Trading Commodity Futures

How Commodity Futures Work

Commodity futures are contracts between buyers and sellers that allow the trading of specific quantities of commodities at set prices for future dates. These contracts cover a wide range of commodities, including agricultural products like wheat and corn, energy resources such as oil and natural gas, and precious metals like gold and silver.

Futures trading enables you to lock in prices ahead of time, offering both opportunities for profit and risk management. These contracts can be used for speculation or to hedge against price fluctuations in the underlying commodity. Understanding how commodity futures work is key to navigating this dynamic market effectively.

Whether you’re new to trading or looking to refine your strategy, mastering the basics of commodity futures gives you the foundation to make informed decisions in the global commodities market.

What Are Commodity Futures in Simple Terms

Commodity futures date back to the 1800s when American farmers and traders needed a reliable system to buy and sell agricultural products. These standardized contracts have evolved into sophisticated financial tools that serve both producers and consumers across various industries.

Basic Definition

A commodity futures contract is a binding agreement between two parties to buy or sell a specific amount of a commodity at a fixed price on a future date. For example, purchasing wheat futures means locking in the price you’ll pay for a set amount of wheat, regardless of market fluctuations before delivery.

The standardization of futures contracts sets them apart from other financial instruments. Each contract clearly specifies:

- The quality and quantity of the commodity

- The specific price and minimum price changes allowed

- The delivery date and location

- The terms of settlement

Unlike regular shopping where prices change daily, futures contracts establish exactly what you’ll pay months in advance. Additionally, regulated exchanges like the CME Group oversee these contracts, ensuring all participants adhere to established rules.

Why People Use Commodity Futures

People trade commodity futures for two primary reasons: hedging and speculation.

Hedging - Protection Against Price Changes

Consider a Kansas wheat farmer whose primary concern is wheat prices dropping before harvest. By selling wheat futures, the farmer can secure a guaranteed price for the upcoming crop. Similarly, a cereal company might purchase wheat futures to stabilize their raw material costs. Hedging enables producers and consumers to operate their businesses with greater certainty regarding future costs and revenues.

Speculation - Seeking Profit Opportunities

Beyond farmers and manufacturers, traders enter the market to profit from price changes. These speculators analyze market trends and aim to buy low and sell high, similar to stock traders. They rarely desire the physical commodity and typically close their positions before delivery.

Futures markets thrive by bringing diverse traders together. Commercial users such as farmers and food processors require these markets to manage business risks. Speculators provide vital liquidity, facilitating easier buying and selling for all participants.

A critical distinction between futures and other investments lies in their obligations. A futures contract requires you to buy or sell at the agreed price unless you close your position early. This makes futures distinct from options contracts, where you can choose whether to complete the transaction.

Standardization and exchange trading have established commodity futures as essential tools for price discovery and risk management. Businesses can focus on operations without worrying about sudden price changes, resulting in greater market stability.

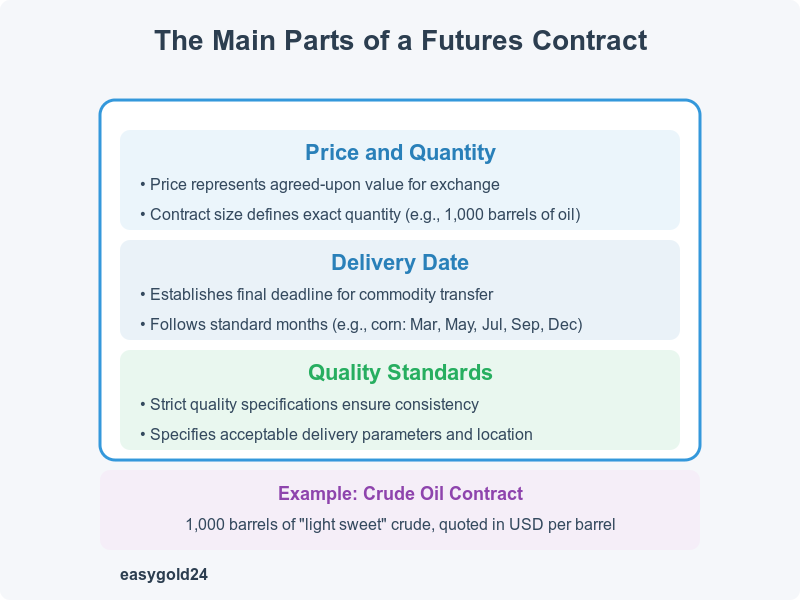

The Main Parts of a Futures Contract

A futures contract contains specific elements that define the traded commodity. Let’s examine these fundamental components that make commodity futures function effectively.

Price and Quantity

The price in futures contracts represents the agreed-upon value for commodity exchange. Prices fluctuate throughout each trading day, and exchanges determine a daily settlement price based on the closing price range. This settlement price helps calculate the market value of outstanding positions.

Contract size specifies the exact quantity of commodity in each contract. Examples include:

- One crude oil contract equals 1,000 barrels

- One corn contract represents 5,000 bushels

- Treasury bond contracts have a face value of USD 100,000

Exchanges establish these standardized quantities based on market participants’ needs. Prices follow specific quotation methods; for example, corn futures are quoted in cents per bushel.

Delivery Date

The delivery date establishes the final deadline to transfer the underlying commodity. Exchanges set specific delivery periods that may include:

- A specific day within the month

- The entire month

- Multiple days within a designated window

Commodity futures typically follow standard delivery months. For instance, corn futures deliver in March, May, July, September, and December. Trading ceases several days before the last possible delivery date to ensure smooth settlement.

While physical delivery remains an option, traders usually close their positions before the delivery date. Only a small percentage of commodity futures result in actual delivery. Many contracts now offer cash settlement, which involves a simple transfer of funds based on the contract’s value at expiration.

Quality Standards

Exchanges implement strict quality specifications for each commodity to maintain consistency in trading. These standards protect buyers and sellers by defining what constitutes an acceptable delivery.

For example, crude oil contracts specify the grade “light sweet,” which refers to specific levels of hydrogen sulfide and carbon dioxide content. These quality parameters ensure that:

- Buyers receive exactly what they expect

- Sellers understand what they must deliver

- Trading remains standardized throughout the market

The contracts also specify delivery locations and facilities. Lumber contracts require delivery in designated states using specific types of boxcars. These detailed specifications prevent confusion and disputes while maintaining market integrity.

These three core elements—price and quantity, delivery date, and quality standards—create a transparent and efficient marketplace. Through these specifications, futures contracts provide effective price discovery and risk management in commodity markets of all sizes.

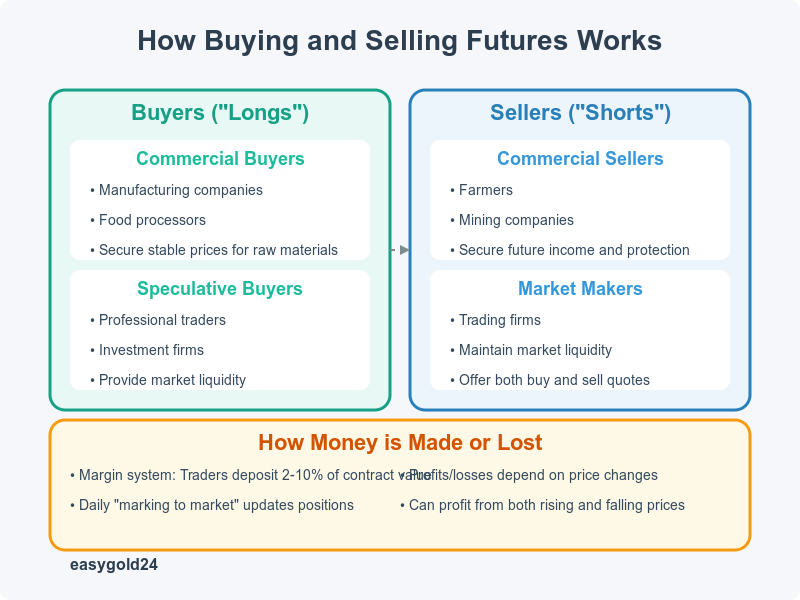

How Buying and Selling Futures Works

Commodity futures trading unites market participants from diverse backgrounds who fulfill unique roles in this financial ecosystem. Let’s examine how these markets operate and what drives profits and losses.

The Role of Buyers

Buyers in futures markets, known as “longs,” agree to purchase specific amounts of commodities at set prices. These buyers typically fall into two categories:

Commercial buyers, such as manufacturing companies and food processors, aim to secure stable prices for their raw materials. A plastics producer might use natural gas futures to lock in costs for production needs, protecting them when prices rise.

Professional traders and investment firms comprise most speculative buyers who seek to profit from price changes without taking physical delivery. These participants provide essential liquidity to the market, facilitating trading for everyone.

The Role of Sellers

“Shorts” take the opposite side of these trades, promising to deliver commodities on specific future dates. The primary sellers include:

Farmers and mining companies sell futures to secure their future income. A Kansas wheat farmer might sell futures contracts to guarantee harvest prices, protecting income if prices fall during harvest season.

Market makers are crucial participants who continuously buy and sell. These trading firms maintain market liquidity by offering both buy and sell quotes, enabling large trades to execute smoothly without significant price changes.

How Money is Made or Lost

The futures market employs a margin system where traders deposit 2% to 10% of the contract’s value. This creates opportunities for substantial gains but carries significant risks.

Here’s a practical example of profit and loss:

- A farmer sells 10 wheat contracts at USD 3.50 per bushel

- Each contract covers 5,000 bushels

- If prices drop to USD 3.00, the farmer makes USD 0.50 per bushel

- Total profit reaches USD 25,000 (10 contracts × 5,000 bushels × USD 0.50)

The market updates positions daily through a process called “marking to market.” This means:

- Your margin account increases with profits

- Losses reduce your balance

- You must add funds if losses decrease your balance below required levels

Traders typically close positions before the delivery date. Their profits or losses depend on price changes between opening and closing trades. Speculators focus on these price movements and can sometimes double their investment due to leverage.

Futures markets are distinctive because traders can profit from both price increases and decreases. Unlike stocks, you can sell short without restrictions, providing greater flexibility in trading strategies.

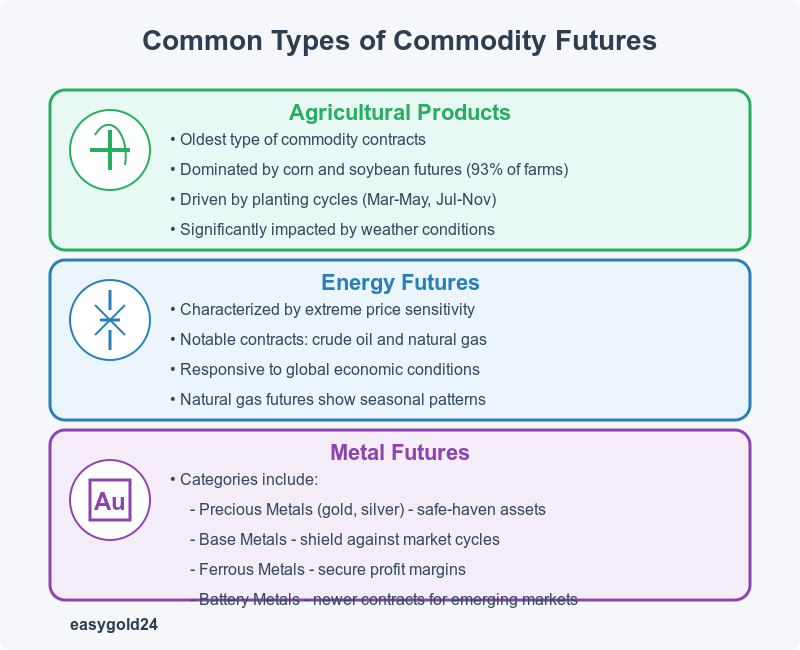

Common Types of Commodity Futures

The commodity futures market encompasses three major sectors, each with its own economic purpose and trading patterns. Let’s examine these key categories that form the foundation of futures trading.

Agricultural Products

Agricultural futures represent the oldest type of commodity contracts, originating when farmers sought to secure crop prices. Today, corn and soybean futures dominate this sector, with more than 93% of farms trading these specific contracts.

Two main planting cycles drive most agricultural trading:

- March through May

- July through November

Weather conditions significantly impact agricultural futures prices. Adverse weather can reduce available planting area and increase prices. This relationship between weather and crop yields makes agricultural futures particularly active.

Energy Futures

Energy futures are characterized by extreme price sensitivity. Minor changes in supply or demand can trigger substantial price movements. The most prominent energy futures include:

- Crude oil, which reached its highest price of USD 145.31 in July 2008

- Natural gas, which exhibits unique trading patterns with sharp price fluctuations

Energy futures prices quickly respond to:

- Global economic conditions

- Industrial demand shifts

- Seasonal heating requirements

- Manufacturing sector needs

Natural gas futures display regular seasonal patterns connected to winter heating demand. Actual usage frequently differs from expert predictions.

Metal Futures

Metal futures are divided into several categories:

Precious Metals: These contracts provide stability and function as safe-haven assets during economic uncertainty. Gold futures exhibit recurring boom-bust cycles that affect trading volume.

Base Metals: These contracts help shield against market cycles and supply chain fluctuations.

Ferrous Metals: Trading these metals helps companies secure profit margins and mitigate supply chain risks in one of the largest physical commodity markets.

Battery Metals: These newer contracts allow traders to protect against rising price risks through cash-settled financial instruments.

Metal futures contracts typically trade in standard lots from 1 to 50 metric tons, with prices denominated in US dollars. The London Metal Exchange offers traders exceptional flexibility with its prompt-date structure. Traders can select daily, weekly, and monthly options that correspond to physical market movements.

Steps to Start Trading Commodity Futures

A strategic approach and careful preparation will enhance your success in commodity futures trading. Here’s a comprehensive guide to help you trade these financial instruments safely.

Choose a Broker

Selecting the right futures broker forms the foundation of your trading success. Verify that your chosen broker is properly registered with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). A registered broker provides better protection for your investments and adheres to regulatory standards.

Consider these factors when evaluating brokers:

- Access to real-time market data and quotes

- Quality of the trading platform and execution speed

- Competitive commission rates and fee structures

- Educational resources

- Customer support quality

The NFA’s database can help you verify any broker’s disciplinary history and registration status. You can choose between full-service brokers that provide detailed guidance or discount brokers that offer straightforward trading platforms based on your specific needs.

Open an Account

Opening a futures trading account involves several critical steps. Brokers will assess your financial standing and trading experience, requiring information about:

- Your net worth and annual income

- Previous trading experience

- Risk tolerance levels

- Investment objectives

After approval, you must understand various agreements and risk disclosure documents. Focus on these aspects:

- Margin requirements

- Commission structures

- Account minimums

- Trading platform features

- Statement delivery methods

Start With Small Trades

Novice traders often rush into trading too many contracts. Beginning with one or two contracts is sufficient to develop your trading method without financial pressure. This approach facilitates steady learning.

Micro futures contracts could serve as your starting point, as they represent one-tenth the size of standard contracts. These smaller contracts provide:

- Lower capital requirements

- Reduced financial risk

- Better position sizing flexibility

- An opportunity to learn market dynamics

Be vigilant for these warning signs that might indicate problems:

- Promises of unusually high returns

- Pressure to act quickly

- Confusing jargon without clear explanations

- Guarantees against losses

Maintaining detailed records of your trades and regularly reviewing statements will help track your progress. This careful monitoring and systematic approach will build your confidence while managing risks in the futures market.

Commodity Futures Markets and Their Role in Trading

Commodity futures markets serve as key instruments for managing price risks and creating opportunities for traders. These markets allow participants to lock in prices for specific amounts of commodities, such as agricultural products, energy resources, and precious metals, for delivery at future dates. For businesses, this provides a hedge against price volatility, while traders can leverage these contracts to profit from price movements.

Each sector—agriculture, energy, and metals—offers unique trading opportunities. Successful futures trading relies on understanding market patterns, selecting the right trading strategies, and maintaining disciplined risk management. Starting with smaller investments and focusing on specific commodities can help you gain expertise without unnecessary exposure.

As the commodity futures market evolves, trading with the right knowledge and tools is crucial for success. Understanding market dynamics, staying informed about global events, and having a well-structured risk management plan are essential steps toward achieving sustained profitability.

As Hartmann & Benz continues its growth, including its recent listing on the OTCQB market, the landscape for investors is changing. Investors can now access our shares, and alongside this, we’ve launched a security token that simplifies gold ownership and trading. If you’re looking to diversify your investment portfolio and explore new opportunities in the commodity and gold sectors, keep an eye on our developments.