rate projected to reach 3.25% by year-end.

Global headline inflation is set to decline to 4.2% in 2025. Nevertheless, five structural factors – demographics, debt, de-risking, decarbonization, and digitalization – could maintain upward pressure on prices. The labor market outlook remains stable, with U.S. unemployment expected to hover around 4.2%.

Regional market performance

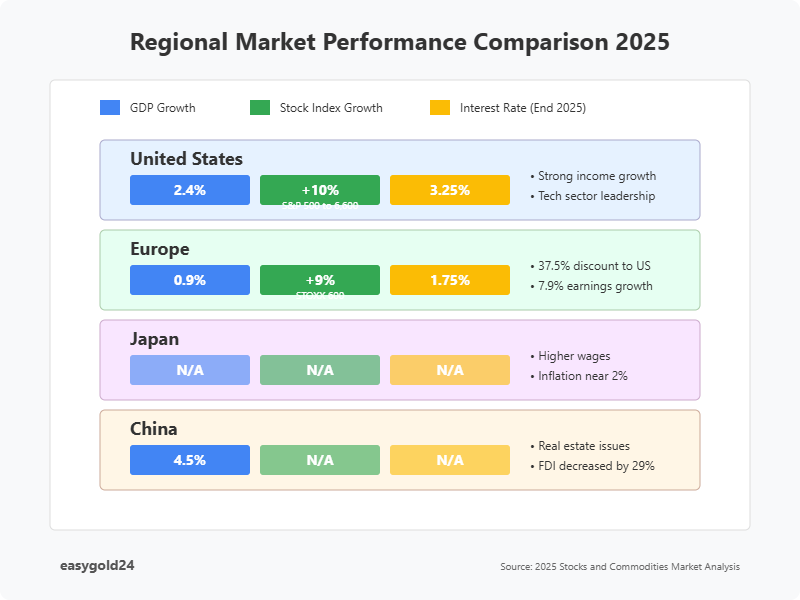

The United States maintains its position as the global growth leader, with GDP projected at 2.4% for 2025. This outperformance stems from solid income growth and productivity gains. Notably, the U.S. economy shows remarkable resilience, supported by accommodating fiscal policy and gradual monetary easing.

European markets face considerable headwinds, with GDP growth forecast at just 0.9%. The European Central Bank is expected to lower its deposit rate to 1.5% by year-end to counter economic stagnation, particularly in Germany. Japan emerges as a bright spot, benefiting from a positive wage-price cycle that’s helping anchor inflation expectations near 2%.

China’s economy faces significant challenges, with growth projected to moderate to 4.5%. The property market downturn and deflationary pressures continue to weigh on economic performance. Southeast Asian economies, however, remain attractive for foreign investment, positioning themselves as valuable connector economies between major trading blocs.

Major market drivers

Trade dynamics play a crucial role in shaping the 2025 outlook. The total value of world trade is anticipated to reach $33.30 trillion. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Regional Comprehensive Economic Partnership (RCEP) will significantly influence global trade patterns.

Technological innovation, particularly in AI adoption, emerges as a key growth catalyst. Companies leveraging AI technologies for productivity enhancement, especially in industrials and healthcare sectors, are positioned to see substantial improvements in operating fundamentals. Additionally, the convergence of public and private markets is creating new opportunities, particularly in sectors like real assets.

Geopolitical factors remain significant market drivers. Ongoing tensions in Ukraine, the Middle East, and Taiwan could disrupt supply chains and impact commodity prices. Moreover, the implementation of new trade policies and potential tariff adjustments could substantially influence global market dynamics.

The policy environment continues to evolve, with fiscal initiatives taking precedence over monetary measures. This shift reflects governments’ focus on finding new avenues for development and growth. Infrastructure investment emerges as a key theme, with both public and private sectors playing crucial roles in future growth initiatives.

Stock Market Predictions 2025

Stock market analysts anticipate a year of moderate gains in 2025, as investors navigate through shifting economic policies and evolving market dynamics. After two consecutive years of 25%+ returns for major indices, market experts project more measured growth ahead.

US market outlook

The S&P 500 is projected to reach 6,600 by year-end 2025, suggesting a potential 10% gain from the 2024 closing level of 5,881.63. Despite concerns about market concentration, fundamentals remain strong with corporate earnings expected to grow steadily throughout the year.

Interest rates will play a crucial role in shaping market performance. The Federal Reserve’s December 2024 decision to cut rates to 4.25%-4.5% sets the stage for further easing, with only two more cuts anticipated in 2025. This measured approach aims to balance growth with inflation control, as core Personal Consumption Expenditures Price Index is expected to decline to 2.5%.

The technology sector maintains its leadership position, albeit with new dynamics at play. Unlike the dotcom era when mega-caps traded at 50-75x forward price-to-earnings ratios, current tech giants trade at roughly half those multiples. Furthermore, the broader application of AI technologies across industries could enhance margins and profitability beyond traditional tech sectors.

European markets forecast

European equities present compelling opportunities in 2025, despite facing economic headwinds. The STOXX 600 index is expected to generate a total return of approximately 9%, supported by several key catalysts:

- Monetary Policy Shift: The European Central Bank is projected to reduce interest rates to 1.75% by mid-2025, creating opportunities in interest-rate sensitive sectors like real estate and telecommunications.

The region’s stock performance could benefit from three potential catalysts:

- Cooling inflation rates

- Larger than anticipated European policy response

- Growing concerns about returns from mega-cap US stocks

Nonetheless, certain challenges persist. Economic data remains weak, specifically in manufacturing, which impacts Germany substantially. The stability of fiscal situations in France, Italy, and the UK faces scrutiny. Yet, consumer-facing sectors like retailers and travel companies show promise, as they remain relatively insulated from trade concerns and benefit from lower interest rates.

Small and mid-sized European companies warrant attention, as M&A activity is expected to increase. At 14 times expected earnings, the MSCI Europe trades at a near-record discount of 37.5% to the MSCI USA, presenting potential value opportunities for investors.

Looking forward, European earnings growth is projected to accelerate to 7.9% in 2025, up from just 1% in 2024. This improvement, coupled with the possibility of peace in Ukraine and subsequent reconstruction projects worth USD 486.00 billion over the next decade, could provide additional tailwinds for European equities.

Commodity Market Analysis

Commodity markets face substantial shifts in 2025, as supply-demand dynamics reshape trading patterns across energy, metals, and agricultural sectors. A comprehensive analysis reveals intricate market movements influenced by policy changes and geopolitical factors.

Energy sector trends

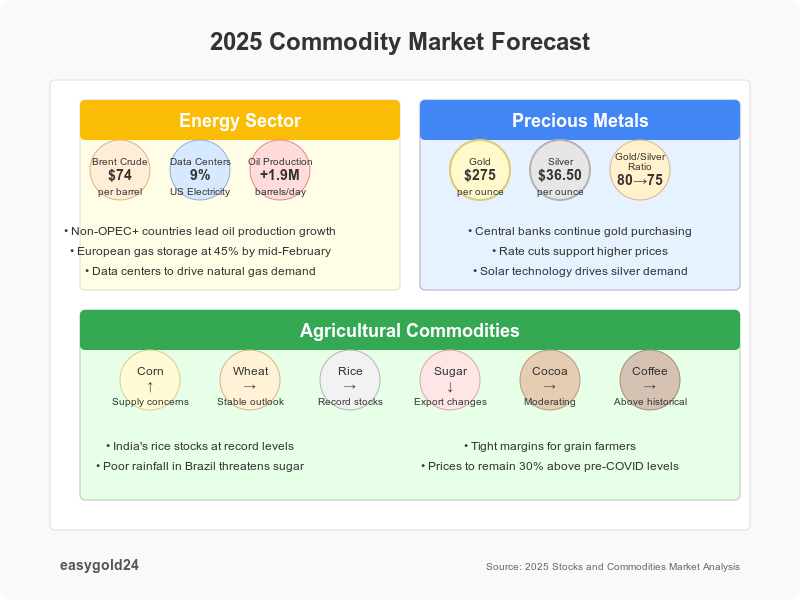

Oil markets anticipate moderate price levels throughout 2025, with Brent crude projected to average USD 74.00 per barrel. Global oil production is set to increase by 1.9 million barrels per day, primarily driven by non-OPEC+ countries including the US, Canada, and Brazil.

Natural gas markets show promising growth potential, although regional variations persist. European gas storage levels have dropped to 45% by mid-February, raising concerns about summer replenishment. Meanwhile, US natural gas demand surges due to increased heating requirements and expanded LNG exports.

The energy landscape sees structural changes as data centers emerge as significant consumers, projected to use 9% of US electricity by 2030. This shift creates additional natural gas demand exceeding 3 Bcf/d by decade’s end.

Precious metals outlook

Gold maintains its upward trajectory, with prices expected to average USD 275.00 per ounce in 2025. The precious metal benefits from persistent central bank buying trends and ongoing currency debasement concerns. Subsequently, silver prices are forecast to reach USD 36.50 per ounce, supported by synchronized central bank rate cuts and robust industrial demand.

The Gold/Silver ratio is anticipated to decline to 80 and potentially target 75, reflecting levels last seen during the 2021 reflation period. Industrial applications, particularly in solar technology, continue driving silver demand growth.

Agricultural commodities forecast

Agricultural markets in 2025 show divergent trends across various commodities. Corn prices maintain upward pressure due to supply concerns and weaker US output estimates. Conversely, wheat and rice prices demonstrate moderation, supported by positive supply outlooks.

India’s rice stocks reached record levels in January, measuring eight times above government targets, enhancing export prospects. Sugar prices dropped to their lowest since 2022, following India’s decision to lift export restrictions. Yet, weak precipitation in Brazil threatens sugar output and export potential for 2025.

Cocoa and coffee markets, after experiencing significant price increases, are expected to ease in 2025 but remain above historical averages. Farmers of major grains and oilseeds enter 2025 with compressed margins, facing uncertainties from potential tariff implementations and shifting trade patterns.

The commodity market outlook reflects broader economic uncertainties, with prices projected to register their sharpest drop since the pandemic. Even so, overall commodity prices will maintain levels 30% higher than pre-COVID-19 figures, underscoring the lasting impact of recent global events on market fundamentals.

Investment Opportunities by Region

Regional investment landscapes reveal distinct opportunities across emerging and developed markets in 2025. Foreign Direct Investment (FDI) patterns signal shifting dynamics, with developing economies experiencing a 2% decline for the second consecutive year.

Emerging markets potential

India stands out as a compelling investment destination, recording a 13% increase in FDI flows. The nation’s GDP growth remains robust at 5.4%, with projections indicating approximately 6% annual expansion over the next five years. Indian equities present attractive valuations, trading at one of the lowest forward price-to-earnings differentials relative to the S&P 500 index in two decades.

Latin American markets offer substantial value propositions. Brazil’s market implies a 12.5% annualized gain in US-dollar terms over the next decade. Mexican equities demonstrate resilience with defensive characteristics, as more than 40% of holdings concentrate in consumer staples and communication-services stocks. The country’s equity index projects an 8.5% annualized return in US-dollar terms over the coming decade.

Chinese markets face structural challenges, yet opportunities persist. FDI flows to China decreased 29% for the second consecutive year, now 40% below their 2022 peak. Still, authorities prioritize policy support, with stimulus measures expected to evolve throughout 2025.

Developed markets outlook

U.S. regional banks present compelling opportunities, with earnings-per-share growth projected in the mid to high teens for both 2025 and 2026. These institutions trade at approximately 11.83x forward earnings and 1.15x price-to-book value, representing substantial discounts to historical averages.

European markets showcase value potential, primarily through small-cap stocks trading at a 40% discount to their fair value estimates. The MSCI Europe trades at 14 times expected earnings, maintaining a near-record 37.5% discount to the MSCI USA. European earnings growth anticipates acceleration to 7.9% in 2025, up substantially from 1% in 2024.

Real estate investments across developed markets reveal promising prospects. Cyprus property prices have risen by an average of 6.8% annually over the past five years. Portugal’s real estate market remains dynamic, with rental yields reaching 5.67% in Lisbon’s city center and 6.52% in the metropolitan area. Spain’s property market offers 30-40% lower prices compared to other major European markets like Paris or London.

Investment flows indicate changing preferences, as 30% of limited partners plan to increase their private equity allocations in the next 12 months. Technology sectors maintain strong performance, with 2024 marking the third-highest year on record for deal value. Across asset classes, Asia experienced slower growth compared to North America and Europe in fundraising, performance, and deal activity.

Risk Factors to Watch

Mounting concerns about state-based armed conflict emerge as the primary risk factor for 2025, with 23% of experts identifying it as the most likely trigger for a global crisis. This assessment underscores the intricate relationship between geopolitical tensions and market stability.

Geopolitical tensions

The Russia-Ukraine conflict continues to unsettle European energy security, alongside escalating tensions in the Middle East. These developments create a tinderbox context where leaders must balance immediate security concerns with long-term environmental and social challenges. Certainly, the digitization of energy infrastructure has heightened vulnerability to cyberattacks.

State-based armed conflict tops the risk hierarchy, followed by extreme weather events at 14% and geo-economic confrontation at 8%. By 2035, environmental risks will dominate the top five concerns, reflecting insufficient international action on climate change. Extreme weather events have already cost the global economy over USD 2 trillion in the past decade.

Policy changes impact

Trade protectionism emerges as a critical concern, as proposed tariffs of 60% on China and up to 20% on all trading partners could reshape global commerce. These policy shifts might trigger retaliatory measures, potentially impacting economic growth rates by 0.7-1.1 percentage points in affected regions.

The implementation of new tariffs presents a stagflationary challenge – simultaneously weakening growth and boosting inflation. Accordingly, central banks face the complex task of balancing growth risks against price stability. The Federal Reserve’s approach suggests a focus on growth risks and business cycle management rather than temporary price increases.

Market volatility indicators

Financial experts anticipate heightened market volatility throughout 2025, primarily driven by three key factors:

- Interest rate uncertainty, particularly in long-term yields

- Political concentration with unified government control

- Escalating geopolitical risks

The VIX Index, measuring expected market volatility, might see significant increases after maintaining relatively low levels over the past two years. Undoubtedly, the first six months of 2025 appear particularly susceptible to volatility. This outlook reflects various factors, including policy uncertainty at both Federal Reserve and administrative levels.

The financial system maintains its resilience despite these challenges. Certainly, most banks report capital levels exceeding regulatory requirements. Yet, hedge fund leverage appears concentrated and elevated, warranting careful monitoring as markets navigate through these multifaceted risks.

Strategic Growth and Opportunities in 2025

As we look ahead to 2025, the global market landscape presents both significant opportunities and challenges, particularly for emerging and developed markets alike. While growth projections remain modest at 3.3%, certain regions, notably the U.S. and India, stand out as key players with strong potential. Gold continues to perform well, driven by global economic uncertainties and the shifting dynamics in energy markets, positioning it as a reliable asset for investors looking for stability.

Hartmann & Benz's Successful OTCQB Listing

Hartmann & Benz, the parent company of EasyGold, has successfully completed its listing on the OTCQB market, marking a significant milestone in our growth trajectory. This step allows us to engage a broader base of international investors and expand our business, focusing on the acquisition of raw and old gold. Our shares are now publicly traded, offering new opportunities for participation in our venture.

Investing in EasyGold: A Strategic Opportunity

For investors, this presents a unique opportunity to be part of a company that is strategically positioned in the precious metals sector. With strong corporate fundamentals, a clear market positioning strategy, and the recent introduction of our EasyGold security token, we are offering an innovative way to invest in gold without the complexities of physical storage.

Looking Ahead: Diversification and Research

The market conditions for 2025 suggest that a well-researched, diversified approach will be key. We are committed to providing transparent, reliable investment opportunities as we continue our growth. Keep track of our progress and learn more about our journey and the potential for investment by staying updated with the latest news and insights.

Your continued support is invaluable as we navigate the evolving market landscape and take steps toward a prosperous future.