Stock Trading For Beginners

Stock Trading Basics: Smart Ways to Start Your Investment Journey

Stock trading may seem straightforward at first, but the reality is more complex. It’s estimated that 95% of traders struggle to generate consistent profits, with day traders often facing the greatest challenges despite careful market timing.

Success in trading is possible, but it requires discipline and a strategic approach. Experienced traders risk only 1-2% of their account balance on each trade. The Financial Industry Regulatory Authority (FINRA) sets a minimum account balance of $25,000 for pattern day trading, underlining the seriousness of the endeavor.

When you start your investment journey, it’s essential to understand fundamental market principles and develop your first trading strategy. With the right preparation, you can approach the stock market with confidence and make informed decisions to grow your wealth.

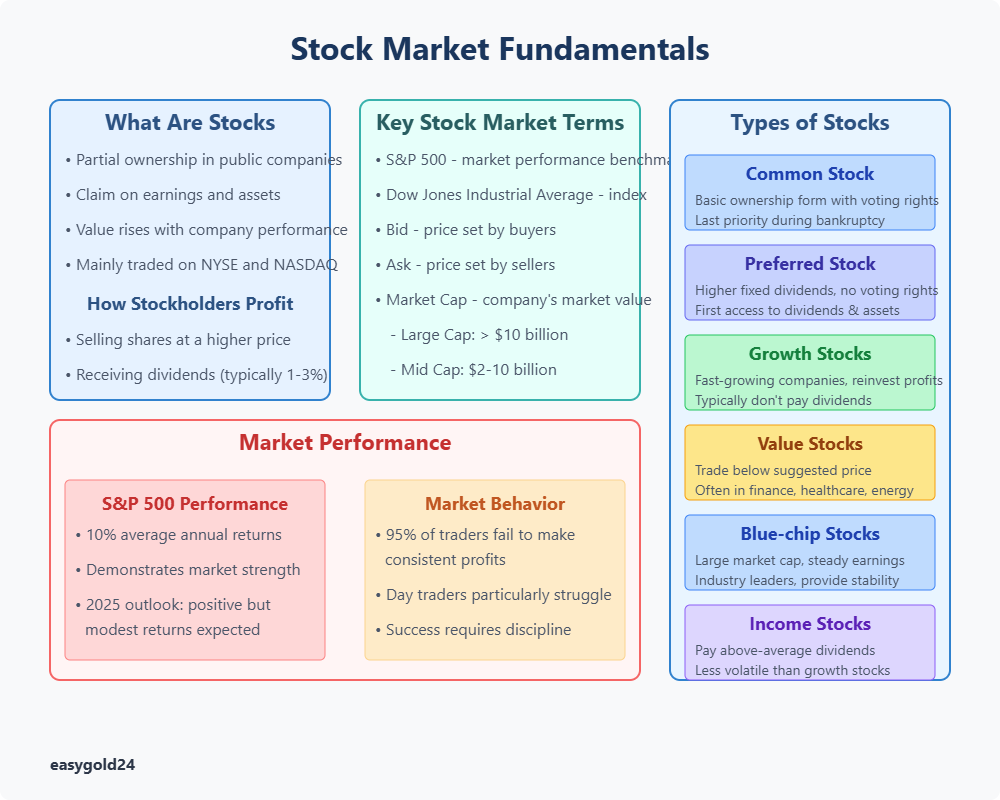

Understanding Stock Market Fundamentals

Companies sell ownership shares to raise capital through the stock market. Anyone starting their investment experience needs to understand these fundamentals.

What Are Stocks and How They Work

Stocks give investors partial ownership in a public company and a claim on its earnings and assets. Stock values rise when companies perform well financially, creating profit opportunities for investors. The New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ) handle most of these share trades.

Stockholders make money in two ways. They can sell shares at a higher price than what they paid or receive dividends. Some companies pay regular cash dividends to shareholders, which typically range from 1% to 3% of the stock price.

Key Stock Market Terms for Beginners

The S&P 500 and the Dow Jones Industrial Average serve as benchmarks that measure the stock market’s performance. These indexes track specific stock groups and show investors how the market performs.

New stock traders should familiarize themselves with these terms:

- Bid and Ask: Buyers set the bid price while sellers determine the ask price

- Market Capitalization: Large-cap companies have market values above $10 billion. Mid-cap ranges between $2 billion and $10 billion. Small-cap stocks fall below $2 billion

- Initial Public Offering (IPO): A private company’s first public share offering

Different Types of Stocks

Stock markets offer various investment options with unique benefits:

Common Stock: This basic form of company ownership provides voting rights and possible dividend payments. Common stockholders receive last priority for asset claims during bankruptcy.

Preferred Stock: These shares combine stock and bond features with higher fixed dividends than common stock. Preferred stockholders usually cannot vote but receive first access to dividends and assets during liquidation.

Growth Stocks: Companies expected to grow faster than market averages issue these shares. They typically don’t pay dividends because profits fuel expansion. Low interest rates and economic growth help these stocks perform better.

Value Stocks: These shares trade below prices that company performance suggests. Financial, healthcare, and energy sector value stocks often perform well during economic recovery.

Blue-chip Stocks: Large market capitalization companies issue these shares. Blue-chip companies demonstrate steady earnings and lead their industries. Investors seeking stability find these shares attractive.

Income Stocks: These companies pay above-average market dividends regularly. Income stocks exhibit less volatility than growth stocks and attract investors who want steady income instead of quick gains.

The S&P 500 Index demonstrates the market’s strength with 10% average annual returns over decades. Market analysts note that 2025 might show positive but modest returns after two years of 25%+ gains, though some express concerns about overvaluation.

Getting Started with Stock Trading

Stock trading begins when you open a brokerage account. A solid foundation through proper account setup should precede any market analysis or trading strategies.

Setting Up Your First Trading Account

Your trading journey starts with choosing between three main account types. A cash account allows you to trade with settled funds and works best for beginners. Margin accounts enable trading at a 2:1 ratio but require more expertise. Tax-advantaged accounts like IRAs and 401(k)s provide specific benefits to retirement-focused investors.

Opening an account functions similarly to a bank account setup, with one key difference.

Brokers require detailed information about your:

- Investment objectives

- Risk tolerance

- Financial knowledge

- Time horizon

Brokerages need basic identification details such as your Social Security number, contact information, and employment status. The Securities and Exchange Commission requires brokers to follow strict “know your client” verification standards.

Choosing the Right Trading Platform

The trading platform you select shapes your entire trading experience. Several established brokers stand out with features that help beginners:

Charles Schwab excels with comprehensive educational resources that include stock reports, Morningstar analysis, and Reuters news coverage. Their ETF screener helps new traders find promising funds.

Fidelity leads with exceptional customer service and immediate phone support to answer detailed questions. Their platform combines research tools with an intuitive interface.

These critical factors matter when selecting a platform:

1 Platform Security: Your chosen broker should provide SIPC insurance that covers up to $500,000 in investments.

2 Cost Structure: Modern platforms typically offer:

- Commission-free stock and ETF trading

- No monthly account fees

- Fractional share trading capabilities

3 Educational Resources: The best platforms provide:

- Interactive tutorials

- Webinars

- Practice trading simulations

Account Minimums: Online brokers often waive minimum deposits to start trading. Day traders should note they must maintain $25,000 in their accounts due to regulations.

5 Trading Tools: Quality platforms come with:

- Real-time market data

- Stock screening capabilities

- Technical analysis tools

Paper trading features help you practice strategies without risking real money. Once ready, you can transfer funds electronically from your bank account, which takes a few business days to settle.

The platform you choose should align with your long-term goals. As your skills develop, you might require more advanced features. Select a platform that can grow with your trading expertise.

Most brokerages provide mobile apps alongside their desktop platforms. Apps facilitate position monitoring, but desktop interfaces work better for complex trades. Consider how you’ll primarily use your account when making your choice.

Essential Tools for Stock Trading

Stock trading success depends on the right combination of tools and resources. Technological advances have given traders access to sophisticated software that enhances their decision-making process.

Must-Have Trading Software

Modern trading platforms combine technical analysis capabilities with real-time market data. Technical analysis systems generate buy and sell indicators based on market patterns that help remove emotion from trading decisions. TradeStation’s desktop software distinguishes itself with extensive charting capabilities, tick data, and integrated automated technical analysis.

Interactive Brokers’ Trader Workstation (TWS) platform features over 120 technical indicators and advanced analysis tools. Power E*TRADE delivers customizable charting functions with more than 30 drawing tools that serve both novice and experienced traders effectively.

MetaTrader 4 enables investors to implement algorithmic trading strategies across multiple markets. Many online brokers support this platform, making it a versatile choice for traders who wish to automate their positions.

Stock Screening Tools

Stock screeners help traders identify promising investment opportunities among thousands of available stocks. Trade Ideas, an established industry leader, processes large volumes of market data through its AI-driven analytics engine. The system employs 310 alerts and 243 filters that cover technical indicators, social media sentiment, and other non-structured data sets.

Finviz Elite offers premium features including:

- Advanced technical analysis tools

- Real-time data streams

- Enhanced stock screening capabilities

TradingView has evolved into a powerful option with:

- Support for thousands of stocks and other assets

- Over 100 customizable technical indicators

- Extensive backtesting capabilities

Market Analysis Resources

Market analysis requires diverse data sources and interpretation tools. Charles Schwab’s StreetSmart Edge platform includes Screener Plus that uses real-time streaming data to filter stocks based on fundamental and technical criteria. The platform integrates well with pre-defined watch lists to enable efficient portfolio monitoring.

Fidelity’s Active Trader Pro comes with an advanced suite of analysis tools:

- Customizable charting functions

- Technical signal alerts

- Extended hours data access

- More than 60 fully customizable technical indicators

StockCharts has become a premier resource for technical analysis that offers multiple timeframe analysis options from intraday to yearly charts. Traders who rely on various chart types and technical indicators find the platform’s versatility particularly valuable.

TrendSpider provides state-of-the-art technical analysis through its AI-powered pattern recognition capabilities. This technology helps traders identify potential trading opportunities with greater precision.

Successful traders combine multiple tools rather than relying on a single platform. Trading Central’s technical analysis tools have been incorporated into numerous brokerage platforms. These tools analyze price action and interpret classic chart patterns automatically to provide traders with informed insights into market conditions.

Building Your First Trading Strategy

Creating a strong trading strategy requires understanding key technical patterns, establishing clear rules, and managing position sizes. A well-structured approach helps you avoid emotional decisions and maximize returns.

Simple Chart Patterns

Technical analysis forms the foundation of many trading strategies through identifiable price patterns. Head and shoulders patterns indicate potential trend reversals that resemble three peaks. The middle peak (head) rises higher than the two surrounding peaks (shoulders). Double tops and bottoms also signal trend changes. Double tops suggest bearish momentum while double bottoms indicate bullish moves.

Pennants and flags represent continuation patterns. Traders draw these using converging trendlines that indicate brief market pauses. Triangle patterns appear frequently and provide traders with several opportunities:

- Ascending triangles indicate rising support levels

- Descending triangles show falling resistance

- Symmetrical triangles suggest market indecision

Entry and Exit Rules

Clear entry and exit criteria are essential for consistent trading results. Most retail investors limit their risk to 2% of investment capital per trade. Even a sequence of 10 consecutive losses would only reduce trading capital by 20%.

You must plan your trade execution carefully. Begin by setting your entry price based on technical or fundamental analysis. Then calculate your stop-loss level—the price where you’ll exit if the trade moves against you. Finally, set profit targets that correspond to your risk tolerance.

Your trade management should address:

- Position duration expectations

- Risk tolerance levels

- Fundamental market conditions

- Technical indicator confirmations

Successful traders use multiple indicators to confirm their trade signals. Moving averages, relative strength index (RSI), and volume analysis function more effectively together than any single indicator.

Position Sizing Basics

Position sizing determines how many shares to trade while maintaining acceptable risk levels. The formula incorporates three main components:

Account Risk: Most traders limit risk to 2% of their capital per trade. With a $25,000 account, you would risk $500 maximum per trade.

Trade Risk: Calculate the dollar distance between your entry price and stop-loss. Buying Apple at $160 with a stop-loss at $140 means $20 risk per share.

Position Size Calculation: Divide your account risk by trade risk. Using our example:

- Account risk: $500

- Trade risk: $20 per share

- Position size: 25 shares ($500/$20)

Unexpected gaps below stop-loss levels can result in larger losses. Prudent traders reduce their position sizes before significant events like earnings announcements.

Position sizing profoundly affects trading psychology. Large positions can trigger emotional decisions. Appropriately sized trades allow you to think clearly and adhere to your trading plans. Position sizing calculators help remove emotion from these calculations.

Position sizing directly connects to your risk management strategy. Maintaining consistent position sizes relative to account value helps you navigate market volatility more effectively. This systematic approach protects both your capital and mental state, which are essential for long-term trading success.

Managing Trading Risk

Risk management is the cornerstone of successful stock trading. It distinguishes between consistent profits and devastating losses. Even the most skilled traders must implement reliable risk management practices to control losses.

Setting Stop Losses

Stop-loss orders function as an automated safety net to protect your trading capital from significant drawdowns. These orders automatically close your position when a stock reaches a preset price, limiting potential losses. This eliminates the dangerous “it will come back” mindset that often results in larger losses.

Consider several factors when setting effective stop-loss levels:

- Market volatility – Use longer-term moving averages for volatile stocks

- Support and resistance levels – Place stops at key technical points

- Price fluctuations – Position stops at least 1.5 times the current high-to-low range

For example, if you buy a stock at $50.00 with a stop-loss at $48.00, this creates a $2.00 per share risk. The primary advantage of stop-loss orders is that they’re free to use.

Take-profit orders complement stop-losses and automatically close positions at your profit target. These orders establish a structured approach to manage both downside risk and upside potential.

Risk Per Trade Calculation

The risk per trade calculation depends on position size and maximum acceptable loss. Professional traders adhere to the 1% rule and never risk more than 1% of their total account value on a single trade. This approach ensures that a series of losses won’t substantially deplete your trading capital.

Here’s a practical example of position sizing with the 1% rule:

- Account value: $10,000

- Maximum risk (1%): $100

- Entry price: $14.85

- Stop-loss: $14.55

- Risk per share: $0.30

- Position size: 333 shares ($100/$0.30)

This calculation demonstrates how proper position sizing helps maintain consistent risk across different trades, regardless of share price or market conditions.

Risk-to-reward ratios are essential metrics for evaluating potential trades. Most traders seek a minimum 1:2 ratio, meaning the potential profit should be at least double the risk. Using our previous example, if you risk $2.00 per share, your profit target should be at least $4.00 per share.

Effective risk management requires attention to multiple factors:

- Volatility Assessment: Adjust position sizes based on market conditions

- Gap Risk Management: Account for potential price jumps between trading sessions

- Leverage Consideration: Understand how borrowed funds can magnify losses

- Correlation Risk: Monitor multiple positions moving against expectations

Sound risk management removes emotion and fear from trading decisions. Clear rules that you follow consistently create a framework for sustainable trading success.

Stop-loss orders become market orders once triggered. Your execution price might differ from your stop price during volatile markets. Consider using stop-limit orders when precise control over execution prices is necessary.

Starting Your Trading Journey

Developing proficiency in stock trading requires patience and practice. Paper trading provides a risk-free method to build skills and test strategies without risking actual capital.

Paper Trading First Steps

Virtual trading platforms simulate real market conditions. Begin with one or two stocks to facilitate tracking and analysis. This approach helps you understand market behavior and platform mechanics without financial risk.

To maximize benefits from paper trading:

- Maintain a detailed trade journal

- Track wins and losses

- Document reasons for entering and exiting trades

- Analyze your results

- Commit to at least six months of practice

Most brokers now incorporate paper trading into their platforms. These simulators replicate live market conditions and allow you to test various strategies while building confidence.

Moving to Real Trading

The transition from paper to live trading requires careful planning. Begin with a small portion of your intended trading capital. This incremental approach helps you manage the psychological pressure of risking real money.

Critical steps for transitioning to live trading include:

- Capital Management: Start with funds you can afford to lose

- Time Commitment: Decide between part-time or full-time trading

- Risk Assessment: Understand your risk comfort level and adjust your plan accordingly

- Strategy Validation: Ensure your paper trading approach works in various market conditions

Many traders employ dollar-cost averaging when initiating real trades. They purchase shares over several days rather than all at once to reduce timing risks.

Common Beginner Mistakes to Avoid

Understanding typical mistakes helps new traders navigate challenges more effectively. The most significant issue is emotional trading that leads to hasty decisions and substantial losses.

Overtrading: New investors often trade excessively, particularly when attempting to recover losses. This revenge trading can quickly deplete your account and accumulate fees.

Moving Goal Posts: Traders sometimes alter their plan mid-trade by:

- Removing stop-loss orders

- Switching technical indicators

- Holding positions longer than planned

Unrealistic Expectations: Beginners frequently pursue quick profits or attempt to time market peaks and valleys. This typically results in disappointment and poor outcomes.

Position Sizing Errors: New traders often take excessive risks, which exacerbates potential losses. Disciplined traders limit risk to 1-2% of their account per trade.

Market Timing: Trading around earnings reports can be challenging. Markets move unpredictably during these periods, making risk control more difficult.

Your trading plan should clearly define:

- Trading goals

- Risk management rules

- Entry and exit criteria

- Position sizing guidelines

Trading success comes from experiencing various market conditions. Even experienced traders return to paper trading to test new ideas or refine existing ones. Above all, maintain detailed records of paper and live trades to identify patterns in your trading behavior and continuously improve.

Stock Trading: A Disciplined Approach to Building Wealth

Stock trading requires focus, knowledge, and disciplined execution. It’s essential to understand the fundamentals of the market, select the right tools, and create a strategy that works for you. By managing risk through careful position sizing and implementing stop-loss measures, you can protect your capital from significant losses.

For those just starting, paper trading is a great way to build confidence without the risk of losing money. Once you’re comfortable, live trading introduces new psychological challenges, so it’s crucial to start small and stick to your risk management principles.

Continuous learning and adaptability are key to long-term success. Successful traders refine their strategies over months or years. As the markets evolve, so must your approach, always staying disciplined and aligned with your trading plan.

Invest in the Future with Hartmann & Benz

Hartmann & Benz has already achieved a significant milestone—our shares are now listed on the OTCQB market. This marks a crucial step in making our shares available for public trading and investment. As a company dedicated to investing in gold, we’re also launching a security token that allows investors to hold gold easily, without the need for physical storage.

Explore the potential of investing in Hartmann & Benz shares, and gain exposure to the gold market through our unique security token. Stay informed about our progress and updates as we continue to grow and evolve in the global financial landscape.

Ready to take your next step?