Stock Trading Risks

Stock Trading Risks: What Your Broker Won’t Tell You

Stocks continue to outperform bonds over the long term—by as much as 40%. But behind the promise of higher returns lies a network of risks many investors underestimate or overlook entirely. What’s often missing in mainstream conversations is a clear view of what can go wrong.

Many U.S. investors enter the market without understanding how vulnerable their portfolio is to outside forces. Economic slowdowns can sharply reduce corporate earnings. Political instability—domestic or global—can shake market confidence overnight. Even companies with strong fundamentals are not immune to market volatility.

The real risk isn’t just losing money. It’s failing to prepare. Brokers often highlight potential gains while downplaying the full spectrum of threats. But responsible investing demands a different mindset—one that accounts for the unpredictability of markets.

At EasyGold, we believe risk awareness is a core part of smart investing. By understanding how economic cycles, global events, and even sector-specific shifts affect stock performance, Sie positionieren sich besser für nachhaltigen Erfolg. When combined with a diversified asset model like tokenized gold, risk exposure becomes more manageable—even in uncertain times.

Get clear on the risks. Then act with purpose.

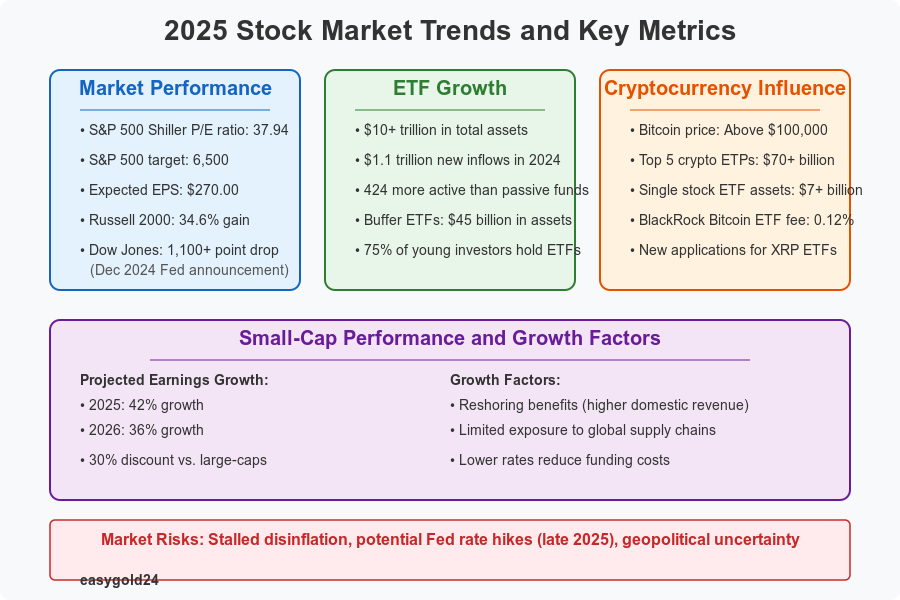

Common Stock Trading Risks in 2025

Stock market dynamics in 2025 create unique challenges for investors. The global economic landscape has become increasingly complex, requiring investors to consider multiple risk factors simultaneously.

Market Volatility Risks

Market volatility remains high due to ongoing geopolitical uncertainties. Trade policy changes and global tariffs significantly drive market fluctuations. The tech sector clearly demonstrated this volatility following DeepSeek’s launch, a Chinese AI model that triggered substantial market movements.

The market’s heavy concentration in select stocks, especially the Magnificent Seven, creates vulnerability to sudden disruptions. This focus on tech means that even minor setbacks in AI adoption or profitability could spark significant market swings.

Company-Specific Risks

Companies face intense challenges as they navigate various obstacles. The S&P 500’s valuation metrics have reached concerning levels previously observed only during the late 1990s and 2021. Additionally, earnings expectations across different sectors face heightened scrutiny in this uncertain economic climate.

Forward P/E ratios and their relationship to one-year performance present an interesting narrative. Data since the 1950s reveals almost no correlation (-0.11), suggesting that today’s high valuations might not necessarily predict future returns.

Economic Risks

The economic environment presents several key challenges. Labor market patterns are rapidly evolving, with immigration accounting for almost all U.S. labor force growth in the past four years, making the economy particularly sensitive to policy shifts.

Housing affordability remains a major concern. Higher mortgage rates combined with record-high home prices have pushed affordability to multi-decade lows in 2024. This problem could persist if the Federal Reserve maintains high interest rates throughout 2025.

Inflation, currently at 2.9%, continues to create economic pressure. This elevated level might delay predicted interest rate cuts and negatively affect market performance. Furthermore, restrictive trade policies and immigration restrictions could push inflation even higher.

Markets currently face a “barbelled” risk scenario. Strong consumer spending and rising inflation could disrupt stability on one side. On the other, deteriorating employment data and weakening consumer spending might signal a more severe recession if the Federal Reserve delays rate cuts too long.

Hidden Risks Your Broker Never Mentions

Stock trading involves hidden risks that your broker might not disclose. Understanding these dangers is essential to protecting your investments.

Payment for Order Flow

Brokers now operate under a zero-commission model, generating revenue through payment for order flow (PFOF). Wholesalers pay brokers to route their retail clients’ orders through them. While this enables free trading for clients, it creates potential conflicts of interest. Options markets generate two-thirds of all PFOF revenue, where PFOF rates are significantly higher. This substantial difference incentivizes brokers to promote options trading over equity trading, potentially regardless of their clients’ best interests.

Platform Outage Risks

Recent platform failures highlight significant vulnerabilities in online trading systems. Industry experts indicate that many current systems cannot handle the substantial increase in retail trading volume. Major institutions including Fidelity, Charles Schwab, and Vanguard experienced significant service disruptions throughout 2021. Traders were unable to execute trades during critical market moments, resulting in substantial losses. These outages negatively impacted market quality, with affected stocks experiencing reduced trading activity and volume during disruptions.

Account Security Risks

Brokers often downplay another significant risk: account security. Identity thieves deploy malicious software to monitor computer activity and steal login credentials. These programs can track keystrokes and infiltrate brokerage accounts. Phishing attacks pose similar dangers, with criminals sending fraudulent emails and creating duplicate websites to deceive investors into divulging sensitive information.

Brokers require robust security measures to counter these threats, including:

- Regular security training for employees to identify phishing attempts

- Strong encryption across networks and devices

- Comprehensive monitoring systems to detect unauthorized activity

Nevertheless, many trading platforms lack thorough verification measures and fail to implement agency best practices for cybersecurity. This leaves investors vulnerable to account breaches and financial losses.

Modern Trading Risks to Watch Out For

The digital landscape introduces new risks to stock trading and transforms how markets respond to information and automated systems. Investors must remain vigilant to protect their investments.

Social Media Manipulation

Stock manipulation schemes flourish on social media platforms. In 2022, the SEC uncovered a $100 million fraud scheme where eight influencers used Twitter and Discord to manipulate exchange-traded stocks. These individuals built a following of hundreds of thousands, promoted specific stocks with price targets while secretly planning to sell their own shares.

Fake accounts and bots exacerbate this problem. Automated accounts frequently post similar messages about different stocks, merely substituting tickers and keywords to create artificial buzz. This typically follows a “pump-and-dump” pattern where false information causes prices to spike rapidly before collapsing.

Deepfake videos now present the most significant risk to financial markets. A single convincing deepfake could temporarily disrupt trading, while a coordinated campaign might cause lasting damage to market trust and stability.

Algorithm Trading Impact

Algorithmic trading accounts for approximately 80% of U.S. stock trades and introduces new risks to market stability. These systems can fail catastrophically, as demonstrated in the 2010 “flash crash” when the Dow Jones dropped 1,000 points in five minutes before recovering.

The widespread use of similar trading algorithms by multiple institutions increases systemic risk.

Companies become collectively vulnerable to manipulation when employing comparable models. Research demonstrates that altering just one word in an algorithm’s input data can significantly impair its performance over time.

Additional algorithm-related risks include:

- Sudden liquidity evaporation, similar to what occurred in currency markets following the Swiss franc’s euro peg removal in 2015

- Technical failures resulting in missed trading opportunities or substantial losses

- Increased market volatility when algorithmic systems process large trading volumes

Financial regulators have intensified monitoring of meme stocks and issued warnings about excessive institutional adoption of similar AI models.

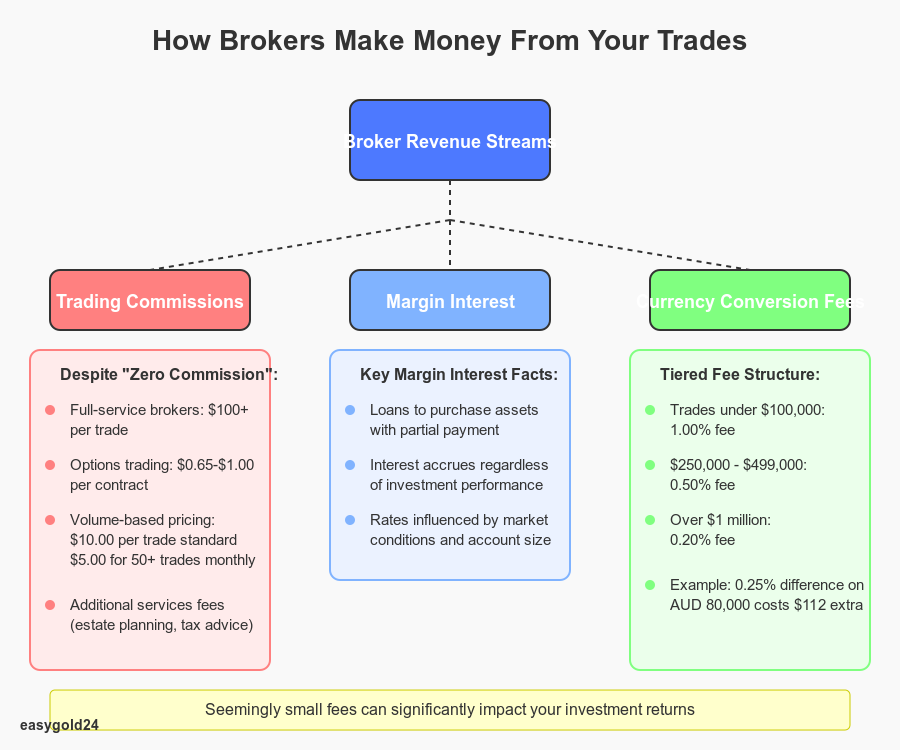

How Brokers Make Money From Your Trades

Brokers generate profits from your trades through various revenue streams that operate behind the facade of commission-free trading. This knowledge enables you to make informed decisions about your trading costs.

Trading Commissions

While the industry has shifted toward zero-commission trading, many brokers still impose fees for specific services. Full-service brokers charge $100 or more per trade while providing additional services such as estate planning and tax advice. The standard industry fee for options trading ranges from $0.65 to $1.00 per contract.

Your trading volume determines the commission structure, with per-trade commission rates decreasing as trading activity increases. Many firms charge $10.00 per trade to regular customers and reduce this to $5.00 for customers who execute 50 or more trades monthly.

Margin Interest

Margin trading allows investors to borrow money from brokers to purchase assets by paying only a portion of the asset’s value upfront. These loans accrue interest regardless of investment performance. Market conditions and your broker’s asset holdings influence interest rates, with larger accounts typically qualifying for lower rates.

Currency Conversion Fees

International trading incurs hidden costs through currency conversion. Brokers apply markups ranging from 0.20% to 1.00% on currency conversions. The fee typically remains at 1.00% for conversions of $100,000 or less, decreasing to 0.20% for amounts exceeding $1 million.

Brokers employ this tiered structure for currency conversion:

- Trades under $100,000: 1.00% fee

- $250,000 – $499,000: 0.50% fee

- Over $1 million: 0.20% fee

These seemingly small percentages can significantly impact your returns. A 0.25% difference in conversion fees on an AUD 80,000 transfer costs an additional $112. It is advisable to review your broker’s currency conversion fee structure before trading international securities.

Stock Trading Risks: What You Need to Know

Stock trading comes with inherent risks, often not fully disclosed by brokers. While market growth continues, understanding these risks is crucial for protecting your investments.

Global political tensions, shifts in inflation, and the dominance of the tech sector are influencing market dynamics in 2025. In addition, emerging challenges like platform security concerns and social media manipulation are reshaping the landscape. Investors must navigate these uncertainties to maintain stability in their portfolios.

At EasyGold, we recognize the importance of mitigating risk in an ever-evolving market. By diversifying into gold-backed assets like our security token, you can manage exposure while staying ahead of market fluctuations. Our tokenized gold offers a streamlined way to hold substantial gold assets without the need for physical storage, providing a more secure and cost-effective approach to trading.

The key to successful investing lies in a solid strategy that accounts for both visible and hidden risks. It’s about understanding market behavior, evaluating various factors, and selecting investments that align with your long-term goals.

Hartmann & Benz is now listed on the OTCQB market, offering our shares and gold-backed security tokens for public trading. This step marks a new chapter in the accessibility and management of wealth through our innovative solutions. As we continue our growth, we encourage potential investors to explore our offerings, understanding the value of tokenized gold ownership and its benefits in today’s complex market.

Stay informed, keep your investments protected, and explore the potential of our gold-backed assets for greater financial security.